I mostly avoided airline stocks for years. Turn-offs included high fixed costs of aircraft, oil-price sensitivities, fierce competition, and the vagaries of weather and other unexpected events. I agreed with Warren Buffett’s comment that airlines were the “worst kind of business”.

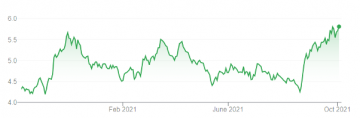

Lately, I have become much more interested in airlines. Readers will recall I nominated Qantas Airways (QAN) as a top stock for 2021 – a view I retain. Qantas is up from $4.85 at the start of 2021 to $5.62. But most of Qantas’s gains this year have come since September.

A continuing pullback in the share market in October – often a lousy month for investors – would be an opportunity to add more Qantas shares to portfolios. Many challenges for Qantas remain, particularly on international travel. But it’s a big winner from border re-openings.

Watch Qantas emerge from Covid in stronger shape. Like all good companies, it hasn’t wasted the crisis. Costs have been cut; profit margins expanded. A weakened competitor in Virgin Australia Holdings is another positive for Qantas, which has been well-led during the pandemic.

Chart 1: Qantas Airways (QAN)

Source: ASX

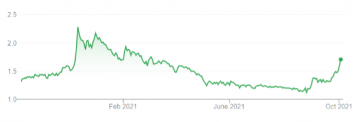

My airline optimism extended to Qantas’s Trans-Tasman rival, Air New Zealand. In early September, I wrote favourably about Air New Zealand (AIZ) and Auckland International Airport (AIA) Like Qantas, both stocks are obvious plays on a travel recovery as lockdowns (finally) end.

Air New Zealand has risen from $1.44 in my September column (“NZ travel stocks a solid long-term buy”) to $1.62. That’s a good sign in a market that has retreated over the last few weeks.

I wrote in that column: “Air New Zealand’s worst days should be behind it. That might seem hard to picture now with Auckland in lockdown. But the market always looks forward and NZ travel still has excellent long-term prospects.” That view of Air New Zealand still holds.

Chart 2: Air New Zealand (AIZ)

Source: ASX

Of the two stocks, I prefer Qantas. Air New Zealand arguably offers more value at the current share price, based on consensus analyst forecasts. But Qantas is the better play for long-term portfolio investors, partly because of the latent value in its frequent-flier program.

This week, my attention turns to the smaller ASX-listed airline stocks: Alliance Aviation Services (AQZ) and Regional Express Holdings (REX). Both are small-cap stocks, meaning they suit experienced investors who understand the features, benefits and risks of this style of investment.

Here is a snapshot of their prospects:

- Alliance Aviation Services (AQZ)

I have outlined a bullish view on Alliance a few times over the years for the Switzer Report (“Would you buy an airline stock? What about regional aviation? February 2019). Alliance has rallied from $2.59 in early 2019 to $4.06, having been as high as $4.92.

Alliance has been volatile. It listed on ASX through an Initial Public Offering (IPO) at $1.60 a share in December 2011. The stock soared to $2.30 within six months of listing, then tumbled to 41 cents during the mining-investment downturn in 2014.

The market forgot about Alliance for a few years. In early 2020, it recovered to above $2.60, only to tank to about $1 when global equity markets crashed in March that year. Alliance then rallied, becoming a standout small-cap stock during the recovery.

Alliance transports fly-in, fly-out workers to remote mining and energy sites around Australia. The Queensland company also provides charter flights for companies, governments and tourism operators – and flew a few Rugby League teams around for their games during the pandemic.

Like other airlines, Alliance will gain when lockdowns end and tourism bookings boom. Demand for Alliance’s contract and charter flights should take off in the next two years.

I’m more interested in Alliance’s wet-lease activity. Airlines use wet-lease contracts to lease an aircraft (which comes with crew, maintenance and insurance) to boost temporary fleet capacity.

In February, Alliance announced a wet-lease agreement with Qantas for up to 14 recently acquired Embraer E190 aircraft. Qantas has so far exercised its option for eight E190s. Alliance has committed to a fleet of 32 E190s, which it bought at historically low prices.

Some good judges I know believe Alliance’s earnings-per-share could double when all its E190s are deployed. If that happens, Alliance would be on a PE of about 10 times (at a $4.06 share price), which is not excessive given its recovery prospects and long-term growth profile.

When small-cap stocks rally as Alliance has done, it’s easy to believe the gains have been made. The key is looking forward, to understand the company’s true value.

With soaring tourism bookings after lockdown, airlines will need to boost their temporary fleet capacity. That’s good for Alliance’s wet-lease aircraft business and its earnings growth.

Chart 2: Alliance Aviation Services

Source: ASX

- Regional Express Holdings (REX)

As with Alliance, I outlined a positive view on REX in my report on regional airline stocks for this Report. I wrote in 2019: “I’m becoming more bullish on Rex as its operational performance improves. … Rex would be a neat bolt-on acquisition for a big airline and looks reasonable value with or without a takeover.”

REX sank from $1.55 in February 2019 to 54 cents during the March 2020 equities crash. It recovered to above $2 in late 2020, fell to $1.20 in August and now trades at $1.70. For all its potential, REX has given its shareholders a bumpy ride over the past five years.

Rex’s FY21 annual report, released in late September, is worth reading. It describes Rex as being on “life support” during the early part of Covid and even includes an excerpt of a favourite poem of Executive Chairman Lim Kim Hai (IF, by Rudyard Kipling).

Rex took delivery of its first Boeing 737-800 aircraft in November 2020 and received its sixth Boeing 737 in April 2021. The new aircraft boosts REX’s position in the domestic airline market; REX has launched several Boeing 737 services between Sydney, Melbourne and the Gold Coast.

But in its FY21 results presentation, REX had a negative outlook. It said: “The first half of the (financial year 2021-22) will be dominated by lockdowns and internal border closures. It is possible that the second half will be struck by further waves of infection given the experience of other highly vaccinated countries. As such, the outlook for the (financial year) is pessimistic.”

REX is a clear beneficiary when lockdowns eventually end, border restrictions cease and travel booms. Longer term, REX is setting itself up to become a much larger player in the domestic airline market, rather than operate as a fringe regional airline.

Speculators might buy REX as a short-term “reopening” play. It has an appealing chart pattern as its price breaks higher.

However, I prefer to watch REX’s progress and wait until there are tangible signs of recovery. There’s enough risk with the airline stocks as it is, so I’ll stick with Qantas and Alliance Aviation (which has Qantas as a 19.99% shareholder).

Risks aside, there’s a big prize ahead for REX shareholders if it can become a major competitor in domestic aviation. But Rex is still a long way from achieving that, and Covid clouds the outlook. As such, I’ll stand on the sidelines with REX for now and enjoy its feud with Qantas. The competitive reaction from Qantas on REX routes is another concern.

Chart 4: Regional Express Holdings

Source: ASX

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 6 October 2021.