Prime Minister Scott Morrison’s announcement earlier this week to ramp up the rollout of charging stations is further confirmation that the electric vehicle (EV) megatrend is happening. With the European Commission leading the charge and set to ban new petrol, diesel and hybrid cars from 2035, car manufacturers globally are investing billions of dollars in electric vehicles.

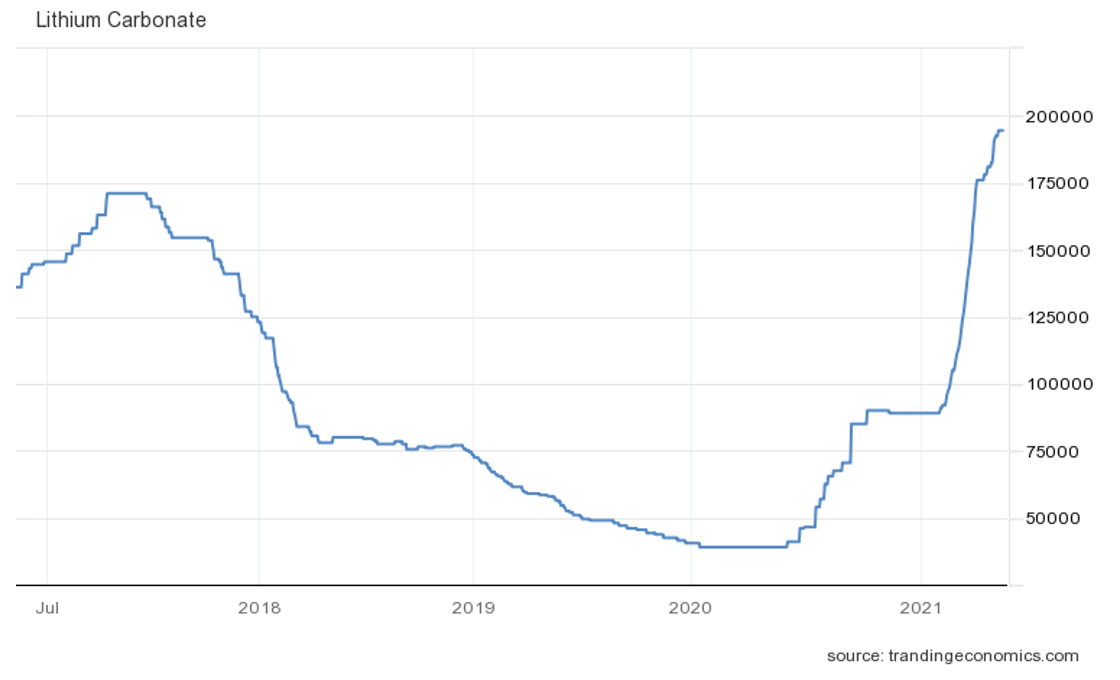

This is driving (pardon the pun) a surge in the prices of lithium and other materials that go into the batteries that EVs require. The chart below shows the price for lithium carbonate (in Chinese yuan per tonne). It has almost quadrupled since mid-2020.

Other lithium substances such as the higher grade spodumene, which the Australian hard rock miners produce, show a similar story.

A point to note from the chart above is that the lithium/EV “hype” is not new – prices plunged from 2017 as the expected demand for lithium batteries failed to materialise. But this time feels different as Governments start to regulate the end of the internal combustion engine and manufacturers switch their investment to EVs. It is starting to look like an unstoppable trend.

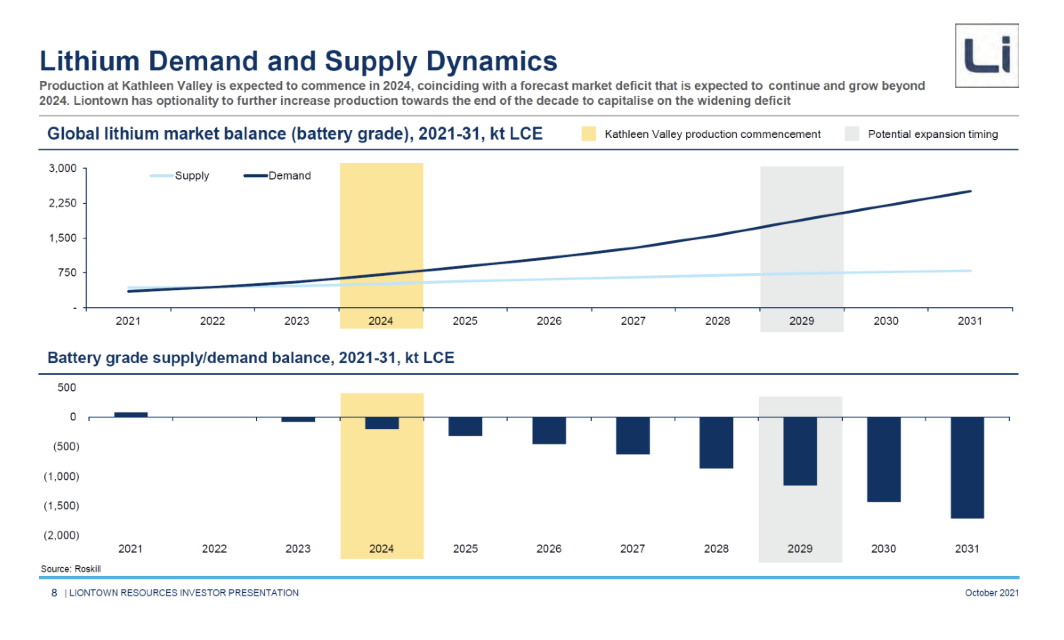

That doesn’t mean that the price of lithium substances will keep increasing. One thing is for sure – higher prices will in due course lead to higher production. But given lead times, new production is some way down the track and according to most forecasters, there will be a demand/supply imbalance for many years to come.

Budding producer Liontown Resources (ASX: LTR) posted the following diagram in a recent investor presentation. Supply is shown in light blue, demand in dark blue, with the supply deficit getting worse in the bottom chart. Liontown is set to go into production with its Kathleen Valley mine in WA in 2024 (the yellow highlight), with potential expansion in 2030 (the grey highlight).

So if you are a believer, how can you play this megatrend?

Starting with “pure play” lithium producers, the two main Australian companies are Orocobre (ORE) and Pilbara Minerals (PLS). Conglomerate Wesfarmers (WES) owns Kidman Resources, while Orocobre has recently completed a merger with Galaxy Resources. Mineral Resources (MIN) produces spodumene from its Mt Marion mine and is restarting production at the Wodgina mine in the Pilbara, but its share price tends to be swamped by movements in the iron ore price.

Orocobre will produce approximately 220,000 dry metric tonnes (dmt) of spodumene from the Mt Cattlin hard rock mine in WA, 12,000 tonnes of lithium carbonate from the Olaroz mine in Argentina, and has two major development projects in Argentina and Canada (James Bay). It is also building a processing plant for lithium hydroxide in Japan.

Orocobre (ORE) – 11/16 to 11/21

According to FNArena, there are 3 “buy” recommendations and 2 “neutral” recommendations from the major brokers. The consensus target price is $10.15 (range $8.65 to $12.00), 10.6% higher than the last ASX price of $9.18.

Pilbara Minerals owns 100% of the world’s largest, independent hard-rock lithium operation. Located in Western Australia’s resource-rich Pilbara region, the Pilgangoora Project produces a spodumene and tantalite concentrate. It has guided to FY22 production of up to 510,000 dmt of spodumene. Pilbara has also entered into a JV with South Korea’s POSCO for a downstream lithium chemicals plant.

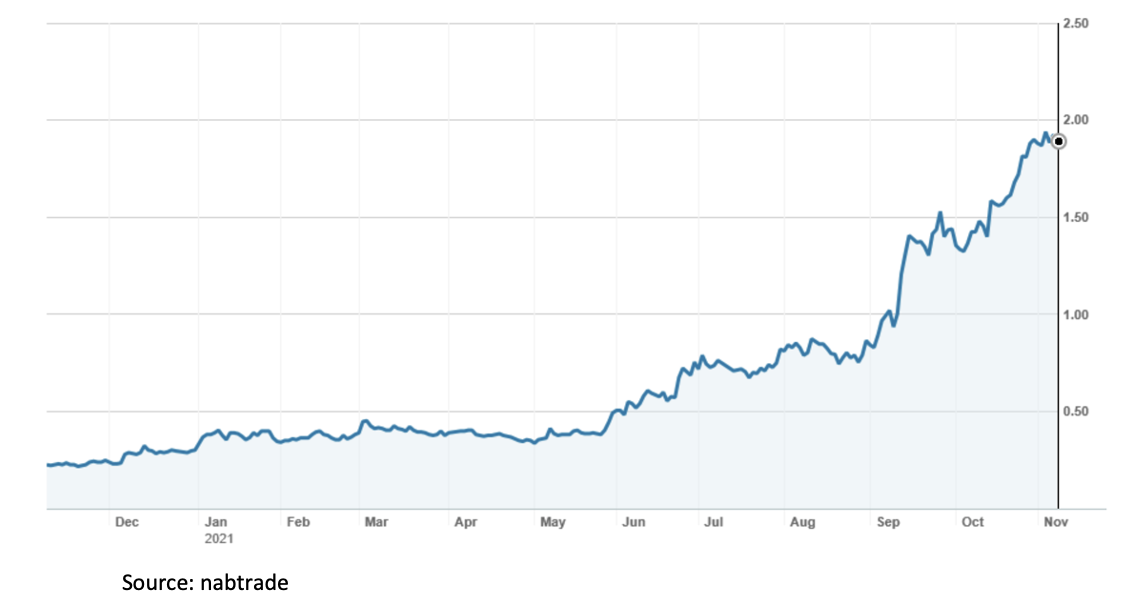

The brokers feel that Pilbara is fully valued, with a consensus target price of $2.34, about the same as the last ASX price of $2.30. Macquarie is at the top of the range with a target of $2.80 and an “outperform” call, while Credit Suisse has an “underperform” and a $2.05 target.

Pilbara has enjoyed a meteoric rise in its share price in 2021, starting the year at $0.87.

Pilbara Minerals (PLS) – 11/16 to 11/21

There are also several “would-be producers” such as underground miner Liontown (LTN), with its Kathleen Valley and Buldania mines.

Another way to play the trend is through an exchange traded fund. ETF Securities has the Battery Tech & Lithium ETF, which trades under the ASX ticker of ACDC. It tracks the Solactive Battery Value-Chain index which represents the performance of companies that are providers of electrochemical storage technology and mining companies that produce metals that are primarily used for the manufacturing of battery-grade lithium batteries. The index is equally weighted and includes companies such as Chinese manufacturer BYD Co, Pilbara Minerals, Tesla, Livent Corporation, SolarEdge Techno and Rolls Royce.

Performance has been strong – up 48.5% over the year to 9 November and 31.1% pa over the last three years. The following graph shows the price performance of the ETF on the ASX.

Battery Tech & Lithium ETF (ACDC) – 8/18 to 11/21

Thematic ETFs like ACDC are less risky than buying the miners directly, but that’s not to say that they aren’t risky. Essentially, you need to have faith in how the index is constructed.

My inclination is to back one of the miners directly. Sticking with the brokers and their valuations, I prefer Orocobre. The downside with Orocobre is the “geographic/political” risk of investing in Argentina, the upside is access to a more diversified portfolio of assets.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.