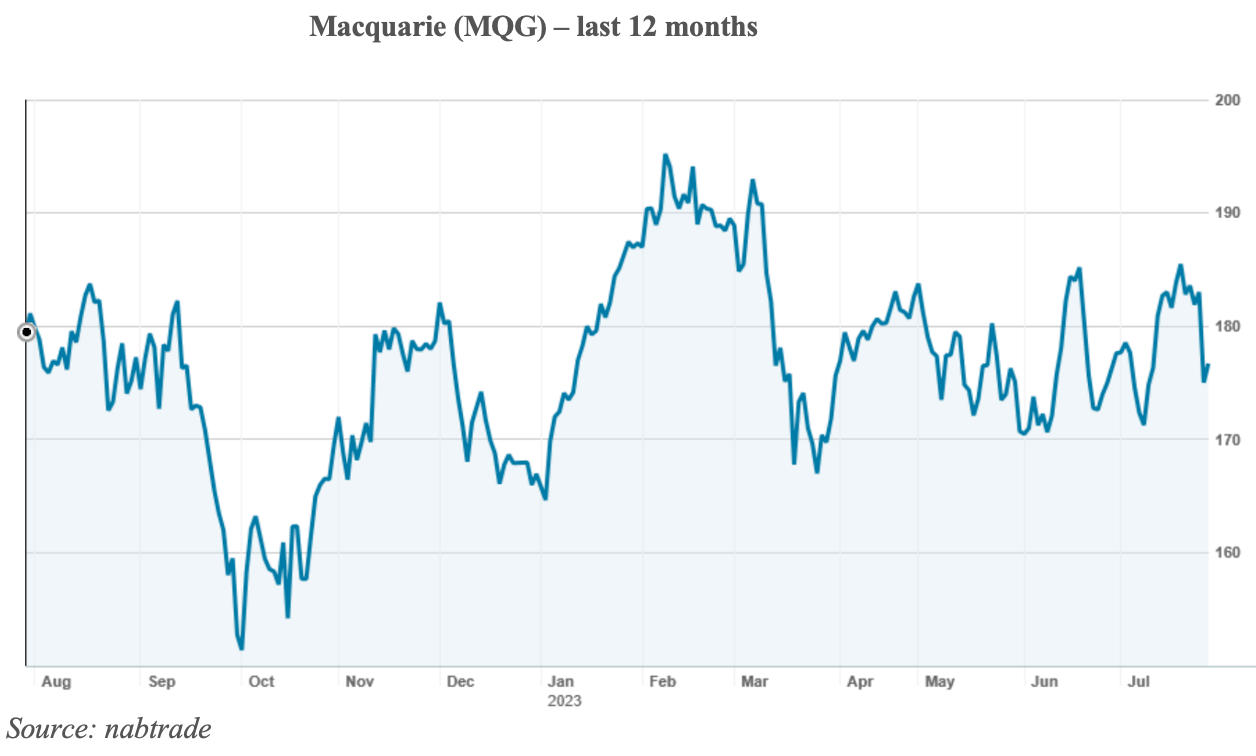

Back in May, I wrote a review of Macquarie Group (MQG) following the announcement of its annual financial results (see https://switzerreport.com.au/macquarie-delivers-again/ [1] )

I concluded: “I think it is reasonable buying right now. There is nothing in the profit result to suggest that Macquarie won’t continue to excel over the medium term.”

I noted that Macquarie’s CEO Shemara Wikramanayake had issued a cautious outlook, implying that the boom conditions that drove Macquarie’s profit in FY23 (in particular, commodities trading) were unlikely to be repeated in FY24.

I wrote “The concern about sustainability of earnings is understandable. Macquarie’s commodities income in FY23 benefitted from exceptionally strong trading conditions (largely due to the hostilities in the Ukraine and inflation), and market conditions are unlikely to be as conducive again in FY24.

However, Macquarie deliberately positions itself in markets with “structural tailwinds” and while it may not be commodities that will provide the boost to earnings in FY24, the chances are that there will be something else. This is the way Macquarie operates – it is very adept at leveraging the next big opportunity.”

Last Thursday, Macquarie held its AGM and delivered an update on trading conditions for the first quarter of FY24 (the period from 1 April to 30 June 2023). It said: ‘Weaker trading conditions with 1Q24 Operating Group contribution substantially down on the prior corresponding period (i.e., 1Q23)”.

Performance by Macquarie’s Commodities and Global Markets business was ‘significantly down due to reduced trading activity across Gas and Power”. Lower investment related income from green energy investment impacted the contribution from Macquarie Asset Management.

Macquarie didn’t quantify the drop, but the use of the word “substantially” meant that the market had no choice but to sell the stock down.

The market had been expecting FY24 profit to fall compared to FY23, but most analysts had been pencilling in a fall of about $900m from $5.2bn to around $4.3bn. Now, many have lowered their forecast to around $4.0bn.

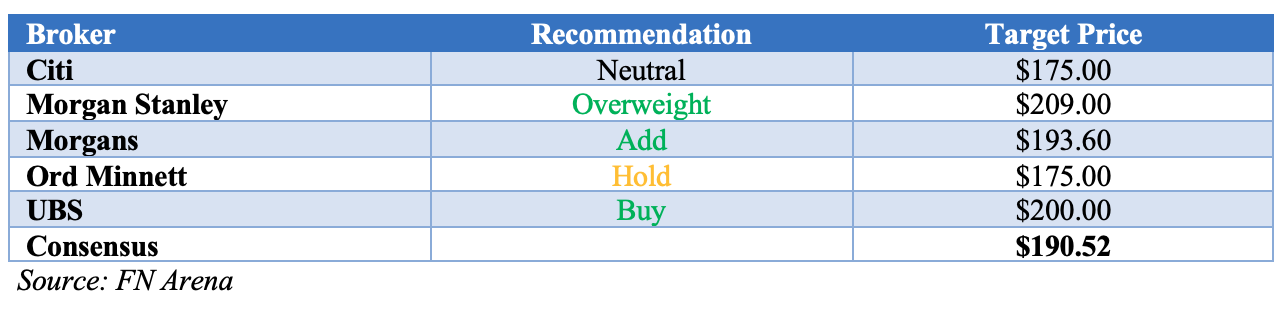

What do the brokers now say?

Here’s the synopsis of the major brokers from FN Arena. Morgans says: “Management commentary suggested softer short-term conditions for a number of divisions, particularly the annuity-style and market facing businesses.

As a result of this commentary, the broker downgrades its FY24 and FY25 EPS forecasts by around -8% for Macquarie Capital, Commodities and Global Markets as well as Macquarie Asset Management.

The Add rating is retained on the analyst’s confidence in the medium-term outlook and the target falls to $193.60 from 201.80.”

UBS says: “At first glance, UBS finds the trading update on the first quarter of FY24 by Macquarie Group weak, assessing it to be -15% “light” relative to expectations for the first half.

The broker expects consensus earnings downgrades will also be reflected in the share price. Division commentary outside of Banking and Financial Services also “reads poorly”, in the broker’s view, with commodity market earnings significantly down on the first quarter of FY23. UBS has a Buy rating and $200 target.”

Morgan Stanley “expects consensus earnings downgrades due to management’s outlook, which allows for weaker conditions in the first third of FY24.

The analyst points out the previously announced sales of UK offshore wind farms and a US port did not complete in the 1Q, but at least they signal a return of transactions in infrastructure and green energy.

On capital markets, the broker views the 1Q miss as largely timing and sees an improving outlook, while for commodities there are a wide range of potential outcomes. It’s felt the group is well placed to resume earnings growth in FY25.

The broker’s Overweight rating is kept but the target falls to $209 from $215.”

Broker Citi “lowers FY24 net profit estimates by -6% to $4bn, leaving outer year forecasts unchanged. While first quarter commentary was softer than expected, the broker also notes a more difficult outlook.

Neutral retained, as it is too early to be definitive on commodity volatility and deal flow may recover as rates stabilise. Still, the broker finds it hard to make a case for re-rating as expectations continue to be guided lower. Target is $175.”

Broker Ord Minnett “advises investors to not draw long-term conclusions from quarterly updates, given group earnings are dependent on market conditions and the timing of asset realisations.

As the broker’s prior profit forecast for FY24 of $4.3bn implied an -18% drop on FY23 this now appears difficult to achieve based on the commentary provided. Estimates are lowered by another -5% to $4bn.

Ord Minnett also suggests the transition to renewable energy could lead to more instability and earnings volatility compared with that experienced historically by the group. Importantly, there was no change to language around the outlook for banking and financial services. The Hold rating and target of $175.00 are retained.

Overall, the consensus target price fell from to $190.52, 7.8% higher than Friday’s closing ASX price of $176.71. The table below shows a summary of the recommendations and target prices.

On multiples, the brokers have Macquarie trading around 16.2 times forecast FY24 earnings and 14.8 times forecast FY25 earnings. Based on a $176.71 share price and $6.59 forecast dividend, it is yielding 3.7%.

Bottom line

Keep the faith. Macquarie is recognised for its risk management DNA, its ability to pivot and leverage the next market opportunity and its conservatism when it approaches the investor community. I put this announcement in the “conservative category”.

However, with broker targets being lowered and profit forecasts cut, short-term gains in the stock price (back above $200) will be harder. Portfolio investors should hold, while others can arguably afford to be a little more opportunistic.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.