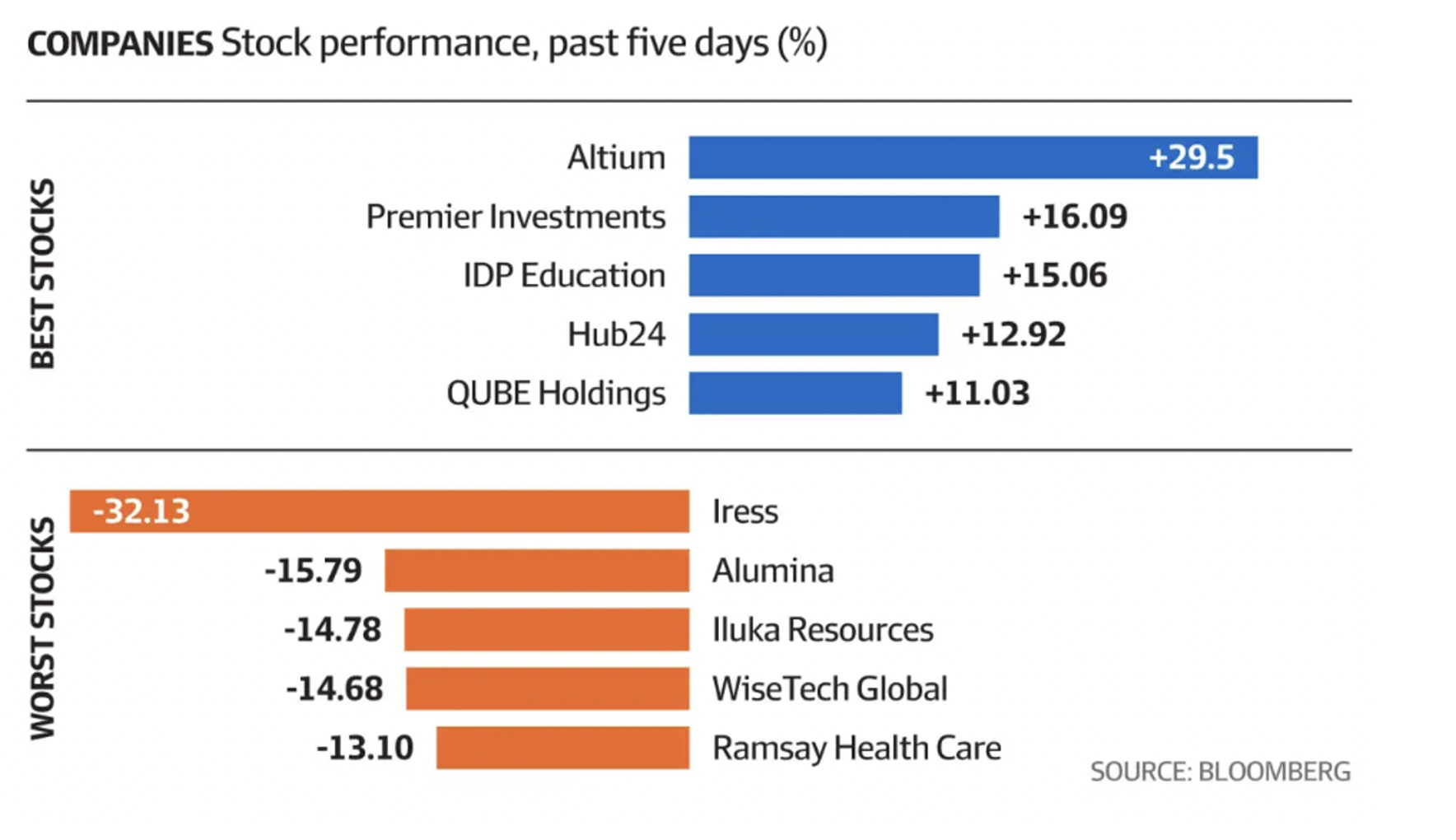

I’m often curious about what a good week’s worth of share price rises means for the future of a stock, so this week I’ll look at the winners and losers as portrayed in the Bloomberg chart that the

AFR shows us on Fridays.

Let’s keep it positive and look at the winners first.

- Altium flying high

It was a big win for Altium, with a 29.5% gain over the week. Not surprisingly, four out of five analysts have a lower target price because few would’ve expected such a big reaction to the latest profit report. Interestingly, Morgans still has another 4% upside pencilled in. While I expect this good company to do well over the year ahead, the best of their near-term gains has already been delivered.

This company has declared itself as a quality outfit and should be bought when the market goes crazily negative.

- No surprise for Premier Investments

Premier Investments gain last week isn’t surprising as news stories all suggested something positive was coming. However, the size of the rise was bigger than most expected, with that 16% jump. That said, Morgans still sees another 22.8% gain ahead, while Shaw and Partners tip nearly a 14% rise. Four out of six analysts now see a drop in price coming, but the PMV team continues to defy their critics.

- Experts back IDP Education

IDP Education has been a company that my expert colleagues on Switzer TV have remained solidly behind. And they got it right, with that 15.06% gain last week, and there’s still plenty of analysts seeing more upside ahead.

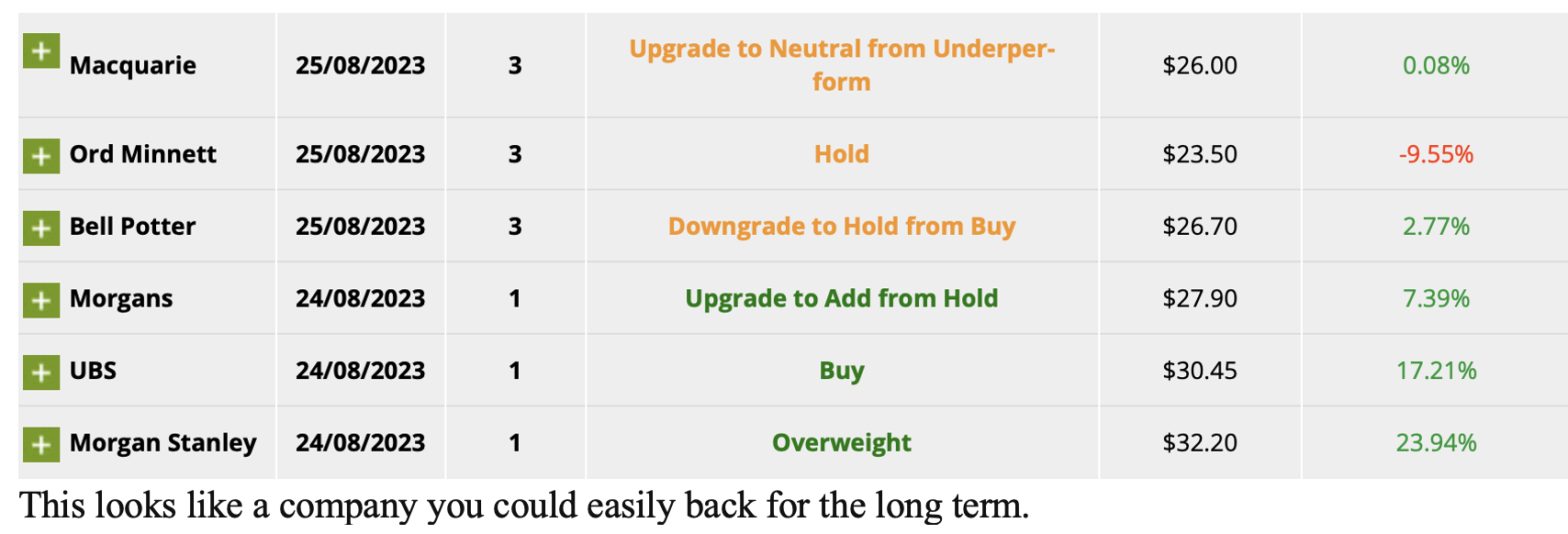

- More good news for Hub24

The next winner was Hub24 with a 12.92% gain. The good news is that the consensus still sees a 9% increase ahead. Five out of six analysts like the company, with Ord Minnett a big supporter with a 18% gain tipped, while Shaw and Partners sees a 23% surge ahead. This is an industry darling, and many advice firms are switching to this platform for their clients.

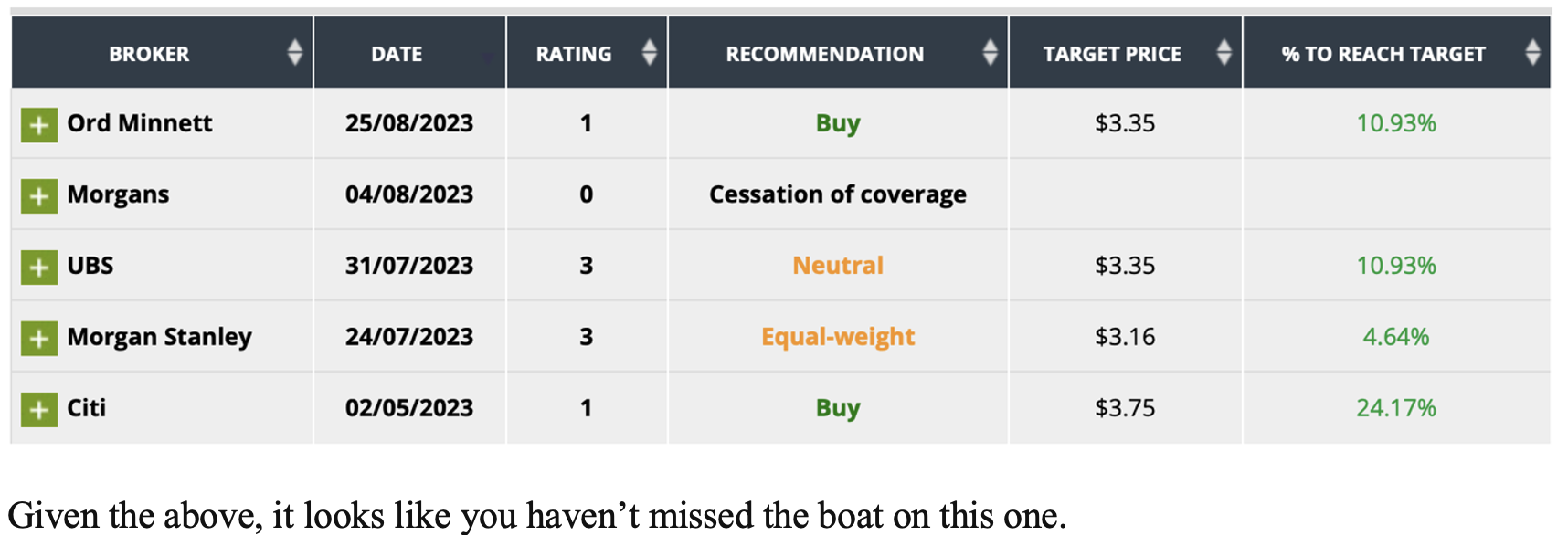

- QUBE Holdings delivered well

QUBE Holdings is another company the analysts liked a few weeks ago when I went looking for ‘under the radar’ companies. It duly delivered last week. Following that 11% rise, this is what the expert company assessors are now saying.

Last week’s losers

Now let’s look at the losers for the past week to see if the sell-off created a buying opportunity or did the moves indicate the analysts’ assessments.

- Iress had a shocker

Finance IT business Iress really had a shocker, and it shows how reactive the market is to disappointing news, with a 32% share price dumping. But what do the analysts think about this company? The consensus say it has 17% upside, while four out of four company watchers expect a better performance in the future. That said, these people could change their minds after digesting last week’s report of a bigger-than-anticipated loss. This is what Motley Fool reported: “On the bottom line, Iress posted a reported loss of $139.8 million and an underlying profit decline of 31% to $24.4 million. The reported loss includes a $130.4 million significant item relating to the impairment of UK goodwill and $12.5 million losses on the derecognition of intangible assets due to changes in strategy.”

- Alumina at odds with expectations

To Alumina and the near 16% fall is at odds with what analysts were anticipating with three thinking a rise between 16% and 30% was on the cards. Macquarie was a dissenter with a 15% fall tipped and I think they know this company is going to be challenged by regulatory changes for environmental reasons that could really hurt the business’s bottom line. I’m giving AWC a wide birth.

- Iluka Resources can defy expectations

Iluka Resources is a company that can defy expectations and its 14.78% fall doesn’t surprise me. The news about disappointing earnings would surprise a few analysts. This is what was thought before the result, but it shows the company had a lot of fans. There could be a case for waiting for this current negativity to work itself out, but after that this could be a good buying opportunity.

Four out of five analysts were very positive on Iluka before last week.

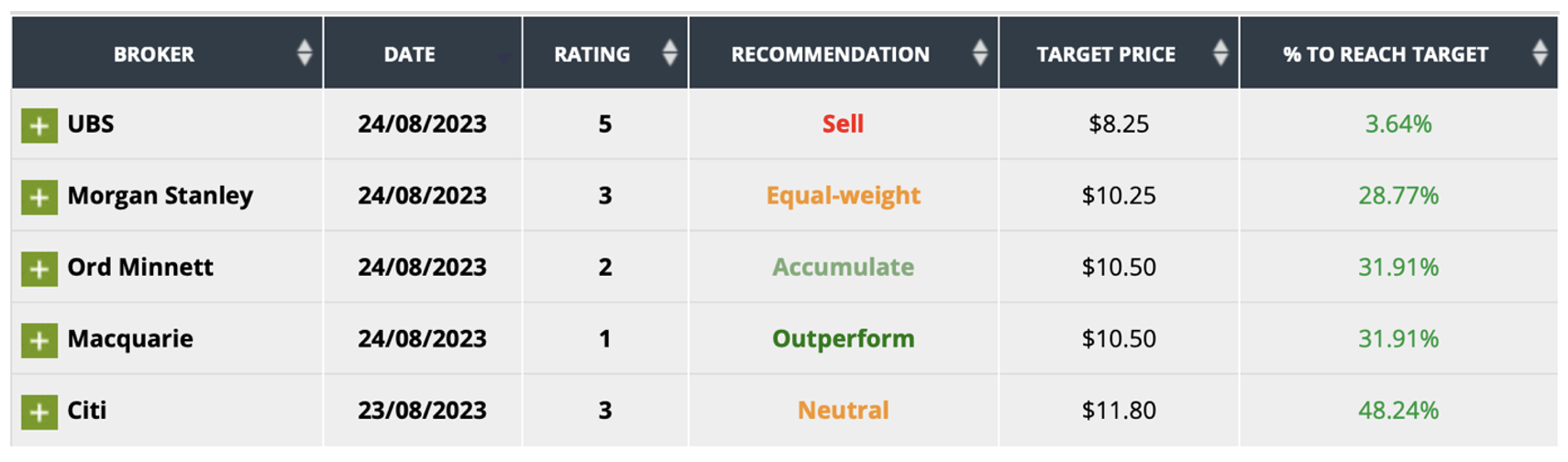

- Wisetech Global still popular

Wisetech Global faced a reworking of its market assessment after some great runs higher. Even after the 14.68% sell-off, the consensus view says the share price could go 7% higher. Four out of six analysts love the company, with Morgan Stanley tipping a 29% gain, Ord and Macquarie have a 32% higher price target, while Citi goes for a 48% slam dunk winner! This could be a classic quality company that has been over-beaten by the market.

- Ramsay Health Care close to my heart

The final loser is a darling of yours truly. Ramsay Health Care has a consensus rise of 19% and five out of five analysts on FNArena like the business. Ord and Morgans still see a near 40% gain ahead. I think they’re right, but it could take more time than I initially envisaged.

One last look

One final company I want to look at is Pilbara Minerals, which saw an 8% drop on Friday to $4.70. Whatever comes out in the news, PLS has a consensus rise of over 14% and four out of five analysts are with the company. Meanwhile, Morgans see a 22% gain ahead and Macquarie (the best on mining guesses) tips a 59% rise.

I link lithium to electric vehicles and last week Goldman Sachs gave Mercedes-Benz a big thumbs up stock tick for its big push into EVs. It gave the company a 45% upside call.

You might have missed the lithium stocks at low prices but the spectacular future demand for EVs will help companies such as PLS.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances