On Saturday I pre-empted what I hope is happening — my much-predicted turnaround for US stocks, which should be a great help to our market’s progress, even if the new RBA Governor Michele Bullock makes the mistake of raising rates tomorrow on Cup Day. My Switzer Daily piece today tells why I’m opposed to a rate rise and I’m not alone, with some pretty respectable commentators and economists seeing it my way.

A rate rise could hurt many companies listed on the stock market, such as retailers like Harvey Norman and JB Hi-Fi. However, it will push up the $A, which will help all my overseas investment recommendations that I suggested that you hedge a few months ago. That includes HNDQ, which captures the top 100 Nasdaq companies, and also IHVV, which a great way to play the S&P 500.

Recall that both these indexes have been powered along by the surge in stock prices for the Magnificent Seven — Alphabet (GOOGL), Apple (AAPL), Amazon (AMZN), Meta Platforms (META), Microsoft (MSFT), Nvidia (NVDA) and Tesla (TSLA). But I have argued that when rate rises are over in the US, there’ll be a lot of catch-up rebounds for the share prices of growth and tech companies smashed because of rising rates.

What I’m talking about is the other 97 Nasdaq stocks and the other 493 S&P stocks, and it looks like that resurgence started last week. Have a look at what the most watched stock market indexes in the US did last week:

- Dow Jones up 4.68%

- Nasdaq up 5.26%

- S&P 500 up 5.29%

While I loved seeing my view on the power of catch-up plays for ignored stocks over 2022 and 2023 vindicated through these indexes, I especially like the big bounce-back of the smaller cap Russell 2000 index, which jumped 6.9%!

Our follow-the-leader mentality might be temporarily infected by Cup Day rate rise talk, but if the Yanks keep believing in the ‘rate rises are over’ talk and keep buying, our big market influencers will go along for the ride.

That said, what the US and the Fed’s Jerome Powell gave last week with ‘no rate rise’ line and supportive comments from the central bank boss (along with a nice soft jobs report on Friday) could all be undone if Mr. Powell rattles the market with a speech he delivers on Thursday.

We wait with bated breath. If he doesn’t go negative on us, we should be in for a nice couple of months, unless the Middle East and/or Washington with its potential government shutdown linked to debt issues, undermines this newfound positivity.

Personally, I don’t see these as any long-lasting negatives for stocks going forward. It’s like these negatives are more short-term issues, while the end of rate rises also opens the door on possible rate cuts some time in 2024.

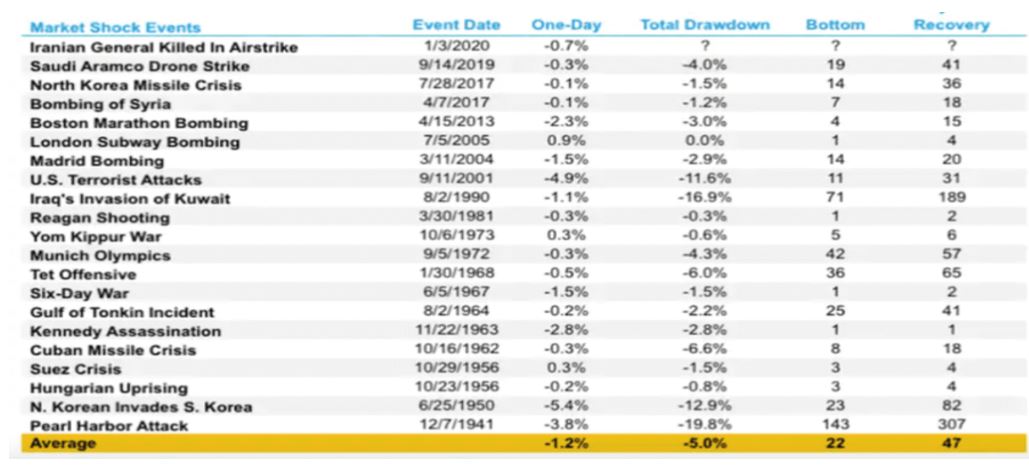

Clearly, fear about Iran getting involved in the Middle East conflict is a concern, but this table shows how geopolitical concerns tend to be short term.

Even the terrorist attacks on New York in September 2001 saw a market recovery of losses within 31 days. In contrast, the Kuwait invasion did hit the market for 189 days, but that was a US invasion of another country! I think we can bet against that happening in the modern context.

The set-up for the rest of this year and rolling into 2024 should be good news for tech stocks and other growth companies that have been hit for a six since interest rates rose. There could be slowness to react for some of our tech stocks, because our interest rates could still be on the rise, but once we hit our top, I’ll bet we’ll see some nice rebound in share prices.

Here’s the latest consensus rise for tech/ growth stocks that have been hit by the economic implications of higher rates:

Company Predicted consensus gain

1. Xero (XRO) 3.7%

2. Megaport (MP1) 27%

3. Seek (SEK) 18.8%

4. Tyro (TYR) 93.6%

5. CSL (CSL) 32.5%

6. Macquarie (MQG) 11.5%

7. Treasury Wine (TWE) 15.1%

This is the time to look for growth stocks that have been beaten up because the next year or two is likely to be positive for the earnings of these companies and their share prices.

In coming weeks, I’ll look for other growth stocks that have copped it after 20 months of rising rates.

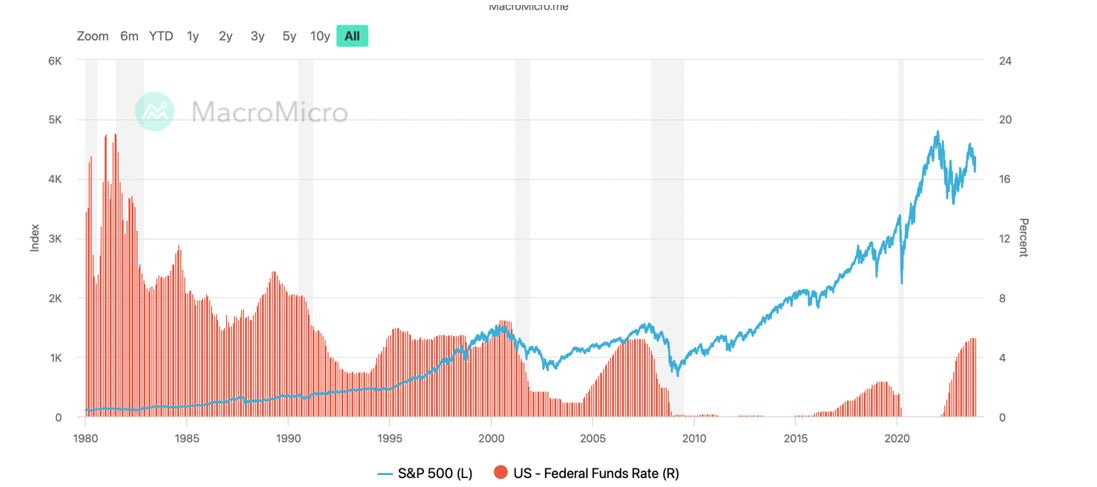

In case you need to see how stock markets react to interest rates, see this chart of the S&P 500 and the Fed Funds Rate.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances