ResMed is a California-based medical equipment company that employs more than 7,500 employees worldwide. RMD mainly provides cloud-connectable medical devices for the treatment of sleep apnea and other respiratory conditions. ResMed has produced over 150,000 ventilators and bilevel devices to help treat the respiratory symptoms of patients with COVID-19. It also provides software to out-of-hospital care agencies to streamline transitions of care into and between these care settings for seniors and their care providers (i.e. home health, hospice, skilled nursing facilities, life plan communities, senior living centres, and private duty).

The company operates in more than 140 countries worldwide and has manufacturing facilities in Australia, Singapore, France, and the United States. Revenue was US$3.0 billion in fiscal year 2020.

Raymond Chan cites these 4 reasons for liking ResMed:

- Its fourth quarter was better than expected, on recovering sleep patient flows and Philips’ device recall gains, despite GM contracting on unfavourable mix and higher costs.

- Device/mask growth increased double-digits, with underlying gains (ex-COVID related sales) up 46%/16%, respectively, on “unprecedented” demand.

- While near-term margin pressure is likely to remain, fundamentals are improving, with US$300-350 million flagged in incremental gains from Philips’ device recall pointing to an improving medium term earnings outlook.

- We have adjusted our FY22-23 forecasts materially higher and introduced FY24 estimates, with our DCF/SOTP based PT increasing to A$41.34.

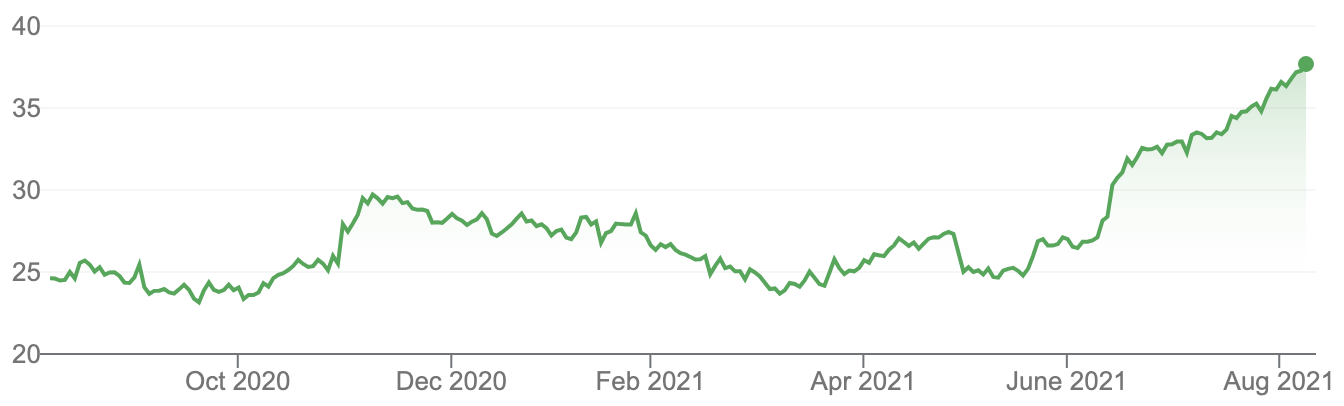

ResMed (RMD)

Source: Google

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.