I used to go through a tank of petrol each week before Covid. I’ve worked from home for more than a decade but running around after kids each week chewed up plenty of fuel.

During Covid, a tank of petrol now lasts me a month. Sometimes longer. With Melbourne in perpetual lockdown, and kids learning from home, my car mostly sits in the driveway.

I notice a similar pattern in my suburbs: people working from home, cars in driveways, less traffic on roads … just as you’d expect during a strict lockdown.

What happens when lockdowns end? The easy answer is more people driving for longer, greater traffic congestion and extra wear and tear on cars. That’s good for toll roads, auto-parts suppliers like Bapcor (BAP), and listed panel beaters that benefit from vehicle collisions.

I’m interested in car dealerships and car financiers. For those working from home, there hasn’t been as much need to buy a used or new vehicle in the past two years, at least in Sydney and Melbourne. That should equate to even higher pent-up demand when restrictions end.

It will be an interesting few years for car dealers and financiers when restrictions end. The pandemic has affected vehicle demand and supply. When lockdowns are finally behind us, there should be more vehicle supply available.

A car salesperson told me his dealership has had a spike in enquiries during Covid. People wanted information about a car, but didn’t upgrade due to supply issues or because they weren’t able to test-drive. Some dealers will have a huge pipeline of sales leads to work with.

Moreover, his dealership, like many others, reduced its salesforce and found ways to boost productivity. That should lead to higher margins for dealerships on used and new car sales, thanks to a lower cost base and better use of technology to attract and convert buyers.

At the same time, household wealth has risen during the pandemic, courtesy of rising house and share prices. Add to that high household savings rates and it’s a no-brainer that more consumers, particularly those who couldn’t go on holiday, will upgrade their car.

Then there are people who lost their job or have done it tough during Covid. They might need to buy a used car to get to work when the economy improves next year. With fewer assets to use as collateral, they need an unsecured personal loan, possibly from a fintech provider.

Taken together, there will be rising demand for used and new cars next year, and more people seeking finance to buy them. That’s why I still like car dealerships and, increasingly, financiers that provide unsecured loans.

I’ve outlined several car-related ideas for The Switzer Report in the past two years Several stocks have rallied this year, but in 2019 they were contrarian ideas.

Two favoured ideas – Autosports Group (ASG) and Motorcycle Holdings (MTO) – have rallied. Autosports, a luxury-car dealership network, is up from about $1 at the start of 2019 to $2.59. Motorcycle Holdings is up from $1.85 to $2.94. Both stocks have further to run, albeit with slower share-price gains from here.

Here are two vehicle financiers that stand out:

1. Money3 Corporation (MNY)

Money3 specialises in secured and unsecured loans for vehicles. The business has a consumer loans and a commercial loans division in Australia, and a consumer loans business in New Zealand.

In its latest investor presentation, Money3 reported around 63,000 loans in its portfolio, of which more than 50,000 are for consumer auto loans. The company has financed over $2 billion worth of vehicles loans, across 170,000 loans in Australia and New Zealand.

Money3 is delivering consistent growth. Compound annual revenue growth (CAGR) is 26% over FY17 to FY21. Underlying earnings (EBIT) have had a CAGR of 30% over this period. The company’s loan book has increased from $214 million in FY17 to $601 million in FY21.

Money3 expects its loan book to grow to $760-$810 million in FY22. Improving supply of new and used vehicles, rising vehicle demand from consumers who cannot travel overseas (and have surplus funds to spend) and a contraction of traditional lenders in car finance (which favours non-bank lenders) bode well for growth in the company’s loan book.

The market has recognised Money3’s potential. The stock has rallied from 87 cents in March 2020 (when it was badly oversold) to $3.28. But that’s only 25 cents higher than Money3’s peak share price before Covid ($3.05), even though it’s a stronger business today.

At $3.28, Money3 is on a trailing Price Earnings (PE) ratio of about 12. That’s below the market’s average multiple and undemanding given Money3’s growth profile.

The business is strongly leveraged to rising demand for vehicle finance next year as more people return to work. Also, its New Zealand business, small in the scheme of Money3 for now, continues to expand, giving the company two growth engines.

Money3 is due for share-price consolidation. Capitalised at $691 million, it suits long-term investors who understand the features, benefits and risks of small-cap stocks.

Chart 1: Money3 Corporation (MNY)

Source: ASX

2. MoneyMe (MME)

Like the similarly named Money3, MoneyMe is an ASX-listed fintech company that uses big-data analytics to deliver a virtual credit offering for consumers.

MoneyMe provides loans, a Freestyle Virtual Mastercard, a shop-now, pay-later solution, the ListReady finance solutions in real estate, and a car-financing solution (Autopay).

Autopay is an innovative idea. Launched in April 2021, the technology settles secured vehicle finance within 60 minutes, day or night. The big selling point is that it allows customers to browse a car, test drive it, buy it (through finance) and drive it away on the same day.

By offering a fast-finance solution that boosts sales, MoneyMe expects Autopay will have rapid uptake in car dealerships. More than 200 car dealers and brokers have already integrated into the Autopay platform, suggesting the product has high market acceptance.

I like the look of MoneyMe. Its revenue is up from $32 million in FY19 to $58 million in FY21. Net profit has risen from $5 million to $12 million in that period.

A highlight is loan originations jumping from $117 million in FY19, to $384 million in FY21. About 90% of that is from personal loans and the Freestyle Virtual Mastercard. The rest comes from ListReady, MoneyMe+ (shop-now, pay-later) and Autopay.

Put another way, MoneyMe has three new products poised for faster growth. The company is doing a good job leveraging its core Horizon technology into new lending products, and developing future growth engines. I expect faster growth in its loan origination from here.

In December 2019, MoneyMe listed on ASX through an Initial Public Offering (IPO) that valued it at $211.8 million at the offer price of $1.25 a share. The company is now worth $357 million, based on a recent share price of $2.08, Morningstar data shows. That’s a good effort during a pandemic.

But the stock is down from its 52-week high of $2.48 and has tracked sideways in a range-bound style since mid-July. That’s surprising given MoneyMe’s September trading update.

The business reported record loan originations for the first two months of FY22. Originations are up 307% on the prior comparative period (which was Covid-affected).

Of note was MoneyMe’s Autopay originations reaching a $25-million milestone. Autopay has gone from $6 million in the fourth quarter of FY21 to $18 million in the first two months of FY22. Growth is off a low base, so comparisons need care. But it looks like MoneyMe is onto a winner with Autopay, which will be extended to 900 car dealerships.

If I’m right and demand for used cars continues to rise when lockdowns end, Autopay could do well. MoneyMe’s median customer age is 30. That’s a prime market for tradies and other workers who will need a car – or upgrade their existing one – to get to work when lockdowns end.

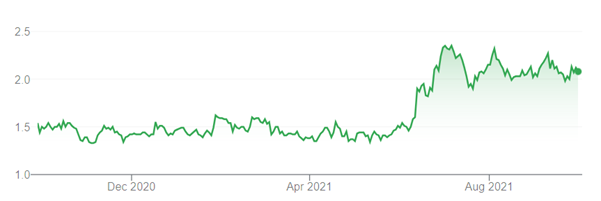

Chart 2: MoneyMe (MME)

Source: ASX

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 28 September 2021.