Is it time to buy retail stocks? That question seems fanciful as living costs climb, consumer confidence slumps and Australia flirts with recession this year.

But we’re always told to buy when the news is at its worst. To take advantage of irrational market selling and panic. To be greedy when others are fearful.

Right now, that’s retail. Maybe not exactly now, but the time to buy retail stocks is getting close. Valuations of some retailers have priced in enormous bad news.

I recently interviewed seven fund managers for an article on small-cap companies. The story wasn’t about retail, but I still asked them for their view on the sector.

Each said it is still too soon to invest in retail, given the coming economic storm as home borrowers face sharply higher interest payments this year. Renters face higher rents, and everybody is grappling with noticeably higher living costs.

But these fund managers were looking at a few retail situations. That’s always the way: professional investors identify select opportunities in beaten-up sectors and buy into bad news. Too many retail investors avoid these opportunities because they are distracted by macro-economic forecasts, most of which are wrong.

I have argued this year that the gloom about Australia’s economy is overstated. I can’t see us plunging into recession while unemployment is so low and wages growth is up.

Yes, the economy will slow, and it might feel like a per-capita recession. But I still think Australia will avoid a technical recession, and that the odds of doing so are strengthening as the US recovers and inflation there cools.

That’s not to say retailers won’t feel more pain at the cash registers this year. I visited one of the country’s largest shopping centres last Friday and was surprised at how quiet it was. For once, I could park without driving around for 20 minutes!

But what matters most is company valuation. Some high-quality retailers now trade on single-digit Price Earnings (PE) ratios and have solid, fully-franked yields.

Also important is avoiding generalisations about the sector. Some retailers can continue to grow quickly by opening new stores and are less hostage to the domestic economy.

To be clear, I’m not saying the retail sector is awash with opportunity or that further falls are unlikely. Rather, that a few retailers are trading at bottom-quartile valuations and that the time to buy them is when news is at or near its worst.

To do so, investors need conviction, patience and willingness to go against the prevailing market view. Retailers look terrible now, but in 12-18 months we’ll be talking about rate cuts, lower inflation and more households getting back on their feet.

Here are two small-cap retail stocks for portfolio watchlists:

- Lovisa Holdings (ASX: LOV)

I have written about the fast-fashion jewellery chain several times in this column over the past five years, and it remains one of my favoured retail ideas.

To recap, Lovisa sells fast-fashion jewellery. I know this first-hand, having visited its stores too many times with a teenage family member!

Lovisa has a great retail concept: cheap jewellery that is affordable for its market of younger female consumers; designs that are ‘on-trend’; and a price point that makes it possible to keep adding jewellery to one’s collection (or dispose of it faster).

I like Lovisa for two reasons. The main one is Lovisa’s international growth prospects as it rolls out more stores. Remarkably, Lovisa had 715 stores worldwide in FY23. It opened 103 stores in the half-year alone.

Without much fanfare, Lovisa has become one of Australia’s great retail export success stories. Its stores are now in the US, UK, Europe, Africa and Latin America. The US, in particular, has been a source of strong store growth this year.

In some ways, COVID-19 was good for Lovisa because it allowed it to snap up some prime retail sites for new stores. This rapid store rollout will continue to drive Lovisa’s earnings growth as the global economy slows. It will also create larger economies of scale and greater buying power for Lovisa jewellery.

The second reason I like Lovisa is its price point. Like all retailers, Lovisa will be affected by a slowing economy. Its younger market faces rising rents and other costs that will take a big bite out of their budgets. But it’s also true that more consumers will trade down to cheaper items and occasional treats, such as Lovisa’s jewellery.

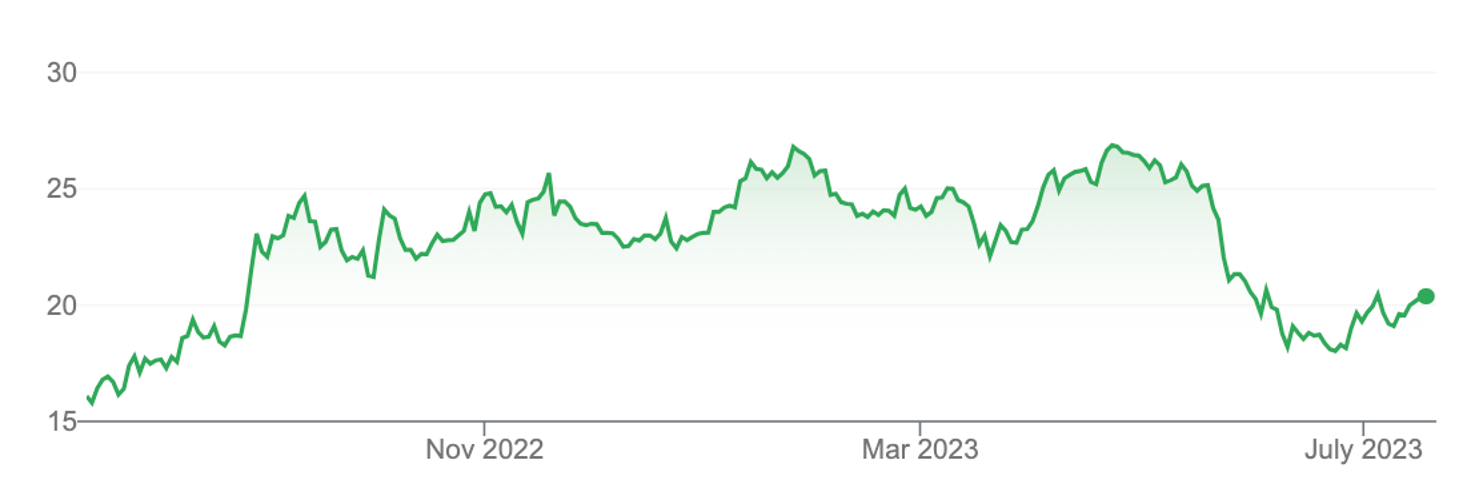

Lovisa is down about 25% from its 52-week high. At $20.27, Lovisa trades on a forward PE of about 26 times. That’s reasonable for a company that is growing quickly overseas as it opens hundreds of new stores and exploits its opportunity.

A few brokers who are good judges of retail stocks value Lovisa at around $22-$23. The stock is no screaming buy, but there is some margin of safety if economic conditions deteriorate from here – and rapid store rollout to support growth.

Chart 1: Lovisa Holdings

- Nick Scali (ASX: NCK)

Like Lovisa, Nick Scali has been my other go-to small-cap retailer over the past five or so years. The furniture retailer is well run. When economic conditions are so uncertain, it pays to stick with the highest-quality operators in their market.

Nick Scali has many challenges as the economy slows, housing construction weakens and renovation activity wanes. Who wants to buy a pricey new couch when they are worried about soaring interest costs and meeting home-loan repayments?

At its half-year results in February, Nick Scali said trading remains stronger than pre-COVID levels, despite rising interest rates. January trade was better than expected.

Much has happened since, with rates climbing and consumer confidence falling. Judging by Nick Scali’s fall this year, the market expects an earnings downgrade, which is yet to arrive (Nick Scali said it would monitor February-to-April trade before providing further guidance). In this case, no news is good news.

Nick Scali is down 20% from its 52-week high. At $9.98, it trades on a trailing PE of about 8 times and yields about 8%, fully franked.

Nick Scali expects to open four stores in the second half of FY23. Trading conditions for Nick Scali will surely deteriorate as the economy slows.

But a lot of expected bad news on earnings has been priced into a company that has shown over the years it can continue to grow in different market conditions.

Nick Scali looks like a stock for long-term investors to lock away at this price, provided they can withstand short-term volatility. A single-digit trailing PE, low double-digit forward PE and high grossed-up yield are attractive for a company of its quality.

Chart 2: Nick Scali

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 19 July 2023.