The best news any investors (except for short-sellers) would want to hear is that talks between Russia and Ukraine have seen “certain positive shifts” and this news is even more helpful when it comes out of the mouth of Vladimir Putin.

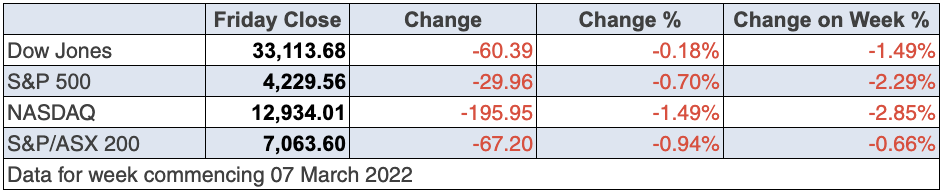

It has to be the best explanation of why the German DAX ended up 1.38% overnight, the UK’s FTSE 0.8% higher and the French CAC rose 0.85%. It’s early days and you have to expect twists and turns when you’re dealing with Putin, but we’ve now seen two positive market moves when talk of ending this war emerges.

Of course, when a real solution emerges, expect a big rebound of stocks. But then the focus will shift onto inflation and the pace of interest rates rises in the US.

But if you have a natural inclination to be negative, let me inform you that respected market experts (such as US-based Tom Lee of Fundstrat Global Advisers, who told CNBC this week that markets are: “far more treacherous than expected but the S&P 500 could still rally to 5100 or higher by year’s end”) are surprisingly positive.

On that basis, experts like Lee are saying not to give up on the US stock market’s most significant index being up 20% this year! If Wall Street can do that, it will be very positive for local stocks, and this potentially good news story would be helped by a slide in inflation, which the end of the war would assist, as it would bring down the price of oil and petrol at the pump.

On inflation, the European Central Bank surprised many this week by saying it could stop bond-buying in the September quarter if the economic data justified it. That ordinarily would be a positive sign that the EU economy was on the mend from the pandemic problems. But the timing was curious, given the negativity linked to the war threat that has been spooking European stock markets.

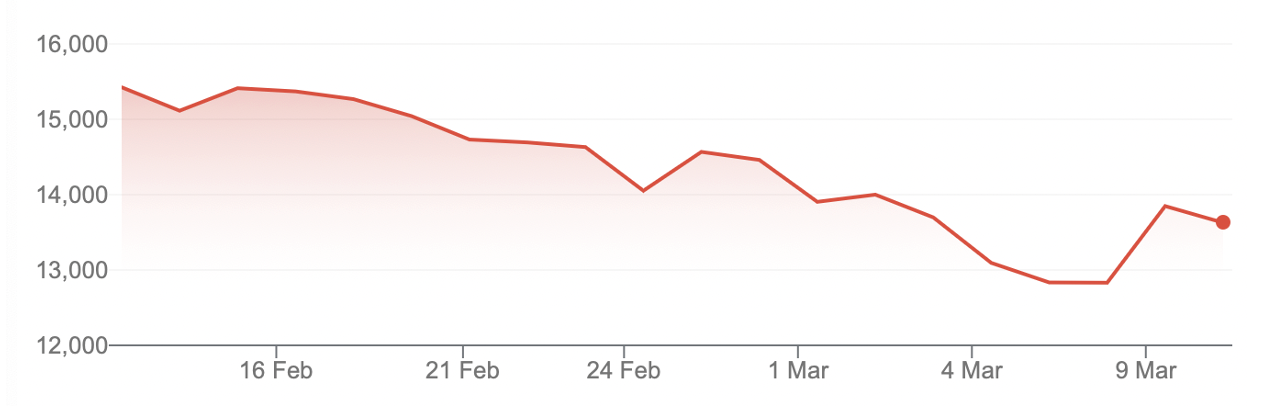

DAX one month

The German stock market is down 11.65% in a month, while our S&P/ASX 200 is off only 2.49% and 4.87% over six months, yet the headlines are making a lot of Aussie investors more scared than they need to be.

Sure, individual stocks have fallen by a lot more because of the war and inflation threats but the share price of good companies will eventually rebound.

To Wall Street and the Dow was in line for the 5th week of losses, despite being in positive territory overnight and before the closing bell. Inflation and rate rising concerns have now been replaced by war fears, but the S&P 500 has lost about 11.3% year-to-date, which has taken a lot of excessive enthusiasm for tech stocks out of the market.

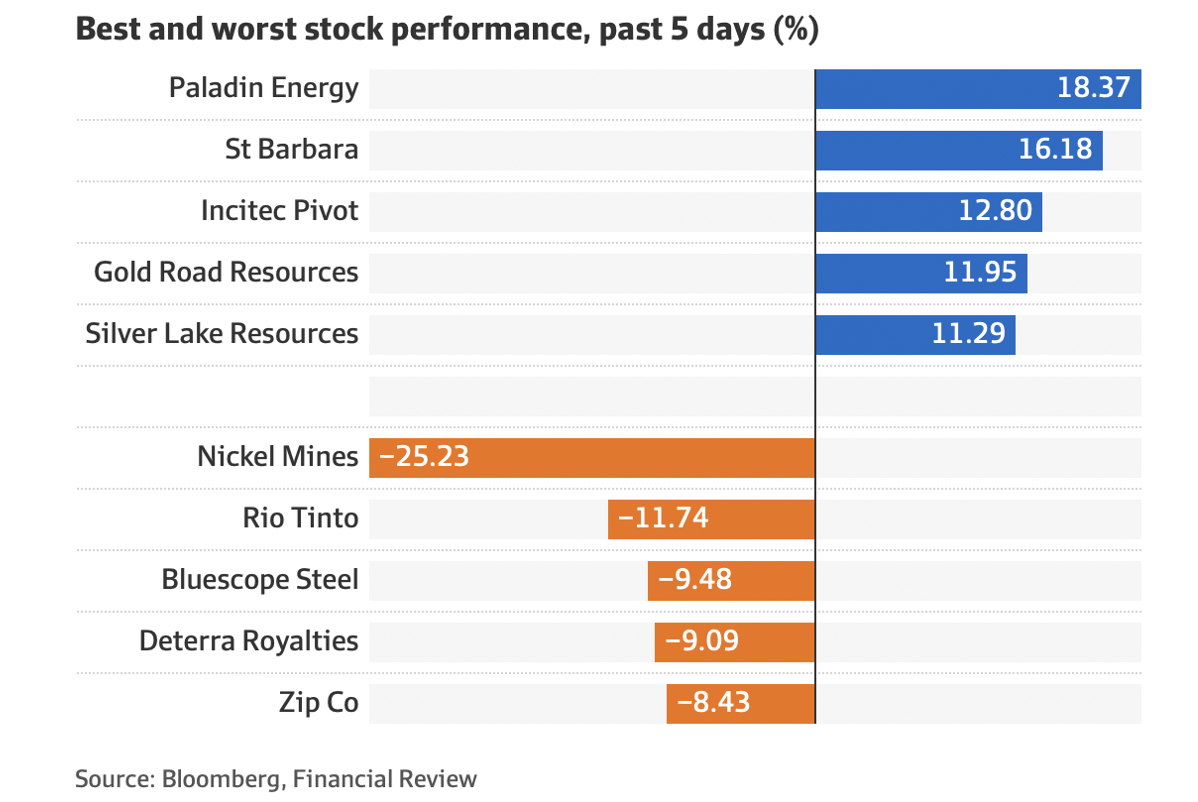

The downside of the prospects of peace was seen yesterday as metal and oil prices fell, which will affect many of our local companies that have seen their share prices spike since the Putin play for Ukraine.

The link between the war and what could happen to economies and then profits, as well as stock prices, was seen with the University of Michigan consumer sentiment index out yesterday, which dropped to 59.7 in March, down from 62.8 in February. This marks the weakest reading since September 2011. The combined effects of war fears and price sticker shock, especially at the bowser, is behind a lot of this negativity. Peace would be both a great circuit-breaker for the financial fear factor and the hip-pocket pummelling from rising prices.

Recall this week that peace rumours saw the DAX up nearly 8% in a day’s trading and the pan-European STOXX 600 index rose by 4.7%, notching its best day since March 2020.

And while peace would bring down the share prices of Woodside and Newcrest, banks would benefit as bond yields would rise. We saw that happen yesterday.

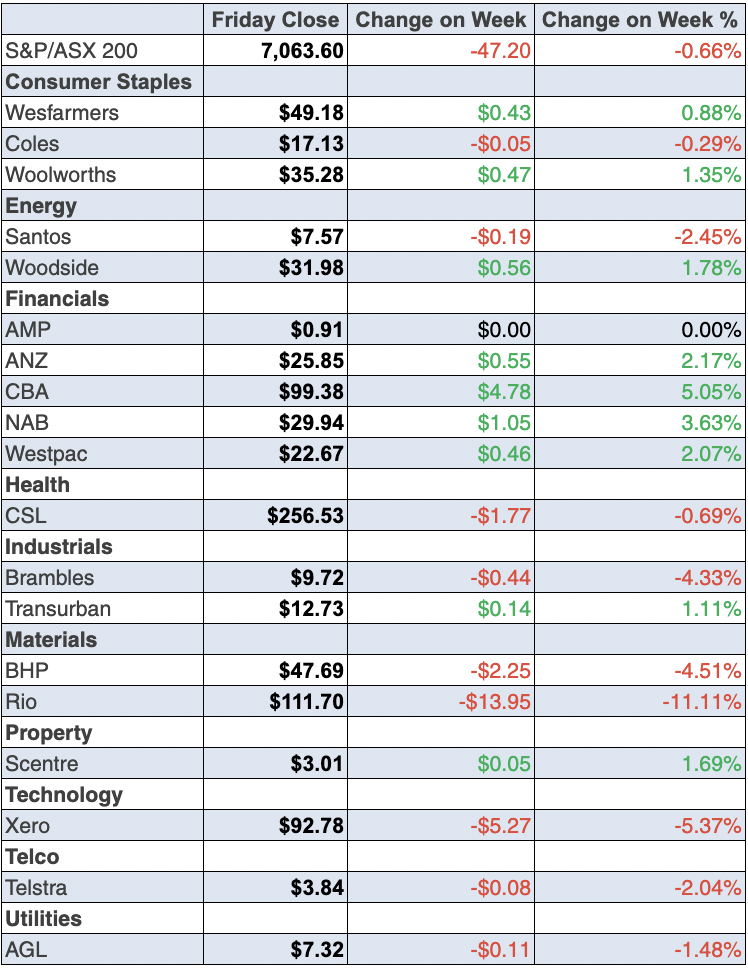

To the local story and the S&P/ASX 200 Index was down 47 points (or 0.66%) to finish at 7063.6. Behind that slide was a fall in the prices of those stocks that had gone higher, as war fears grew in recent weeks.

This from the AFR’s William McIness late yesterday adds weight to possible peace news: “While energy and metal prices spiked at the start of the week [1], those prices unwound amid signs that Ukraine was open to making concessions [2] to Russia in order secure a peace deal.”

Miners ended up having a rough week, with BHP down 5.36% to $47.69, Rio gave up a big 10.89% to $111.70 and Fortescue dropped 5.93% to $18.23.

The irrational overselling of tech stocks continued, with the highly-regarded Xero down 4.35% for the week to $92.78, which looks like great value, with the consensus call of analysts being 34% higher! Meanwhile, Zip lost 7.08% to $1.58, despite analysts seeing it 63.8% higher down the track.

The falling mining stocks and the gains for banks, which were previously dumped because of the war’s effect on exposed banks to Ukraine and Russia, had a good week, which makes you think these moves higher could be a positive sign on many fronts for stocks generally. CBA rose 5.44% to $99.38, NAB added 4.43% to $29.94, while Westpac gained 2.58% to $22.67 and ANZ was up 2.17% to $25.85.

The small weekly gain of 0.11% for gold miner Newcrest and its fall on Friday of 0.63% might be another market sign or hope that peace sooner than we might have thought is a chance.

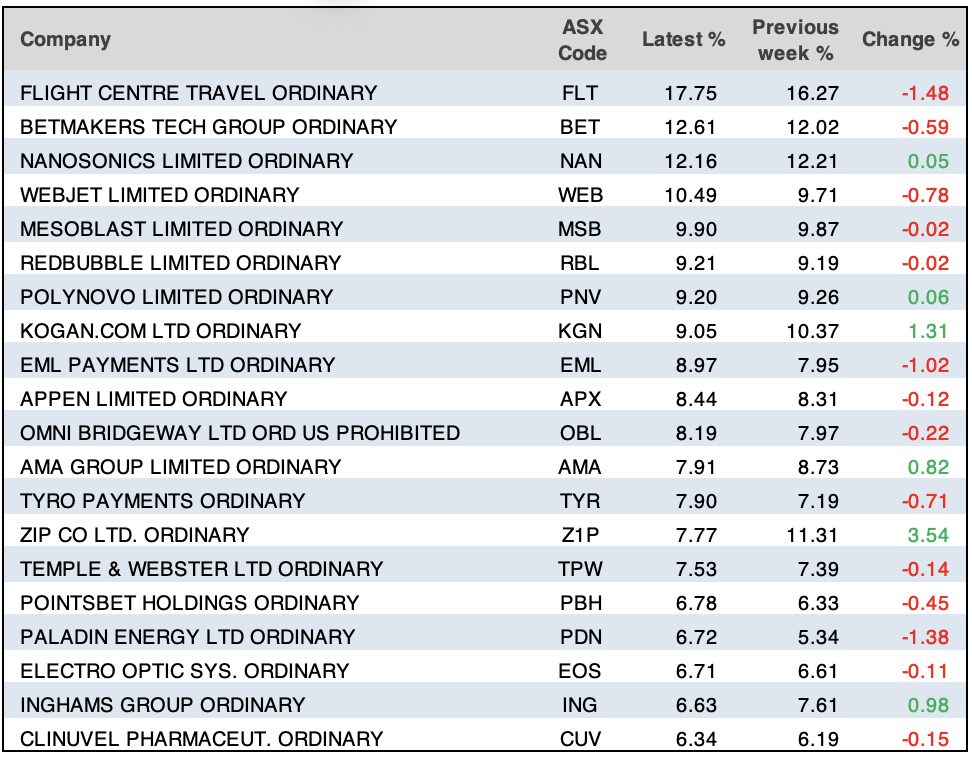

Here are the big winners and losers of the week:

What I liked

- CSL’s plasma business had a win overnight after a new technology platform it’s hoping to install in collection centres received US Food and Drug Administration approval. (SMH)

- The National Australia Bank (NAB) business confidence index rose from 4.5 points in January to 12.7 points in February (long-run average: 5.3 points).

- The NAB business conditions index rose from 1.9 points in January to 8.5 points in February (long-run average: 5.8 points). Employment conditions jumped 8.6 points (the most in 14 months) to 7.6 points.

- The weekly ANZ-Roy Morgan consumer confidence index rose by 0.9% to 100.1 points last week.

What I didn’t like

- The Westpac-Melbourne Institute Index of Consumer Sentiment fell by 4.2% in March (the most in 7 months) to an 18-month low of 96.6 points. Sentiment is down 13.6% on a year ago.

- The European Central Bank (ECB) surprised markets by accelerating its exit from pandemic-related stimulus. The ECB plans to end its asset purchases in the September quarter. This is an OK goal but why tell us now with the Ukraine war spooking us?

- The US Consumer Price Index (CPI) rose by 0.8% in February (survey: 0.8%) to be up 7.9% over the year (survey: 7.9%) – a fresh 40-year high but I’m glad it was not bigger than the survey guess!

- The business optimism index in the US fell from 97.1 to 95.7 in February (survey: 97) and the economic optimism index fell from 44 to 41 in March (survey: 43.2), thanks to Vlad the Invader.

- A key inflation measure tracked by the European Central Bank lifted to 9-year highs.

Peace in perspective

These hopes for peace could be way too pre-emptive but the stock market reactions are not only good reasons to be grateful for small market mercies, they do give us insights into what could easily happen to stocks over the rest of the year if peace occurs and inflation dissipates over 2022.

Given the ASX 200 is down 6.93% year-to-date, and Tom Lee sees a potential 20% rebound for the S&P 500, my early call of a 10% rise in stocks in 2022 doesn’t look all that outlandish.

Pray for peace and price cuts!

The week in review:

- This week in the Switzer Report, I assess why even though the healthcare sector has been full of absolute winners, the worst global health crisis ever has been bad for stock prices of some of our best healthcare companies. I examine 6 healthcare stocks that could improve your portfolio’s health! [3]

- Paul (Rickard) says there’s nothing wrong with being “underweight” BHP, but when a stock is so big, underweight or overweight positions increase the risk of portfolio underperformance or outperformance. While Paul’s not advocating you rush out and buy BHP, he is saying if you’re underweight, then take action in the short to medium term [4] to bring your position closer to market weight. In his second article, Paul braves the BNPL sector which has been smashed in 2022, namely whether he thinks Zip Co is a buy or a sell at these levels. [5]

- James Dunn provides 6 interesting stories on the stock market, [6] all linked by the fact that their share prices are less than 60 cents.

- With petrol prices the way they are, Tony Featherstone felt compelled to look at Australian Real Estate Investment Trusts (A-REITs) that own petrol stations and convenience stores. Tony has written favourably on Waypoint REIT (WPR) for our Report before and has previously covered Dexus Convenience Retail REIT (DXC), putting them both to the test again this week. [7]

- In our “HOT” stock column, Michael Gable, Managing Director of Fairmont Equities [8], explains why [9] he thinks Lake Resources (LKE) is a buy.

- In Buy, Hold, Sell — Brokers Say, there were 14 upgrades and 12 downgrades [10] in the first edition, while Mineral Resources finds itself among the upgrades and Rio Tinto in the downgrades in the second edition. [11]

- And finally, in Questions of the Week [12], Paul Rickard answers subscribers’ queries about whether you should buy an ETF rather than AFIC or Argo which are trading at big premiums?; If China invaded Taiwan, how would our big miners fare?; Why is Inghams out of favour?; Why is Rio’s share price down almost 10% today?

Our videos of the week:

- The misconceptions of cholesterol | The Check Up [13]

- How do you play stocks with war fears rampant + my experts like Seek, CSL, Santos, Resmed and more! [14]

- What happened to Shane Warne and how can others avoid his tragic end? | The Check Up [15]

- How do you invest with? + two fund managers explain their favoured stocks: MTS, CSL, NXT & more [16]

- Boom! Doom! Zoom! | Thursday 10 March [17]

Top Stocks – how they fared:

The Week Ahead:

Australia

Tuesday March 15 – Weekly consumer confidence (March 13)

Tuesday March 15 – Reserve Bank Board meeting minutes

Tuesday March 15 – Property price indexes (Dec quarter)

Tuesday March 15 – Monthly business turnover indicator (Jan)

Wednesday March 16 – Overseas arrivals and departures (Jan)

Wednesday March 16 – Household impacts of Covid-19 (Feb)

Thursday March 17 – Labour force (Feb)

Thursday March 17 – Population growth (Sep quarter, 2021)

Overseas

Monday March 14 – US Consumer inflation expectations (Feb)

Tuesday March 15 – China retail sales/production/investment

Tuesday March 15 – US Empire State manufacturing index (March)

Tuesday March 15 – US Producer prices (Feb)

Wednesday March 16 – China New home prices (Feb)

Wednesday March 16 – US Federal Reserve (FOMC) policy decision

Wednesday March 16 – US Retail sales (Feb)

Wednesday March 16 – US Import/Export prices (Feb)

Wednesday March 16 – US NAHB housing market index (March)

Thursday March 17 – US Industrial production (Feb)

Thursday March 17 – US Housing starts/building permits (Feb)

Thursday March 17 – US Philadelphia Fed manufacturing index (March)

Friday March 18 – US Existing home sales (Feb)

Friday March 18 – US Conference Board leading index (Feb)

Food for thought: “Invest for the long haul. Don’t get too greedy and don’t get too scared.” — Shelby M.C. Davis

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

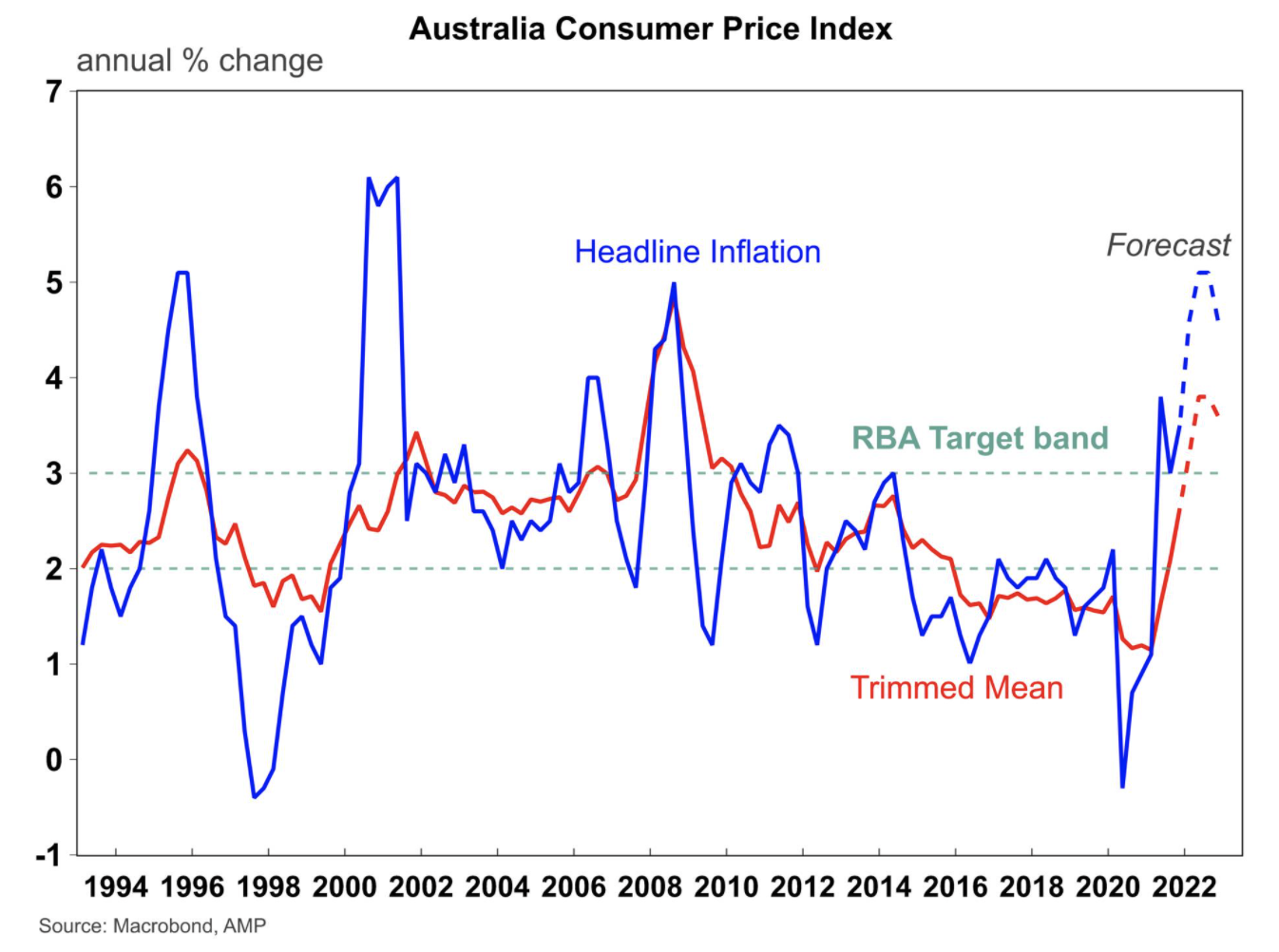

Chart of the week:

Our chart of the week looks at AMP Capital’s projections for inflation in Australia for 2022 with the various headwinds from the Ukraine war and our east coast floods. “In Australia, the total inflation impact from the Russia/Ukraine war and the floods will add 0.5 percentage points to March quarter headline inflation and 0.2 percentage points in the June quarter from lingering high commodity prices. This means that we expect annual headline inflation growth of just over 5% in June and around 4.5% over the year to December. Trimmed mean inflation is expected to be 4% over the year to June and 3.6% over the year to December,” AMP’s Diana Mousina reports.

Top 5 most clicked:

- 6 healthcare stocks that could improve your portfolio’s health! [3] – Peter Switzer

- 6 picks under 60 cents [6] – James Dunn

- Are you underweight BHP? [4] – Paul Rickard

- Is Zip a buy or a sell? [5] – Paul Rickard

- Buy, Hold, Sell – What the Brokers Say [10] – Rudi Filapek-Vandyck

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.