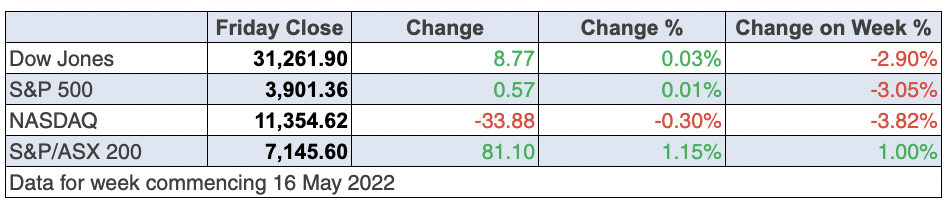

Wall Street just can’t sustain positivity, despite an early rally overnight, and the Dow is staring at an eight-week loss in a row, which hasn’t happened since 1923! Another bit of history relevant to now is the fact the average bear market lasts 338 days in the US, so this bear market might have two-thirds to go! But as Warren Buffett reminded us: “If past history was all there was to the game, the richest people would be librarians.”

Interestingly, the Dow rallied into the closing bell showing us that there are still dip buyers, who are contributing to the creation of a bottom.

To resuscitate my old academic ways, I’d remind you that an average ignores the big and small outlier numbers, and this could easily be a short bear market, especially if central banks don’t move too fast and too hard on interest rates.

And China out of lockdown and the end of the Ukraine war will all be bear- and inflation killers, so they remain big watches for this stock market.

This from George Ball, chairman at US investment firm Sanders Morris Harris, makes a lot of sense: “Stocks are still liberally priced and the psychology that drove them upward for a decade has turned negative.”

And this chart of the S&P 500 needs a close look.

S&P 500

From the pre-pandemic high of the S&P 500 to its high in December last year, that was a whopping 41% rise! And from the bottom of the Coronavirus crash, the US market was up, wait for it, 106%! This tells you that the old Yankee enthusiasm got a real workout between late March 2020 and 31 December 2021.

Have a look at where the Index is now and compare it to where it was just before the steep fall of the pandemic’s smashing of stocks. It’s still 13.5% off that old pre-pandemic high, while our market is around line ball with that old pre-crash level, after only being about 7% higher in 2021, before gravity took control of stock prices.

Apart from the fact that we sell iron ore, coal, gas and other resources the world needs (which is helping our index defy the big falls seen on Wall Street and the Nasdaq on Times Square), we never had market excesses that need to be brought back to the real world.

That said, I think the US market-drivers are working on trying to create a bottom for this market.

The trigger for this week’s negativity was bad reports from Walmart and Target, but both companies said sales were good but it was the cost impost that ate into profits. That’s why China out of lockdown will be a help but the US will still have rising wage issues to deal with.

Also, rising interest rates are bound to hit the US consumer, but no one knows how badly they will take higher rates, as the stimulus used to help the States avoid a Great Depression has left $4 trillion in Americans’ bank accounts, which could easily keep them spending in the early phases of the rate rise cycle.

We don’t know, so watching the economic data over the next few months will be crucial for working out if stock sellers eventually get outnumbered by buyers.

By the way, even though the big retailers of the US reported badly, on Tuesday we also learnt from Craig that “US share markets were firmer on Tuesday with strong data on retail sales and production allaying concerns about the health of the economy”.

A sign I liked this week was to read that “European share markets were firmer on Tuesday on hopes for an easing of Covid restrictions in China,” CommSec’s Craig James reported. “Shanghai recorded three straight days with no new COVID-19 cases outside quarantine zones.”

The contrast of news that we see from US economic and company reports explains why there are buyers of stocks after big sell-offs. Provided there is no left-field piece of bad news, I think we’re in the bottoming phase and this could be a shorter-term bear market.

And as I write this, I know a lot of what happens will be driven by what the Fed boss Jerome Powell does and says in coming months. This is what he said this week at a Wall Street Journal event: “What we need to see is inflation coming down in a clear and convincing way and we’re going to keep pushing until we see that.”

This didn’t help positivity about rising interest rates but I do think it will be the data that will influence what he does with rates.

To the local story and who would’ve thought this week of dramatic stock sell-off news could have produced a positive week for the share market?

The S&P/ASX 200 was up 1.2% on Friday giving us a 1% gain for the week. We haven’t done that for about five weeks!

Market watchers say China cutting interest rates helped. And if you add this attempt to stimulate their economy on top of comments that say the country will get out of lockdown on June 1, it potentially helps our economy via the demand for our resources.

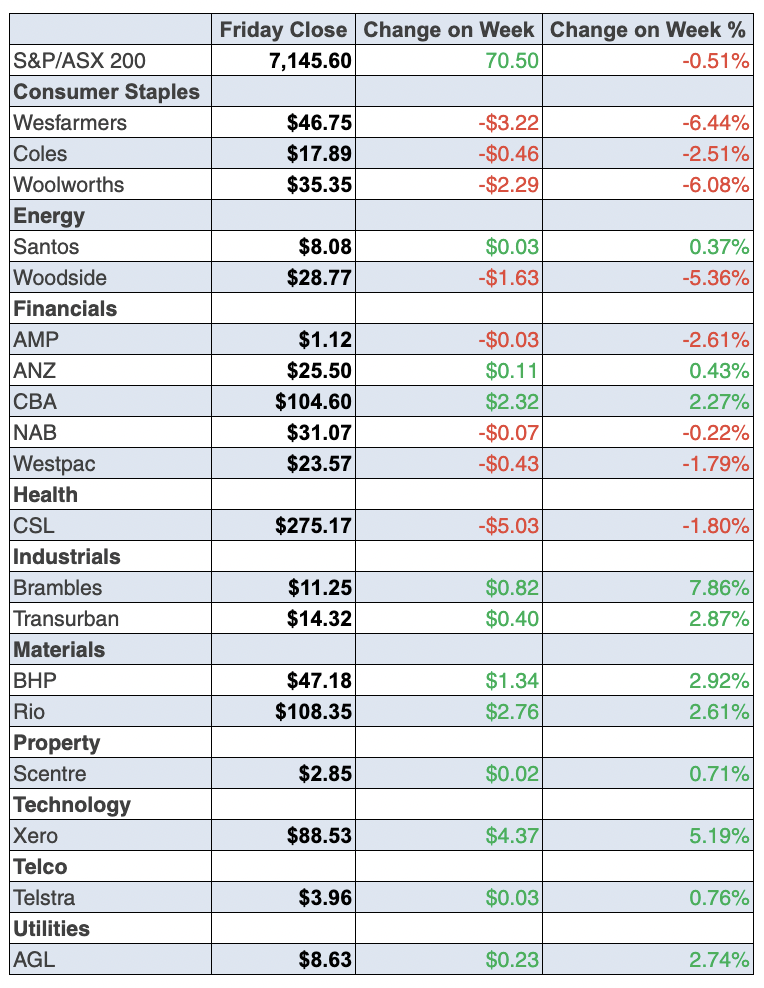

Not surprisingly, the miners had a good day on Friday, with BHP up 2.05% to $47.18, Rio was 1.5% higher at $108.35 and Fortescue surged 3.87% to $20.15.

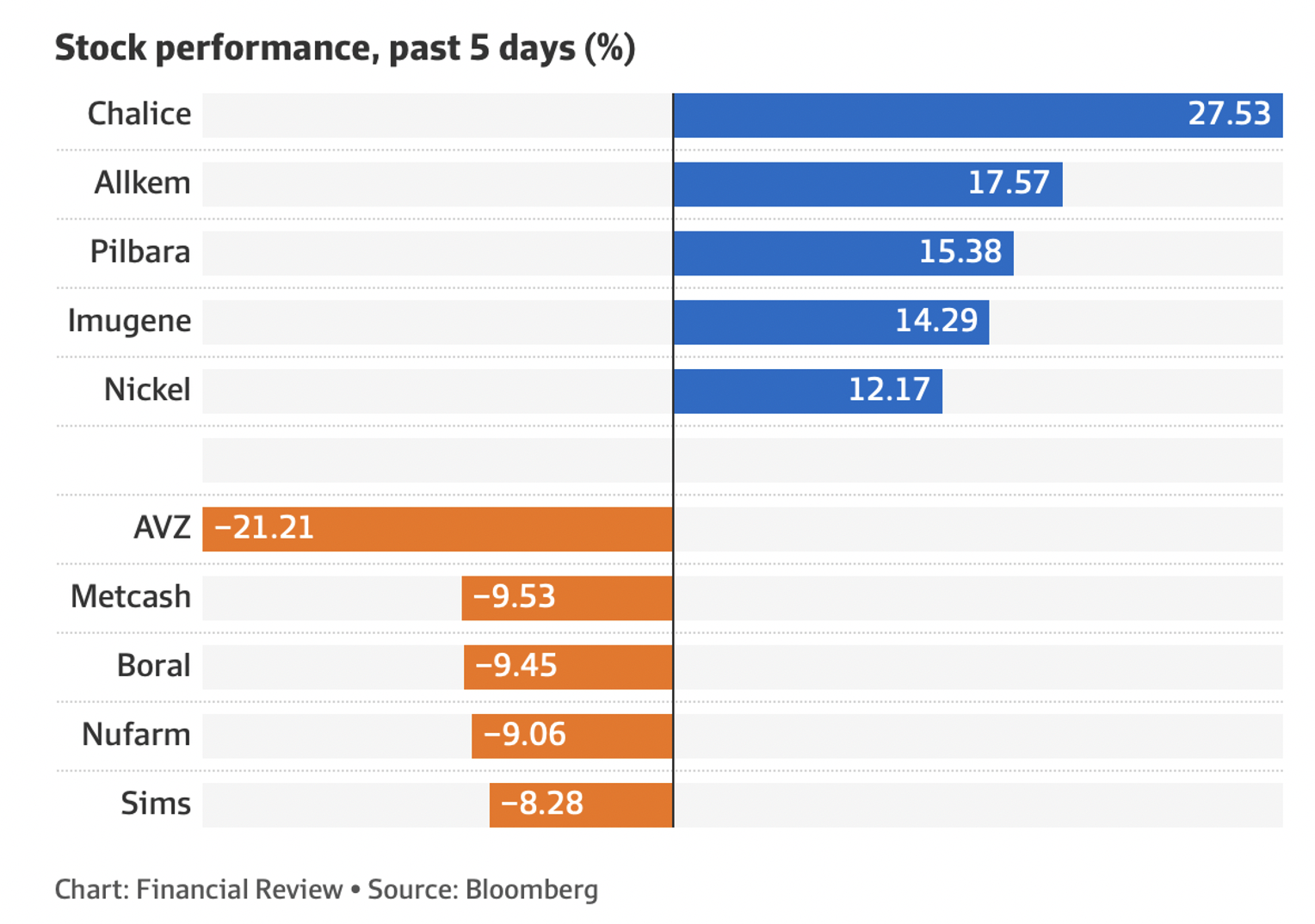

Here are the big winners and losers for the week:

After a bad week for retailers and tech, the US market gave us a decent lead, so JB Hi-Fi gained 2.81% to $46.15, while Life360 stormed up 12.1% on Friday and Xero put on 3.37% to finish at $88.53.

The overall tech sector was up 4.6%, which was a nice rise.

For bank fans, CBA rose 1.55% for the week to $104.60, NAB lost 0.58% to $31.07, ANZ gave up 0.27% to $25.50 and Westpac dropped 2.44% to $23.57.

I can’t help but think when inflation subsides and rate rise expectations are peeled back, tech stocks will have a nice ride higher. But lower inflation will need a lot of headwinds such as Ukraine, Chinese lockdowns and central bank interest rate rises to become less threatening.

And that will take time. You know I’m ‘punting’ on those better inflation tidings to show up around October to November, which could set us up for a more sustained market rebound in December and beyond.

What I liked

- Employment rose by 4,000 in April with full-time jobs up by 92,400 but part-time jobs were down by 88,400. Total employment hit a record high of 13.4 million in April.

- The unemployment rate was 3.85% in April, down from 3.93%, the lowest level since the current monthly series began in February 1978. And looking back even further (when the labour force data was published quarterly), it is the lowest jobless rate since August 19.

- US retail sales rose by 0.9% in April in line with forecasts.

- US industrial production rose by 1.1% in April (survey: 0.5%)

What I didn’t like

- The ANZ-Roy Morgan consumer confidence index fell by 1.3% last week to 89.3 points (long-run average since 1990 is 112.4). It was the fourth straight weekly decline in confidence.

- According to the Australian Institute of Petroleum, the national average unleaded petrol price rose by 5.4 cents last week to a 6-week high of 185 cents a litre.

- Existing US home sales fell by 2.4% in April to an annual rate of 5.61 million, the lowest since June 2020 (survey: 5.64 million). The Conference Board leading index dipped 0.3% in April (survey: flat). The Philadelphia Fed manufacturing index fell from 17.6 to a 2-year low of 2.6 in May (survey: 15).

- Chinese retail sales fell by 11.1% in the year to April (survey: -6.1%) with production down 2.9% (survey: 0.4%) and investment up 6.8% in the four months to April (survey: 7%). The jobless rate rose from 5.8% to a two-year high of 6.1%. Lockdowns will do this.

- The New York Empire State manufacturing index fell from 24.6 to -11.6 in May (survey: 17).

Will Dr Phil Lowe do a Jerome Powell?

This week we learnt from the RBA minutes that the Board had considered delaying the lift in rates to the June meeting but concluded that “recent evidence on wages growth from the Bank’s liaison and business surveys was clear”. The fact Dr Phil and his Board were not desperate to raise could have been based on pre-election impact concerns but my chats with economists confirmed my views that while our inflation will possibly rise a bit more, we won’t have inflation like the US at 8.3% and the UK at 9%. And don’t forget Turkey at 70%.

And that means Dr Phil won’t have to be too aggressive with our interest rate rises, which was a point that the CBA’s CEO Matt Comyn has been making, backed by his economics team.

The week in review:

- This week in the Switzer Report, I posit that provided earnings keep surprising on the high side and interest rates don’t go crazy, there’s scope for share prices to rise in the second half of this year. I’m looking at these five beaten-up quality [1]plays that will be winners when the rebound happens.

- When the market goes negative on a company, it can be pretty punishing, but Paul (Rickard) says that if he had to name one Aussie technology stock for investors to own, it would be Xero, [2] despite its major fall from grace. Paul says there’s nothing in the company’s financial result last week that makes him less interested in owning it.

- Tony Featherstone goes through three LIC yield [3]ideas for conservative income seekers and says that patient investors should put quality LICs on their radar.

- James Dunn says it’s time for another batch of stocks priced under $1. James says there are plenty of good stories brewing under the $1 mark and he looks at four of them in his article this week. [4]

- In our “HOT” stock column, Michael Gable, Managing Director of Fairmont Equities [5], explains why he thinks Computershare (CPU) is a buy. [6]

- In Buy, Hold, Sell — there were 9 upgrades and 16 [7]downgrades in the first edition, and in the second edition, James Hardie earned two upgrades while Wesfarmers received the only downgrade. [8]

- In Questions of the Week, [9] Paul Rickard answers your queries about should you sell your shares in Ramsay Health Care due to the proposed takeover? Is Dominos Pizza a buy? How can I find out which stocks are short sold? What are the codes of the new cryptocurrency ETFs?

- And finally, Paul presents his handy guide that involves 5 ‘super’ actions you should be aware of before the end of the financial year. [10]

Our videos of the week:

- Walking 10,000 steps a day, do we really need to? | The Check Up [11]

- Is it time to buy tech companies? + Julia Lee’s two best companies to buy now! | Switzer Investing (Monday) [12]

- Is this consumer confidence slump irrational? Can we trust the stock market rebound we are seeing? | Mad about Money [13]

- How bad is this stock market slump? + Should you worry about a recession or be looking to buy? | Switzer Investing (Thursday) [14]

- Maurie Stang from Vectus Biosystems (VBS) | The CEO Masterclass [15]

- Boom! Doom! Zoom! | 19 May 2022 [16]

Top Stocks – how they fared:

The Week Ahead:

Australia

Monday May 23 – Speech from Reserve Bank official

Monday May 23 – Household spending indicator (March)

Tuesday May 24 – ‘Flash’ purchasing manager indexes (May)

Tuesday May 24 – Weekly consumer confidence (May 22)

Wednesday May 25 – Construction work done (March quarter)

Wednesday May 25 – Speech from Reserve Bank official

Wednesday May 25 – Skilled job vacancy index (April)

Thursday May 26 – Business conditions & sentiments (May)

Thursday May 26 – Business investment (March quarter)

Thursday May 26 – Detailed labour force (April)

Friday May 27 – Retail trade (April)

Overseas

Monday May 23 – US Chicago Federal Reserve national activity

Tuesday May 24 – US S&P Global purchasing managers index (May)

Tuesday May 24 – US New home sales (April)

Tuesday May 24 – US Richmond Federal Reserve manufacturing

Wednesday May 25 – US FOMC minutes

Wednesday May 25 – US Durable goods orders (April)

Thursday May 26 – US Economic growth (March quarter)

Thursday May 26 – US Pending home sales (April)

Friday May 27 – US Personal income/spending (April)

Friday May 27 – US Goods trade balance (April)

Friday May 27 – US Consumer sentiment (May)

Food for thought: “Save to invest, don’t save to save.” ― Oscar Auliq-Ice

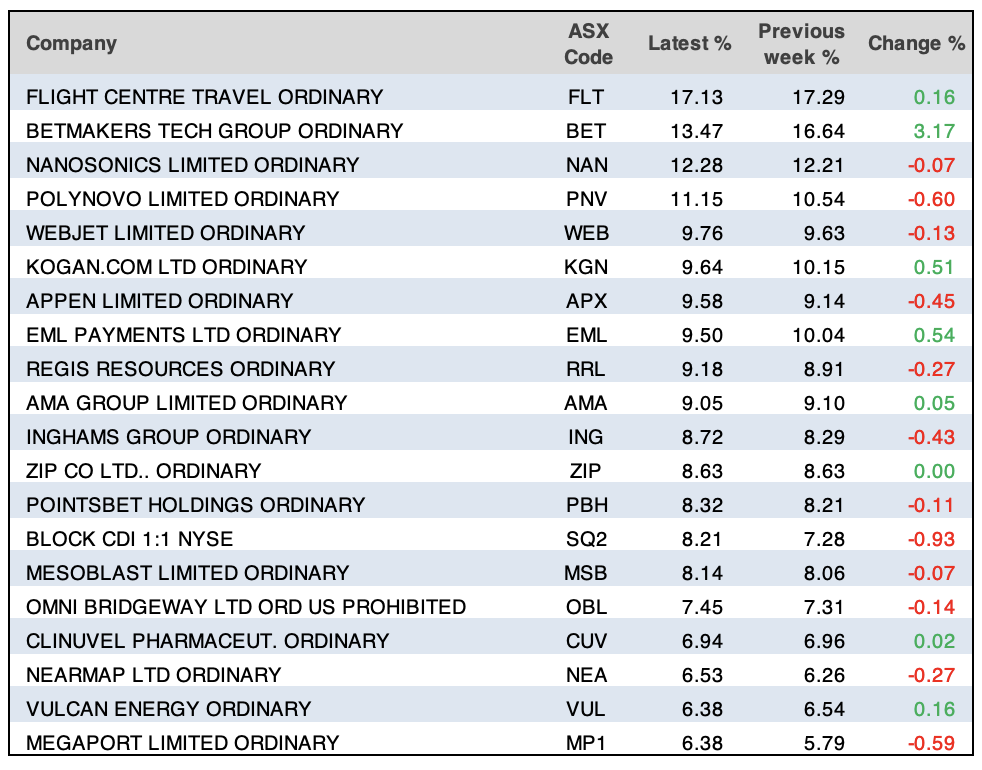

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

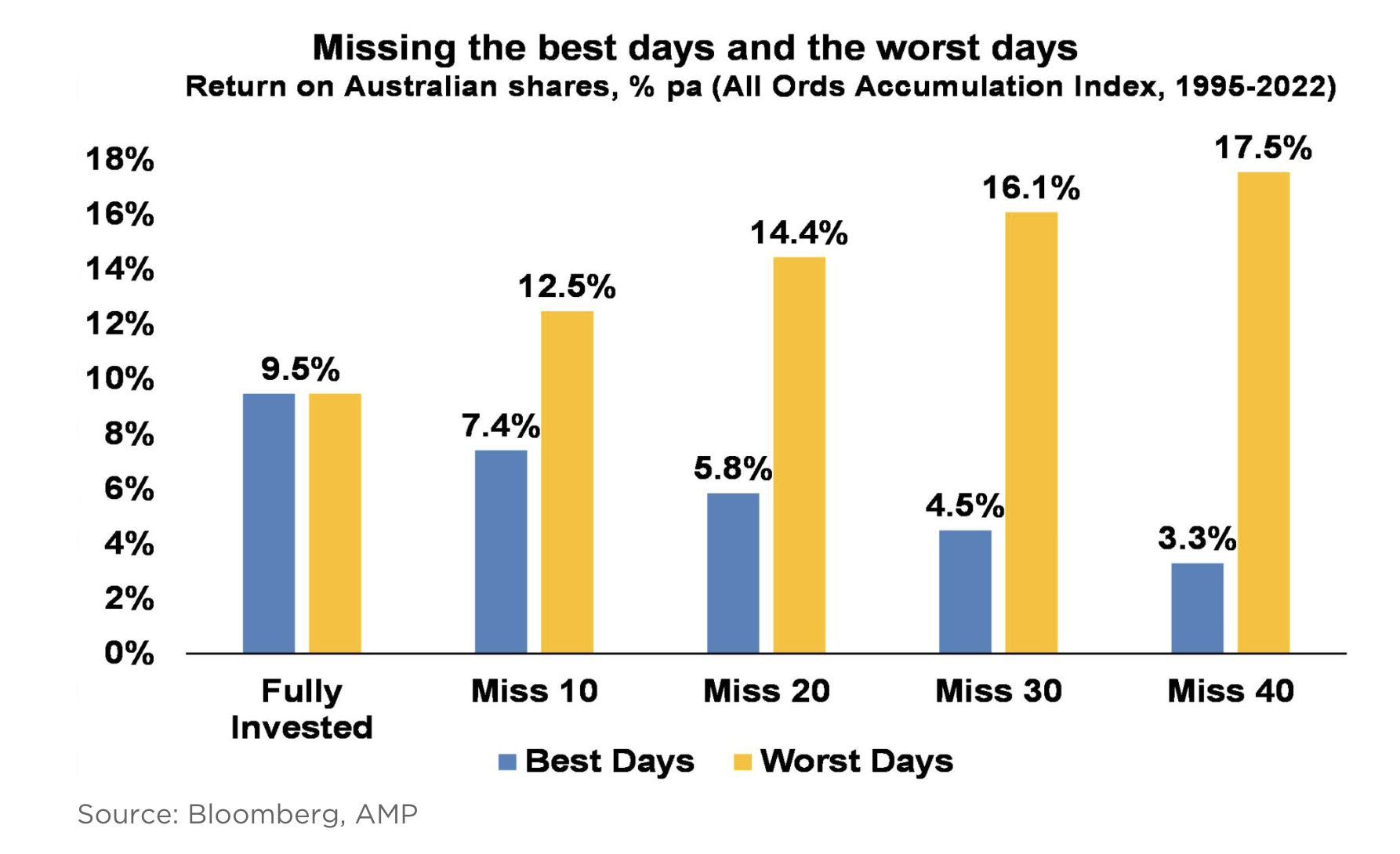

Chart of the week:

Following the theme of last edition’s Chart of the Week, we have another gem from AMP Capital’s Shane Oliver regarding the age-old investing wisdom of time in the market versus timing the market.

“In times of uncertainty, it’s tempting to try and time the market, ie to sell ahead of falls and buy in anticipation of gains. But without a proven asset allocation or stock-picking process, trying to time the market is very difficult,” Shane said.

“A good way to demonstrate this is with a comparison of returns if an investor is fully invested in shares versus missing out on the best (or worst) days. The [chart below] shows that if you were fully invested in Australian shares from January 1995, you would have returned 9.5% pa (including dividends but not allowing for franking credits, tax and fees).”

“If by trying to time the market you avoided the 10 worst days (yellow bars), you would have boosted your return to 12.5% pa. If you avoided the 40 worst days, it would have been boosted to 17.5% pa. But this is very hard to do, and many investors only get out after the bad returns have occurred, just in time to miss some of the best days and so end up damaging their longer-term returns. For example, if by trying to time the market you miss the 10 best days (blue bars), the return falls to 7.4% pa. If you miss the 40 best days, it drops to just 3.3% pa. Hence the old cliché that: ‘It’s time in that matters, not timing’”.

Top 5 most clicked:

- My 5 ‘beaten up’ quality winners when the rebound happens [17] – Peter Switzer

- What’s the one Aussie tech stock that I’d recommend? [18] – Paul Rickard

- 4 stocks under $1 [19] – James Dunn

- 5 ‘super’ actions to take before the end of the financial year [20] – Paul Rickard

- 3 LICs for dividend yield [21] – Tony Featherstone

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.