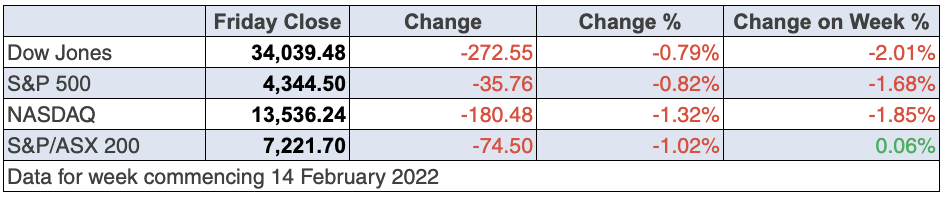

The US stock market is heading for its second losing week, in contrast with ours where we’ve gone up three weeks in a row. This trend makes me think my prediction that our market can play catch up and do better than Wall Street this year might be on the money.

But before we see that play out, we need to get over the current threats to positive stock prices, namely, fears over a possible Russian-Ukraine war that drags in NATO allies, and the expected interest rate rise from the Federal Reserve in March. That hasn’t been helped by increasingly more economists tipping a half-a-percent rise, and then there’s the grandstanding St. Louis Fed President James Bullard, who has called for a 1% hike next month!

Thankfully, his New York counterpart John Williams has publicly said there was no need for such a “big step” to kick off the interest rate tightening cycle.

But the current and most immediate concern is a war orchestrated by Vladimir Putin and it has stocks on the slide as US President Joe Biden moves US troops closer to the border. This game of geopolitical chess is not good for risk assets such as stocks.

Edward Moya, senior market analyst at Oanda in the US, summed it up precisely with the following: “Wall Street is feeling very jittery as it looks to the left and sees intensifying geopolitical risks with the Ukraine situation and then it looks to the right and sees the potential for aggressive Fed tightening.”

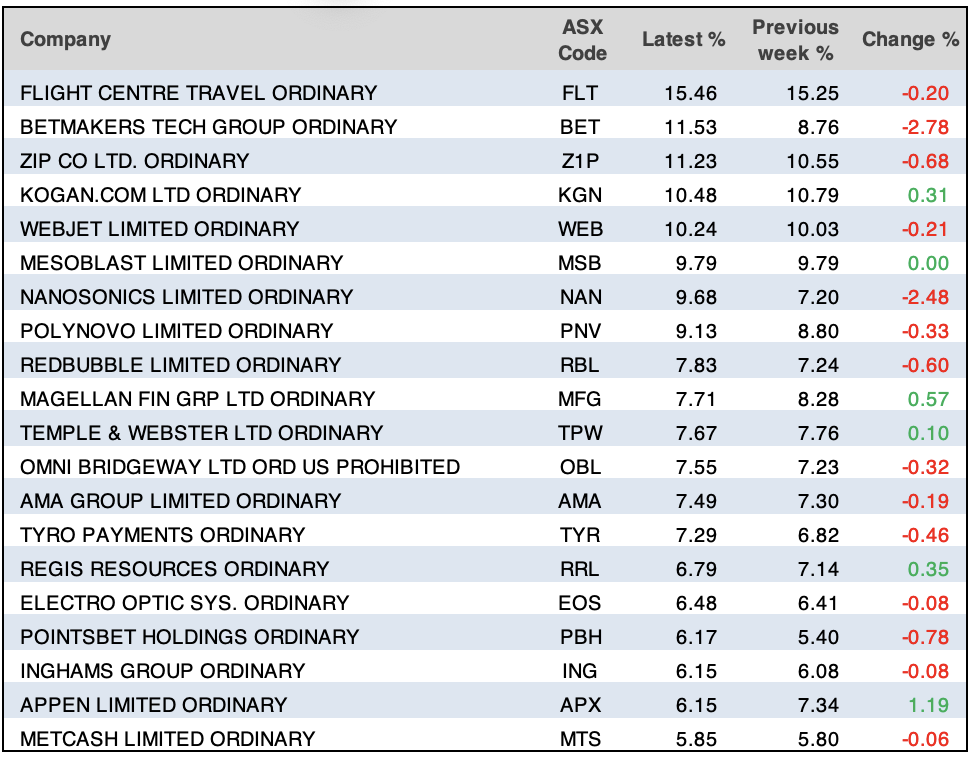

But importantly, there are still a lot of potential stock buyers out there, as we saw Wall Street investors and traders react to a perceived de-escalation of tensions between Ukraine and Russia on Tuesday in the States that drove our market up strongly on Wednesday. This was good news for banks and so-called ‘mega cap’ technology stocks in the US. And travel-dependent stocks also lifted sharply on re-opening hopes. Webjet spiked about 5% on Wednesday from $5.80 to $6.08 on the report that Russian troops had started to pull back but new reports pouring water on the intel set Wall Street up for its worst day for 2022. And it explained our 72-point slide on the All Ords on Friday.

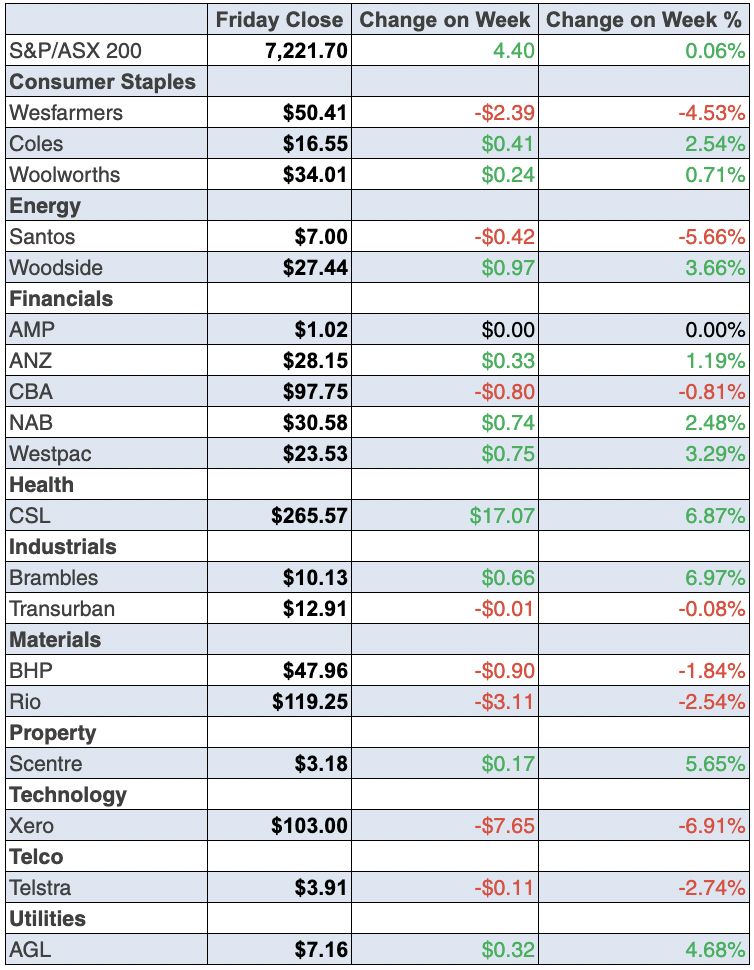

To the local story and despite the fear and loathing about war and interest rate rises, our market was up for the third week in a row. The S&P/ASX 200 rose 0.1% for the week, despite a 74.5 point (or 1%) loss on Friday, thanks to Vlad and his border antics.

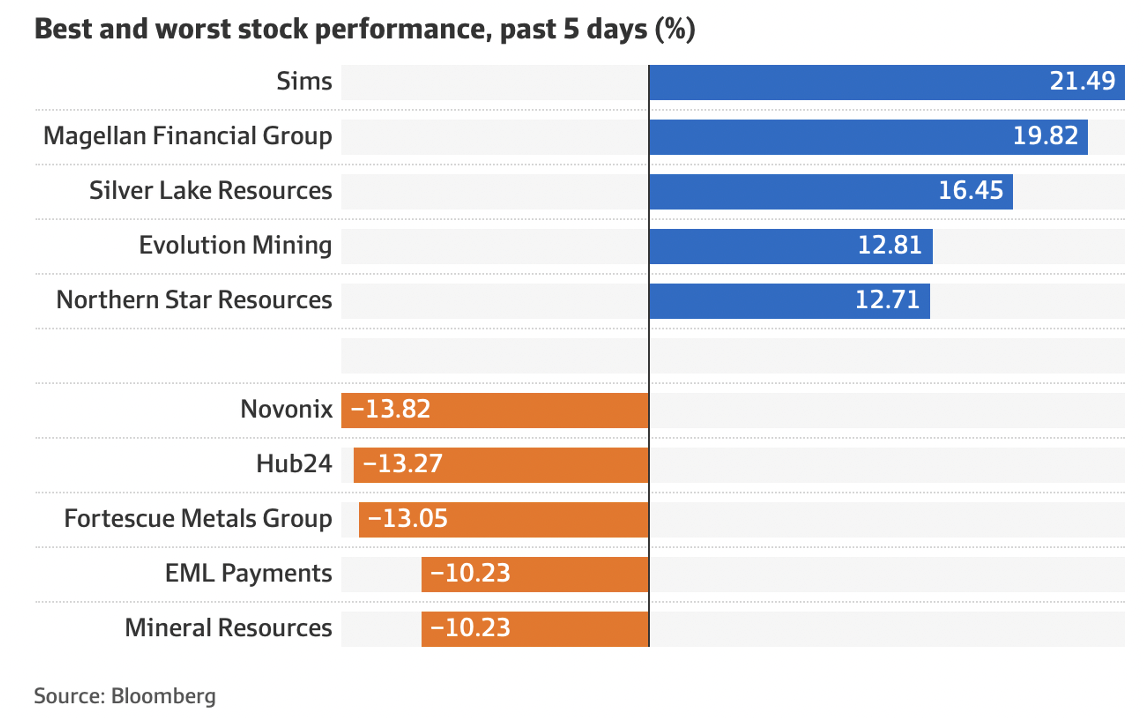

Star of the week was Magellan, which put on 18.5% on Friday after the company results were miles better than the awful inferences from the reports in the press over recent weeks! That 24% rise in first-half profit showed that family issues that have attracted too much attention were a distraction from what was going on in the company. Also, the fact the company is considering buying back shares helped the stock price.

The company is also offering a one-for-eight bonus option exercisable at $35, which we will look at more closely next week.

Here were the winners and losers of the week:

All this inflation, interest rates and war talk has been good for gold, with Newcrest up 4% for the week to $24.36. And Northern Star, my favourite that I’ve talked about in our weekly Boom! Doom! Zoom! show was up 7.5% this week.

EML copped it with a class action announced over its Irish central bank drama, despite a pretty good report. Its Gross Debit Volume was up 206% to $31.6bn. GDV is the monetary value of transactions across its payment products, which should’ve been a big plus for the company. Over $10 million has been put aside to fight the legal action, which is big considering EBITDA was $26.9 million.

The surprise stock price moves were the iron ore miners after BHP put out a ripper report. The company’s share price was off 0.6% for the week, Fortescue lost 11.6% and Rio gave up only 0.23%.

I will investigate that FMG sell off next week on Monday’s TV show. Last week’s TV show attracted over 19,000 views, so don’t ignore it!

By the way, reporting season has been a big help for our stock market’s ‘better-than-the-Yanks’ performance. Here is Shane Oliver from AMP Capital’s take on reporting so far: “So far beats are outnumbering misses by a wide margin at 47% of results to 29%, but there has been a slowing in momentum with only 59% reporting profits up on a year ago which is down from 75% in the last reporting season and 54% have raised dividends which is less than the average of 59%. However, reflecting the bias towards upside surprises 51% have seen their share price outperform the market on reporting day. Consensus earnings growth expectations for the current financial year have edged up from 13.1% to 13.3% helped by energy and financials.”

What I liked

- Employment rose by 12,900 in January, with part-time jobs up by 30,000. But full-time jobs were down by 17,100. Total employment hit a record high of 13.255 million in January.

- The participation rate rose from 66.1% in December to a near-record high of 66.2% in January.

- The unemployment rate was steady at a 13-year low of 4.2% in January (lowest since August 2008).

- The weekly ANZ-Roy Morgan consumer confidence index rose by 3.3% (the biggest lift in 10 months) to 103.2 points. The result is clearly positive for consumer discretionary as well as consumer staples sectors.

- In the December quarter, the number of actively trading businesses in Australia rose by a record 1.6% to 2,467,801. Over the past year, the number of businesses rose by a record 4.8%. Quarterly records extend back to the March quarter of 2013.

- In January 2022, provisionally there were 265,450 overseas arrivals to Australia – the highest result since international border restrictions were imposed in March 2020. There were 190,500 overseas departures from Australia in January, down from 227,230 in December.

- US retail sales rose 3.8% in January (survey: 2%). Industrial production lifted 1.4% in January (survey: 0.5%).

What I didn’t like

- According to Commonwealth Bank (CBA) economists, “CBA’s internal household card spending data for the week ending 11 February shows a slowdown in spending growth after a run of very strong weekly increases”.

- Global crude oil prices have hit fresh 7-year highs this morning in Asian trade, with the global benchmark Brent crude oil price above US$95 a barrel on escalating Ukraine-Russian political tensions.

- US producer prices rose by 1% in January (survey: 0.5%) to be up 9.7% on the year.

- St Louis Federal Reserve president James Bullard again called for higher interest rates. Traders are pricing in a 67% chance of a 50-basis point increase in the federal funds rate in March.

- The Philadelphia Fed manufacturing index fell from 23.2 to 16 in February (survey: 20).

- In the January 25-26 meeting minutes of the US Federal Reserve, “Most participants noted that, if inflation does not move down as they expect, it would be appropriate for the Committee to remove policy accommodation at a faster pace than they currently anticipate”.

- The US leading economic index fell 0.3% in January owing to a surge in omicron cases, high inflation and persistent supply-chain disruptions. The decline in the index was the first since last spring.

It’s a waiting game

Despite my confidence that stocks will rebound this year, turning this early volatility into a new leg-up rally once the economic rebound is confirmed, we still have to wait out the implications of this Putin play and the Fed’s move in March with interest rates.

One interesting positive indicator for the US economy strangely is the Israel economy! And this week it registered 8.1% economic growth for 2021, driven by a wait for it, 16.6% jump in GDP in the December quarter. The most significant contribution to this highest growth of any OECD country in 2021 came from a notable increase in private consumption, which rose by 11.7%. This could easily be replicated in other countries such as ours, as we get free of Omicron and other virus-related restrictions.

That’s a left-field indicator but it is seen as a positive one for US growth by some experts. I hope it’s a sign of things to come.

The week in review:

- This week in the Switzer Report, I explain why [1] my prediction for a 10%+ upside in stocks for 2022 still holds strong despite the various narratives flying around about the coronavirus, rising interest rates, and Russia knocking on Ukraine’s door.

- Paul Rickard provides a framework for investors to distinguish between a company currently at a bargain price, and that which is more or less a ‘falling knife’ by looking at two companies [2] that some may argue are in the buy zone, although could still have a way to go on the downtrend. He also looks at the results [3] from CSL Limited’s (CSL) earnings report and whether its stellar performance really is in fact a “surprise”.

- James Dunn serves up one for the micro-cap hunters, pointing to what he believes is value for money with these 3 stocks under $1. [4]

- With the falling unemployment rate in Australia and the increasing number of workers looking to switch jobs, Tony Featherstone thinks this could be a boon for HR stocks, and he sees two, in particular, that could do well during this cycle. [5]

- For our “Hot” stocks this week, Raymond Chan of Morgans gives United Malt Group (UMG) an ‘Add’ rating, [6] while Michael Gable of Fairmont Equities sees a buying opportunity [7] in the charts for Credit Corp Limited (CCP).

- This week in Buy, Hold, Sell – What the Brokers Say, there were an equal number (eight) of upgrades and downgrades [8] in the first edition, and in the second edition, [9] Bendigo & Adelaide Bank (BEN) received the only upgrade, while BHP Group (BHP) was among the downgrades.

- And finally, in Questions of the Week, [10] Paul answers your questions on the off-market share buyback for JB Hi-Fi Limited (JBH), potential reasoning behind NB Global Corporate Income Trust’s (NBI) current dip, whether Treasury Wines (TWE) is a buy, and CSL’s Share Purchase Plan.

Our videos of the week:

- Nasal Vaccines are the way of the future | The Check Up [11]

- Will stocks rebound this year? Experts name future winners: QBE, the banks, BPT, QAN + more! | Switzer Investing [12]

- Putin has helped the stock market go high & BHP + CSL show and tell, what do they tell us? | Mad about Money [13]

- Are these reporting week stocks a buy? Domain, BHP, Telstra, JB Hi-Fi, CSL, TWE and more! | Switzer Investing [14]

- Boom! Doom! Zoom! | Thursday 17 February [15]

Top Stocks – how they fared:

The Week Ahead:

Australia

Monday February 21 – ‘Flash’ purchasing managers index (Feb)

Tuesday February 22 – Weekly consumer confidence (Feb 20)

Wednesday February 23 – Wage price index (Dec quarter)

Wednesday February 23 – Construction work done (Dec quarter)

Thursday February 24 – Business investment (Dec quarter)

Thursday February 24 – Average weekly earnings (Nov)

Thursday February 24 – Detailed labour force data (Jan)

Overseas

Monday February 21 – China loan prime rates

Monday February 21 – China House price index (Jan)

Monday February 21 – US Presidents Day holiday

Tuesday February 22 – US Home prices (Dec)

Tuesday February 22 – US ‘Flash’ purchasing managers index

Tuesday February 22 – US Consumer confidence (Feb)

Tuesday February 22 – US Richmond Federal Reserve index (Feb)

Thursday February 24 – US Economic growth (Dec quarter)

Thursday February 24 – US New home sales (Jan)

Friday February 25 – US Durable goods orders (Jan)

Friday February 25 – US Personal income/spending (Jan)

Friday February 25 – US Pending home sales (Jan)

Food for thought: “The secret to investing is to figure out the value of something – and then pay a lot less.” – Joel Greenblatt

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the week:

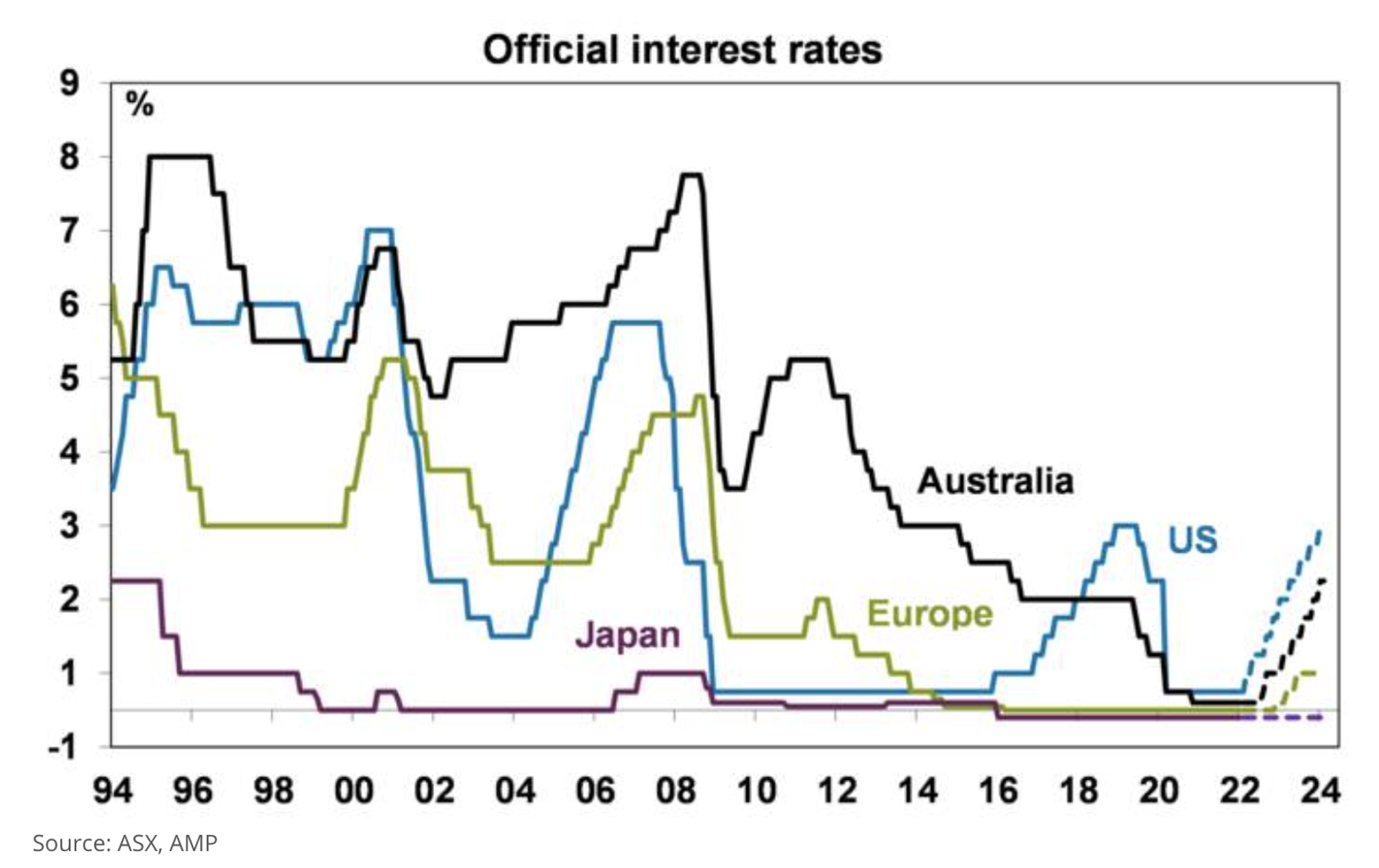

In our chart of the week, AMP’s Shane Oliver shares the firm’s predictions on future interest rate rises in Australia.

“We are assuming a rise in the cash rate over the next few years to around 1.5 to 2%, which all things being equal will translate to an increase in variable mortgage rates of up to 2%. While this will cut into household spending power it should still be manageable for borrowers as banks were imposing a serviceability buffer of 2.5% up until October (ie, borrowers had to still be able to service the loan with up to a 2.5% higher interest rate) which has since been raised to 3%. This would take the cash rate back to or just above where it was in the years just before the pandemic but assumes much lower unemployment and faster wages growth and inflation.”

Top 5 most clicked:

Top 5 most clicked:- My 10% call for stocks this year still has legs! [1] – Peter Switzer

- 3 stocks under $1 [4] – James Dunn

- CSL surprises. But was it really a surprise? [3] – Paul Rickard

- Buy, Hold, Sell – What the Brokers Say [8] – Rudi Filapek-Vandyck

- “Hot” stocks: United Malt Group (UMG) [6] – Maureen Jordan

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.