It’s the virus versus the vaccine for financial markets, and despite the fact that COVID-19 is having a second shot at the UK, Europe and the USA, the vaccine is getting on top, with even copper hitting a two-year high. This is a good sign for those wanting to believe the vaccine will underwrite a global economic recovery next year. It comes as Chinese Purchasing Manager Indexes are at their best levels since 2018 and construction worldwide is on an uptrend.

This is good news for those invested in commodity-based stocks, which do well in the early phase of an economic upswing.

That said, the rising number of coronavirus cases in the US, which saw New York City and Chicago announce fresh restrictions to curb its spread, supported ‘stay-at-home’ stocks in the technology sector again this week. The seven-day infection average is now 165,029, which is 24% higher than last week and is unsettling Wall Street. On Thursday, the Californian Governor, Gavin Newsom, issued a “limited stay-at-home order” on a majority of the state’s residents, requiring non-essential work and gatherings to cease between 10pm and 5am. This isn’t great with Thanksgiving looming on Thursday and is bound to put pressure on these numbers as families and friends travel to celebrate America’s favourite public holiday.

A stock like Zoom Video was up over 6% overnight and is a classic stay-at-home company. But for the month, it’s still down 19%.

That’s a ‘now’ trade for the short-term player. Those investing for the future, basing their purchases on what stocks will do well next year, have to look to the reopening trade companies.

The fact that the Unibail-Rodamco-Westfield stock was the best performer this week on the ASX (up 25.68%) pretty well proves that. So does the strength that has returned to the energy sector, which is up 22% in two weeks on Wall Street.

Like all stock market situations, there are competing forces and the reopening trade is gaining the upper hand. This was reflected in European share markets, which hit their highest levels in more than eight months on Monday, as hopes for an effective coronavirus vaccine were boosted by positive news from Moderna, whose vaccine was shown to be 94.5% effective in preliminary analysis of a large late-stage clinical trial. Even the good news for the Eli Lilly/Remdesivir treatment added more muscle to beat the virus going forward.

And on the post-election front in the US, despite President Trump’s delayed admission of defeat, sentiment was also boosted after advisers to US President-elect, Joe Biden, said they were opposed to a nationwide COVID-19 lockdown. A moderate Democrat President will be well received by Wall Street, if this considered moderation can be sustained. In part it explains why notable US hedge fund manager, Bill Ackman, told the Sohn Hearts & Minds Conference a week ago that investors should be long stocks in 2021.

This comes as JPMorgan has forecasted a negative 1% growth rate in the US for the first quarter of 2021 because of the infection surge and related restrictions. But because of the favourable vaccine news, it expects the US economy “will expand briskly in 2Q and 3Q.” If this is right, then it will be good for corporate profits next year and justifies why the stock market isn’t convulsing on the infections’ spike right now.

I’ve always argued that vaccine news is going to be critically important to how we play stocks and it’s working out that way, so we have to hope that vaccine news doesn’t turn sour. I’d like to see more progress on stimulus in the US but the current political standoff and handover isn’t helping that important issue for stocks.

To the local story this week, and banks continued their bounce back for the best monthly rise this year. The S&P/ASX 200 Index lost 8 points on Friday to close at 6539.2 but it was up 2.1% for the week, and up a whopping 10.3% so far this month!

In case you missed it, CBA put on 9.4% to end at $80, ANZ rose 8.6% to $22.34, Westpac was up 8.6% to $19.91 and the NAB added 7.2% to $22.73.

Fortunately, the improving economic outlook and comments from APRA, which made the belief that bank dividends would progressively improve, helped the banks find friends on the stock market.

It’s generally felt that this better economic outlook, boosted by our great handling of the virus and the likelihood of vaccines in early 2021 (if not earlier) is all good for financials, energy, retail, health and industrial stocks.

Surprise of the week was Crown Resort’s share price, which finished at $9.33, despite a run of shocking news that included a Moody’s downgrade of its credit rating and a forced delay of the opening of its Barangaroo casino because of regulator concerns.

Not surprisingly, given that Wall Street and other global stock markets seemed more focused on a spring reopening trade rather than a stay-at-home Covid winter fear, gold miners had a bad week, as the Bloomberg/AFR table shows.

What I liked

- The weekly ANZ-Roy Morgan consumer confidence rating rose for the 11th straight week, up by 3.4% to a 9-month high of 106.6 (long-run average since 1990 is 112.6). Sentiment is up by 63.2% since hitting record lows of 65.3 on March 29 (lowest since 1973).

- Employment rose by 178,800 in October (survey forecast: minus 27,500). Full-time jobs rose by 97,000 and part-time jobs rose by 81,800.

- The unemployment rate rose from 6.9% to 7% in October (survey forecast: 7.1%). This is a long way from the 10% tip we saw in March!

- The participation rate lifted from 64.9% to 65.8% in October, which is a good growth sign.

- In seasonally-adjusted terms, the Internet Vacancy Index (IVI) increased by 6.2% (or 9,100 job ads) in October 2020 to stand at 155,000.

- The Housing Industry Association reported that New Home Sales fell marginally by 1.3% in the month of October but remain 31.6% higher for the three months to October, compared with the same time last year.

- The CBA card spending in the week to November 13 lifted by 11% on a year ago, compared to a 13% lift for the previous week.

- The NSW Government has projected a record $16 billion deficit in 2020/21 after a deficit of $6.9 billion in 2019/20. Spending helps the economy.

- Chinese industrial production rose at a 6.9% annual rate in October (consensus: 6.7%) – the same annual growth rate as September.

- US existing home sales rose by 4.3% to a 15-year high — a 6.85 million annual rate in October (survey: minus 1.2%).

- The Conference Board leading index in the US rose 0.7% in October as expected, despite rising infection rates!

- US housing starts rose 4.9% to a 1.53 million annual rate in October (survey: 3.2%).

- The NAHB housing market index rose from 85 to a record high 90 in November (survey: 85).

What I didn’t like

- The Wage Price Index (WPI) rose by 0.1% in the September quarter (consensus: 0.2%). Annual wage growth fell from 1.8% to 1.4% – the slowest annual growth rate on record (over 22 years). Consensus was for annual wage growth of 1.5%. (It’s still not bad considering Victoria’s issues when the stats were looked at.)

- The Philadelphia Fed manufacturing index dipped from 32.3 to 26.3 in November (survey: 22.5). The Kansas City Fed manufacturing index eased from 23 to 20 in November (survey: 11).

- Chancellor Angela Merkel warned that the virus situation in Germany remains “very serious”.

- Disappointing US retail sales data, surging virus cases and worries about shutdowns dented sentiment.

Mesoblast deal

For those wondering why Mesoblast was up 12% for the week, it’s because the company has entered an exclusive licence and collaboration agreement with Novartis to commercialise Mesoblast’s remestemcel-L therapy drug.

The week in review:

- If you don’t know what stock market rotation means, you’re about to learn about it! My article this week went through 13 stocks I believe will surge on this rotation [1].

- This week, Paul Rickard wrote that he doesn’t think he has ever seen such a bad result by a major bank than with Westpac [2]. With underperformance comes opportunity, and he says you might want to consider Westpac in preference to the other major banks.

- Tony Featherstone said he is bullish on residential property and Australian equities over the next two years and shared two themes to watch and stocks that will benefit [3].

- At its current price, Afterpay is just too expensive but there’s probably reasonable value still to be had in Zip Co, Splitit, Sezzle, Laybuy and others according to James Dunn [4].

- For our “HOT” stock this week, Michael Wayne explained why he likes Audinate [5].

- Downgrades outnumbered upgrades in both editions of Buy, Hold, Sell – What the Brokers Say this week. The first edition [6] saw 12 upgrades and 17 downgrades, while the second edition [7] brought 3 upgrades and 9 downgrades.

- And in Questions of the Week [8], Paul Rickard answered questions on the benefits and traps of Westpac and NAB’s new capital notes; how to invest in renewable energy, investing in China and technology, and Phoslock Environmental Technologies.

Our videos of the week:

- Boom! Doom! Zoom! | November 19, 2020 [9]

- Hearts & Minds Conference: Which 4 stocks are the Top 4 Fund Managers Buying! [10] | Switzer TV: Investing

- Is the property price rebound continuing & what suburbs/towns are hot? [11] | Switzer TV: Property

Top Stocks – how they fared:

The Week Ahead:

Australia

Monday November 23 – IHS/Markit purchasing managers (November)

Tuesday November 24 – CBA weekly credit & debit card spending

Tuesday November 24 – International trade in goods (October)

Tuesday November 24 – Speech from Reserve Bank official

Wednesday November 25 – Construction work done (September quarter)

Thursday November 26 – Detailed labour force (October)

Thursday November 26 – Business investment (September quarter)

Overseas

Monday November 23 – US National activity index (October)

Monday November 23 – ‘Flash’ purchasing managers index (November)

Tuesday November 24 – US House price indexes (September)

Tuesday November 24 – US Richmond manufacturing index (November)

Wednesday November 25 – US Consumer confidence (November)

Wednesday November 25 – US Economic growth (September quarter)

Wednesday November 25 – US Personal income/spending (October)

Wednesday November 25 – US Durable goods orders (October)

Wednesday November 25 – US International goods (October)

Wednesday November 25 – US New home sales (October)

Wednesday November 25 – US Federal Reserve meeting minutes

Thursday November 26 – China Industrial profits (October)

Thursday November 26 – US Thanksgiving

Food for thought:

“The biggest risk of all is not taking one.” – Mellody Hobson

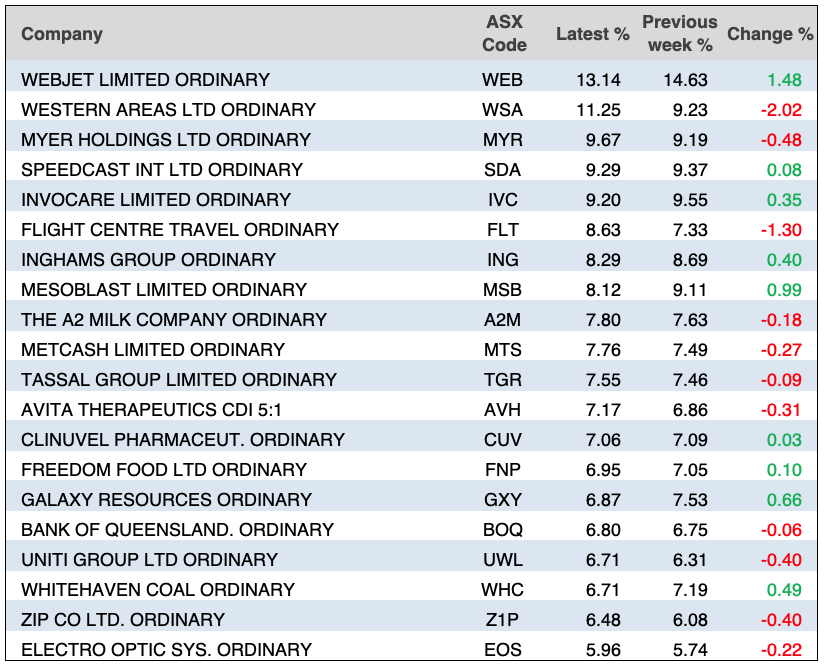

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

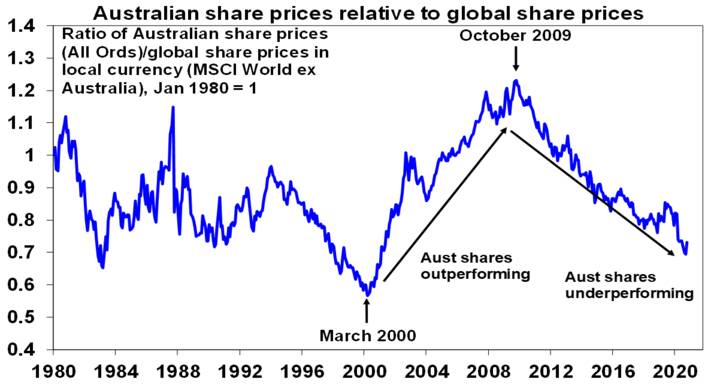

Chart of the week:

In a note from AMP Capital’s Shane Oliver this week explaining why Australian shares will likely outperform next year, he noted that the performance of local shares versus global shares have seen three distinct waves over the past 30 years as seen in the chart below:

Top 5 most clicked:

- 13 ‘value’ stocks that could surge on rotation [1] – Peter Switzer

- Westpac’s a buy [2] – Paul Rickard

- My favourite residential property stock & my pick of the listed asset managers [3] – Tony Featherstone

- 7 ‘other’ BNPL stocks to consider [4] – James Dunn

- My “HOT” stock [5] – Maureen Jordan

Recent Switzer Reports:

- Monday 16 November: 13 value stocks on the turn [12]

- Thursday 19 November: My favourite residential and listed asset manager stocks [13]

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.