I want to make a less than confident but optimistic forecast about the share prices of four stocks and my lack of certainty may increase the odds of me being right!

I’m really annoyed that I’ve lost the source of an interesting US report I read last week that found less confident forecasters tend to be the most accurate! You might have noticed that I never get emphatic about short-term expectations for stocks. I can be a little more certain with the economy as there are less curve balls with that ‘beast’, but even with interest rates or inflation, even well-trained economists can be surprised.

Economics isn’t an exact science, while the stock market borders on the dark arts!

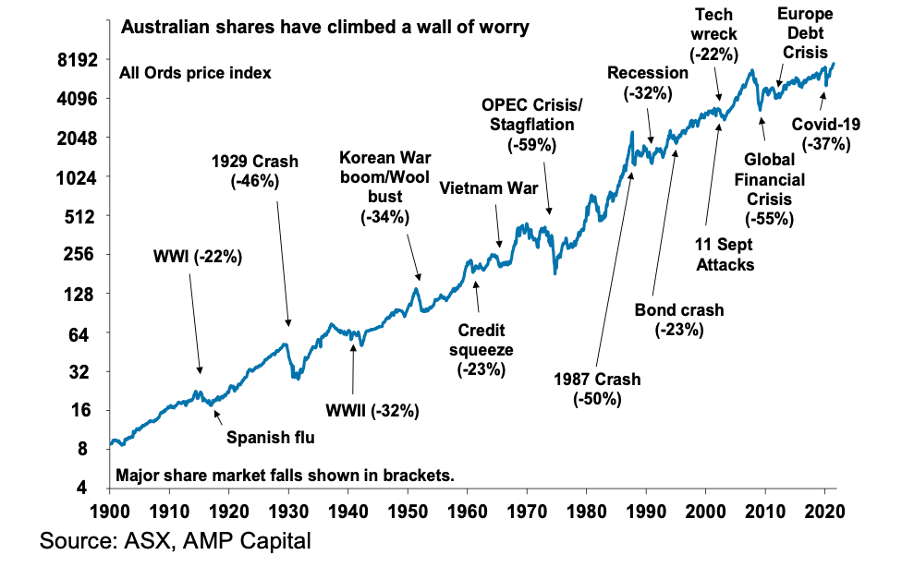

All Ords 1900-2020

The likes of Warren Buffett freely admits he doesn’t know where his stocks and the overall market will go in the short term but he is confident that it will go higher in the long term, as the chart above shows.

Over the years, doomsday merchants have confidently predicted the end of financial markets, Great Depressions, collapsing house prices and gold going through the roof. But, as the study showed, the confident forecasters have a happy habit of being more wrong.

And all this sets the scene for me to look at what happened to my ZEET stocks. I want to see what are the individual and collective outlooks for these businesses of the future.

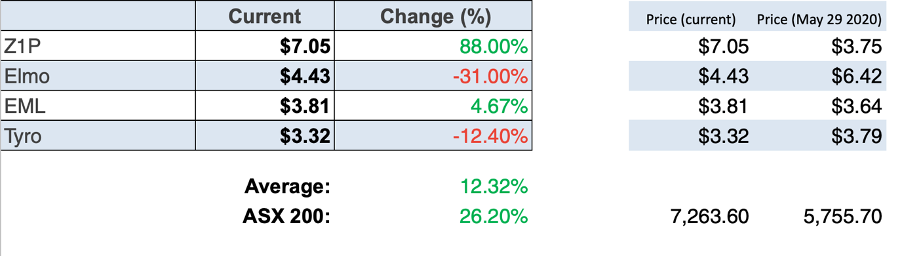

These were put forward by me on May 29 last year as stocks that looked promising. They were Zip Co., ELMO Software, EML Payments and Tyro.

At one stage the group was up 45% plus and had beaten the brains out of the S&P/ASX 200 Index and the WAAAX group of hi-tech stocks, but ZEET’s fortunes have changed. So, I think it’s timely to look at their future.

The tables below show the relative positions of these groups of stocks.

So WAAAX stocks are now up 32.44%, the S&P/ASX 200 is up 26.2% and ZEET is up only 12.32%.

The two laggards have been ELMO (ELO) and Tyro (TYR), while EML is up, but only just.

So, what happened to their spectacular gains? And can they come back?

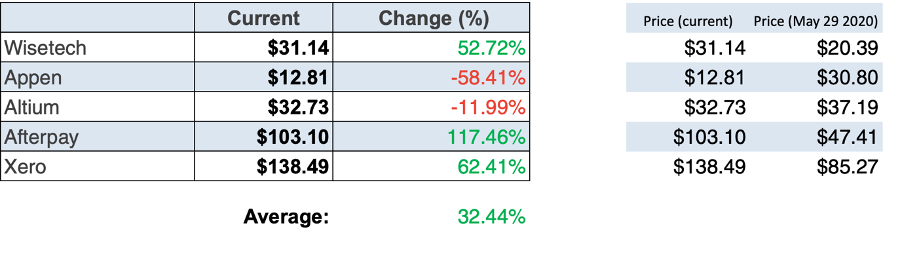

Tyro was a victim of a hedge fund manager based overseas, who put out an exaggerated and negative report on the company that KO’d its share price. The report was released to the market at 11am on a Friday in January and the media published the largely false story without question and the share price nosedived.

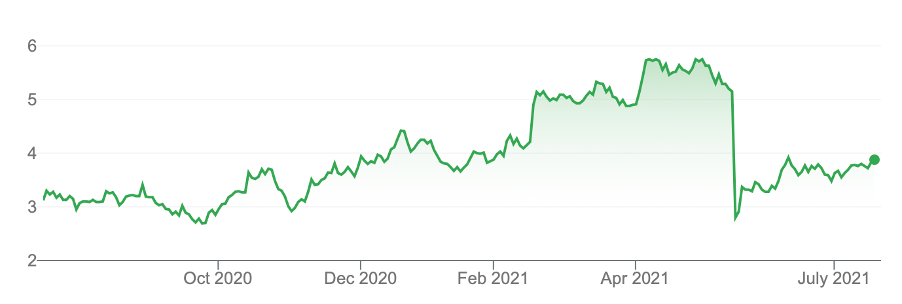

Tyro (TYR)

The company was having problems with lockdowns and had a terminal problem but the hedge fund report was unfair and you can see how the share price has trended back above where it was even before the report in January.

Right now, as a supplier of retail credit card terminals, especially to hospitality, these lockdowns aren’t helping Tyro’s share price. This is a classic reopening trade stock, so I expect a share price gain once vaccinations help create normal lives in 2022.

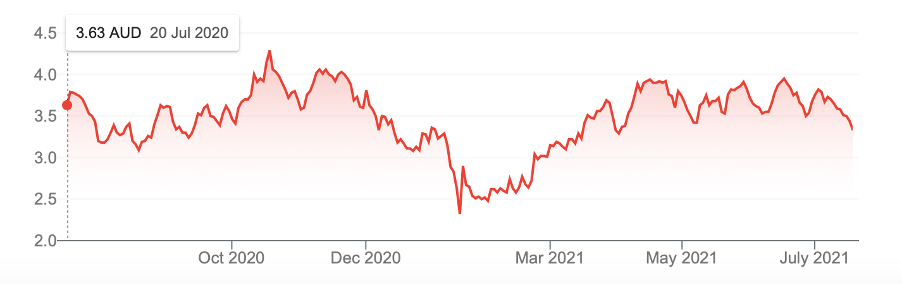

EML was flying high until a Central Bank of Ireland inquiry into some “significant regulatory concerns” over anti-money laundering compliance clobbered the share price. The chart below shows when it happened.

EML Payments (EML)

Uncertainty about the implications and the costs linked to these issues are hurting the stock but this is a company that was always seen as another classic reopening trade stock being into, among other things, digital loadable cards for betting at casinos, as well as gift cards in shopping centres.

Once again, when the world gets back to normal, these two parts of the business will have revenue lifts.

Zip has been a strong performer, up 88% since writing, but it now faces challenges from PayPal, Apple, CBA and others. But I do like the company’s innovative tenacity, its growth in the US via its Quadpay subsidiary and its 2.5 million customer base, that could sell any number of financial products and services in the future.

Finally, ELO has been a disappointment, but I can’t pinpoint anything that the company is getting terribly wrong. It has acquired good add-on businesses for the future, it’s marketing hard (with even a sponsorship with the AFL’s Swans) and, in today’s Australian newspaper, the company’s survey on workplace attitudes to vaccinations attracted headlines.

It looks like a company on the up with a 500-strong workforce.

I think this is a business, which again will benefit from life getting back to normal. The media believed the company should have done well during the stay-at-home stage of the pandemic, with more employees working from home, but many big businesses would be holding back on their HR spending, until they see who is going to be working where in the new workplace environment.

The company’s CEO, Danny Lessem, thinks normalcy will be much better for the business’s prospects.

So that’s my short summaries on the ZEET companies, but what do the analysts say?

That’s a potential average gain of 41% if the experts are right, but even if the ELO gain is pulled back to say 25%, that would still be a 20% gain on average.

That’s the bet you could make on the likelihood that normalcy via vaccinations will deliver these businesses of the future a pretty reasonable gain of 20%.

I can’t predict this with any confidence because this Coronavirus has thrown more curve balls than we could ever have imagined in February last year, when it all began. But I’m more confident that the overall S&P/ASX 200 Index won’t be doing 20% this financial year after its 24% surge over 2020/21.

So what can make me right? That’s simple — will a big vaccination rate happen between now and next year? And then will it create the kind of life normalcy that these companies could thrive off?

I’m going for ‘yes’ and ‘yes’ on these two questions and I’m adding to my ZEET stocks, albeit with guarded confidence.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.