One of my favourite tech stocks has been Xero (XRO). As a user, I am a great fan of its easy to use, intuitive and secure cloud based accounting platform. As an investor, I have been impressed by the growth story with great “SaaS” (software as a service) metrics such as number of users, customer lifetime value, cost of acquisition, churn and average revenue per customer.

In Australia (its major market), it has demonstrated significant pricing power with two hefty increases in user fees over the last 15 months.

However, earlier this month, Xero reported its first half result (its financial year rune to 31 March 24). The market took fright and Xero’s shares dropped about 10%. They haven’t really recovered.

Xero (XRO) – last 12 months

Source: nabtrade

Let’s take a close look at what the market didn’t like, and seek to answer the question………is Xero too expensive?

Xero’s first half

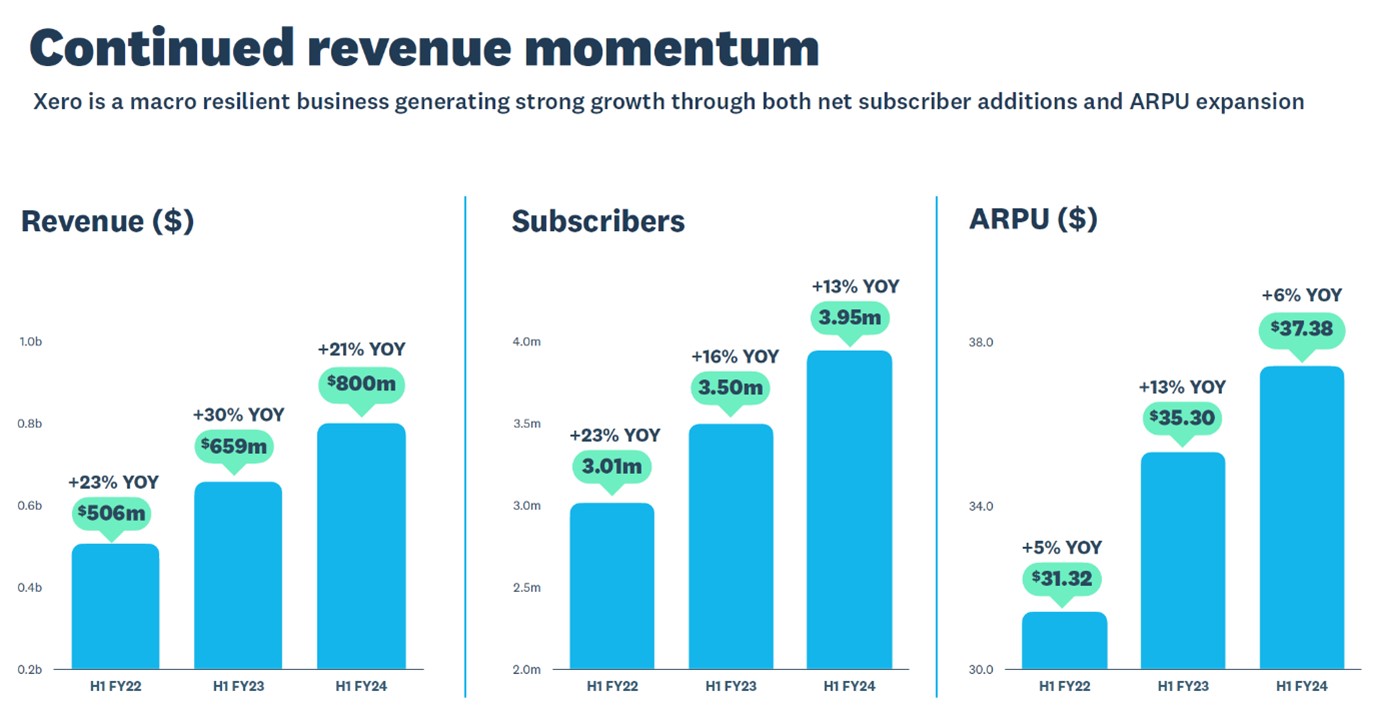

The Xero Management Team, led by new CEO Sukhinder Singh Cassidy, headlined their first half result with “continued revenue momentum and emerging profitability”. First half revenue rose 21% to NZ$800m, EBITDA by 90% to NZ$206.1m and net profit surged to NZ$54.1m.

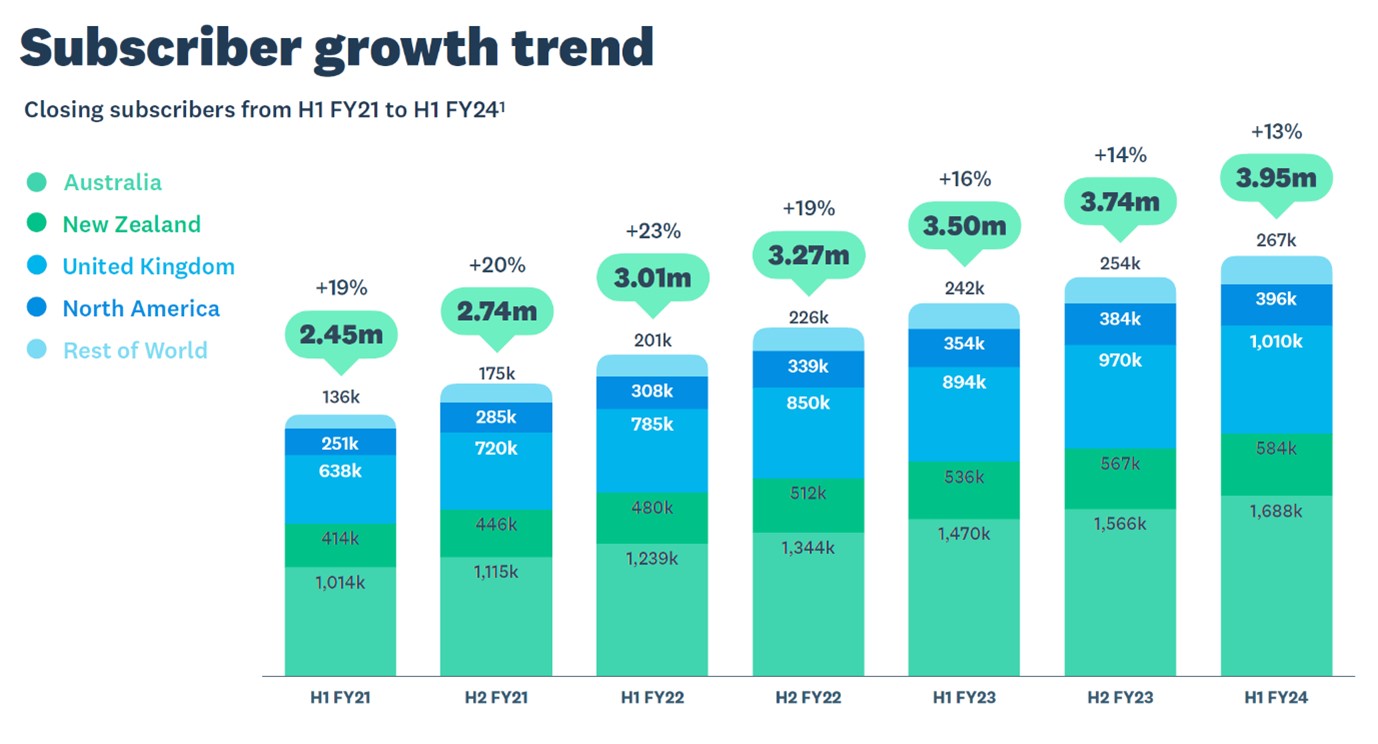

Driving the revenue growth was subscriber growth of 13% and average revenue per user growth of 6%. But the picture across Xero’s international regions was mixed.

Xero’s most mature market, Australia, generated revenue growth of 22% (24% in constant currency). It also had an increase in subscribers of 122,000 in the first half. In the UK, subscribers grew by 40,000, while the North American region added just 12,000 net subscribers in the half. Revenue growth of 9% (6% in constant currency) also underwhelmed.

Tighter management of operating expenses saw Xero’s margin of operating expenses to operating revenue improve (fall) to 79.1%.

Free cash flow improved to NZ$106.7m, or 13.3% of total revenue.

Churn of 0.94% was largely steady.

To help Xero balance growth with profitability, it is considering tracking its performance against the “Rule of 40”, a metric used by a number of leading global SasS businesses. This rule suggests that revenue growth (%) plus free cash flow as a % of revenue should add to 40%. In the September half, Xero would have scored about 34% (revenue growth of 21% plus free cash flow of 13% of revenue).

Looking ahead, Xero says it will seek to balance growth and profitability in its approach to capital allocation. It is targeting an operating expense to operating revenue ratio of around 75% for FY24. This implies a second half margin of around 72%.

Strategically, it is sharpening its focus on segments as a key lever for growth. This includes the North Amewrican market, where it has just completed a review. It has identified two segments that it wishes to focus on: small businesses with multiple jobs to be done, and accountants and bookkeepers with a focus on Client Advisory Services (CAS).

Over the last 10 years, Xero has been investing an average of NZ$30m pa in the USA market, which it says is in line with US venture capital backed businesses. It will now be more focussed on the two segments, change its operating model with direct accountability alongside US based product and engineering support and leverage the Xero open ecosystem as a key product differentiator. It is also going to remove about 150,000 ‘long idle low value customers’, allowing its sales teams to focus and engage with higher value customers.

Xero has also made a number of strategic appointments to its global leadership team.

What do the brokers’ say

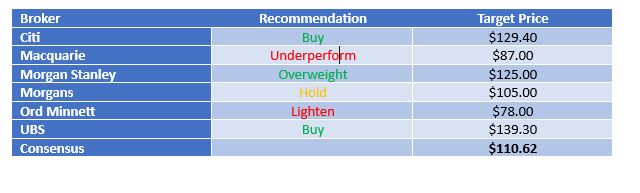

The major brokers are in two camps on Xero, as evidenced by the mix of ratings: 3 “buy” recommendations, two “sell” recommendations and one “hold”. According to FN Arena, the consensus target price is $110.62, about 11.1% higher than its closing price on the ASX of Friday of $99.56. The range is quite wide, from a low of $78.00 through to a high of $139.30.

Major Broker target Prices and Recommendations

Most of the brokers felt the first half result was a slight miss on revenue, EBITDA and subscriber growth, but were impressed with the increase in free cash flow and average revenue per user.

Ords is a “bear” saying: “It considers shares of Xero currently materially overvalued and believes the company will struggle to grow subscribers and revenue. An increasing share of sales and marketing expense is being allocated to recover from customer churn”.

On the other side, “UBS remains positive on the growth and profitability outlook over the medium term, driven by Australia and New Zealand and the UK, with further potential upside from accelerated growth in platforms over time.”

The brokers remain cautious on Xero’s ability to penetrate the US market.

Bottom line

I am encouraged that Xero is considering the “Rule of 40” as it balances demands for growth and profitability, and that it has guided to an improved margin of 75% (operating expenses as a % of revenue).

Most of the brokers see upside, and are supportive of the growth and profitability outlook.

But as befits many Australasian companies, international expansion remains its Achilles heel. Xero needs to demonstrate that it can grow profitably in the UK and North America. The North American strategy is unconvincing.

My sense is that the market has gone a little cold on Xero. To re-rate, it will need to demonstrate an increase in profitability, progress on the “Rule of 40” measure or substantive progress in the UK or North America.

I am not ready to bail on Xero, but to buy more, I want to see better value.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.