I don’t think all tech stocks are born equal. What I’m really saying is Apple is very different to Zoom, while Xero is not like Afterpay. They’re lumped in the same tech group and can get sold off when tech loses friends but this sometimes silly sell-off could be creating opportunities.

Last week I told you that Elmo Software (ELO) was seen as a tech stock that benefitted from the stay-at-home stocks phase of 2020. But the CEO, Danny Lessem disagreed, arguing that many business owners and CFOs were not spending money on innovation and new software with all the worries of the Coronavirus last year.

He thinks as business becomes more normalised, his online products will be more in demand. So this business selling HR, payroll and expense reduction solutions should perform better in 2021, compared to 2020.

This is what happened to ELO’s share price last week.

Elmo Software (ELO)

On that basis, I’m wondering if Xero is in a similar position as ELO? Is Xero a business that will benefit from a more normal business environment in 2021 and 2022, when CFOs and business owners will be more keen to spend to innovate to raise productivity and, ultimately, profits.

The five-day chart of Xero shows that there has been new support for the stock since last Tuesday, surging 9.5% in four days, while the overall market was up only 0.8% for the week. Some of that gain might be because tech stocks did well when the bond market became less concerned about inflation, but by Friday (US time), it started to rekindle its concerns and tech stocks were sold off.

XERO (XRO) 5-days

Anyone invested in Xero (like yours truly) has to hope that the market sees the company as a business stock that will benefit from reopening rather than a tech stock that was over hyped.

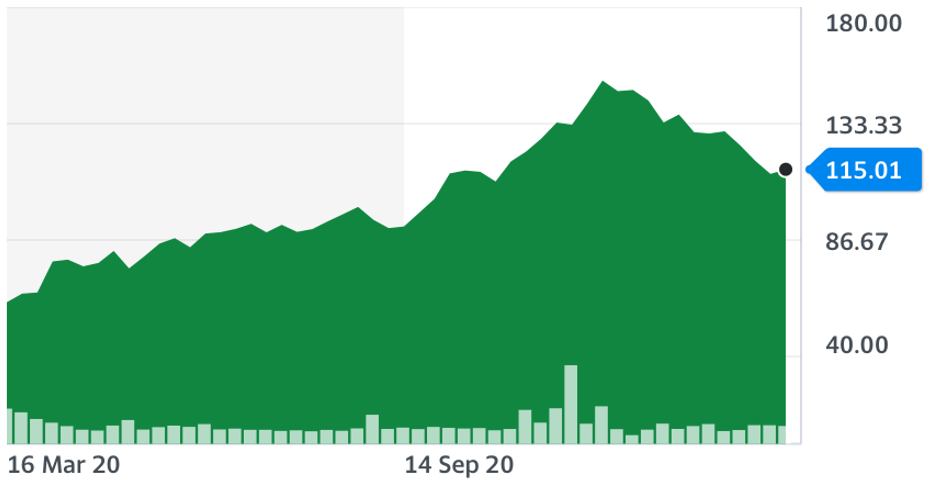

Certainly, the one-year chart below shows XRO has gone for a big ride in 2020 going from $68 to $157 after the Coronavirus crash.

However, it was an $85 stock before the crash, so if my reopening argument holds, then there has to be some real upside with the Australian, US and UK economies bound to boom in the next few years ahead.

For interest sake, this is what the analysts think about Xero’s more near-term prospects. The consensus view on FNArena is $105. Macquarie has a $125 target and Citi does too. The lowest target share price was UBS with a target of $79.50.

Xero one-year

What are some of the supportive views out there for XRO? Try these:

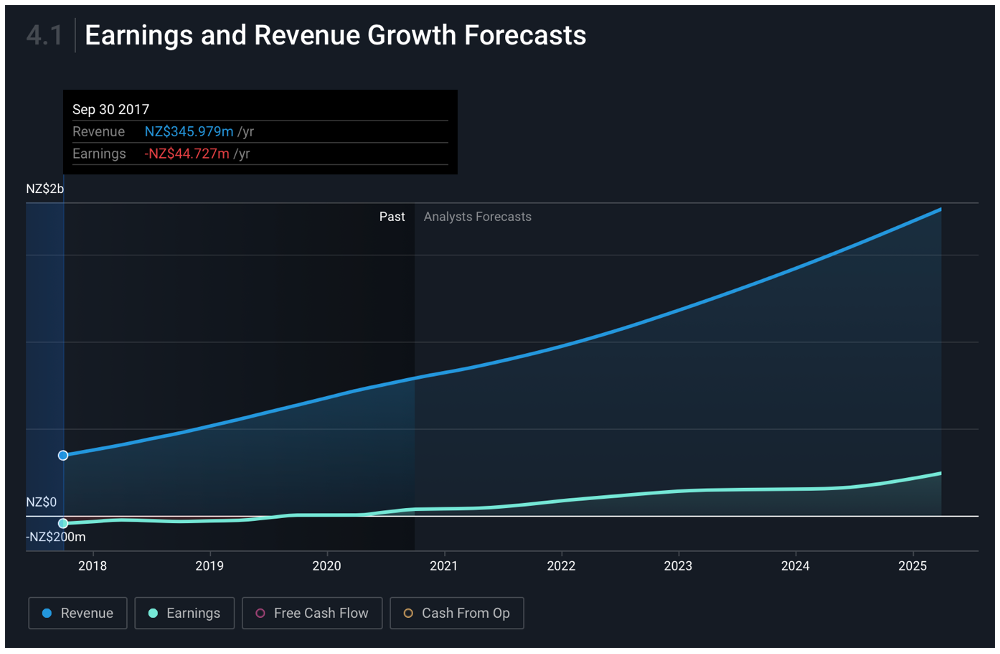

- The Simply Wall Street view starts with reminding us what a great company Xero has been. The share price climbed 691% in five years. In the last 5 years, Xero saw its revenue grow at 29% a year. That’s “well above most pre-profit companies”. (Simply Wall St.)

- They also like that company insiders have been buying XRO share over the past 12 months or more.

- The most recent total shareholder return was 58% over one year and “that’s better than the annualised return of 51% over half a decade, implying that the company is doing better recently.” (Simply Wall St.)

- The company recently announced the acquisition of small business lender, Waddle, for $80 million to accelerate its growth.

- In the six months to September 2020, Xero announced it had slashed spending on advertising and marketing in response to the pandemic, which would slow growth. Even then, Xero added 168,000 new subscribers during the period and grew free cash flow from NZ$4.8 million to NZ$54.3 million. (Motley Fool)

Here are the challenges for Xero’s share price:

- It does have a pile of debt but CEO Steve Vamos says he’s on the acquisition trail.

- Rising interest rates — but that’s a furphy for this company.

- It’s seen as a tech stock, being in the WAAAX group of stocks that have gained on the back of the US-based FAANG stocks’ surge in price in recent years.

- It’s in the MSCI Global Standard Index, which helped its stock price last year but this is now bringing it down as the top 100 tech stocks on the Nasdaq have fallen about 10% in recent times

- The small business market here and in NZ could be saturated.

- The UK experiment has been successful but the US could be a harder nut to crack. US small businesses aren’t as solidly into the cloud and that could be a hold back factor for Xero.

Can’t get this out of my mind

A unnamed but well-known hedge fund short seller told me (off the record) that he was a big holder of XRO shares but he’d sold a lot, though he was still a big shareholder in the company. In a throwaway line, he said he thought that, over time, “this could be a $600 company!”

He could be wrong. He could be trying to use me to raise the share price. Or he might be honestly looking down the track at a very good company.

A share price rise of about 700% in five years, and a chart like this on revenue, tells me that Xero looks like a decent punt at current prices.

Source: Simply Wall Street

I wasn’t saying this when the share price was $157 but now I am. But I’m a long-term investor who buys quality companies when markets are negative on these good operations.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.