At times like this I like to ask my readers, subscribers and clients questions such as: “What kind of investor are you? And if you follow me but you’re a short-term investor, do you know when to get out of stocks that I like?”

I make this point because I don’t want short-term investors relying on me to tell them when to get out. I’m a long-term player who buys good companies when the market beats them up. If you have a strategy like mine, you really have to be patient and not get rattled by all the short-term-oriented comments from market experts who want to play a much shorter game than yours truly.

Investors like me have to love and embrace the message of the legendary poet Rudyard Kipling who penned these words:

If you can keep your head when all about you

Are losing theirs and blaming it on you;

If you can trust yourself when all men doubt you,

But make allowance for their doubting too;

If you can wait and not be tired by waiting…

I’d add these words to Kipling’s wisdom:

“Yours is the Earth and everything that’s in it,

and—which is more—you’ll be an Investor, my friend.”

There’s good reason to be concerned, with the myriad bad news predictors and worrying developments right now. But current news says nothing about the historical perspective that helps you hose down the fires of negativity that prevail in news.

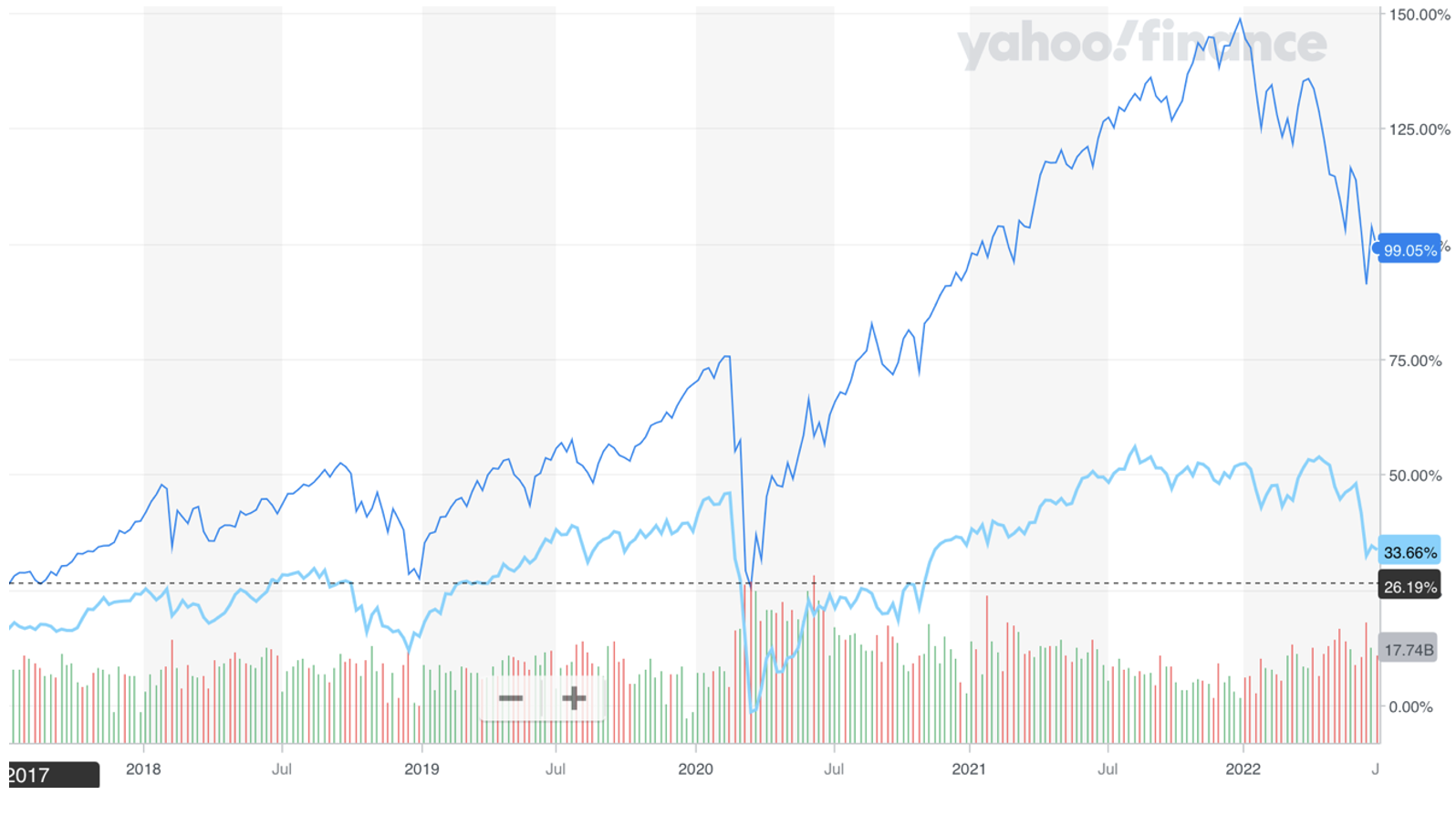

For example, an ABC report late last week talked about the $11 trillion of losses from stock markets since this US bear market spooked global share markets. But that same report didn’t talk about the trillions added before the latest pullback! This chart of the S&P 500 says it all:

S&P 500 & S&P/ASX 200

The chart above shows how the S&P 500 Index over-rebounded after the Coronavirus crash and is now readjusting to a future reality that won’t have official interest rates near 0.1%. Note how our S&P/ASX 200 didn’t spike like the US market. This explains why we haven’t been in a bear market like the Yanks. We’re down about 14% and that number would be a lot less if there was no Ukraine war or China going back into lockdown. Then the market pullback would be about inflation, interest rates and recession fears.

When you throw in all these problems for economies (Putin, Xi, inflation, rate rises and recession fears), it’s no wonder stocks are having such a rough time. But this won’t last. This is what the long-term investor hangs onto when they feel like losing their head and selling out. Fortunately, history tells them to hold their nerve and not be afraid to buy quality companies beaten up by the market.

What quality companies?

Well, try an ETF for the S&P/ASX 200, such as IOZ, A200 or STW. There you get 200 quality companies in one trade! And as this tracks the index, what does history tell us about short-term bad times like this compared to the many good times for stocks?

S&P/ASX 200

This chart above teaches many of us a lesson that needs to be remembered. From 31 May 2006 to now, the index rose from 5001 to 6539. That’s about a 30% gain over 17 years, which has been less than 2% a year. At the same time, dividends have averaged 4.5% before franking, so let’s just call it 6% in total.

So anyone who simply invested in the overall market via an ETF has averaged 8% a year, including the help from the Tax Office.

Let’s have some more market-assessing numbers to help you keep it real when you look at recent returns.

On a five-year basis (which is the more appropriate way to assess a portfolio like the S&P/ASX 200), the overall return from capital gain was about 3% plus dividends of 4.5% plus franking. Let’s call it 9% a year.

On a three-year basis, the overall capital gain was a loss of 3%, so we lost -1% by being 100% exposed to stocks.

Why did this happen?

Well, try the Trump/China trade war, the Coronavirus crash/lockdowns, China’s pandemic problems for global supply, the Ukraine war’s impact on petrol prices, the inflation surge linked to the former problems and then the aggressive interest rate rises that now threaten a recession!

If you’re whinging about stock returns, then you’re immature and you’re forgetting what interest rates for savers have returned for over a decade.

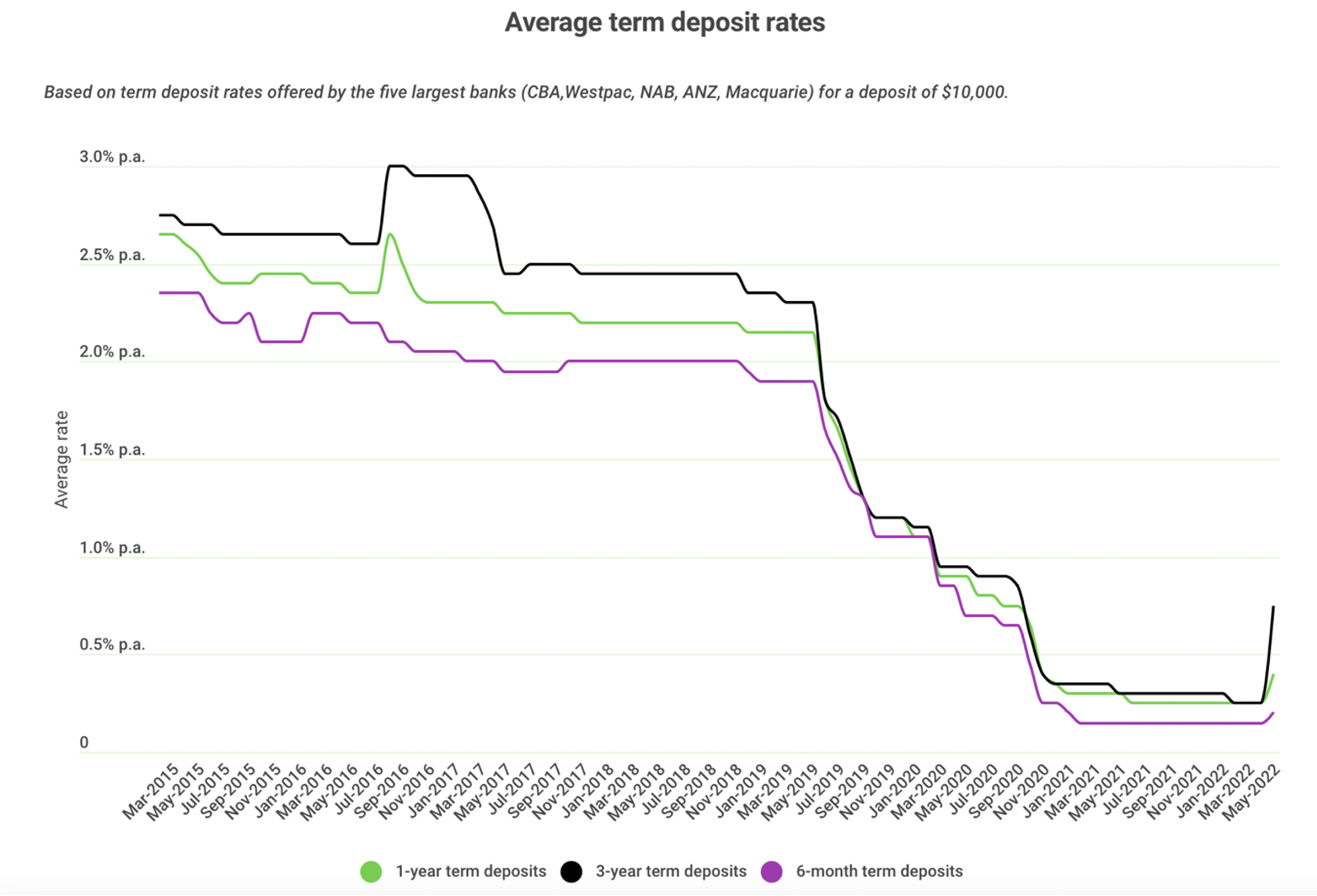

This chart will remind you how unrewarding the safety of the bank deposits has been for a long time:

What has hurt a lot of cautious investors has been the fast increases in interest rates that have made bond funds (which are normally seen as more defensive) come in for a shocker of a year. Bond funds lost capital value because of rising rates or yields that pushed the price of existing, lower interest rate bonds in these funds down.

These funds still kept paying pretty good income but their value fell because they needed to cut the prices of their bonds to unload them to buy higher-yielding bonds.

In an interview for tonight’s TV show, Chris Joye (of Coolabah Capital and AFR fame) says this will be a better year for bond funds. I think this will coincide with a better year for stocks in 2022/23.

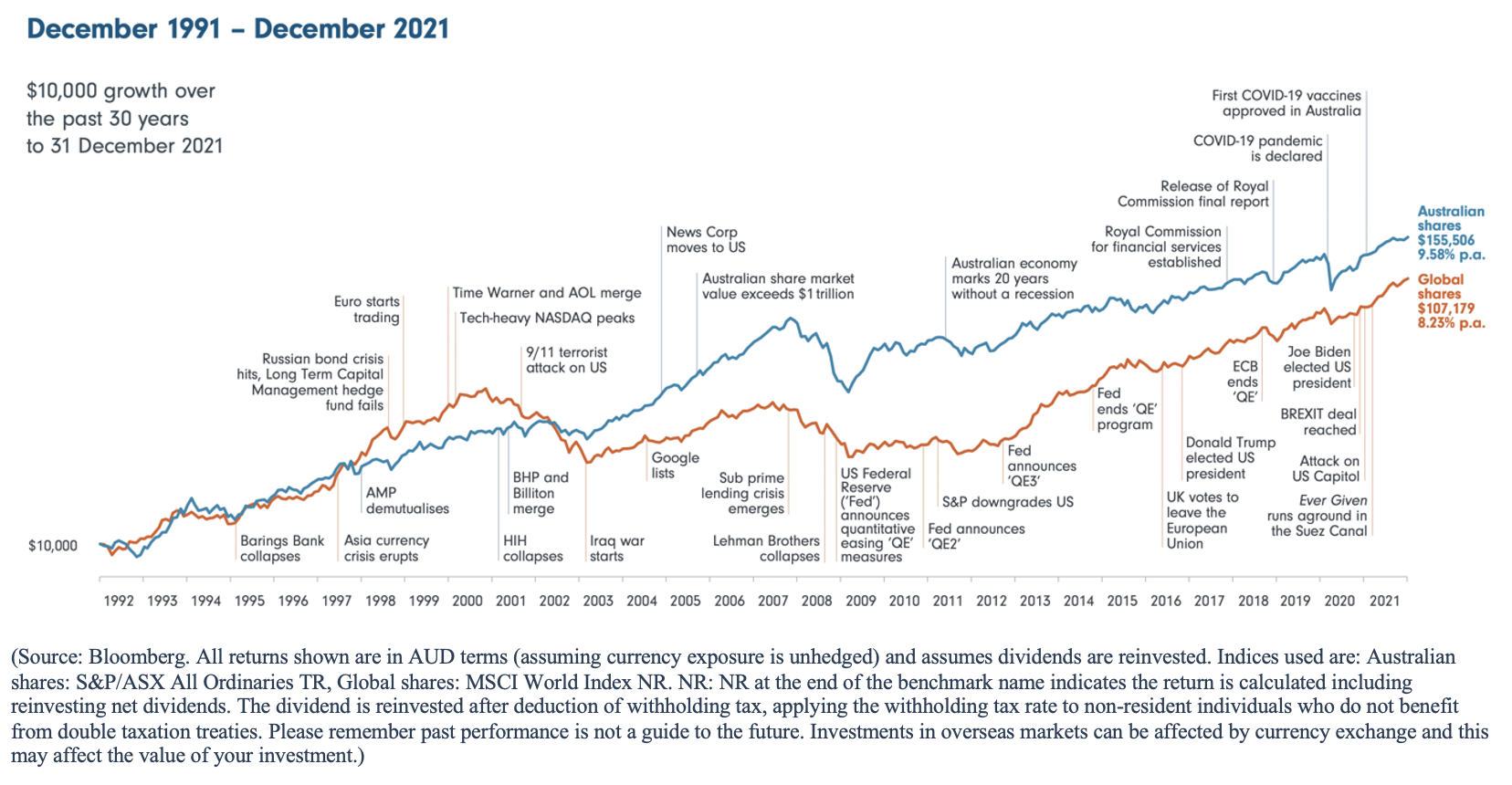

Work I’ve done shows that after the Coronavirus crash the market rebounded 40% in a year! And after the GFC, from March 2009 to April 2010, the rebound was 54%! It seems like stocks like to rebound out of bear markets.

I’ve said this before and I’ll keep reminding you of what the University of Pennsylvania’s Professor Jeremy Siegel said a couple of weeks ago: “We’ve had bigger shocks in the past … There may be another 5%, who knows, there may be another 10%, but that means for me, moving forward, that just raises the return on the market looking forward”. (CNBC)

And then JPMorgan’s Marko Kolanovic (the company’s chief global markets strategist) recently came up with this optimistic take on the rest of 2022:

- His team expects the S&P 500 to end the year at 4800. That’s 25.4% above where the broad market index closed on Friday.

- This would be the S&P 500’s all-time high set on January 3.

- He thinks a geo-political solution to the Ukraine war will happen later this year.

- Inflation will fall.

- Moderating inflation will help the US avoid a recession.

- That would be good for US company profits.

- And that means stock prices have been over-smashed this year.

- If right, his scenario will also mean interest rates won’t have to rise as much as the most negative forecasters have been predicting.

Sure, the market could fall some more, with a number of my experts thinking we could get a sell-off after reporting season in the US for the June quarter results. But after that, I think the December quarter will bring in a better setting for stocks. Experts who think the US is already in recession, already see rate cuts in 2023, which would be a plus for stocks.

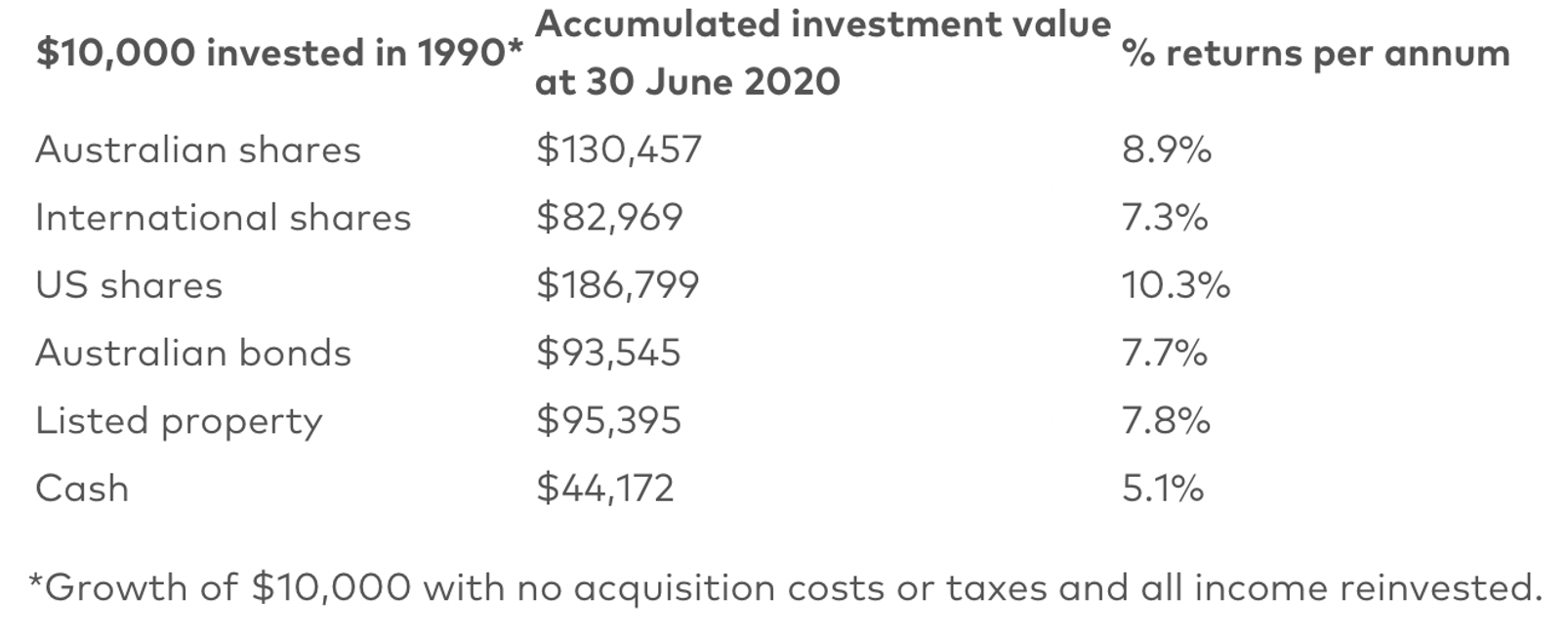

Vanguard is a business that has pioneered ETFs. A couple of years ago, Robin Bowerman put out this table looking at a $10,000 investment in 1990 in the broad Australian share market. It showed that it yielded 8.9% and had grown to $130,457, while investment in US shares would have returned 10.3%, to reach $186,799. The table below shows how $10,000 performed in different markets between 1990 and 2020.

During that time, there was the dotcom crash, the GFC crash and the Coronavirus crash. Immature investors were stressed out about their short-term returns, while those who learnt from history were buyers of quality stocks that were unreasonably beaten up or they did nothing, kept their heads and stayed the course.

Every time you want to complain about stocks, just look at this chart and understand that this is a short-term problem. The long-term will deliver. Provided you create a good collection of stocks or buy an ETF for the overall market, you will average a return of about 8% before inflation.

You will only do better by taking risks. If you have a more cautious portfolio compared to being 100% invested in stocks, you should expect a return closer to 6-7%.

I’m investing with the idea that Marko Kolanovic is on the money, but even if his scenario doesn’t materialize later in 2022, then it will be in 2023.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.