Let’s talk about Supermarket business.

Wesfarmers (WES)

“WES’s FY21 result was a bit below market consensus at EBIT line,” said Raymond.

“Its key positives are:

- Proposed A$2 per share capital return and;

- Improvement in group EBDIT margin.

“On the other hand, the key negatives are:

- A fall in operating cash flow and retail sales impacted by recent lockdown. In the first seven weeks, we noted even Bunnings recorded a sale fall of 5%.

“After last week’s 6% sell off, WES is starting to look a little bit interesting at its current level,” Raymond concluded.

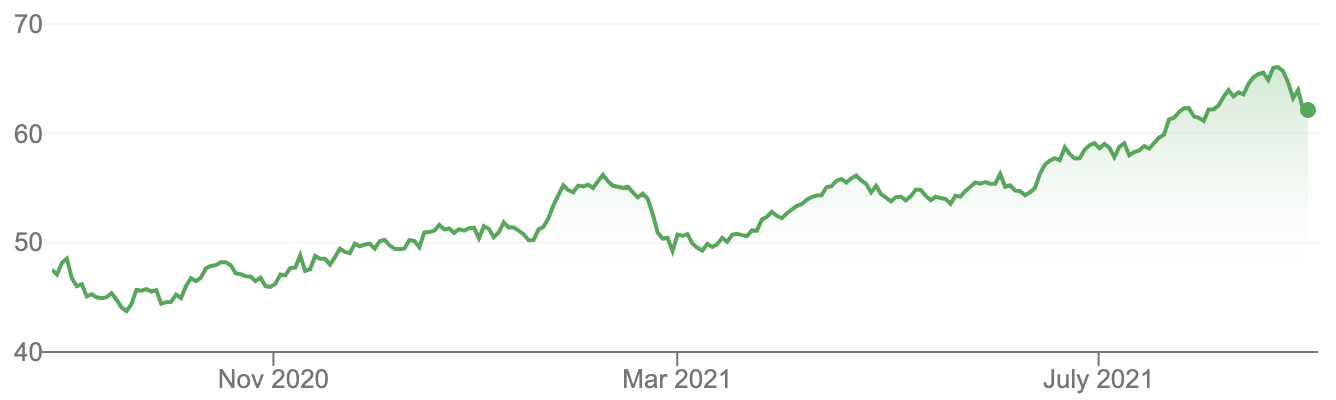

Wesfarmers (WES)

Source: Google

And what about Woolworths (WOW)?

“The result was broadly in line with market expectation,” Raymond said.

“Here are the key positives:

- $2 billion off market buyback

- Positve sale growth from food segment.

“Meanwhile the key negatives are:

- Weak retail results due to lockdown

- High capex I assume it’s important to maintain its competitiveness.

“We have a Hold recommendation on WOW,” Raymond concluded.

Woolworths (WOW)

Source: Google

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.