Like

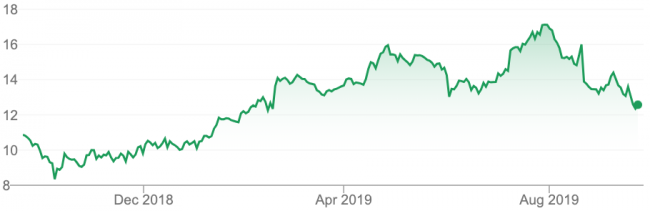

Michael likes A2 Milk (A2M). “Analysts were unimpressed by last week’s Investor Day but the numbers still add up, he says.

“With long-term growth above 15% and a price-to-earnings ratio around 30x, the 25% share price pull back looks like an opportunity,” he adds.

Source: Google

Dislike

Michael doesn’t like Collin’s Food (CKF). “Its share price is boosted by its addition to the S&P ASX200 index,” he says.

“However, at close to $10, the share price is at all-time highs, on a P/E ratio around 24x.

“The KFC and Taco Bell franchise holder would need spectacular growth to justify this sort of multiple,” he adds.

Source: Google

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.