My experience with successful people has taught me that it pays to cop feedback — especially constructive criticism. Unfortunately, in the modern world of social media and keyboard warriors, you have to develop a very thick skin to cop the bagging you can accumulate on Twitter and the like.

Last week on our own feedback site, someone thought my “stocks will rise by 10% this year” call, was “comedy gold”. He heard this when I repeated it when I interviewed Chris Joye of Coolabah Capital, who has a 30% to 60% crash of stocks call out there!

But after all that’s happened, I now think the rise for stocks this year from here will be more than 10%. Why? Well, let me explain.

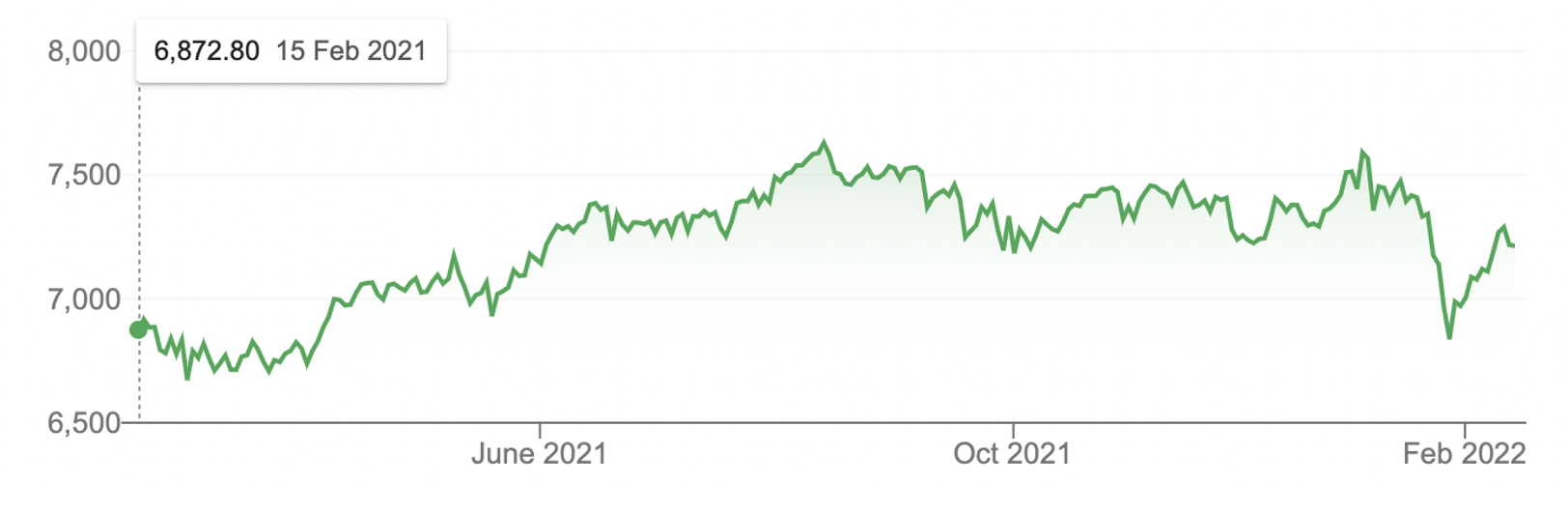

Early in the year (January 11), I came out with ‘the 10% rise of our market’ call. That’s when our S&P/ASX 200 Index was at 7390. It’s now at 7220 and bound to go lower after the Ukraine war fears are added to the interest rate worries that have sent tech and other growth stocks lower.

S&P/ASX 200

The chart above shows what’s happened. While the steep fall proves that we’re in for a volatile year (as we predicted last year for 2022), it also shows how we can rebound. On January 27, our ASX 200 Index slumped to 6838.8, but we’ve now rebounded over 5%, despite the fact that interest rate concerns have deepened.

Right now, interest rate and inflation fears are competing with the expected economic rebound after Omicron dissipates and supply chain problems reduce, bringing down inflation as the world sees the global economy rebound.

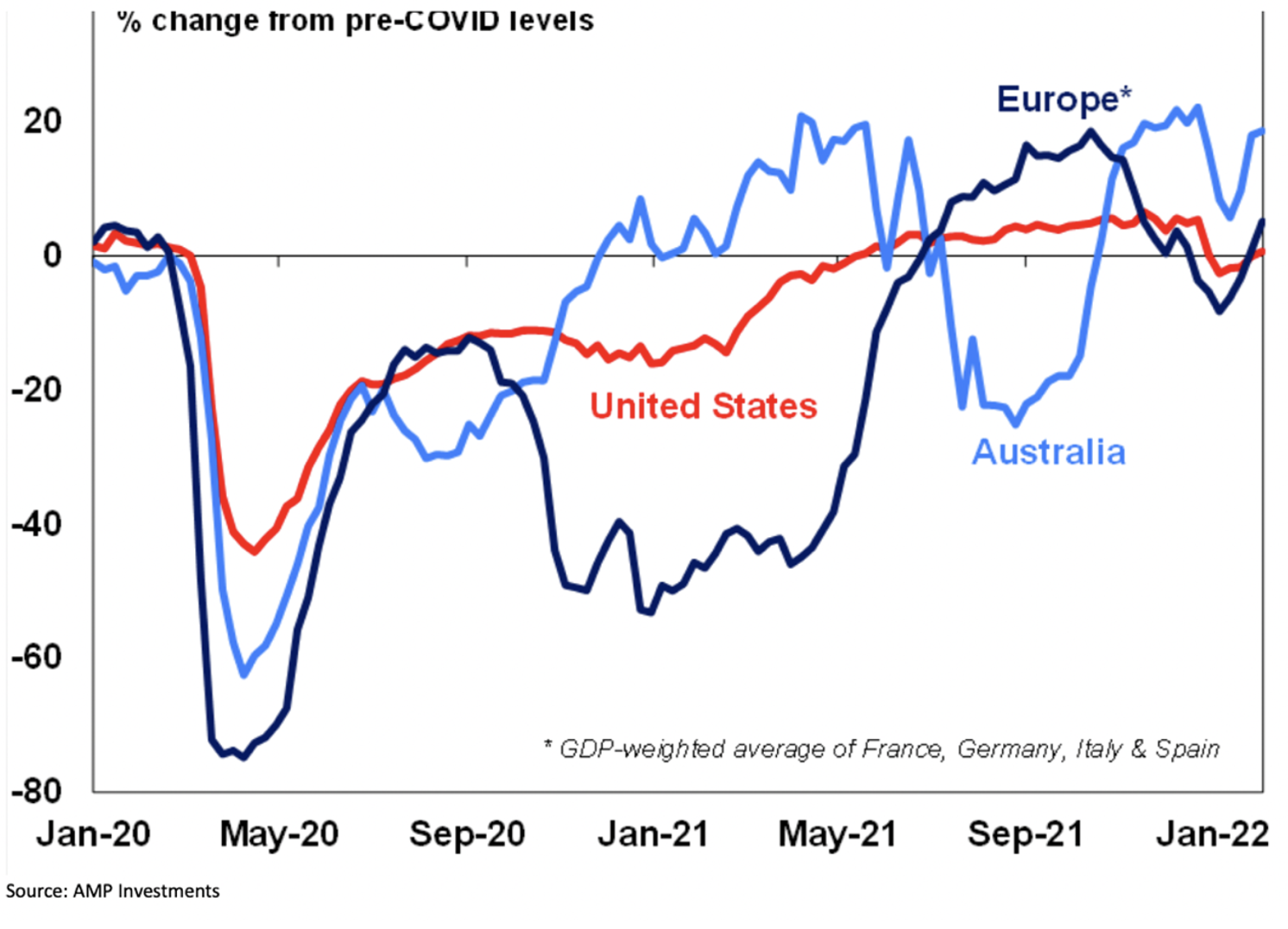

The latest Economic Activity Tracker chart from AMP Capital shows how economies boom out of pandemic restrictions and lockdowns — and that kind of rebound lies ahead this year. This should power the stock market, as good economic growth underpins share prices. The blue line in the chart above shows how even with Omicron we’re starting to rebound.

I was staggered by how the NAB business confidence index bounced higher in January. As I said in my Saturday Report: “that number rose strongly in January to 3.5, after a minus 12 reading in December … the 15.5 point rise was the fourth biggest rise on record”.

So I’m pinning my hopes on no serious war fallout and no new virus threat, which has to be a reasonable bet.

But what about the US economy and stock market, as Wall Street is critically important to our market?

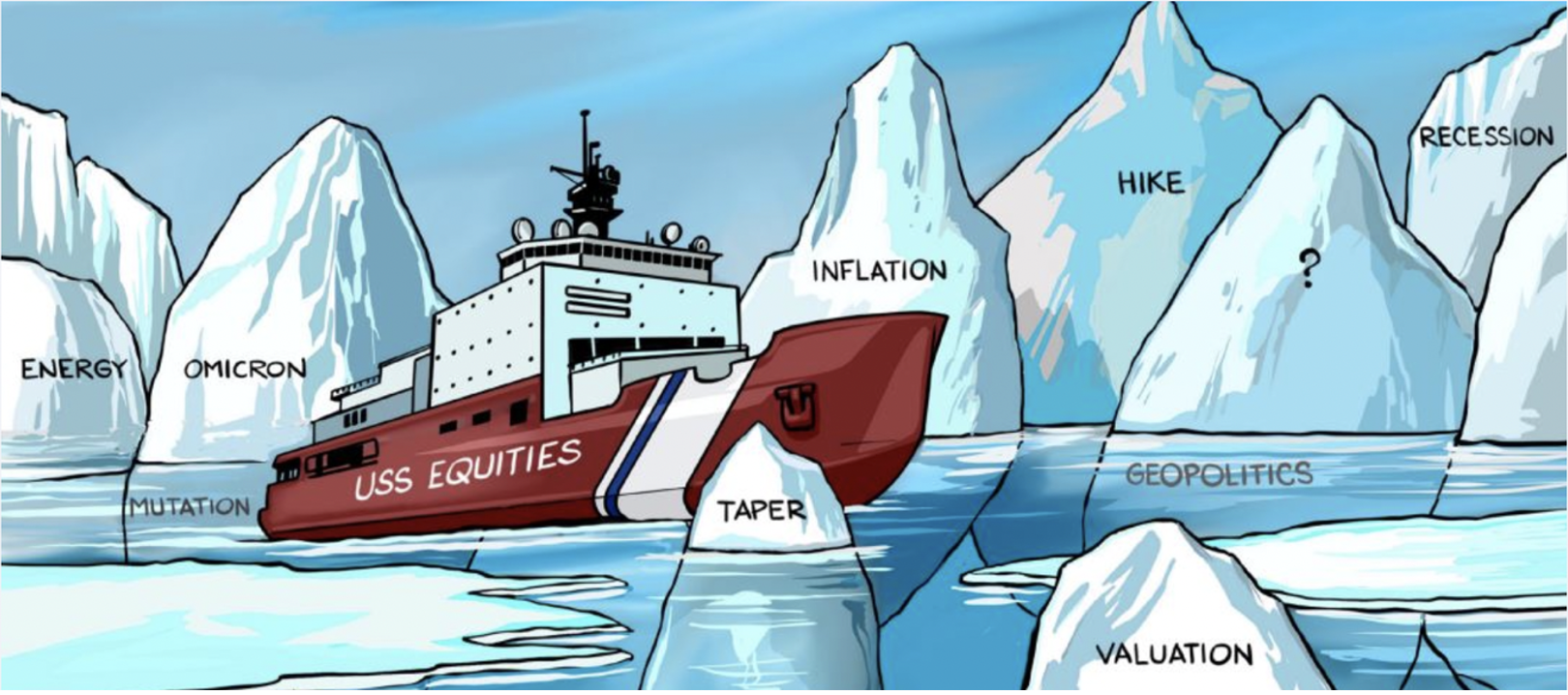

This cartoon from Goldman Sachs shows the ‘icebergs’ that markets have to navigate in 2022.

This is what the Goldman Sachs’ investing team said in their introductory piece to what happens this year: “2021 was a remarkable year for US financial assets. US equities returned an eye-popping 28.7%, extending their gains since the trough of the global financial crisis to 812%—an outperformance of more than 500 percentage points relative to non-US developed and emerging market equities.”

And after 13 years of recommending their clients “stay invested”, with the threats displayed above and the huge year for stocks in 2021, you’d expect that they could be ready to be less confident about being long stocks. But you’d be wrong!

This is their latest take on stocks for 2022: “We expect an ongoing economic expansion in the US to support above-consensus earnings growth for S&P 500 companies this year, leading to mid-single-digit total returns that are superior to cash and bonds.”

They argue that the S&P 500 index could end 2022 at 4950 to 5050, but they don’t rule out the index making it to 5300.

I’ve always argued that our market has the potential to outperform the US stock market because we underperformed the Yanks in 2021. Also, the expert pundits are very keen on financials, mining and energy companies as the global growth kicks in.

This makes a 10% gain for our market over this year very believable. But what about Chris Joye’s 30-60% fall call?

Well, when I pressed him, Chris admitted that his worst-case scenario could be a 2023 or 2024 outcome. He also agreed if the Fed is measured with its rate rises, then the market’s fall could be later rather than sooner. He also conceded the trade-off between the pace on interest rate rises, against the slowing of inflation and the pace of economic growth could create more favourable conditions that would help bankroll rising stock markets, at least for 2022.

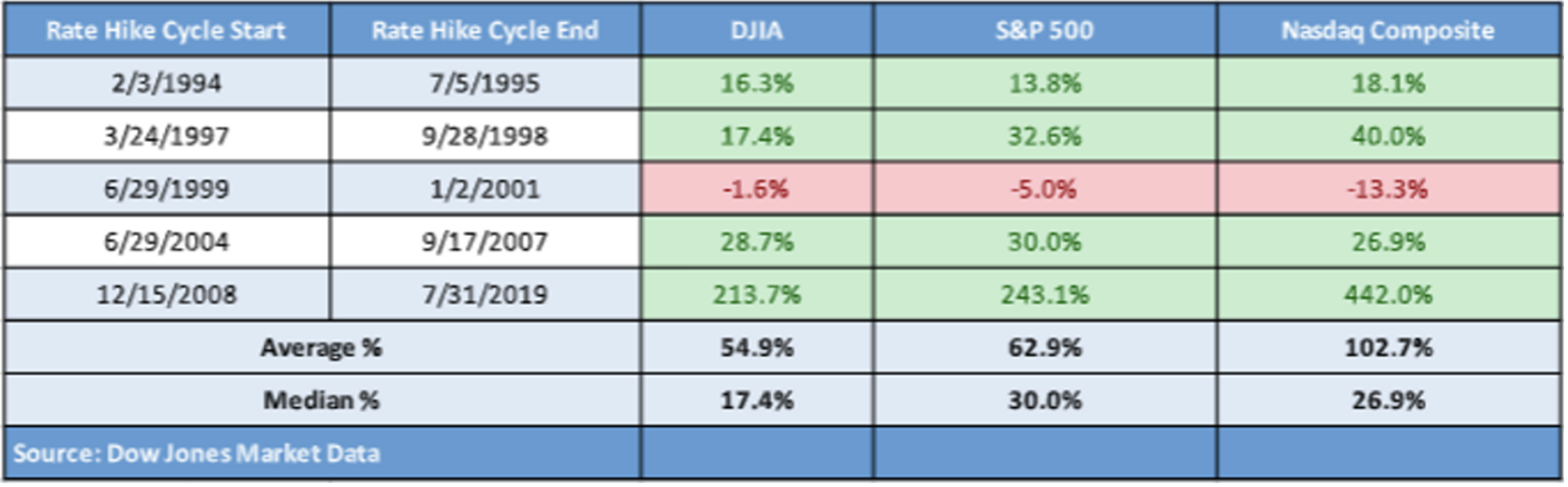

And then there’s this important chart below, which a few weeks ago I should have shown you to explain how stock markets actually rise even when interest rates start to rise.

Rising Interest Rates & Rising Stock markets

Only in 1999-2001 did rising interest rates come along with falling stock markets. That was the dotcom bust period for US stocks. And what about the rises for 2008 to 2019, which were 213% on the Dow and 442% on the Nasdaq!

Maybe the median numbers (17.4% and 26.9%) are more of what we can hope for, given how much the US market has already risen. That said, I think the case is pretty clear that rising interest rates don’t immediately smash stock markets.

Personally, I‘m waiting for a convincing bottom for the overall stock market and then I’ll be looking at an ETF for the ASX 200, and maybe even more of my Switzer Dividend Growth Fund, which tends to follow the overall market but should deliver a slightly better dividend.

By the way, only on Friday, CNBC told us that Goldman lowered its official S&P 500 target to 4900 from 5100 previously. The new forecast represents just a minuscule 2.8% price return from where the benchmark ended in 2021. However, the target is still 10% higher than Friday’s close.

Of course, I could be wrong, but given Goldman Sachs’ and others investment banks’ views on stocks going forward, I will be in pretty good company.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.