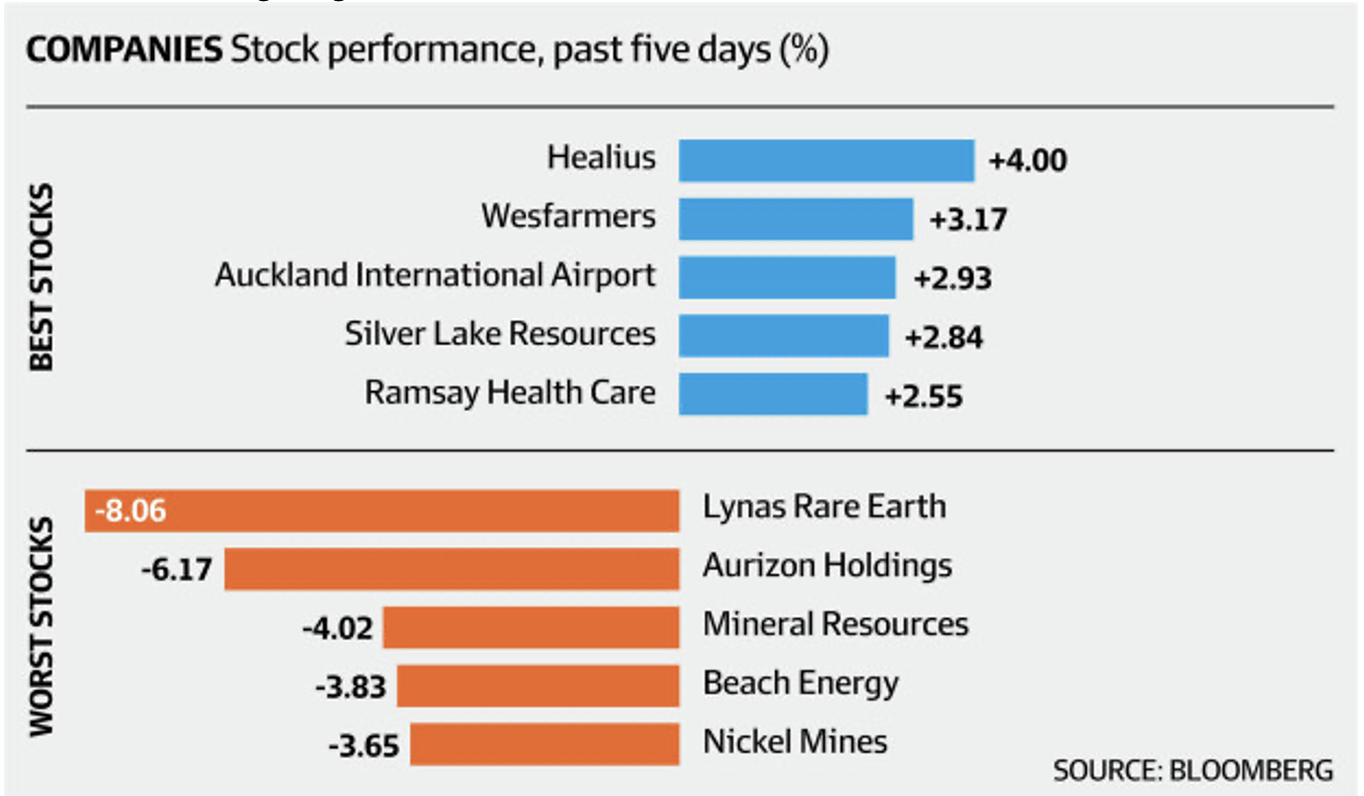

The news overseas is on the mend, with some of the recent headwinds that have been hitting stock prices now abating; the oil price surge U-turning, Chinese property concerns losing some heat and US corporate earnings coming in better than expected.

European markets took their cue from Asia, which saw stock prices rise on the announcement that Evergrande was set to make the coupon payment on its US dollar-denominated bond. Its share price actually rose 4.26% in Hong Kong on the news.

“So far for the third quarter earnings season, 84% of the 117 companies that have reported have beat analysts’ earnings estimates, according to Refinitiv,” CNBC reported. “Profits are on pace in the quarter to increase 34.8%…”

That said, not all headwinds have lightened, with concerns about supply chain shortages, rise in costs and inflation still generating some negativity for anyone contemplating going longer on stocks right now. For those contemplating what sectors could be positioned to do well, the Wall Street consensus right now is that financials and commodity-sensitive stocks could find friends on US markets.

Before the close there was not a great deal of market excitement after a week that brought record highs, so you have to expect some profit-taking. And the big news that US profits of the star S&P 500 companies are really impressing, was a tailwind that’s really important for stocks right now.

Anyone wanting to get more confident about stocks should note a good question from a subscriber at our weekly Boom! Doom! Zoom! webinar, that showed the guy in question has been paying attention, and he got his answer from both me and the market.

That question referred to a story I wrote maybe a month or so ago talking about how after a September sell-off (which we saw), you can get another dip down in October before a take-off into a fairly typical November-December rally.

So the question was: “Have we seen that October sell-off?” I suggested the questioner check out my podcast [1] with former NSW Treasury Secretary and market timer, Percy Allan, who actually saw on Wednesday that the short-term sign (the 10-day moving average was higher than the 30-day moving average) had just signalled that the market was on the rise.

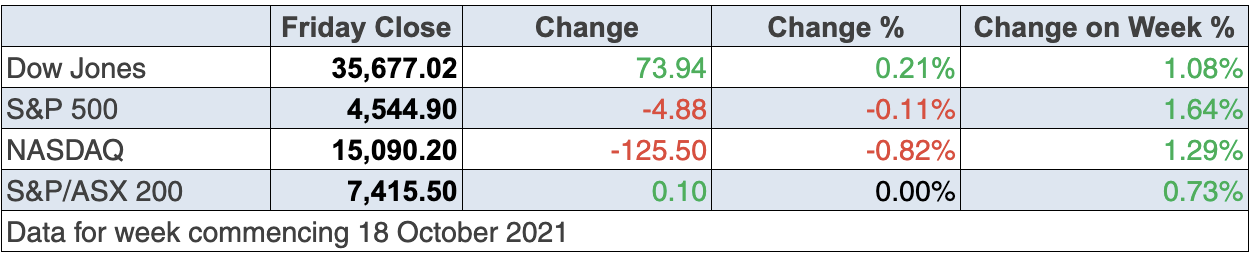

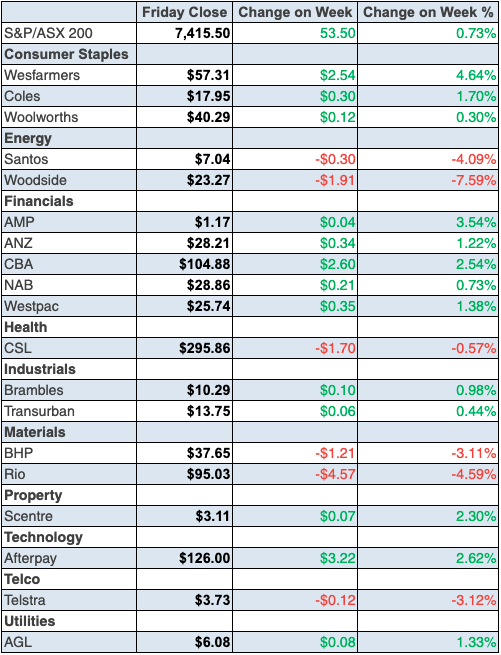

S&P/ASX 200

To the local story, and this week’s action reinforced that message from Percy Allan, with the S&P/ASX 200 finishing the week at a one-month high. The chart above shows we’ve been on a dropping trend since Friday the 13th in August. Superstitious types will see an irony in that! Since October 6 we’ve been trying to kick off an uptrend, which is starting to look convincing paired with the positive stories abroad this week (referred to above).

The Index was up 53.5 points (or 0.7%) for the week to stop the clock at 7415.5, with banks having a better week and Magellan Financial Group up 5.17% for the week to $36.28, after its Barrenjoey Capital Partners division turned in some good profit news.

CBA was up 2.27% for the week to $104.88, NAB 0.42% higher to $28.86, Westpac was up 0.55% to $25.74, while ANZ put on 0.86% to $28.21.

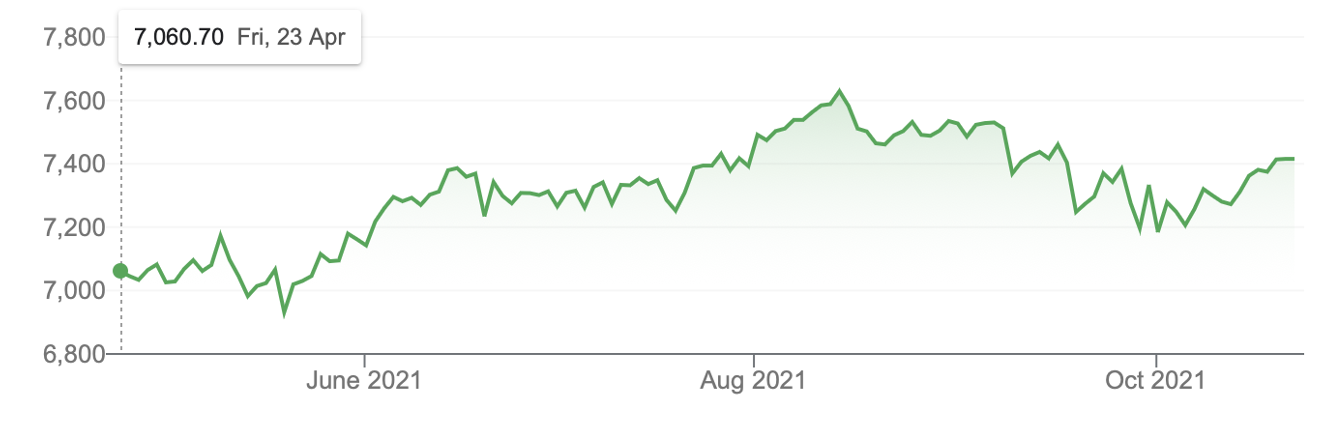

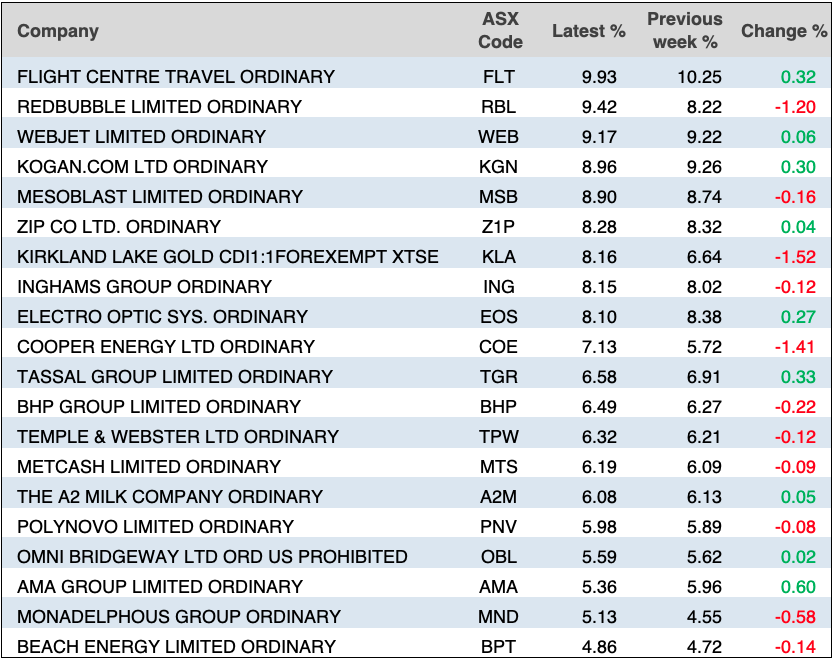

Here are Bloomberg’s big winners and losers:

It was good to see the likes of Appen up 12.47% to $10.91 and Altium up 7.14% to $37.80. Not to mention ELMO Software, which at long last is showing the promise I’ve tipped, with a 13.19% rise to $5.32 on a good third quarter update.

Energy stocks lost their recent oomph after oil price rises went negative, which tempers recent stock price rises, but it’s a plus for the world economy.

Whitehaven Coal was down 11.52% for the week, while Woodside gave up 8.24% though it’s still up 21% since September 9.

The miners didn’t have a great one but I still reckon they’re in buying territory. So does Mike Gable of Fairmont Equities. (Have a look at Monday’s TV show here. [2]

BHP lost 3.46% for the week to finish at $37.65, Rio gave up 4.59% to $95.03 and Fortescue slipped $1.99% to $14.31.

What I liked

- Consumer confidence rose for the sixth straight week, up by 1.3% to a 14-week high of 107 points.

- Commonwealth Bank (CBA) national credit and debit card spending is 16% higher for the week ending 15 October 2021 when compared to the corresponding week in 2019.

- After falling for several months as a result of the lockdowns in south-east Australia, payroll employment rose over the two weeks to 25 September, with gains in NSW and the ACT, and Victoria looking like it has bottomed.

- The preliminary Australian IHS Markit Composite Purchasing Managers’ index (PMI) rose from 46 in September to a 4-month high of 52.2 in October. A reading above 50 indicates an expansion in activity.

- National skilled job vacancies rose by 4.9% in September to stand at 228,988 available positions.

- The US Federal Reserve Beige Book noted that the US economy is expanding at a “modest to moderate rate” and “most districts reported significantly elevated prices” due to “supply chain bottlenecks”. It could be better news but it’s OK news, given the supply chain issues in the States.

- The NAHB housing market index in the US rose from 76 to 80 in October (survey: 76).

- The Democrats are moving towards a compromise $US2 trillion Build Back Better plan – which is down from the proposed $US3.5 trillion plan. If agreed, it could clear the way for a vote in the House on the $US550 billion infrastructure package that has already passed the Senate and sees moderate Democrats supporting an increase in the debt ceiling.

What I didn’t like

- US industrial production fell by the most it has in seven months, down by 1.3% in September (survey: minus 0.2%).

- The Chinese economy expanded 4.9% in the year to September although it was the slowest rate in a year.

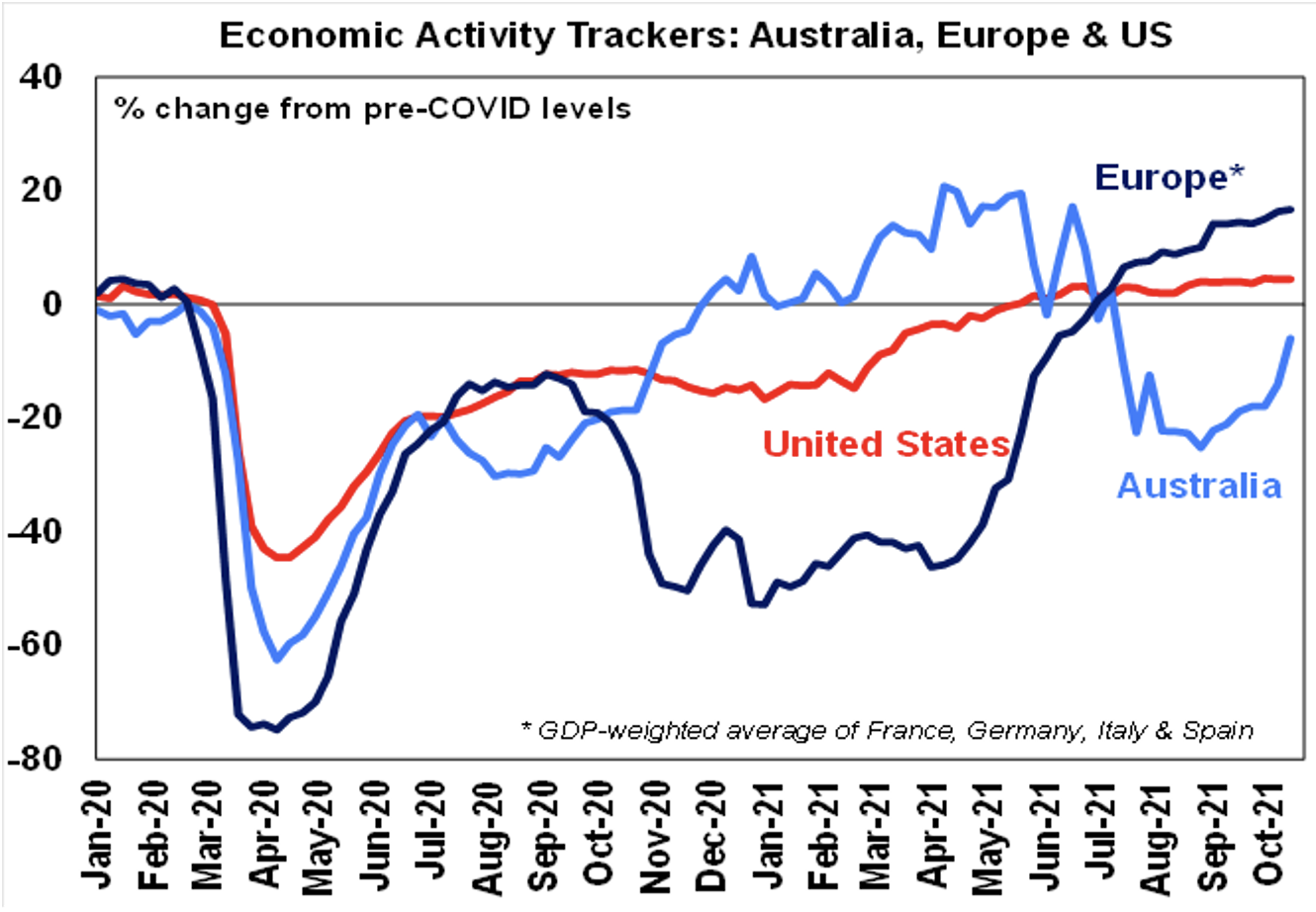

Love this chart

AMP Capital’s Shane Oliver tracks how our economic activity reacts to Coronavirus threats that spark the much-maligned lockdowns and restrictions. It’s great to see that blue line U-turn and trend upwards following the NSW reopening. Victoria should help this week.

A good economy in rebound mode should underpin nice share prices rolling into the festive period and the New Year, which could be a rootin’-tootin’ rally!

The week in review:

- I reveal five stocks [3] that I continue to put my faith in and believe will experience healthy uptrends in the near future despite their bearish patches in recent times.

- Paul Rickard reviews the top 20 companies on the ASX [4] to determine a shortlist of the seven best picks of the litter, later revealing his pick that takes the crown as the top stock solid to the core.

- James Dunn caters for investors with a higher risk tolerance this week as he looks at 4 stocks under 40 cents [5] which he believes show a lot of promise in the microcap sector.

- As NSW enjoys its second week out of lockdown, with Victoria soon to follow, Tony Featherstone anticipates a strong market trend for the fitness and physio sector, analysing his two stock picks [6] that could benefit from this uptick.

- For our “Hot” stocks this week, Raymond Chan of Morgans selected Treasury Wines (TWE) [7] and Managing Director at Fairmont Equities Michael Gable considers Orocobre (ORE). [7]

- This week in Buy, Hold, Sell – What the Brokers Say, there were 9 upgrades and 5 downgrades [8] in the first edition, and 9 upgrades and 14 downgrades [9] in the second edition.

- And in Questions of the Week, [10] Paul Rickard answers questions from subscribers about the his thoughts on the Vanguard Diversified High Growth Index ETF (VDHG), whether to hold or take profits on 29Metals (29M), the definition of CHESS Depositary Interests (CDIs), and whether to take up entitlements on Aristocrat Leisure (ALL).

Our videos of the week:

- Boom! Doom! Zoom! | October 21 2021 [11]

- We speed date and assess these rising stocks: Appen, A2Milk, Nuix, South 32m, AGL & Fortescue [12]

- Why Healius, Brambles, CSL & Suncorp are buys and CBA is a sell + Will Star be sued? [13]

Top Stocks – how they fared:

The Week Ahead:

Australia

Monday October 25 – CommSec State of the States

Tuesday October 26 – Weekly consumer confidence (October 24)

Tuesday October 26 – CBA credit & debit card spending (October 22)

Wednesday October 27 – Consumer Price Index (September quarter)

Thursday October 28 – International trade prices (September quarter)

Thursday October 28 – Regional internal migration (June quarter)

Friday October 29 – Producer Price Index (September quarter)

Friday October 29 – Private sector credit (September)

Friday October 29 – Retail trade (September & September quarter)

Overseas

Monday October 25 – US Dallas Fed manufacturing index (October)

Tuesday October 26 – US home price indexes (August)

Tuesday October 26 – US new home sales (September)

Tuesday October 26 – US consumer confidence (October)

Wednesday October 27 – US durable goods orders (September)

Wednesday October 27 – US wholesale inventories (September)

Wednesday October 27 – US advance good trade balance (September)

Thursday October 28 – US economic growth (advance, September quarter)

Thursday October 28 – US pending home sales (September)

Friday October 29 – US personal income/spending (September)

Food for thought: “The secret to being successful from a trading perspective is to have an indefatigable and an undying an unquenchable thirst for information and knowledge” – Paul Tudor Jones

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

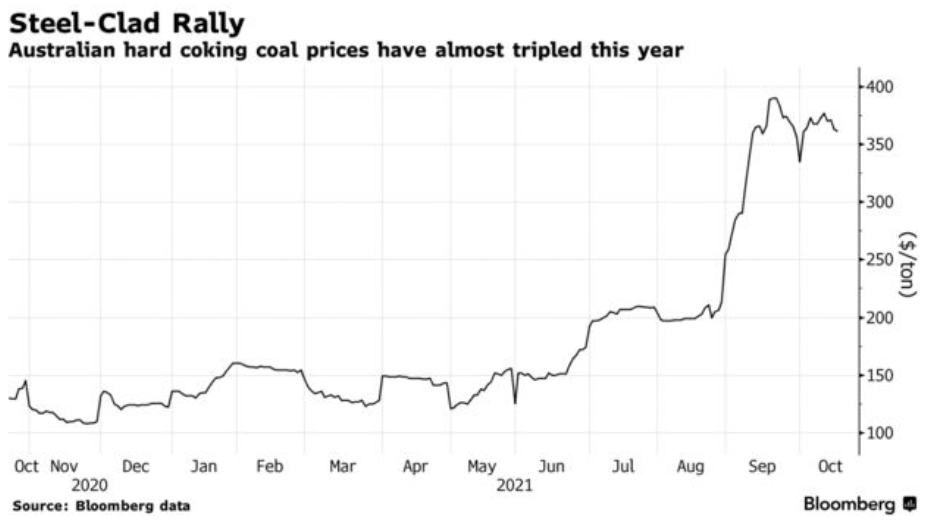

Chart of the week:

The following chart from Bloomberg News shows the dramatic surge for Australia’s coking coal commodities which have nearly tripled in price in 2021 despite China’s ban on Australian coal exports. The article notes that: “Prices for steelmaking coal have raced higher this year on strong demand from China and constrained supply across many key producing nations. Still, the rally faces headwinds after Beijing began a policy blitz aimed at taming prices and easing the nation’s power crisis.”

Top 5 most clicked:

Top 5 most clicked:- One stock solid to the core [4] – Paul Rickard

- 5 stocks I still believe in [3] – Peter Switzer

- 4 stocks under 40 cents [5] – James Dunn

- Buy, Hold, Sell – What the Brokers Say [8] – Rudi Filapek-Vandyck

- “Hot” stock: Treasury Wines (TWE) [7] – Maureen Jordan

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.