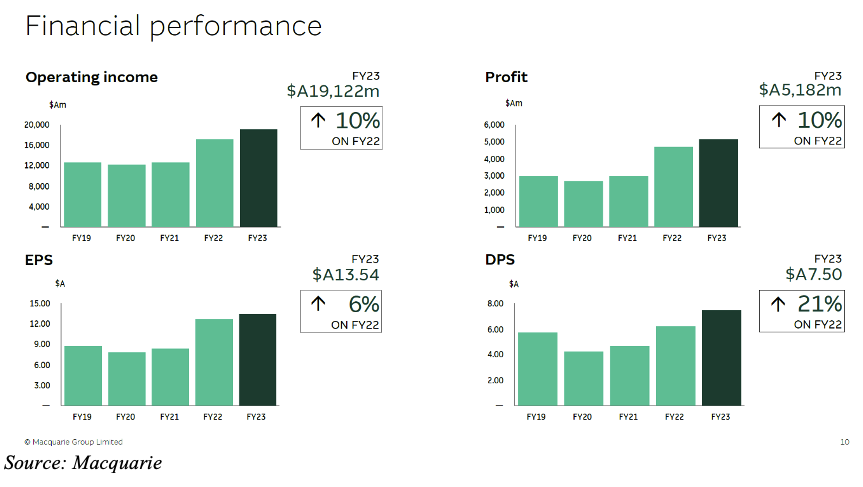

Revenue up! Profit up! Earnings per share up! Dividend up! I’m a huge fan of companies that do this consistently, year in, year out. As the chart below shows, Macquarie Group (MQG) fits into this category.

While the chart only goes back five years, if it was extended over a longer period, it would look even better. Macquarie says that its return on ordinary equity over the last 17 years averages 14%.

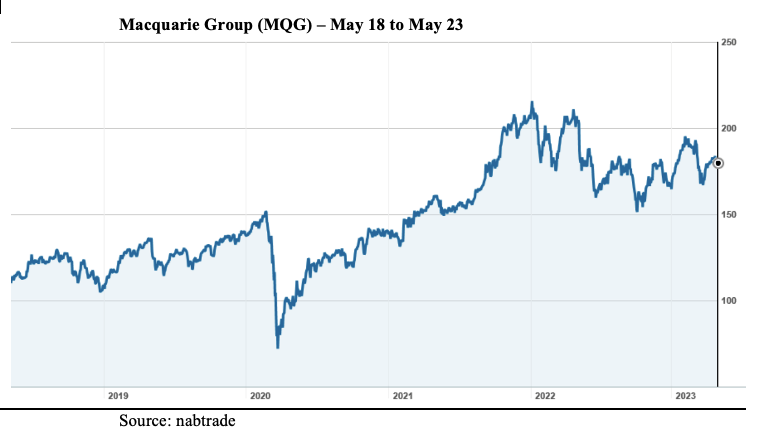

The missing question in this analysis is, of course, the price. The chart looks good, but if you invest in Macquarie, will you overpay to get access to this sort of performance? Let me come back to this.

Last Friday, Macquarie announced its profit result for the year ending 31 March. At $5.18 billion, this was up 10% on the previous year. The second half profit of $2.88 billion was up 25% on the first half, and 8% on the corresponding half in FY22.

A clear beat on analysts’ forecasts, the market’s initial reaction was to mark the company down. There are probably three reasons for this: firstly, the general unease about banks spreading from the problems in the USA with regional banks; secondly, Macquarie has a history of “under-promising and over-delivering” so whereas the result was a “beat”, it was “expected” by the fund managers; and finally, the composition of the result with such an exceptional performance coming from the Commodities and Global Markets division. The market fears that this is not sustainable.

Macquarie has four operating divisions:

- Banking & Financial Services (BFS), which competes with the local Australian banks and provides home loans, business loans and wealth management services.

- Macquarie Asset Management (MAM) – a global specialist asset manager with $870 billion in funds under management in fields as diverse as infrastructure, green investment, agriculture, fixed income and real estate.

- Commodities & Global Markets (CGM); a global business in trading and financial risk management.

- Macquarie Capital (MC), a global business in advisory, capital raisings and equities broking.

The first two business units, BFS and MAM, are considered by Macquarie to be “annuity style businesses”, while the latter two, CGM and MC, are “market-facing” businesses. In FY 23, the profit split between the annuity and market-facing businesses was 41%/59%.

That’s not to say that there isn’t volatility in the earnings of Macquarie Asset Management (MAM). While base management fees are fairly predictable, performance fees aren’t. Further, MAM also books considerable income from the divestment of assets, so the timing of these events can have a big impact on profit from one year to the next. In FY23, MAM was responsible for 23% of Macquarie’s profit. This was down on FY22, due to fewer asset realisations in Macquarie Infrastructure and lower gains on asset realisations in the green energy sector, partially offset by higher performance fees.

Earnings from Commodities & Global Markets (CGM) soared, up 54% on FY22. Benefitting from the elevated volatility in oil, gas, agricultural commodities and power and energy, strong underlying client business led to record risk management and trading gains. The division’s contribution to Group profit increased from a share of 41% in FY22 to 57% in FY23.

BFS generated 12% of group profit. It saw its home loan book rise to $108bn and deposits grow by $33bn to $135bn, giving it a market share in both markets of close to 5%. Reflecting the downturn in equities markets and reduced mergers and acquisitions activity, Macquarie Capital’s share of group profit fell to 8%.

Impressively, 71% of Macquarie’s income was generated offshore. Passionate Australians might say that this is something to be truly proud of – an Australian company that is a global leader in its field of investment banking and financial risk management.

Looking ahead, Management outlined a cautious stance. In an almost “word for word” copy of what she said at the release of the half year result last November, CEO Shemara Wikramanayake concluded her ASX release with this statement:

“Macquarie remains well positioned to deliver superior performance in the medium term, due to its diverse business mix across annuity-style and markets-facing businesses; deep expertise across diverse sectors in major markets with structural growth tailwinds; patient adjacent growth across new products and new markets; ongoing technology and regulatory spend to support the Group; a strong and conservative balance sheet; and a proven risk management framework and culture”.

Macquarie has a history of being conservative with its forecast and outlook statement, and then delivering a positive surprise when it announces its earnings. This profit result was another example of “surprising on the upside”. So, while Macquarie’s caution shouldn’t be dismissed, it does need to be seen in the context of an organisation that places a premium on risk management.

Shareholders were rewarded with a final dividend of $4.50 per share (franked to 40%), up from last year’s final of $3.50, taking the full year dividend to $7.50 per share. This represents a full year payout ratio of 56%, which is consistent with Macquarie’s target payout range of 50% to 70%.

What do the brokers say?

The brokers are largely positive on Macquarie, although cautious about the reliance on earnings from the markets facing businesses, particularly Commodities and Global Markets.

Going into the result, the consensus target price was $209.95, 18.4% higher than Friday’s closing price of $177.35. Individual recommendations and target prices are set out in the table below.

On multiples, the brokers have Macquarie trading around 13.5 times forecast FY24 earnings. Based on a $177.35 share price and $7.50 dividend, it is yielding 4.2%.

What’s the bottom line?

The concern about sustainability of earnings is understandable. Macquarie’s commodities income in FY23 benefitted from exceptionally strong trading conditions (largely due to the hostilities in the Ukraine and inflation), and market conditions are unlikely to be as conducive again in FY24.

However, Macquarie deliberately positions itself in markets with “structural tailwinds” and while it may not be commodities that will provide the boost to earnings in FY24, the chances are that there will be something else. This is the way Macquarie operates – it is very adept at leveraging the next big opportunity.

I am a huge fan of Macquarie and think it should be a core stock in most investors’ portfolios. Is it expensive? Yes. Could it get more expensive? Yes, it could.

Because of its business mix and dependency on the buoyancy of markets and corporate activity, it has traditionally been a more volatile stock. In a bull market, it will typically outperform, and underperform in a bear market.

Here’s my view…

So, if you’re feeling a bit cold on the market, you may want to be a touch patient. Put it on your watch list and wait for the opportunity. Otherwise, I think it is reasonable buying right now. There is nothing in the profit result to suggest that Macquarie won’t continue to excel over the medium term.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.