The global search for yield has found its way to all corners of risk asset markets. Anything with a demonstrable short-term coupon has been ‘bid up in price/bid down in yield’, in line with record low cash rates and record low bond yields.

My strong belief is this has become somewhat dangerous. I am of the view that in many cyclical Australian equity sectors, the risk of substantial capital losses now far outweighs the attraction of “spot” dividend yields.

Buying cyclical equity sectors for “spot” dividend yield is the most potentially capital destroying combination.

In general, when you are receiving an attractive “spot” dividend (or large scale buyback) from a cyclical stock, it is either the peak of the cycle or they have unsustainably reduced operating costs/capex, or most likely, both.

In this context, I believe it is right to be cautious on Australian resource stocks but particularly low grade iron ore producers.

In my view, you only want to own resource stocks when the underlying commodity is rising. They provide earnings, dividend and share price leverage to the given commodity price.

Of course, leverage works both ways and I am of the view that commodity prices, but particularly iron ore, will continue to weaken as supply growth resumes.

Similarly, I would never buy a resource stock solely for its “spot” dividend yield. The dividend is the icing on the cake, not the cake. If the cake is deflating, be careful trying to take only the icing.

It’s also worth remembering that resource companies deplete their asset base every day. They can’t put off sustaining capex forever.

However, the most important debate is the underlying commodity price and the given company’s place on the global cost curve.

As Vale production comes back on over the next 12 to 18 months, there is every chance that iron ore prices revert to the $60t to $70t range from the current $86t. It’s worth noting iron ore has already fallen -27% from the peak price of $118 seen in early July. My opinion is it will fall another -18% to -30% over the next 12 to 18 months, while I also feel the discount of lower grade FE iron ore to high grade iron ore will widen.

Spot iron ore is a deflating bubble caused by a one off issue around the world’s largest producer. As that issue is resolved, the bubble pricing will deflate and so will the share prices of the pureplay iron ore producers.

It is worth remembering that once upon a time cyclical stocks saw P/E contraction and high dividend yields at the peak of their earnings cycle. Nowadays, with so much short-term momentum money in markets, you often see P/E expansion and falling dividend yields at the peak of the cycle. That makes this situation potentially even more dangerous if my view proves accurate.

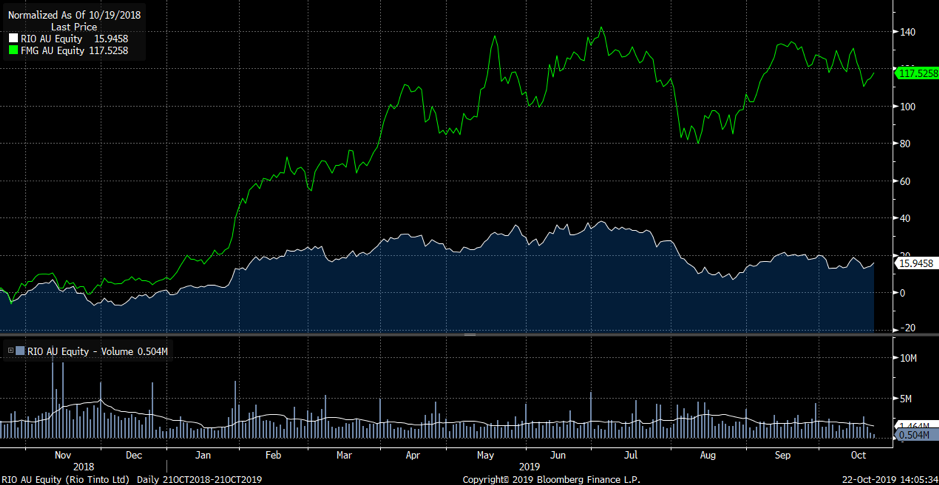

So far, Australia’s largest pure play iron ore producer, Fortescue Metal’s Group (FMG), has seen its share price somewhat defy the -27% initial pullback in spot iron ore prices. History and gravity suggest this won’t persist.

Below is a 5-year chart of FMG vs. the 62% (high grade) iron ore spot price (yellow line). The historical correlation is tight, with the notable exception of the last three months.

If my prediction of a $60 to $70t iron ore price proves right over the next 12’to 18 months, then I believe you will see FMG’s share price re-correlate to the spot iron ore price. That would see FMG as a $4 to $5 share price.

So in chasing FMG’s consensus spot dividend yield of 7%, you are potentially risking a capital loss of -39% to -51%. You could be digging yourself a big hole.

The final point I’ll make is iron ore is the last commodity still standing. In a world where bond yields are pointing to an extended period of slow global growth with low inflation, it is not a bull market for industrial commodities. Commodities are a hedge against inflation, and there isn’t any.

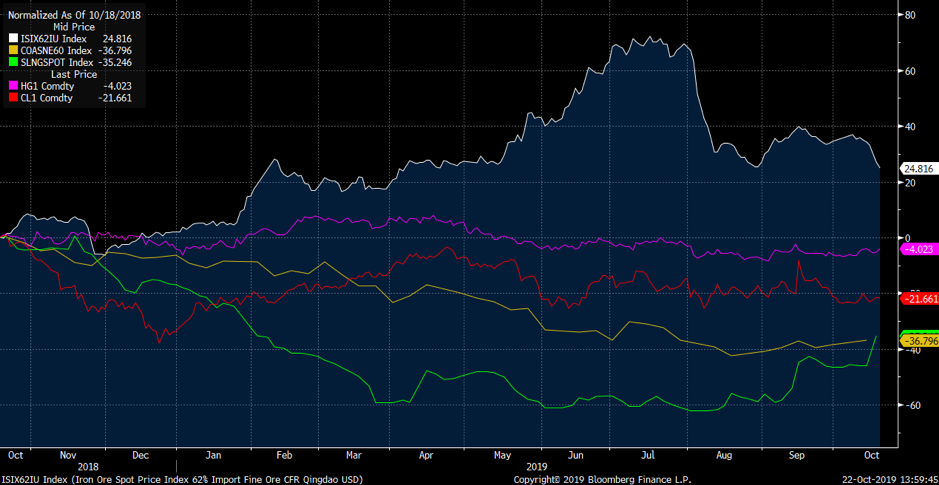

The chart below illustrates the performance of iron ore (white)vs. copper (purple), oil (red), thermal coal (yellow) and LNG (green). Over the last 12 months, iron ore is the only one with a positive price return. This outperformance won’t last and iron ore will re-correlate to its industrial commodity peers, which are all down mildly to significantly over the last 12 months.

If you want to keep some iron ore exposure, I’d suggest considering a switch from FMG to Rio Tinto. Rio Tinto offer’s higher average iron ore grades and more sustainable through the cycle cash flows. Over the last 12 months FMG (green) shares have outperformed RIO (white) by around 100% (illustrated below). I don’t believe that’s sustainable and the margin of safety now lies with RIO in this relationship, particularly in a falling iron ore price environment.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.