A subscriber told me recently that I hadn’t reflected on several stocks for some time and, as I’m in the business of trying to please, I’ve decided to give this loyal supporter the latest analysis for these stocks.

The stocks up for examination are:

- AGL

- A2 Milk

- Appen

- Kogan

- Webjet

Let me do this alphabetically, with AGL first cab on the rank.

- AGL forced to go green

The energy supplier, forced by powerful shareholders to embrace a newer greener approach to power generation, has a 7.7% consensus rise in its share price, if the analysts surveyed by FNArena are right.

Four out of five expert company watchers like the business, and Ord Minnett is a big fan, with a 44.3% higher target price at $12.80.

Over the past year, the stock price is up a lousy 3.26% but year-to-date the gain is 10.32%. The only dissenter on AGL is Morgans with a 22.3% downside predicted.

- Who’s gone sour on A2Milk?

This was a $20 stock even after the Coronavirus crash of the stock market, but it has been going nowhere and I don’t think chart experts would say the current price movement would be getting them excited.

A2Milk (A2M) past.

The consensus rise is 5.4% but the analysts are divided, with three liking the stock and one neutral, while two have gone sour on the stock.

The biggest fan is Ord Minnett, seeing a 32.8% rise ahead, but both UBS and Citi expect a 13-14% fall. On May 10, Rudi Filapek Vandyck reported that Jun Bei Liu from Tribeca Alpha Plus liked both Xero and A2Milk as quality businesses that have been beaten up by the market. Since then, Xero has spiked 17% but A2M has hardly moved. I suspect upside is coming but I’m not sure what it will be. A plus is Beijing removing tariffs on many of our products and soon more Chinese tourists could show up, but A2M remains a speculative play with too many ‘ifs’ and ‘buts’.

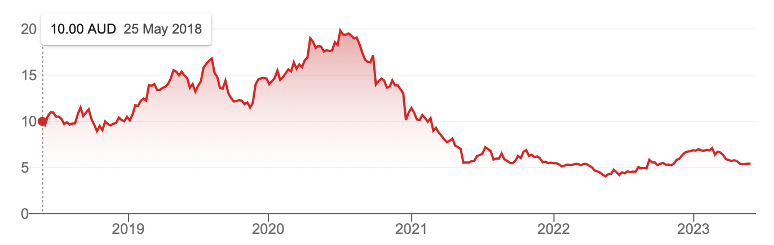

- What will happen to Appen?

OK, it’s time to get real about the shocker that has been Appen (APX). It was once a great business that benefited from having the right offering at the right time, while having few credible rivals. However, the pandemic lockdowns led to its best customers (which needed to cut costs and be less parasitic in using their customers’ data) looking at doing Appen’s work themselves.

This chart below shows what happened to a once great business. APX was a $39 stock in August 2020 but how the mighty can fall! It’s now $2.42 and the chart’s technical analysis doesn’t scream “buy me!”

This is an emphatic “don’t go there” assessment and the only way I could entertain buying APX would be for a punt and to lower my average cost of holding this company.

The new CEO thinks Appen can surf the new artificial intelligence (AI) wave but, of course, he would say that. He also said this: “Appen has tremendous potential. These important initiatives announced today represent a refresh of the business. We are highly focused on the areas that are within our control and have taken the necessary steps to align our cost structure with current revenue expectations and now expect to exit 2023 as an underlying EBITDA and cash EBITDA positive business. With this stronger foundation, we look to the future to fully capitalise on the exciting growth opportunities enabled by generative AI.”

Appen looks like a long-shot racehorse that once was formidable but has become an ‘also ran’ for a long time.

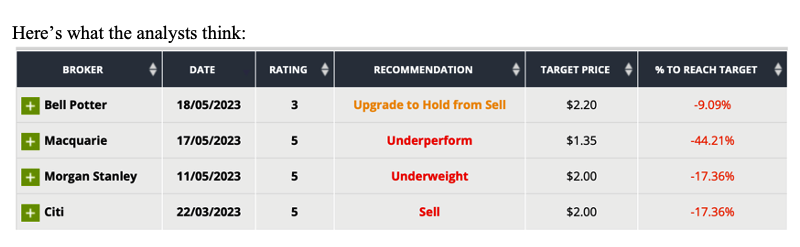

- KGN could surprise but there are lots of ‘ifs’ and ‘buts’.

Kogan.com (KGN) isn’t one of my stocks but in his early days I had a lot of respect for the determination and drive of its founder, Ruslan Kogan. His company was well-placed for the lockdowns, when older Australians had to embrace buying online, which was something younger generations had grown up with.

That said, after lockdowns ended, its share price tanked, as this chart shows.

Kogan.com (KGN)

This was around a $25 stock in October 2020 but the reopening trade and the tech company sell-off partly explain why its share price is now $4.54. Surprisingly, the analysts like the company. By the way, the stock price is up 25% year-to-date and 32.75% over the past six months. The analysts still like the company with a consensus rise of 64.1% predicted. However, there are only two expert company watchers covering the company. Ord Minnett tips a 135.8% rise ahead, while UBS thinks a 7.49% drop is likely. This is another risky, speculative stock that I notice has recently got into flogging travel online.

Kogan could be a surprise packet, but it comes with a lot of risky ifs and buts.

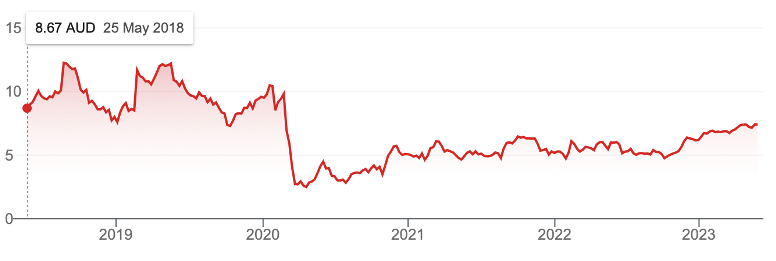

- Webjet – a great rebound/reopening play

The final company that I’ve always liked since I was impressed with its MD, John Gusic (who was a business leader happy to talk to retail investors on TV whether the news was good or bad). Luckily, the news was generally good until the Coronavirus killed travel, but many of you might recall I did tip it as a good rebound/reopening trade play. This chart shows how good that tip was.

Webjet (WEB) five years

Of course, this was once a $12 stock and still might have a way to go to reach its former glory and promise but from its pandemic low on 17 April to now, the share price is up 196%! That’s a flying high result.

Right now, the analysts aren’t on board with this company, with the consensus average saying a 6.1% fall in the share price is on the cards. But wait, there’s more negative news to report.

Five analysts see falls in the stock price between 3% and 19%, while one sees no change. Morgan Stanley is the most negative, seeing a 19% fall but most are really saying that the current share price is about right.

This assessment makes me want to seek out John Gusic to see if he thinks the analysts are missing something. The 60% rise in its share price since early October (a little over eight months ago) could mean it’s a lot to expect that this company’s share price can keep over-delivering.

I won’t be surprised if it does continue to rise, but I doubt whether this breakneck pace can be sustained.

Webjet (WEB) one year

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances