I wrote about Lend Lease (LLC) in early July (see https://switzersuperreport.com.au/how-has-covid-19-impacted-lendlease-is-it-a-buy/ [1] ). At the time, Lend Lease was trading at $12.70. I concluded: “My sense is that there is ‘no hurry’ to buy Lend Lease, as there is still considerable uncertainty as to the impacts of Covid-19. Also, I expect more of a market correction, so I am prepared to wait. But in the next market down turn, this stock will be on my radar. Ord Minnett summarises it well with: “the potential rewards are high for those willing to go the distance”.

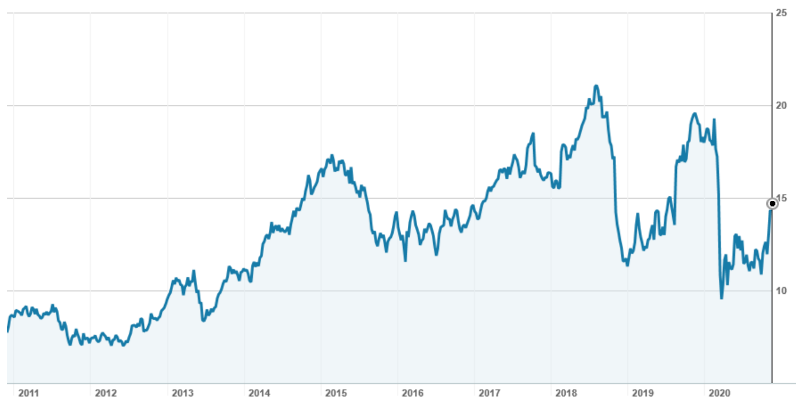

As the chart below shows, Lend Lease (LLC) has largely traded in the $11.00 to $12.75 range since I made those comments, until news of vaccines led to a rally with Lend Lease being supported under the “re-opening trade” theme. On Friday, it closed at $14.49.

Lend Lease (LLC) – last 6 months

Lend Lease also held its AGM last Friday. Apart from headline grabbing “first strike” (47% of shareholders voted against the company’s Remuneration Report), CEO Steve McCann delivered a mixed assessment of the company’s near-term outlook.

While noting the good progress on a number of projects and annual development production of over $8.5bn, he went on to say: “earnings in the first half of FY21 are expected to be subdued. We are focussed on converting a number of investment partnerships in the second half, which are expected to contribute to earnings. The result for FY21 overall will remain influenced by the impact of Covid-19 and the associated Government responses across our gateway cities”.

So is Lend Lease still a stock for the patient, long-term investor?

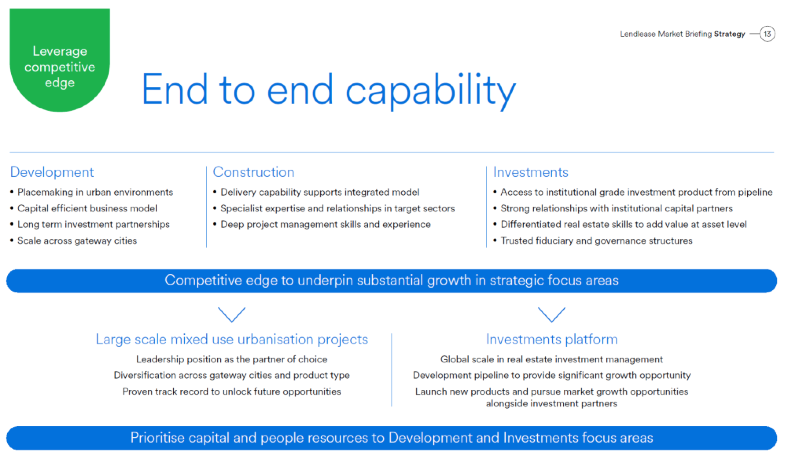

Firstly, a quick re-cap on its strategy because this is what makes the stock interesting.

The Lend Lease story

Lend Lease has undergone a considerable transformation over the last decade, with the exit of its engineering business, downsizing of its construction activities and switch into development and funds under management.

Today, it operates an integrated business model through three segments – development, construction and investment. It has a development pipeline of $113bn, construction backlog revenue of $14bn, funds under management of $36bn and assets under management of $29bn.

It focuses on delivering large-scale mixed use urbanisation projects in global gateway cities, and the investment platforms to support the development and subsequent financial management of those projects.

The 12 gateway cities are Sydney, Melbourne, Brisbane, Perth, Kuala Lumpur, Shanghai, London. Milan. San Francisco, Chicago, Boston and New York. Major urbanisation projects underway include the first residential tower at Barangaroo South in Sydney, The Exchange TRX in Kuala Lumpur, a retirement living project in Shanghai, the Milan Innovation District project and a partnership with Google for the San Francisco Bay Area.

In Lend Lease speak, “placemaking is in our DNA. Place is not a product: it is an emotional attachment to a location. The places we create are meaningful, vibrant and enduring.”

Lend Lease is highly exposed to the urbanization theme, one of the biggest themes of the last century, if not several centuries. Hundreds of millions of people have moved from farms and small rural villages to concentrated towns and thriving cities.

Covid-19 has challenged the thinking about globalization and urbanization, with some arguing that people will want more space and the “Manhattanisation” of major cities will slow. Lend Lease says it has “stress tested” its strategy and its underlying assumptions, and that it is resilient to an evolving market environment. It expects the fundamental drivers of urbanisation to remain, with market dislocation providing opportunities for investment. In residential, it expects structural undersupply to drive long-term performance and strong growth in the ‘build to rent’ sector, with quality and amenity remaining key.

Looking ahead, Lend Lease is targeting 40% to 50% of EBITDA to come from development, 35% to 45% to come from investments and 10% to 20% from construction. There will be roughly an equal split between Australia and international earnings. It wants to accelerate development to an annualised production rate of over $8bn (an uplift of 80% on the levels over the previous 4-5 years), scale its investment platforms from the greater than $50bn development pipeline it has, and improve the quality of earnings by enhancing annuity income and redirecting capital to focus areas of urbanisation and investments.

What do the brokers say?

In the main, the major brokers are positive on the stock, with 4 buy recommendations and 2 neutral recommendations. Target prices range from a low of $13.25 to a high of $15.27, with the consensus of $13.89 now some 4.1% below Friday’s close of $14.49.

In regard to forecasts, they see earning per share of 71.1 cents for FY21 rising to 95.4c in FY22 (this compares to 82.9c in FY19 and a statutory loss of 57.1c in FY20). This puts the stock on a prospective PE of 20.9 for FY21 and 15.6 for FY22. For shareholders, a distribution of 34c for FY21 (prospective yield of 2.3%), up very marginally from last year’s 33.3c.

My view

I really like the Lend Lease strategy and its integrated business model. I do not think Covid-19 is going to crush the desire to live in quality, community-focused developments in gateway cities. Of the companies I consider investing in, it has one of the best articulated strategies.

However, like all great strategies, it will ultimately come down to execution.

On a value sense, Lend Lease looks attractive relative to its pre-Covid 19 peak of $19.46 in February and its all-time high of over $21 in early 2018. But the brokers, who can crunch a number or two, see it as being fully valued.

Lend Lease (LLC) – last 10 years

This year, Lend Lease has taken steps to strengthen its balance sheet, raising $1.2bn via an institutional placement and share purchase plan at $9.80 per share. This has taken its gearing level below 10% and given it total liquidity in excess of $5bn (cash on hand plus undrawn loan facilities). It is targeting a return on equity of 8% to 11%.

Finally, it is exposed to Covid-19 so it is a bit of a play on the “reopening” trade.

Against this, it is yet to finalise a dispute with the Victorian Government over cost over-runs for the Melbourne Metro project (its final engineering project). It has a one-third share of the Cross Yarra partnership and has provided about $550m to cover these costs. While the major brokers think this will be sufficient, a residual risk remains.

Lend Lease has run harder than I expected, so a pullback on the news out of the AGM seems warranted. For portfolio investors, I think Lend Lease remains good long-term buying. They can afford to be a little patient because there will pullbacks, potentially targeting around the $13 level as the opportunity to get set. Holders should sit tight for the ride.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.