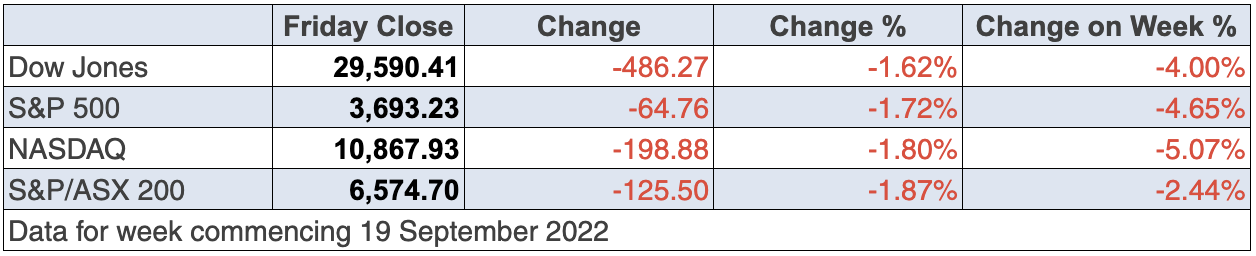

Stock market negativity deepened overnight on Wall Street, with the Dow hitting a new 2022 low and the S&P 500 close to a new low as well. The same goes for the Nasdaq, as the chart below shows, which was down 31.36% for the year to date at the close.

Nasdaq Composite

The Fed is having its way in frightening the life out of the stock market as a part of its program to beat down inflation, with bond yields spiking to levels not seen in a long time.

But this sell-off isn’t just about how rising interest rates hit growth and tech stocks. It has encouraged a lot more investors and speculators to believe that the Fed could be going too hard in coming months and could easily create a recession.

Last week more players thought a recession was a chance, but this week more think it’s becoming very likely. Of course, they could be wrong and Jerome Powell and his central bank might pull off the double play of lowering inflation and achieving an economic slowdown, not a recession, but fewer market participants believe that this week.

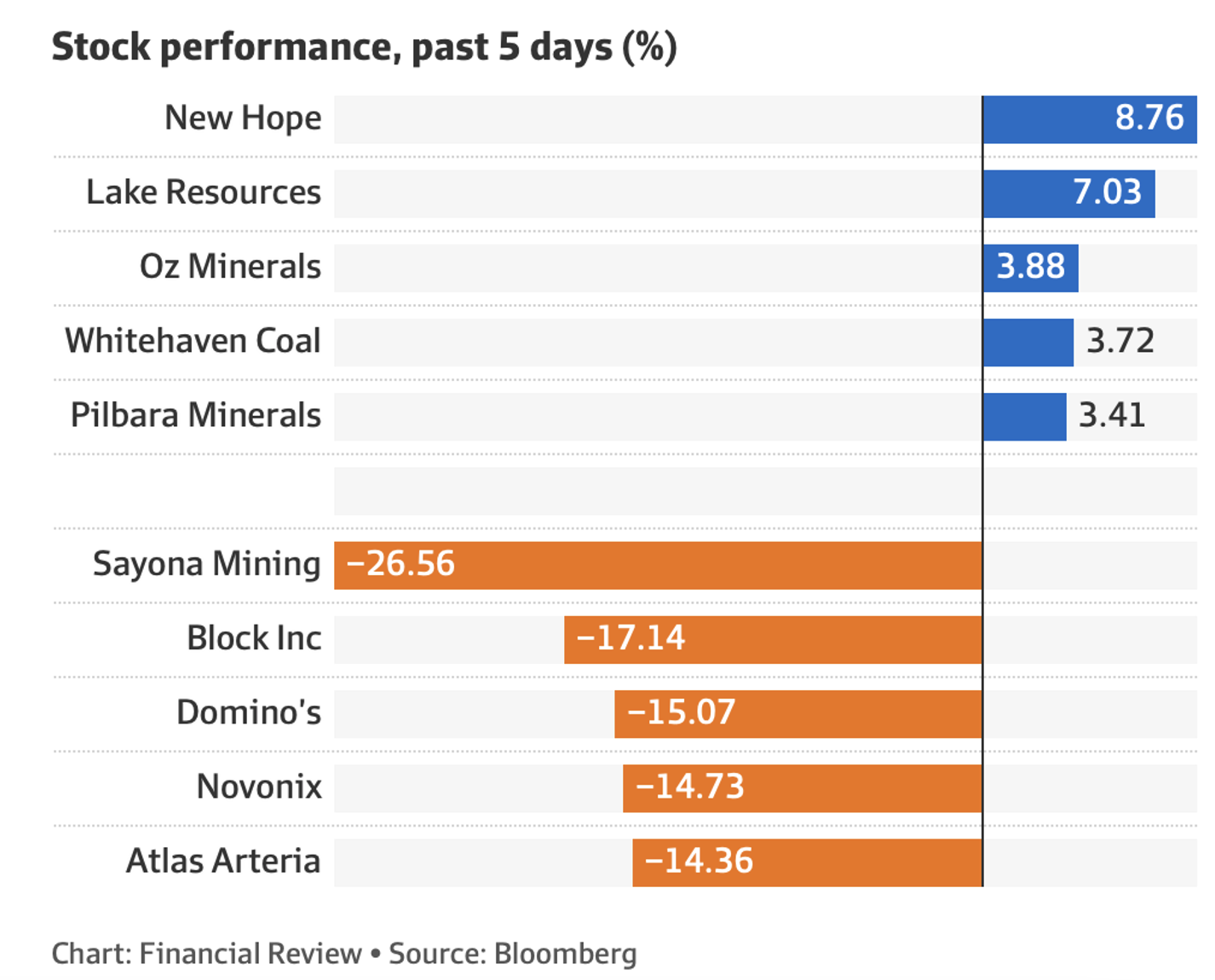

To be precise, after Mr Powell talked to the press after his latest 0.75% interest rate rise, he left no doubt that the plan is to do it again in November. This makes the October 13 CPI release crucially important. If it shows a bigger-than-expected fall in inflation, then the market could start betting that the next US rate rise could end up being less than 0.75%. However, it would have to be an overdue unexpected drop in inflation, but you can never totally trust any statistician to accurately guess what’s actually going on in an economy.

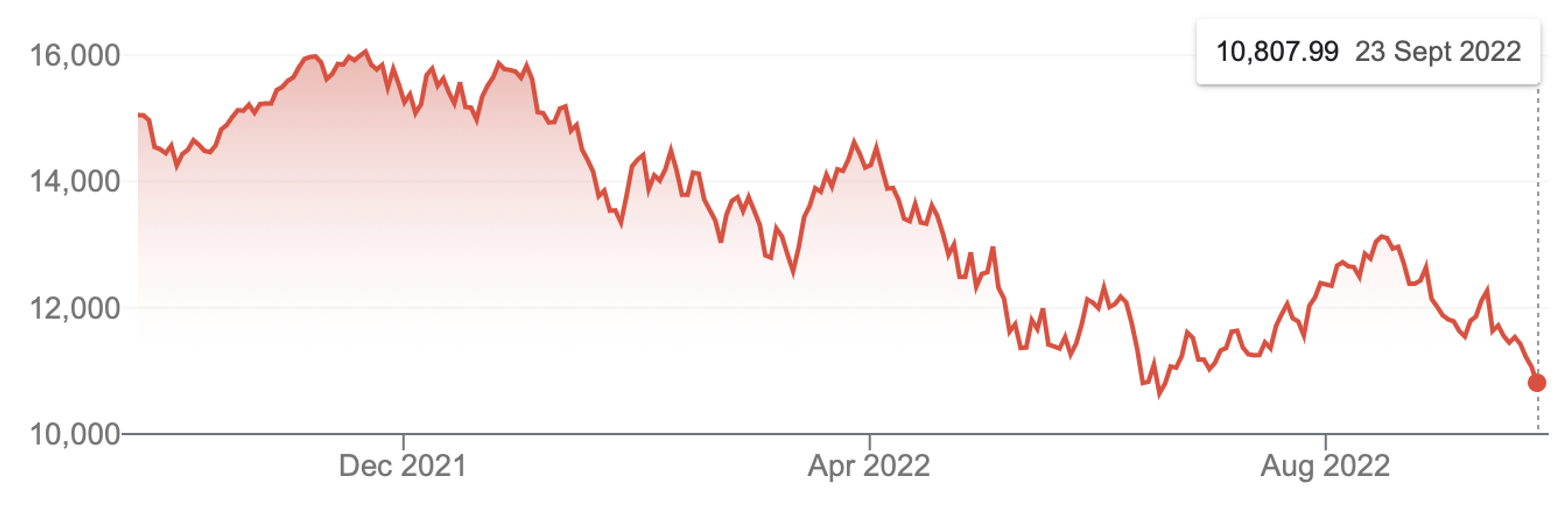

This chart of the AMP Pipeline Inflation Indicator shows US inflation is falling much faster than the official CPI reading.

AMP’s Shane Oliver explains this chart and sums up the risks around these big interest rate rises in a short period of time: “The danger though is that the Fed and other central banks have become locked into supersized hikes based on backward looking inflation and jobs data and a loss of confidence in their ability to forecast inflation at a time when they should be giving more attention to monetary policy lags,” he explained. “This increases the risk of overtightening driving a deep recession. (Just as in hindsight they were too slow to start hiking.)

“Fed tightening and hawkishness has seen the US 10-year/2-year yield curve further invert, strengthening its recession warning, with the more reliable 10-year Fed Funds rate curve yet to invert but getting close.”

But Shane is not all pessimistic:

“However, while inflation is still too high for the Fed and other central banks, there remains snippets of good news and reason for optimism on a 12-month horizon,” he added. “Our Pipeline Inflation Indicator continues to slow, suggesting that inflation will fall faster than the Fed is now expecting, inflation expectations outside of Europe have fallen and Canada has joined the US in showing signs of peak inflation.”

If you’re a long-only investor, that October 13 CPI release and other data drops (such as job numbers on October 7, retail sales and consumer confidence) will all be closely analysed. These have to show the Fed that previous rate rises are working to smash inflation but the problem is that monetary policy can work on a one-two year lag!

This is why more players are betting that Jerome and his interest rate team could be cooking up a recession, including the Chief Equity Strategist at Goldman Sachs.

“Based on our client discussions, a majority of equity investors have adopted the view that a hard landing scenario is inevitable and their focus is on the timing, magnitude, and duration of a potential recession and investment strategies for that outlook,” David Kostin wrote in a note to clients as he cut his outlook. (CNBC)

As I’ve been saying to you for months, we’re in the hands of data drops and what central banks see in those stats.

October, which isn’t a great month for stocks, is going to be crucial.

To the local story and the chain reaction of interest rate rises around started by the Fed this week, which also coincided with the British pound hitting a 30-year low against the greenback. A pound only gets $1.66 Aussie and one US dollar gets 91 pence. A month ago it was 84 pence and in 2007 it was 49 pence!

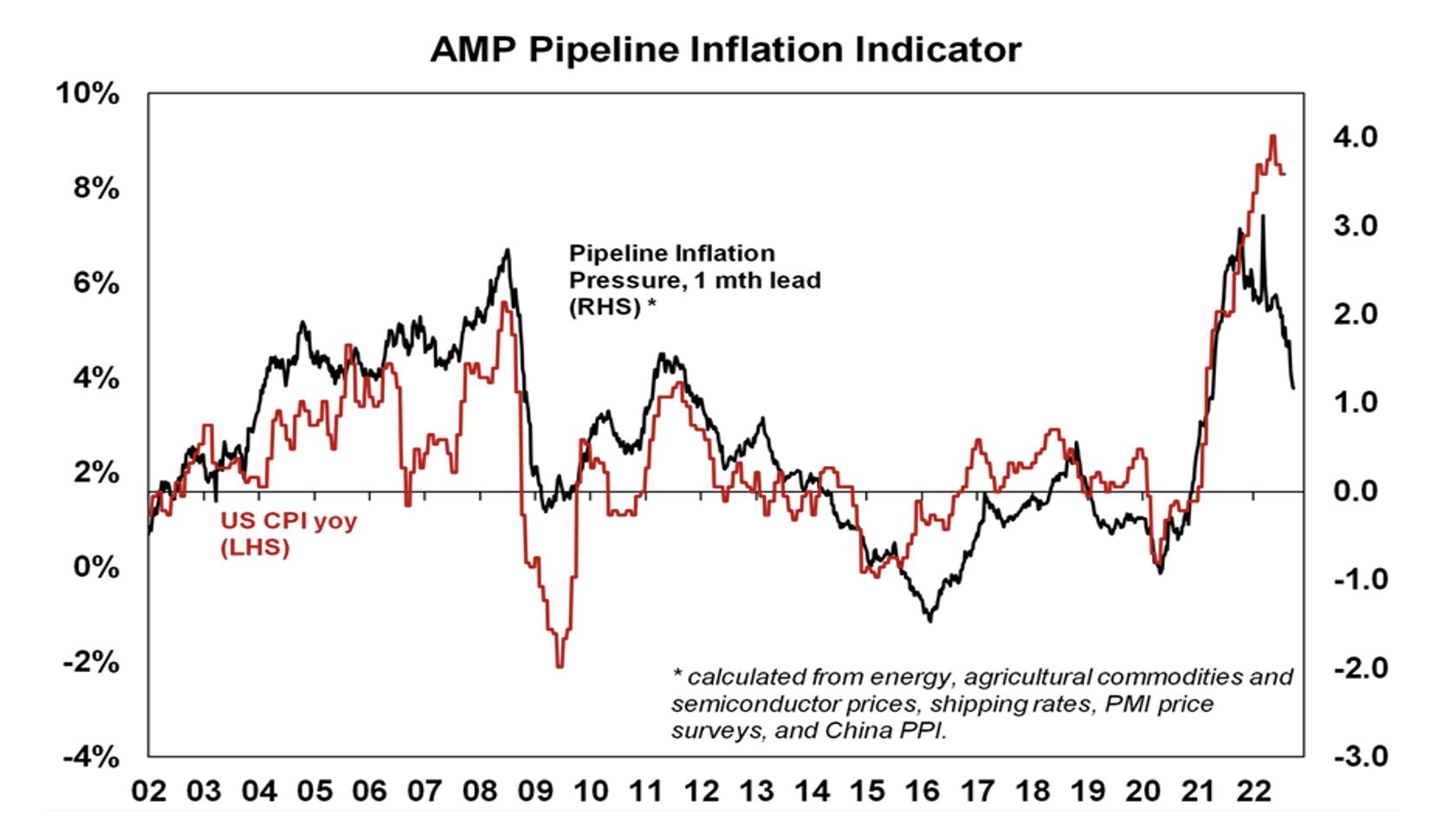

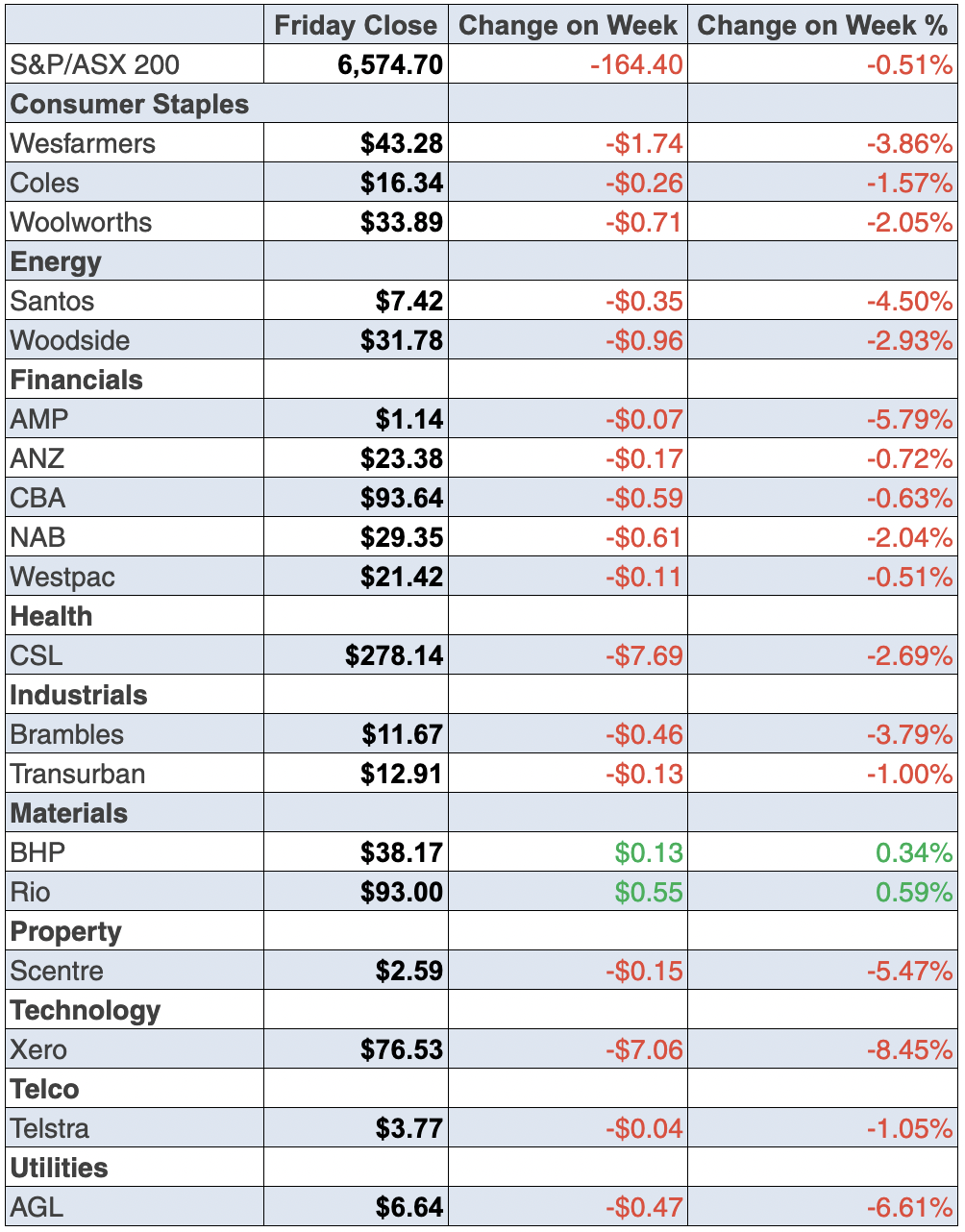

The S&P/ASX 200 lost 268 points this week (or 3.92%) as the Fed’s action hit tech and growth stocks again.

Here are the big winners and losers:

The fickle nature of stocks is shown by how coal businesses are now ‘loved’, thanks to Vladimir Putin’s impact on energy prices. In fact, the gains were bigger than the Bloomberg chart shows, with Whitehaven Coal rising 4.66% to $9.20 over the week and New Hope 13% to $6.33.

To tech, and one of our best, Xero, gave up 9.45% to $76.53, showing how growth stocks are temporarily out of favour, while more risky plays, such as Afterpay (which is now a Block Inc subsidiary trading under SQ2) slipped 8.94% over the week.

For the long-term player, we’re seeing companies at great buying opportunity prices but you have to be patient. Given the negativity around now, lower prices for many great buys should be expected.

Those October data drops on US jobs and inflation will make or break stock prices.

What I liked

- Consumer confidence rose by 0.4% in the past week, almost reversing the previous week’s decline. Sentiment is low but at least it’s not collapsing.

- The preliminary S&P Global Australia manufacturing Purchasing Managers’ index (PMI) rose from 53.8 in August to a 2-month high of 53.9 in September. The services PMI lifted from 50.2 in August to a 2-month high of 50.4 in September. These are good recession-fighting stats.

- The composite PMI, which combines both factory and services activity, rose from 50.2 in August to a 2-month high of 50.8 in September. Readings above 50 indicate an expansion in activity.

- Measures of both input costs and output price inflation hit 7-month lows in September, which is good news for bringing down inflation generally.

- The CBA credit and debit card spending tracker shows a slowdown in spending growth.

- According to the Australian Institute of Petroleum (AIP), the national average unleaded petrol price fell by 0.9 cents a litre last week to a 9-month low of 163.5 cents a litre (c/l). But price discounting on east coast cities has now ended.

- The SEEK Advertised Salary index rose by 3.8% over the year to August 2022, down from 4.1% in July. Advertised salary growth also slowed month-on-month, growing by 0.3% in August. That’s good for inflation.

- US data needs to show a slowing economy so the Fed will slow down rate rises. I liked the Conference Board leading index falling 0.3% in August (survey: – 0.1%). And it’s not saying beware of a recession brewing.

- The National Association of Home Builders index (NAHB) in the US fell from 49 to a 16-month low of 46 in September (survey: 47). This has to be good for inflation.

What I didn’t like

- The Federal Reserve increased its target range for the benchmark federal funds rate by 75 basis points for the third time to 3-3.25%, a level last seen in early 2008. The Fed has to be careful because monetary policy is slow to work (one to two years!) but when it hits, it can create a recession.

- The excessive stock market reaction to the expected rate rise.

- Shares in Ford fell 12.3% after it flagged delivery delays and said inflation-related supplier costs will run about $1 billion higher than expected in the current quarter.

Data heading in the right direction but…

My above look at what I liked and didn’t like clearly shows the data is heading in the right direction, but important statistics (such as the US CPI) need to show that interest rate rises are really working to bring down inflation. Until that happens, we’ll have to cope with this volatility.

The one positive I can throw your way is this: when an equities sell-off ends, historically a big rebound happens, so you have to think and invest long-term. And if you can, avoid panic plays.

P.S. In the last hour of trade, the S&P500 index rebounded 44 points to be down 64 points on the day. This shows that there were dip buyers who see companies at outrageously low prices and they are long-term players.

The week in review:

- Despite stock market turbulence, my article this week in the Switzer Report looks at five quality companies you should consider adding to your portfolio. [1]

- Paul (Rickard) says self-funded retirees and other investors managing the defensive portion of their portfolio can cheer because some term deposit rates now start with a big figure of ‘4’ and there are ‘3s’ everywhere! Paul goes through the best rates on offer. [2]

- In our “HOT” stock column, Raymond Chan, Head of Asian Desk at Morgans gives us an update on 4 consumer staples: Woolworths, Coles, Endeavour Group and Wesfarmers. [3]

- James Dunn delves into five stocks under (or near) the 50-cent price [4]point for investors with higher risk tolerance.

- And finally, in Buy, Hold, Sell — Brokers Say, there was an equal amount (five) of upgrades and [5]downgrades to ASX-listed companies in the sole edition for the week.

Our videos of the week:

- What is immunotherapy and how does it fight cancer? | The Check Up [6]

- 5 quality stocks: GMG, ANZ, XRO, JBH & S32 + Should we fear the Fed interest rate decision? | Switzer Investing (Monday) [7]

- 3 reasons why Dr Phil better be careful about raising interest rates & could stocks slide tomorrow? | Mad about Money [8]

Top Stocks – how they fared:

The Week Ahead:

Food for thought: “The key is not spending time, but investing in it.” – Stephen R. Covey

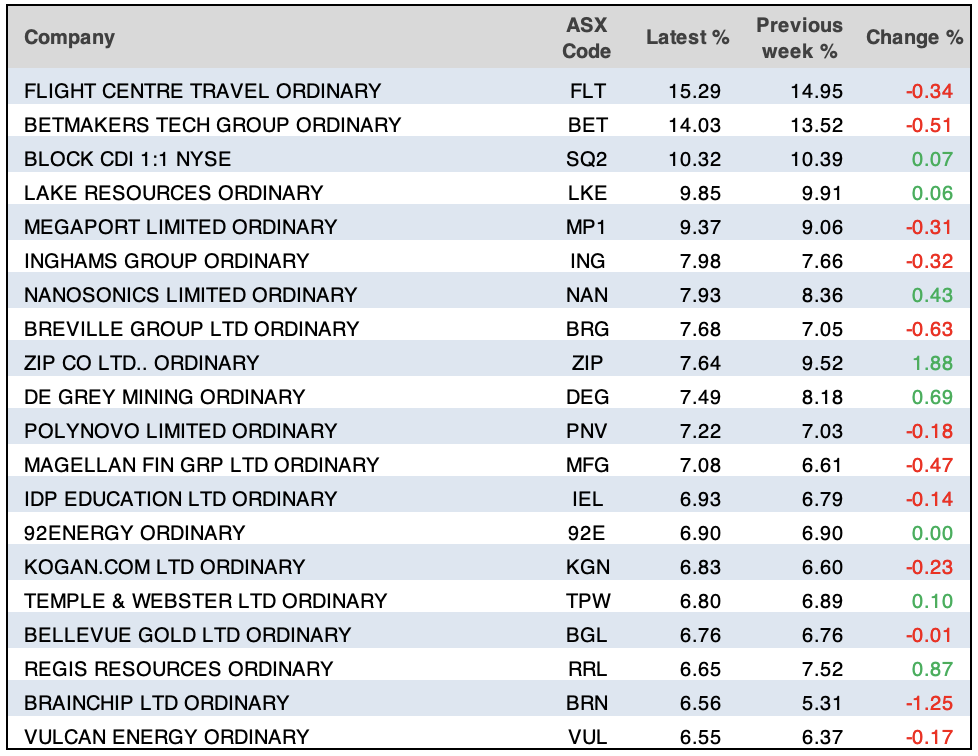

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

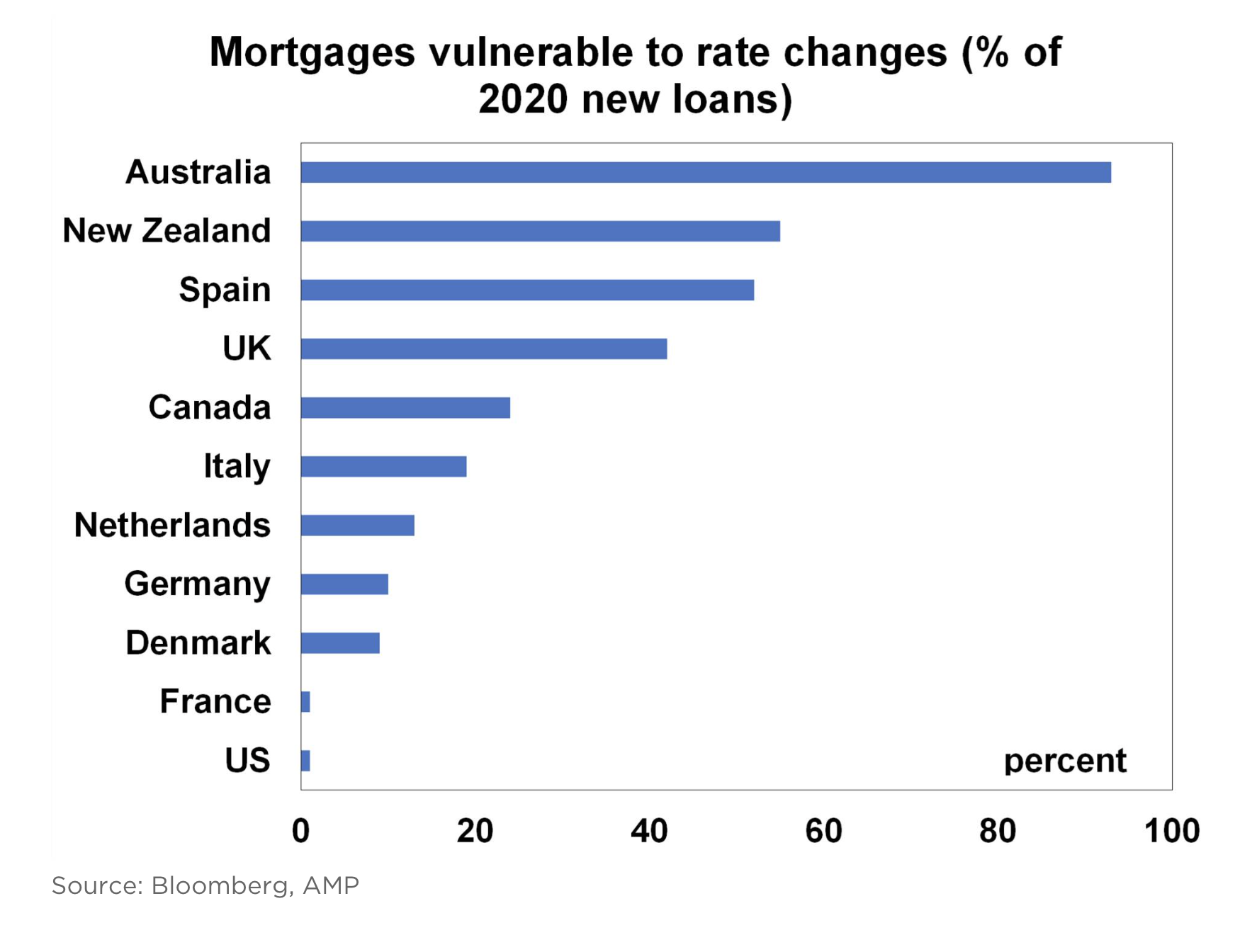

Chart of the week:

Our chart of the week paints a stark picture for Aussie homeowners with variable mortgages and their vulnerability to interest rate hikes relative to other countries. Diana Mousina of AMP Capital explains:

“Households with variable mortgages feel the impact of rate hikes as soon as their minimum repayments change (which is usually 2-3 months after the RBA changes the cash rate) while repayments for fixed-rate mortgages do not change (until they roll off with fixed loans usually available for a period of 1-5 years),” Diana says.

“Across our global peers, [fewer] consumers tend to be on variable mortgages. And for those households on fixed rates, the time that those mortgages can be fixed for is relatively short, between 1-5 years. So, in Australia, there is a very high sensitivity of households to near-term changes to interest rates because of the faster flow-through to changes in repayments for households with debt.

“The credit rating agency Fitch counts ‘vulnerable’ loans as those with a variable rate or a fixed rate that will expire or reset in the next 24 months. On this measure, Australia has the highest exposure to mortgages vulnerable to rate changes across comparable global countries with 93% of loans vulnerable to rising rates (compared to 55% in New Zealand, 42% in the UK, 24% in Canada and 1% in the US),” she concludes.

Top 5 most clicked:

- 5 quality companies worth adding to your portfolio [1] – Peter Switzer

- Term deposits are back in favour and here are the best on offer! [2] – Paul Rickard

- “HOT” stocks update – WOW; COL; EDV; WES [3] – Maureen Jordan

- Five under 50c [4] – James Dunn

- Buy, Hold, Sell – What the Brokers Say [5] – Rudi Filapek-Vandyck

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.