Higher bond yields in the USA weighed on global equities in August. Locally, company reporting season was in full swing, with the overall market losing 1.4% in the month (or 0.7% when dividends are taken into account). Our portfolios followed suit, finishing with modest losses for the month.

Year-to-date, both the market and our portfolios are enjoying respectable gains. The growth portfolio continues to outperform the benchmark index, while the income portfolio, with an overweight position in financial stocks and no exposure to technology stocks, is lagging the benchmark.

There are two model portfolios – an income-oriented portfolio and a growth portfolio.

The objectives, methodology, construction rules and underlying economic assumptions can be referenced here: (see: https://switzerreport.com.au/our-portfolios-for-2023/ [1]

These are long-only model portfolios, and as such, they are assumed to be fully invested at all times. They are not “actively managed”, although adjustments are made from time to time.

In this article, we look at how they have performed so far in 2023. To do so, we will start by examining how the overall market has fared.

Technology and consumer discretionary stocks lead the market

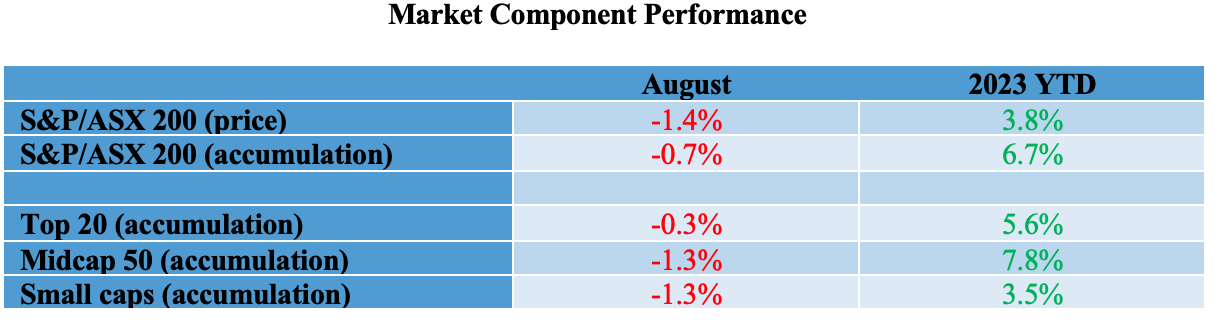

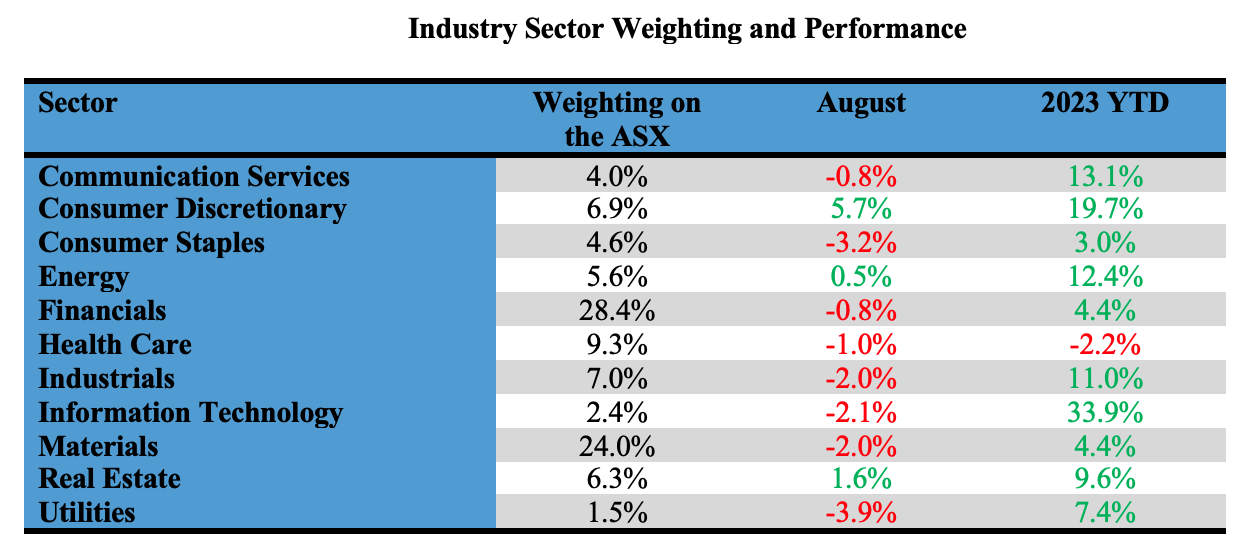

The tables below show the performances in August and for the calendar year of the components and industry sectors that make up the Australian share market.

In August, the “top 20” stocks modestly outperformed the broader market losing 0.3% compared to the index loss of 0.7%. Small caps continued to perform relatively poorly, losing 1.3% in the month. The midcap 50 index, which tracks the performance of stocks ranked 51st to 100th by market capitalization size, continues to outpace the broader market in 2023 with a return of 7.8%.

With the industry sectors, information technology is the standout sector. Following the lead from the USA, the sector has posted a gain of 33.9% in 2023. In August, it gave back 2.1% mainly due to the performance of its leading constituent, WiseTech Global, which lost 19% due to disappointing earnings guidance.

The largest sector, financials, lost 0.8% in August. Making up 28.4% by weighting of the broader S&P/ASX 200 index, the sector has added 4.4% in 2023, underperforming the overall market by 2.3%. The second largest sector, materials, which includes the big miners such as BHP and Rio, has also recorded a return of 4.4% and lags the overall market by 2.3%.

Consumer discretionary is perhaps the “surprise” sector of the year, given the negative commentary about consumers being stretched and higher interest rates taking their toll on consumer spending. Strong profit results from companies such as Wesfarmers and JB Hi-Fi led to the sector recording a gain of 5.7% in the month and being up by almost 20% in 2023.

The healthcare sector is the only sector to be in the “red” in 2023, down 2.2%.

Portfolio Performance in 2023

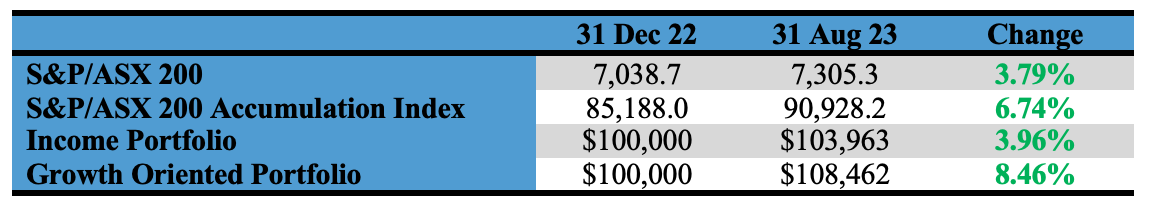

The income portfolio to 31 August has returned 3.96% and the growth-oriented portfolio has returned 8.46% (see tables at the end). Compared to the benchmark S&P/ASX 200 Accumulation Index (which adds back income from dividends), the income portfolio has underperformed by 2.78% and the growth portfolio has outperformed by 1.72%.

Income Portfolio

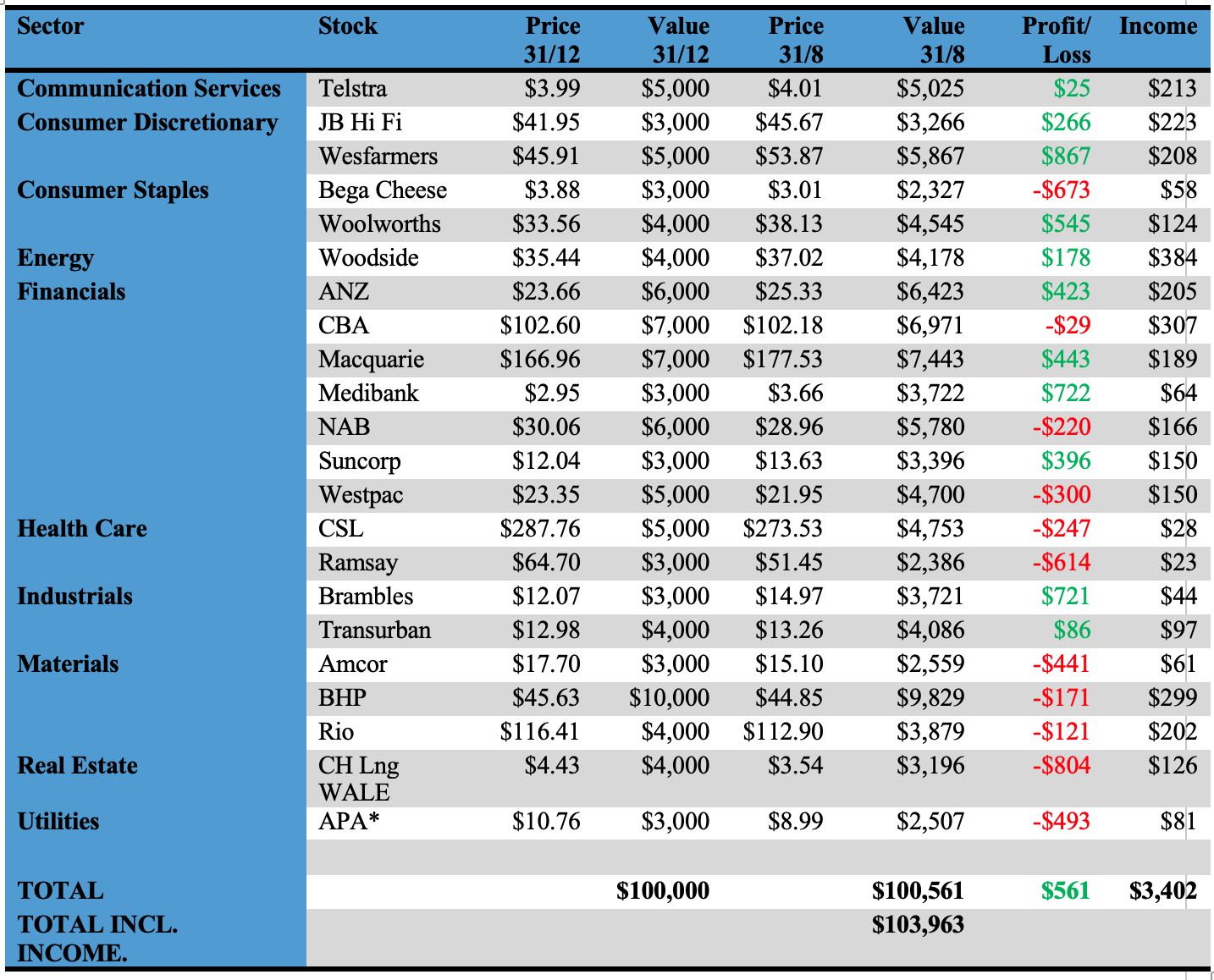

The objective of the income portfolio is to deliver tax advantaged income whilst broadly tracking the S&P/ASX 200.

The income portfolio was forecast to deliver an income return of 5.0% (based on its opening value at the start of the year), franked to 80.3%. With dividends declared during the February and August reporting seasons, it is on track to marginally exceed this. Year to date (eight months to end August), the income return is 3.40% franked to 84.4%.

In the month of August, the income portfolio lost 1.10%. Higher bond yields impacted “bond proxy” stocks such as Transurban, Charter Hall Long WALE REIT and APA, with the latter also being sold off due to an acquisition and capital raising. Compared to the benchmark index, the portfolio underperformed by 0.37%. For the year, it has returned 3.96%, which is 2.78% behind the index.

The portfolio is moderately overweight financial stocks and underweight the more growth-oriented sectors such as information technology and health care. In a strong bull market, the income portfolio will typically lag the market, and in a bear market, it is likely to outperform.

No changes to the portfolio are proposed at this point in time.

The income biased portfolio per $100,000 invested (using prices as at the close of business on 31 August 2023) is as follows:

* Portfolio unable to participate in APA capital raising at $8.50 per share

Growth Portfolio

The objective of the growth portfolio is to outperform the S&P/ASX 200 market over the medium term, whilst closely tracking the index.

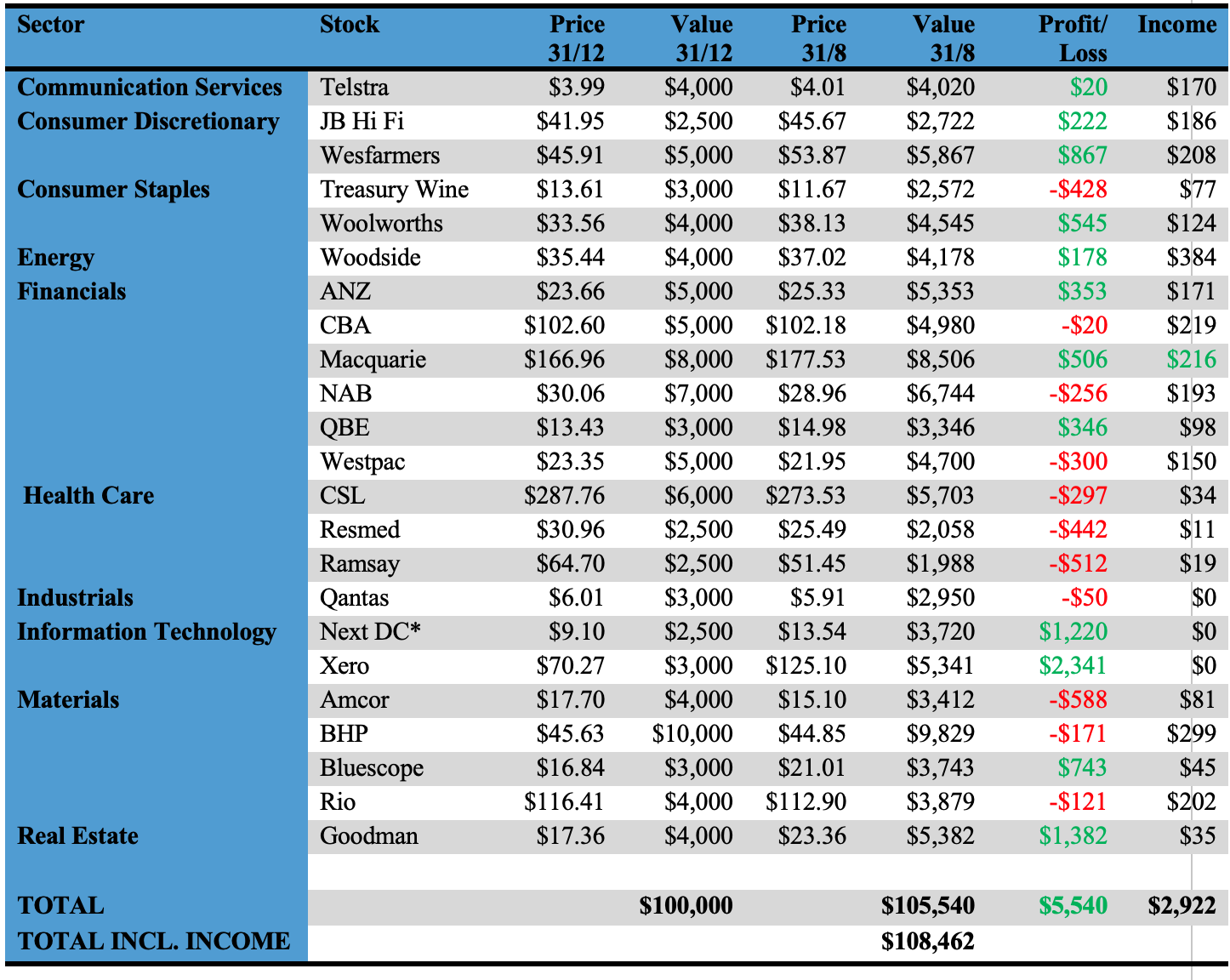

In August, the growth portfolio returned -0.13%, outperforming the benchmark index by 0.60%. This was largely due to the strong performance of Goodman Group, Wesfarmers and NextDC, offset by losses from Ramsay, Resmed and Qantas. Year to date, it has returned 8.46%, outperforming the benchmark by 1.72%. (Note: performance does not include potential participation in NextDC 1:8 non renounceable entitlement issue at $10.80 per share).

The portfolio is moderately overweight financials, health care and information technology. It is moderately underweight industrials, real estate and utilities. Overall, the sector biases are not strong.

No changes are proposed to the portfolio at this point in time.

Our growth-oriented portfolio per $100,000 invested (using prices as at the close of business on 31 August 2023) is as follows:

* Performance does not include participation in 1:8 non-renounceable issue at $10.80 per share

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.