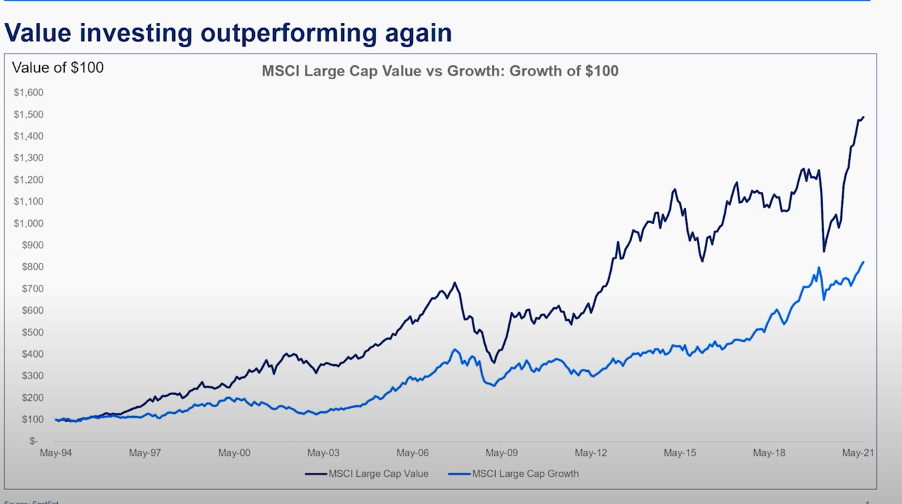

One of the many fascinating observations from the Switzer Listed Investment Conference that we held online last week was this chart, provided by James Holt from Perpetual, who reminded us what kind of stocks do well after a crash of the stock market and a recession.

The chart below compares large cap value (dark blue) to large cap growth stocks (lighter blue).

This shows how out of the dotcom bust of the early 2000s, the GFC slump of 2008-09 and the recent Coronavirus crash, value stocks have surged, and they tend to do that for quite a long time.

These stocks lost their mystic and upside power in the five years before the Coronavirus changed everything, but since the bottom of the crash you can see how they’ve spiked. You don’t have to be Warren Buffett to work out that looking for value stocks after a crash is an investing theme that works.

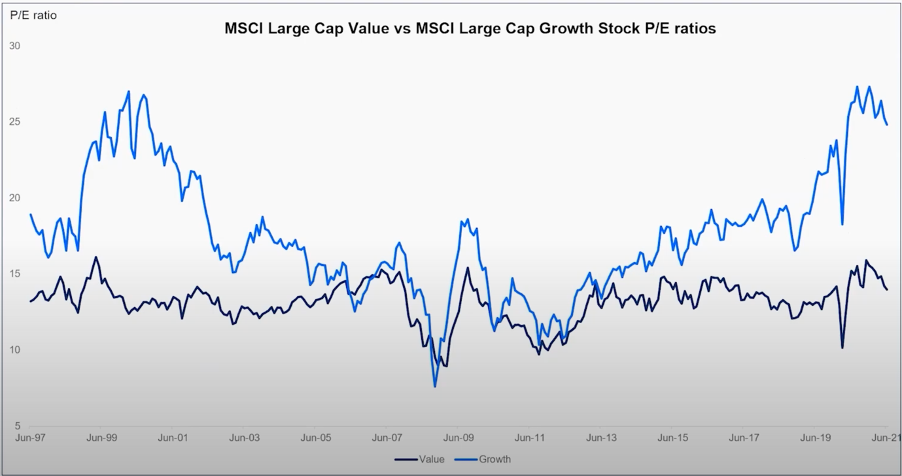

This next chart looks at price/earnings ratios of growth versus value stocks and another compelling case for value stocks is made.

This chart shows how P/Es have shot up for growth stocks, and James Holt points out that they are at levels in the US akin to where they were with the dotcom crash. On the other hand, the dark blue line shows that the P/Es of value stocks haven’t taken off madly. Their more restrained behaviour tells us that more upside is likely ahead.

By the way, if interest rates were higher, I’d be more worried about those elevated P/Es for growth stocks. Instead, they are at such low levels, they don’t kill off fans of these stocks/companies.

History shows value stocks have a strong correlation with an upswing of economic growth — and that’s what’s expected in 2022 here in Australia, with the likes of AMP Capital’s Shane Oliver forecasting 6% growth.

Why? Well, higher vaccination rates will lead to no lockdowns, the reopening of the economy and businesses leveraged to a more open economy. And if those businesses will benefit from no longer being terribly disadvantaged by lockdown restrictions, they will see a healthy rebound in their share prices.

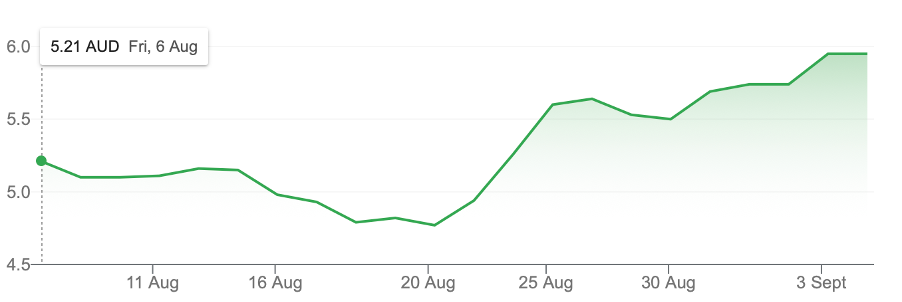

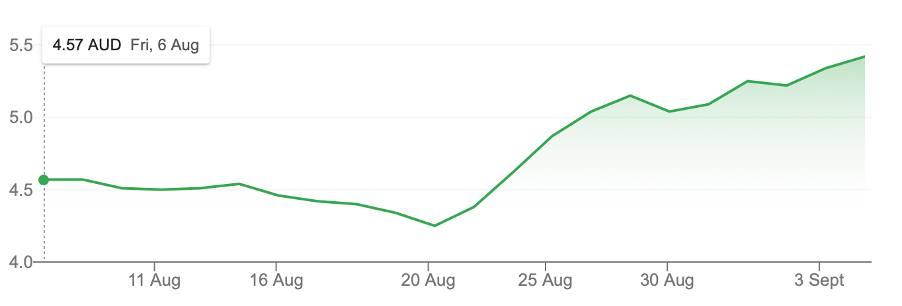

In recent weeks, the positive possibilities for less lockdowns and borders reopening have driven the share prices of Qantas and Webjet.

QANTAS (QAN)

WEBJET (WEB)

In the past month, Webjet is up 14.2%, while Qantas is up 18.27%. These will have more legs up as normalcy eventually shows up in 2022, albeit with vaccinations and booster shots!

Right now, analysts think WEB has a 1.8% downside, with a target price of $5.84. The more optimistic Ord Minnett analyst is flying high with a $7.12 call, which implies a 20% upside.

The flying kangaroo has more supporters, with the FNArena consensus tipping a 9.8% upside for Qantas. But Morgan Stanley thinks the current $5.38 share prices will track up to $7, which says a 30.11% gain is possible on their calculations.

Typical value stocks are often financial, energy and material stocks. They are companies that might be seen as cheap (at the moment) and will do better as the economic cycle kicks up.

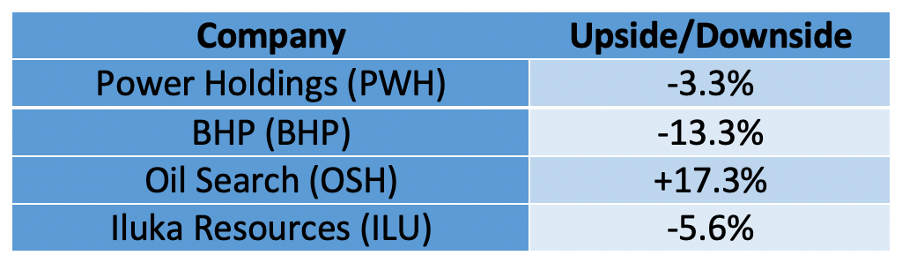

The Perpetual fund that James Holt is connected to, has Power Holdings (PWR) with a 5.2% weighting, BHP at 4.7%, Oil Search (OSH) at 4.2% and Iluka Resources (ILU) at 4.1%.

For Friday’s monthly webinar [1], Paul Rickard and I will unearth some more great value stocks that might be worth investing in for the next few years.

Taking a line through Perpetual’s argument about the upcoming time for value stocks, I identified that a company like Fortescue Metals Group should be well-placed, and analysts have a consensus view on FMG of 14.3% upside.

However, both Macquarie (up 42.78%) and Ord Minnett (up 48.07%) are huge believers in the future of value stocks and obviously the strength of the bounce-back for the global economy in 2022.

I must admit I’m looking forward to digging up more value stock tips for Friday’s webinar!

And if you missed last week’s conference, you can play catch up here [2].

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.