Like: Pushpay Holdings Limited (PPH)

“Pushpay Holdings Limited (PPH) is a cloud-based online payment solution that provides a donor management system, including donor tools, finance tools and custom community apps to religious organisations, non-profit organisations and education providers in the US, Canada, Australia and New Zealand,” said Michael.

“Founded in 2011, PPH operates under a SaaS (Software as a Service) model with a heavy emphasis on churches. As of 31 March 2020, it maintains a customer base of 10,896 churches and an annual revenue retention rate of 100%.

“We find co-founder Chris Heaslip and Directors’ equity stake amounting to 49.7% encouraging, as it suggests there’s a vested interest for management to grow the company

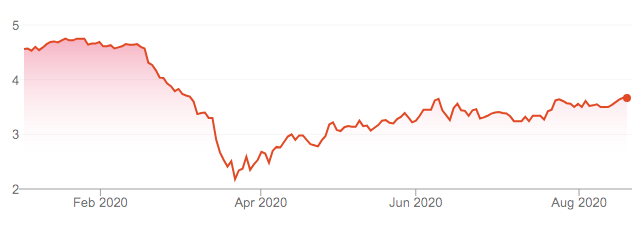

“In the wake of COVID-19, PPH performed very well as the global pandemic forced churches to transition to online service and tithing. Such changes catalysed both Pushpay’s operations and expansion, as evidenced in the share price soaring 213% since March 2020.

“The acquisition of Church Community Builder, complemented Pushpay’s custom community app and donation solution, such that online churches could manage administrative affairs and ensure church announcements, sermon streaming, and mobile giving were maintained throughout quarantine period.

“This new integrated system for churches thrived during the phase of self-isolation and online church such that Pushpay’s total revenues increased by 32% from US$98.4m to $US129.8m last financial year. With social distancing restrictions expected to continue, Medallion is encouraged by Pushpay’s prospects and even more by their gross operating margin jumping from 60% to 65% for the year ended March 2020, and total operating expenses improved by 13 percentage points, from 65% to 52% as a percentage of operating revenue.

“Our view is Pushpay’s integrated system for churches poses as a powerful competitive advantage that differentiates them from other payment process services like PayPal and Stripe.

“Medallion believes there is a direct incentive for churches to subscribe to Pushpay’s products as it leads to more regular donations from the church community. Therefore, despite paying for monthly subscription and donation processing fees, we believe churches would still be inclined to subscribe to Pushpay as the additional costs would be offset by some 76% growth in recurring donations. Thus, we hold a positive outlook for Pushpay as their well-grounded business model leads to systemic revenue growth,” Michael added.

Dislike: Tabcorp (TAH)

“I don’t like Tabcorp (TAH),” said Michael. “It’s a diversified gambling entertainment group and the largest provider of lotteries, Keno, wagering and gaming products and services in Australia.

“Tabcorp’s portfolio includes a number of household Australian brand names such as TAB, Keno, The Lott, George, Max, TGS, eBET and Sky Racing. The Group has four operating segments: Wagering and Media, Lotteries and Keno, Gaming Services and Sun Bets.

“Tabcorp has extended its reseller agreement with Jumbo Interactive (JIN). Under the new agreement this may generate an additional $20m in operating earnings annually.

“However, earnings forecasts by -32% and -24% in FY20-21 and expects no FY20 final or FY21 interim dividend, given the impact on wagering and gaming services caused by physical venue closures.

“Additionally, the company’s multichannel strategy may struggle to stop traditional customers being lost to digital and innovative online betting platform providers, overtime further eroding the value of Tabcorp’s considerable physical retail network.

“Overtime, pressure on Tabcorp from the online invasion causing structural headwinds could have an impact on the broader racing industry. Racing organisations ultimately rely on product fees for prize money. Lower prize money could lead to lower-quality races and develop into a negative feedback loop for the whole wagering industry,” Michael added.

Source: Google

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.