Those praying for a turnaround of sentiment didn’t have their prayers answered by the latest US inflation reading, with the CPI coming in at its biggest reading in 40 years! This coincided with the closely watched University of Michigan consumer sentiment index that printed below expectations. In fact, it hit a record low.

The May CPI was a big 8.6%!

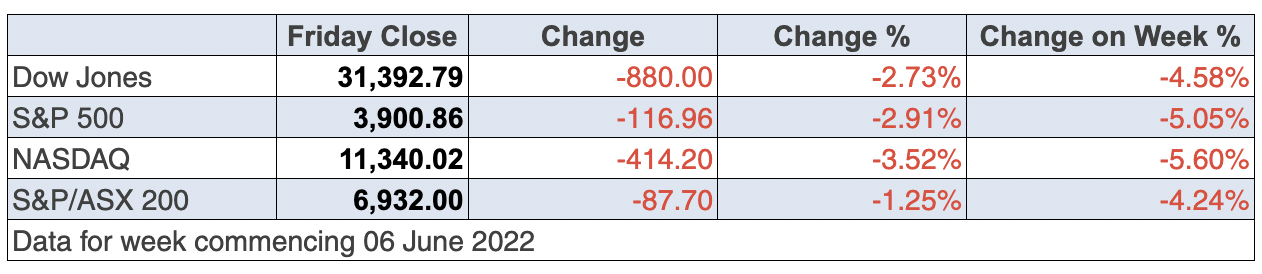

Not surprisingly, the Dow slumped over 700 points in early trade and the Nasdaq gave up over 3%, as interest rate guessers now tip the September Fed decision will result in another 0.5% rise. July was already a done deal with the Fed seemingly committed to it, but September was thought to be a 0.25% rise or maybe no change, linked to a mindset of ‘wait-and-see what’s happening to inflation’.

This has dashed the hopes of those who saw indicators that inflation was peaking. They’ll have to reassess what they’re watching. Of course, these signs of inflation peaking could be real but they don’t mean they translate to lower inflation stats immediately.

I’ve done a lot of reading about economics since my days as lecturer-in-charge of Applied Macroeconomics at the University of NSW, and then over three decades of covering the economy for some of the country’s most prominent news outlets in the country. My history of economic readings tells me that one month’s numbers don’t mean a real lot.

Even before the Ukraine war and China’s re-entry into lockdowns, I told you that inflation wouldn’t be dissipating until September or October, so having high hopes for a June number was exactly that — high hopes.

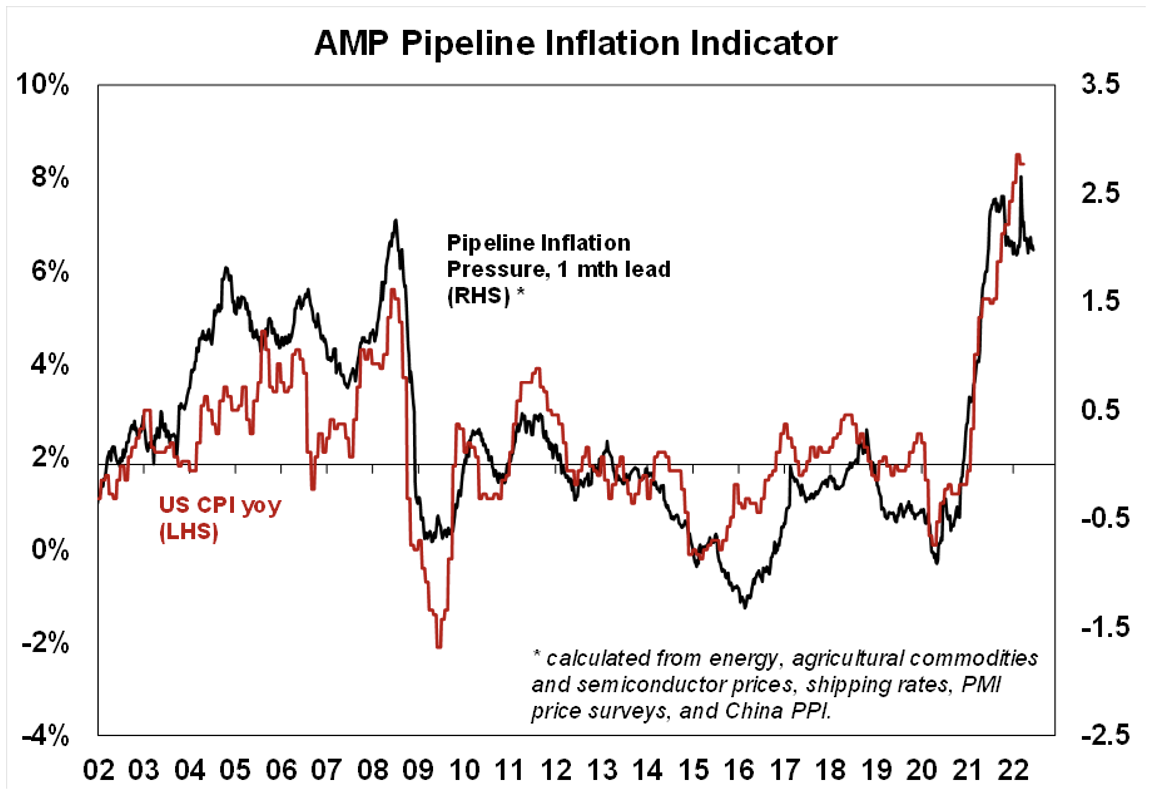

In contrast, I like what AMP’s Pipeline Inflation Indicator is saying about future inflation. Here’s the related chart:

And this is what AMP economist Diana Mousina sees: “The market is still grappling with the question as to whether inflation has peaked (in annual terms) or not. Some signs are improving: container freight costs are down 27% from late 2021 levels, fertiliser prices are 30% below March highs, lumber prices are 61% below March levels and metals prices have fallen generally. This is in line with the continued moderation in our inflation pipeline indicator”.

I’m writing this from Antibes in the south of France and the guy who runs the restaurant we went to last Thursday evening said tourism numbers now are even better than in pre-pandemic times. Anyone trying to book an overseas flight knows that airlines are packed. Normalisation is creeping up on us and with it, inflation will also normalise. It will remain high for a while as unions and workers with power angle for (and get) pay raises, but inflation will fall, interest rate fears will lessen and stock prices will take off again.

Right now, the S&P 500 is off about 18% year-to-date, while our S&P/ASX 200 is down 8.67%. Remember that 4.2% of that fall came when the RBA shocked the market with a 0.5% hike last Tuesday.

We’re in the hands of central bankers and can only hope they play their interest rate rise strategies correctly. Right now, the market is betting they’ll screw up and create a recession, but I trust the market’s judgement on these matters less than central bankers, who haven’t always covered themselves in glory.

That said, the stock market is happy with the worst-case scenario narrative, which is driving stock prices down, creating buying opportunities with some quality companies.

It will take time but I bet I’m right, and it could show up before year’s end. My next story will address optimistic possibilities for the end of this year. I have to do it because everyone else is locked into doomsday scenarios that may well be way too excessive.

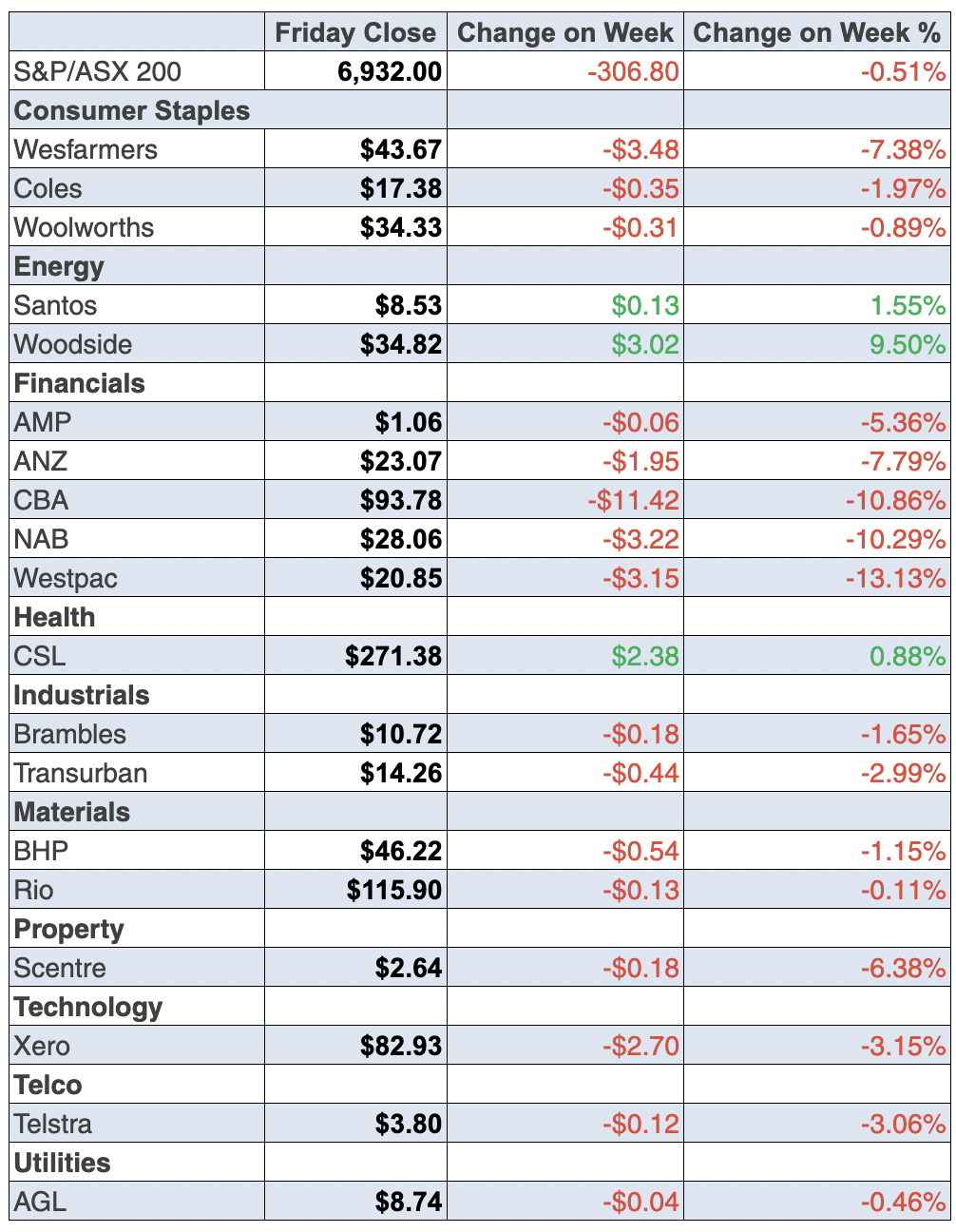

To the local story, and as I said above, the S&P/ASX 200 lost 306 points (or 4.2%) this week to finish at 6932. It was heavily driven by the banks that were tipped to face rising bad debts because of the RBA’s 0.5% rate rise. This rise is bound to be followed by a few more hikes that could result in some borrowers getting into repayment trouble.

Of course, this is pessimistic speculation based on best guesses, and in coming months we’ll see how accurate these guesses are. CBA lost 10.77% to finish the week at $93.78, NAB gave up 10.09% to $28.06, ANZ dropped 7.61% to $23.07 and Westpac slumped 12.83% to $20.85. I’m sure the bank CEOs used expletives as they assessed the market’s over-the-top reaction.

Think about this: what if the RBA’s bold move results in fewer rate rises because it shocks and awes consumers to help ease inflation? Then these sell-offs are excessive, so do with that what you will.

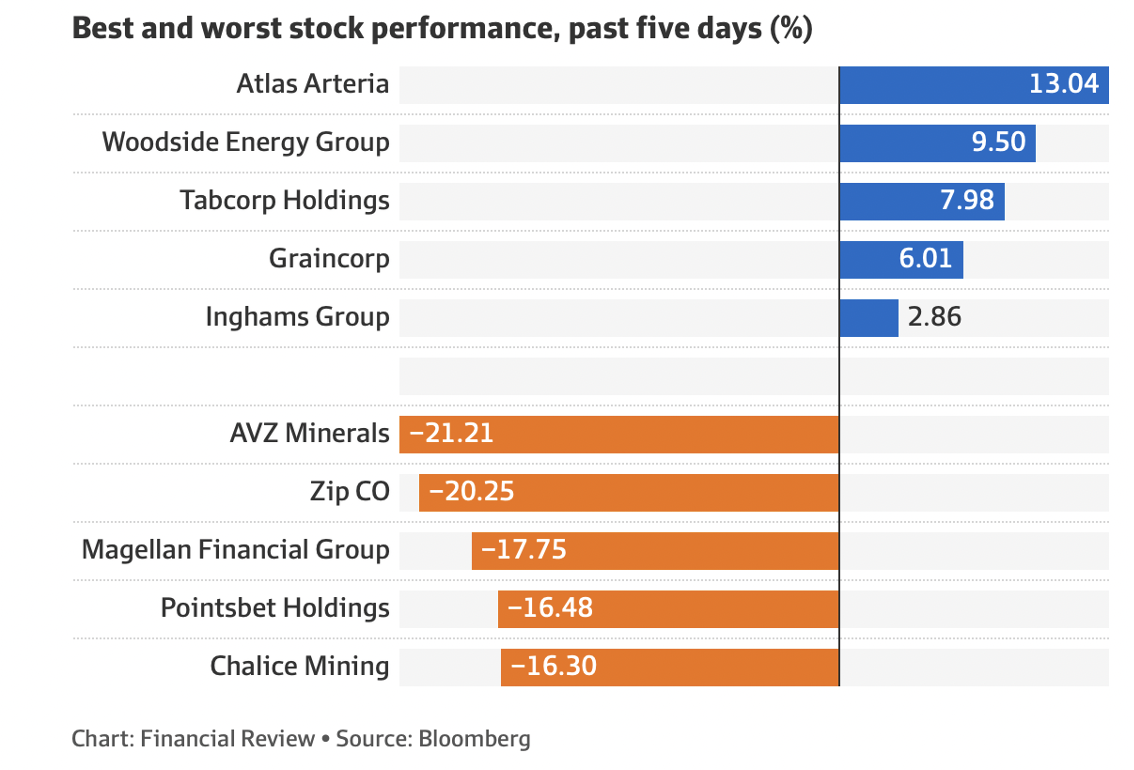

Tech stocks copped it and Magellan didn’t get an uplift out of the story that Hamish Douglas was returning as a consultant to the operation.

In no way am I ignoring the possible worst-case scenarios that could keep stocks down for longer than I’m predicting, but, after sell-offs, markets rebound. And since 1987 the average duration of a correction is about 155 days. The US hit correction territory about mid-February so we have a couple of months to go before we hit that average. And it’s three and two-thirds months before September ends. That’s a positive for my “I can’t wait for September” scenario.

What I liked

- In May, ANZ job ads rose by 0.4% to stand 17.3% higher on the year. This is good for jobs but bad for inflation. We need foreign workers and fast!

- Ditto this: The preliminary Internet Vacancy Index (IVI) rose by 0.9% in May (or by 2,754 available positions) to a 14-year high (since June 2008) of 298,375 positions available. Recruitment activity was up by 25.7% (or 61,045 ads) in May on a year ago and was 77.3% (or around 130,100 available positions) higher than pre-Covid levels.

- In April, business turnover lifted in nine of the 13 selected industries, according to the Australian Bureau of Statistics (ABS). Turnover rose the most for Information Media and Telecommunications (up 8%) and Accommodation and Food Services (up 7.6%), but fell for Construction (down 8.9%).

- Basic resources stocks advanced earlier in the week in Europe by 2.5% on-demand optimism after China eased Covid-19 restrictions. When the Chinese are out of the woods with lockdowns, stocks will like it.

- Initial claims for unemployment insurance (jobless claims) in the US rose by 27,000 to 229,000 in the past week (survey: 210,000). A softening labour market will help decrease inflation.

What I didn’t like

- The Melbourne Institute’s monthly headline inflation gauge rose by 1.1% in May after falling by 0.1% in April. Prices are up 4.8% on the year. The ‘underlying’ or trimmed mean measure lifted by 0.7%, to be up 4.4% on the year – the fastest pace since 2008.

- US 10-year yields rose by around 2 points to near 3.05% — any number over 3% is a worry right now.

- On Tuesday, stocks fell in Europe on fears that aggressive rate hikes by central banks could flatten major economies.

Worried about stocks?

I can only suggest you try to rely on your patience to soothe your fears but I do understand you might be struggling. Markets go through tough times but they do come out winning so be patient and try to control your desire to run.

The week in review:

- This week in the Switzer Report, I comment on how the market craziness continues but when a market surges, your big questions are: Should I get in for more? Or is time to sell and take profits before a sell-off? While these questions aren’t easy to answer, I do my best to address them here. [1]

- Paul (Rickard) takes a look at two frontrunners in the energy sector, Woodside and Santos, and stakes his claim on which is the best buy in the current state of the [2]market while considering other factors such as dividends and the delivery of projects that remain in the pipeline (so to speak). And with interest rates rising, Paul says some stocks can win from higher interest rate rises and in his second article for the week, [3] gives us a rundown of those winners among the top 100 companies.

- Tony Featherstone says ResMed and Fisher & Paykel Healthcare are excellent companies that currently look attractive after sharp price falls this year. [4]

- James Dunn reports that the lithium sector has been feeling the pain recently, with a sell-off analysts always expected from the EV hype that surged last year. And now that the sector is on the cheap, James outlines which company is the best buy at current levels. [5]

- In our “HOT” stock column, Michael Gable, Managing Director of Fairmont Equities [6], reveals that he’s seen the signal for Santos (STO) to be in the buy zone. [7]

- In Buy, Hold, Sell — Brokers Say, there were 5 upgrades and 9 [8]downgrades in the first edition and an equal number (seven) of upgrades and downgrades [9] in the second edition.

- And finally, in Questions of the Week, [10] Paul answers subscribers’ queries about if the banks are back in buy territory? If Atlas Arteria is taken over, what other infrastructure stocks are available? Is Westpac’s new term deposit rate of 2.25% any good? Do I need to be working to get the government to top up my super?

Our videos of the week:

- Two effective antivirals for long COVID | The Check Up [11]

- Stocks to watch: ASX: WDS, STO & BPT + What will happen to the Aussie dollar and its impact on you? | Switzer Investing (Monday) [12]

- Has the Reserve Bank suddenly turned from a dove into a hawk on interest rates? | Mad about Money [13]

- With interest rates rising, what stocks should you look out for? CPU, CGF, QBE, IAG + more | Switzer Investing (Thursday) [14]

- Boom! Doom! Zoom! | 9 June 2022 [15]

Top Stocks – how they fared:

The Week Ahead:

Australia

Tuesday June 14 – CBA household spending indicator (May)

Tuesday June 14 – NAB business survey (May)

Tuesday June 14 – Monthly household spending indicator (April)

Wednesday June 15 – Overseas arrivals and departures (April)

Wednesday June 15 – Weekly consumer confidence index (June 12)

Wednesday June 15 – Monthly consumer confidence index (June)

Thursday June 16 – Labour force (May)

Thursday June 16 – Reserve Bank Bulletin

Overseas

Monday June 13 – US Consumer inflation expectations (May)

Tuesday June 14 – US NFIB small business optimism index (May)

Tuesday June 14 – US Producer Price index (May)

Wednesday June 15 – China retail sales/production/investment (May)

Wednesday June 15 – US Federal Reserve interest rate decision

Wednesday June 15 – US retail sales (May)

Wednesday June 15 – US import and export prices (May)

Wednesday June 15 – US Empire State manufacturing index (June)

Thursday June 16 – China new home prices (May)

Thursday June 16 – US Housing starts/building permits (May)

Thursday June 16 – US Philadelphia Fed manufacturing (June)

Friday June 17 – US Industrial production (May)

Friday June 17 – US Conference Board leading index (May)

Food for thought: “He who restraints his desires is always rich.” ― Voltaire

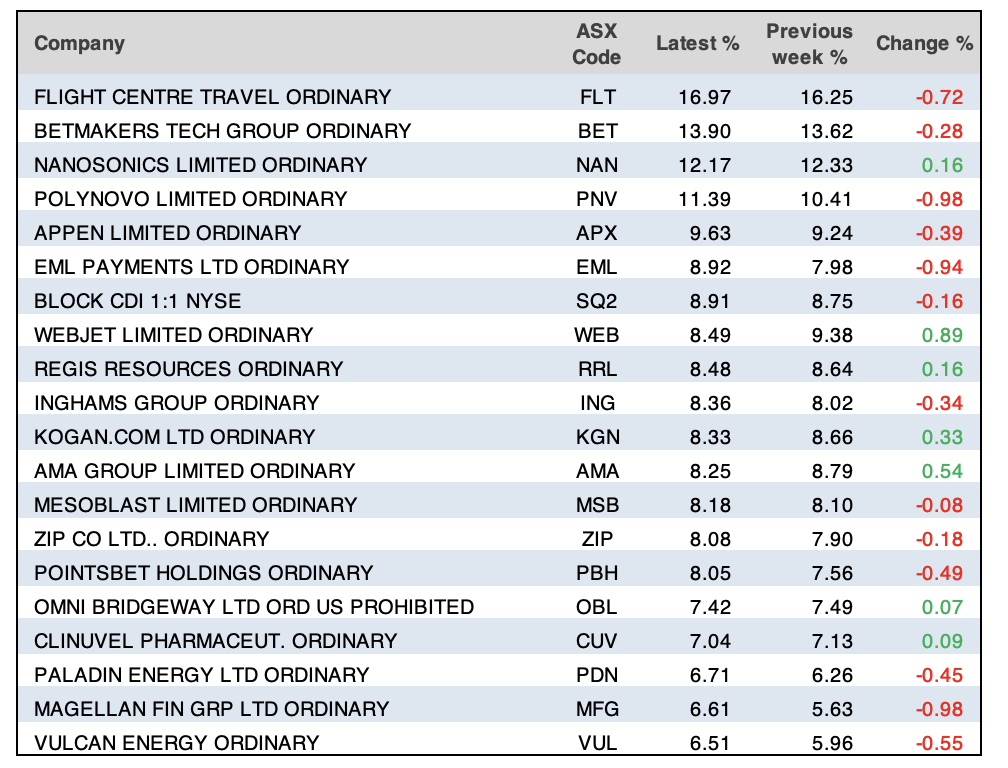

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

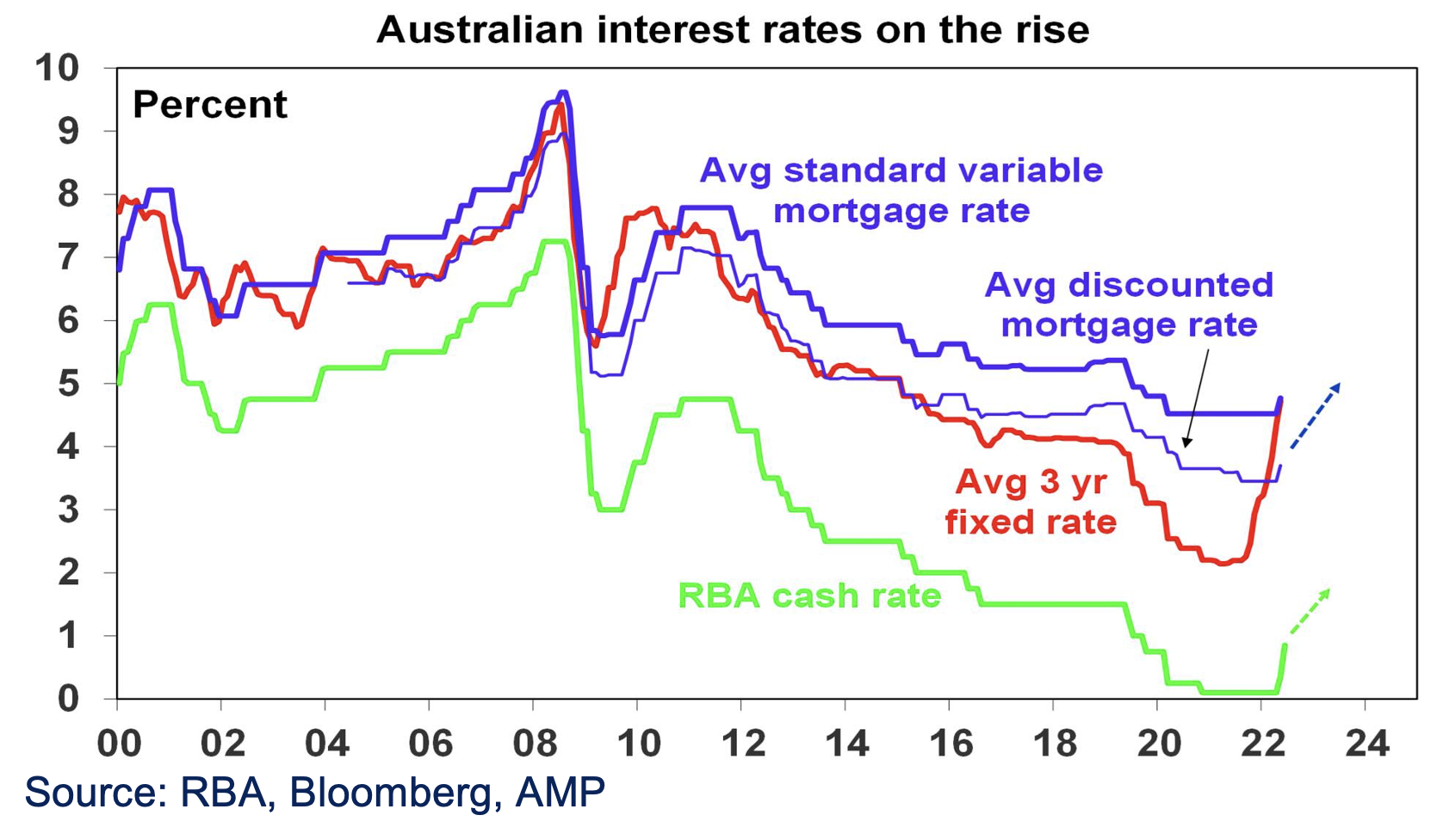

Chart of the week:

In our chart of the week, shock surprise, it’s all about interest rates following the RBA’s 50bpt hike on Tuesday. Here’s what Shane Oliver of AMP Capital has to say on the issue:

“The RBA has increased its official cash rate by another 0.5% taking it to 0.85% for the second rate hike in this cycle. This was above market expectations. Our expectation was for a 0.4% hike with the risk that it would be 0.5%,” Shane said.

“In justifying the move the RBA noted that: the economy is resilient; the labour market is strong with the unemployment rate falling to just 3.9%; the Bank’s business liaison continues to point to higher wages growth; and inflation is expected to increase even more than it expected a month ago with notably higher prices for electricity, gas and petrol. The RBA’s move is consistent with the stepped up pace of tightening from central banks in New Zealand and Canada and likely soon in the US as they all try to get ahead of the surge in inflation and to contain inflation expectations. This and the low starting point explains why the 0.5% rate hike is the biggest in 22 years.

“The RBA’s commentary remained hawkish reiterating that it will “do what is necessary” to return inflation to target and that this will likely require “further steps in the process of normalising monetary conditions” which in short means that more interest rate hikes are likely on the way.”

Top 5 most clicked:

- Do I go, stay in cash or nibble into this sell-off? [16] – Peter Switzer

- Can Woodside keep going up, or is Santos a better bet? [17] – Paul Rickard

- The best lithium buy out of 3 hopefuls [18] – James Dunn

- With interest rates on the rise, which stocks could do well? [19] – Paul Rickard

- Buy, Hold, Sell – What the Brokers Say [20] – Rudi Filapek-Vandyck

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.