In a perfect world, you’d buy an out-of-favour stock and it would start rising immediately. However, as investors and speculators alike have worked out, we simply don’t live in a perfect world when it comes to shares.

That said, I suspect those who bought Magellan Financial Group’s shares on 28 March when the stock hit $12.45 probably got a perfect world result, but that kind of timing doesn’t come along often.

It’s with this in mind that I look at the future for healthcare sector stocks and wonder if the comeback of this sector isn’t too far away.

One stock that has drawn a bit of criticism for Rudi Filapek-Vandyck and yours truly is CSL, which we both believe is a great company due for a comeback. An avid watcher of my TV show thinks Rudi’s belief in CSL is misplaced and this is what this viewer said on 27 January:

“Since its high in Feb 2020, CSL has fallen by 28.4%. From its March 2020 market crash low, it has barely gone up 1%. Dividend yield is very weak at just over 1%, and not fully franked. So after nearly two years, most of which has been a raging bull market (peaking in August 2021), CSL has performed negatively and poorly. How is a new investor supposed to have confidence in investing in CSL now?

I do not accept “believing” it’s for the longer-term view, as an answer. Sorry, but that is a con and BS. The market story with CSL going back 3 to 5 years was that this great stock was then a great BUY and it would easily outperform the market up to now. It has not happened. You cannot be objective if you hold and fall in “love” with a stock, regardless of its share price performance.”

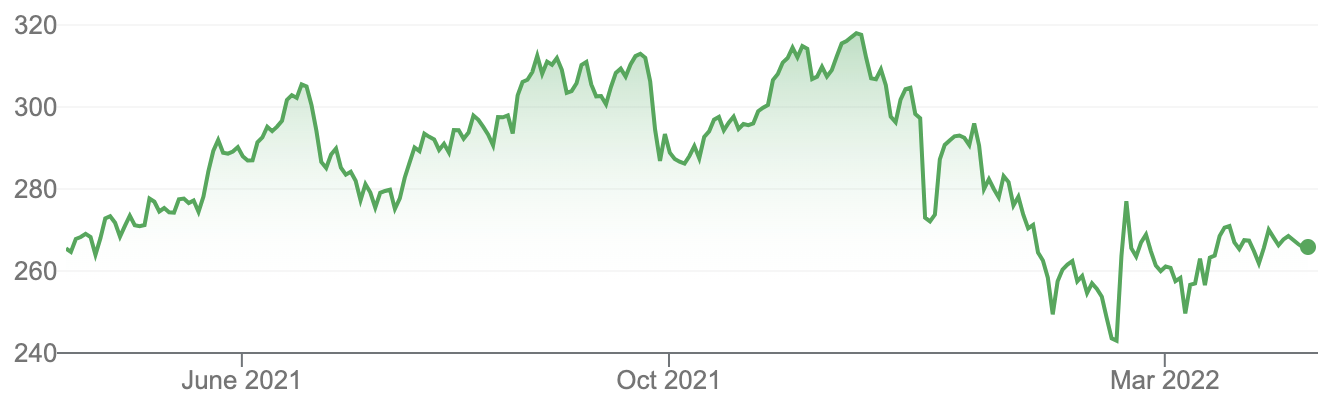

This is tough love from this viewer but I do think he needs to understand when a healthcare stock is a goer and when it’s not. The chart below shows how good CSL has been.

CSL Limited (CSL)

On a three-year basis, its share price is up 35%, which means with dividends it has been delivering over 12% a year. And that’s despite the ordinary period since February 2021, where the fall in its share price has been about 20%.

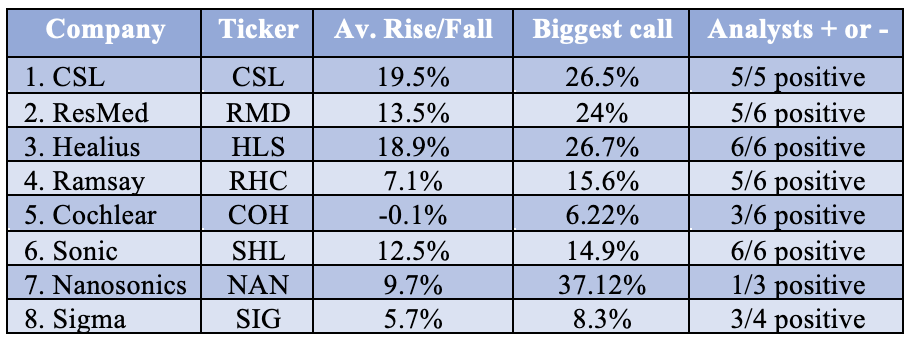

My stock selections are always for the long-term investor and companies such as CSL have delivered (and I believe will deliver) over time, and so do the expert analysts surveyed by FNArena. This table shows their current views on the key stocks in the sector. The overwhelming conclusion is that these professional company assessors like the sector going forward.

Looking at CSL, you can see the consensus potential average stock price is 19.5%, but the most optimistic analyst sees a 26.5% rise out there. Meanwhile, five out of five views on the company are positive, which tends to be the general position held for many of these healthcare companies.

David Kastner of Charles Schwab looked at the US healthcare sector and his observations are worth noting. But given this general positivity towards these businesses and their future share prices, why have they struggled of late?

Try these four things:

- The Covid crisis resulted in a reduction of profitable, elective care.

- The sector has many favourable long-term attributes, such as new cost-saving and care-improving advances in medical technologies.

- An ageing global population.

- A growing middle class in emerging-market economies—all of whom will demand more extensive drug treatments and medical care over time.

“Valuations are relatively attractive, and balance sheets in the sector are generally in good shape, increasing the possibility of higher dividend payments, share-enhancing stock buybacks, and mergers-and-acquisition (M&A) activity,” he noted for US companies.

But Kastner also makes an interesting point: “There are signs of peaking in the rate of economic growth —this has historically been a tailwind for the Health Care sector.”

The table below from my colleague Paul Rickard shows Health Care made a 2.5% recovery in March but was down 10.1% for the year.

There is a case for you to look to raise your exposure to the sector to 9.1% of your portfolio but I suspect over time, if you look at the history of this sector, you could easily hold more, especially after two or more years of being in the stock price doldrums.

Companies such as CSL and Resmed are turnaround/rebound businesses that will do well when we get more and more back to something like the pre-February 2020 normal.

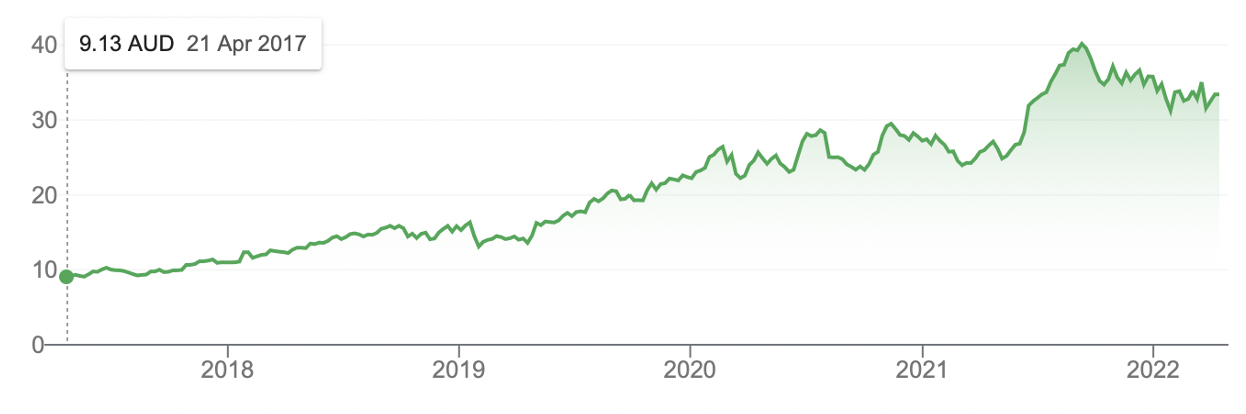

And even if you get in too early, you still will be holding impressive companies, as Resmed’s five-year chart shows.

Resmed (RMD)

By the way, over the past decade or so, I’ve noticed the best time to buy RMD is when the market takes a set against this globally unique company. I guess it doesn’t always work out as you’d think when it comes to listed companies but I will be surprised if it doesn’t with this great Aussie business.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.