Audinate (ASX:AD8) is the leading global provider of professional digital audio networking technologies. The firm provides audio hardware to end users like stadiums, conference centres and transport hubs.

Their Dante platform distributes digital audio signals over computer networks, effectively turning analogue audio networks with many cables and cords, into digital audio networks that connect through a computer network, making it easier for audio professionals to expand and contract these networks effortlessly.

And Michael Wayne, MD of Medallion Financial likes this stock.

“At the Audinate’s annual report, management had indicated to the market that setbacks emerged in live sound equipment revenue as festivals were cancelled around the world. This decrease was partially offset by increased demand in higher education and conferencing applications,” Michael said.

So has the worst of its Covid-induced downturn passed?

“In recent weeks however, the business has updated the market and demonstrated first-quarter sales they were a beat versus many analyst estimates. It is also now clear that the business has experienced a steady improvement in trading conditions since May leading us at Medallion to believe the worst has passed when it comes to the COVID induced slumber,” Michael said.

Would you tell us more about this Dante platform?

“Through the Dante product, Audinate sells a protocol, which is essentially a microchip and piece of software that work together so any piece of audio and visual equipment can interact with one and another. These software and hardware pieces are then included within the products manufactured by Audinate’s customers, which include the likes of Yamaha, Sony and Bose.

“The Dante product can in many ways be conceptualised in similar terms to Bluetooth. However, imagine if Bluetooth was a company rather than something that was owned by a not-for-profit cooperative,” Michael explained.

Is Audinate the clear market leader?

“As it stands, Dante is a clear global leader and boasts more than 8 times the product adoption of its nearest competitor, with Dante’s share of products in the market now increasing to over 70%. At this stage, the business is still building scale but at this rate of progression, it is conceivable in our view that the Dante product will emerge as an unregulated monopoly,” Michael said.

What are the opportunities ahead?

“In simple terms, the company’s hardware and software allows professional audio equipment (speakers, mixers, mics, etc) to carry audio signals over a computer network, rather than using analogy cables. Going forward and Audinate is looking to replicate this success in the digital video space.

“In January 2019, Audinate released to market their digital video offering on the Dante network, which opens up an opportunity to double the addressable market. To date, progress with Dante video licencees has been encouraging, suggesting that the first Dante video products will be available during FY21.

“It is important to understand that there is often a sizable lag between when work with the manufacturer starts, and when the new products makes it to market and starts generating sales and becomes profitable. With the business developing the next generation Dante audio and video software implementations to address a sizable and growing market, we think investors can benefit from watching this space.” Michael concluded.

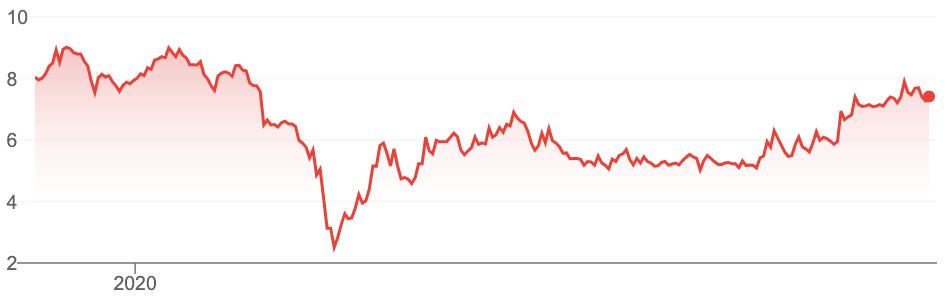

Source: Google

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.