In February, the Government announced a major change to contribution caps. However, eight months later we’re still waiting to find out exactly how the new rules will be applied.

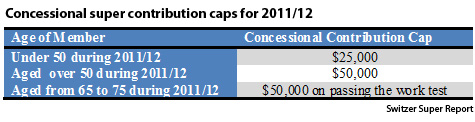

The proposed change, which is meant to take effect from 1 July next year, is that the higher concessional contribution cap of $50,000 for members aged 50 or over will only be available to those with superannuation balances under $500,000. Those with balances in excess of $500,000, and all superannuants under the age of 50, will only be able to access a concessional contribution cap of $25,000.

Given that this could possibly be the last year of the higher limit of $50,000 for many members, early consideration of salary sacrifice or other employer arrangements that allow the maximum contribution should be undertaken. As contributions in excess of the cap are taxed at an additional 31.5%, the effective tax rate on any excess is 46.5% – so be very careful that you don’t go over the cap.

To be fair to Minister Bill Shorten and his advisers in the Treasury, there are some tricky issues to consider. These were outlined in a consultation paper to which 119 submission were made prior to the closing date of 25 March.

The key issues are:

- Are members who have commenced drawing down their superannuation (for example, through a transition to retirement pension) eligible for the higher cap and, if so, are withdrawals from super included in the account balance?

- When is the account balance measured; on 30 June immediately prior to the start of the year, or on 30 June two financial years earlier? (So for the 2012/13 contribution year, the balance as at 30/6/11.)

- Who assesses eligibility – a full self-assessment model, or the ATO?

If withdrawals already made from super are included in the account balance, fewer members than anticipated will be able to access the higher cap. Some members who have recently commenced a transition to retirement pension [1] may be impacted. On the other hand, if withdrawals are excluded and a member’s balance will marginally exceed $500,000 on 30/6/12, it may pay (assuming he or she is over 55) to commence a transition to retirement pension this year.

According to the Minister’s office, no timeframe has yet been set for the announcement – this is one of a number of issues being considered in relation to superannuation policy. At the Switzer Super Report, we think that most of this Government’s reforms in superannuation have been in the right direction. However, on the cap issue, we believe this policy is absolutely inconsistent with the aim of encouraging self-sufficiency in retirement. Given the community’s increasing life expectancy, a $500,000 superannuation balance is not excessive – for many, it is going to be wholly insufficient.

That said, it seems there is little chance of the Government changing their minds on this issue. Further, the Government has also announced that the $500,000 threshold will not be indexed – so there is clearly a disconnect between the Government and the community’s expectations in terms of a comfortable retirement.

Although the implementation issues remain unresolved, members should nevertheless be planning to maximise their use of the concessional caps this financial year.

Here’s a quick re-cap on the rules for 2011/12:

[2]Concessional contributions include:

[2]Concessional contributions include:

- Employer contributions (for example, the 9% SGC); and

- Salary sacrifice contributions.

Contributions by self-employed members where a tax deduction is claimed are also counted as concessional contributions. Self-employed members who engage in a part-time job as an employee need to be cognisant of the ‘10% rule’, which says that the deductibility of the super contribution for tax purposes can only be claimed if “employment related activities” are less than 10% of the individuals’ total assessable income.

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.

Also in the Switzer Super Report

- Peter Switzer: This week’s events are the critical decider [3]

- Rudi Filapek-Vandyck: The broker wrap [4]

- Tony Negline: How you can be the bank [5]