The All Ordinaries index closed at a record high on Friday of 7325.8. It followed record closing highs on Wall Street and in parts of Europe earlier in the week. The slightly narrower S&P/ASX 200 hasn’t topped its February 2020 level of 7192 yet, but at 7064, it is less than 2% away.

Conditions for equity markets cannot get much better. Interest rates are at record lows, the economy is going gangbusters, commodity prices are on the rise, farmers are reporting too much rain, and in the absence of material cost pressures, company profits are set to soar.

Take last week’s jobs report, which Peter (Switzer) summarised as follows:

- Employment rose by 70,700 in March (consensus: 35,000) after increasing by 88,700 jobs in February.

- Full-time jobs fell by 20,800 and part-time jobs rose by 91,500 positions.

- The number of people employed rose to a record high of 13.078 million.

- Unemployment fell from 5.8% to a 12-month low of 5.6% in March (consensus: 5.7%).

- The participation rate rose from 66.1% to a record high of 66.3% in March (consensus: 66.1%).

- In March, the underutilisation rate fell from 14.3% to a 15-month low of 13.5%.

- The underemployment rate fell from 8.5% to 7.9% – a 7-year low.

And recent economic highlights:

- ANZ job advertisements rose by 7.4% in March to a 12-year high!

- The Australian Industry Group/HIA Performance of Construction Index (PCI) is at a record (16-year)!

- The AiGroup Performance of Services index rose 2.9 points to a 2½-year high of 58.7 in March – six in a row!

- Payroll jobs were just 0.2% below levels at the start of the pandemic!

- The Westpac Consumer Sentiment rose by 2.6% in March to 111.8 – the second highest reading in seven years!

- The NAB business confidence index rose from 12 points in January to an 11-year high of 16.4 points in February (long-term average is 5.1 points)!

- The NAB business conditions index lifted to a 30-month high of 15.4 points from 9.1 points (long-term average is 5.3 points)!

- Job vacancies rose by 7% – the 10thsuccessive increase – in February to stand at a 9-year high!

Share markets are predictors of what is to come and tend to work six to 12 months in advance of what is happening in the “real world”. So when markets are setting records, we should not be surprised to see that the lead economic indicators are so strong. But the obvious questions are “is this as good as it gets?” and “should I take some money off the table?”, that is, lighten my shareholdings?

Let’s look at the arguments for and against, and if you do wish to take some money out of the market, what you might care to sell.

The case to “lighten” now

To be honest, I am struggling to find too many arguments to support the proposition. The main one is that there are signs of “frothiness” or what former US Fed Chairman Alan Greenspan referred to as “irrational exuberance”. This was in 1996, three years before the bursting of the so called “internet bubble”.

Take these examples of current “frothiness”. Bitcoin trading near US$60,000, up 800% in the last 12 months. The cryptocurrency exchange, Coinbase, doing an IPO with a market capitalization of US$85bn – more than that of either the NASDAQ or the NYSE and 60 times FY20 revenue. In Australia (and the USA), the surge in trading by retail investors. Everyone is now a “momentum” trader. Tech companies trading on multiples of sales (not profits). And the ‘buy now pay later’ valuation phenomenon.

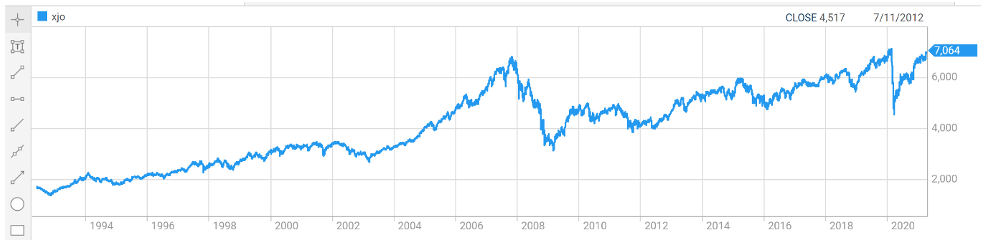

There is also an argument that the rally has been “too strong”, that is, the slope is too steep and too quick. In a little over 12 months, the S&P/ASX 200 has risen from a low of 4,508 on 20 March to 7,064 on Friday – a gain of 57%. The following graph of the market over the last 30 years puts the recent rise into context.

S&P/ASX 200 -1993 to 2021

Then there are the “big picture” factors. You can get worried about debt, or growing tensions with China. Potentially, China could invade Taiwan, but it is still a remote possibility rather than a “likely” possibility.

And then there is the inevitable “black swan”. But because we can’t see it, I can’t see how you can invest for it.

There is nothing wrong with de-risking and taking a profit, and the “comfort” factor is probably as strong an argument as anything.

The case not to lighten

Historically, bull markets take out the high of the previous bull market (see chart above of S&P/ASX 200). We are not there yet. While the All Ords has just exceeded its previous peak, the benchmark S&P/ASX 200 on a closing high basis still has 100 points to go. And then markets usually go well past the previous high, so the argument for trend followers is that “we have more to go”.

A key driver for this bull market has been ultra-low interest rates. As recently as two weeks ago, RBA Governor Phillip Lowe re-affirmed that short term interest rates aren’t going up. “2024 at the earliest”. If he is right and the RBA’s cash rate stays at effectively 0% for the next three years, the “thirst for yield” from retail investors and others seeking dividends will provide an incredibly supportive platform for the sharemarket.

Finally, many investment forecasters argue that the Australian sharemarket is still good value. Farrelly’s Investment Strategy, an independent, specialist allocation research service, in March labelled Australian equities as “fair value” (the All Ords at the time was 7064.0). Under Farrelly’s analysis, to be “fully priced”, the All Ords would need to be 8000. To be “overpriced”, the All Ords would need to hit 9000.

Source: Farrelly’s Investment Strategy, March 2021

If you do want to take some money ‘off the table”, what to sell

The first point of call is “the rubbish”. We all have a couple of “dog stocks” in our portfolio. A bull market, when there are lots of willing and often less discerning buyers, is the time to clear them out. Time after time, the market teaches us that it pays to hold quality. Prepare your portfolio for the inevitable pullback.

Strategically, I think there are three areas to consider.

Firstly, resource stocks, particularly the iron ore majors BHP, Rio and Fortescue, and second tiers such as Mineral Resources. Driven by Chinese demand and supply challenges at the world’s largest producer, Brazilian miner Vale, iron ore is currently fetching nearly US$180 per tonne.

The good news is that the Australian producers’ costs of production are under US$15 a tonne, and their share prices assume considerably lower prices on a long run basis. But at some point, Vale will get back to full production.

I am not suggesting you dump your holdings in these companies because I have no basis to say that the iron ore price has peaked. Rather, it is about trimming the exposure to reduce r weighting.

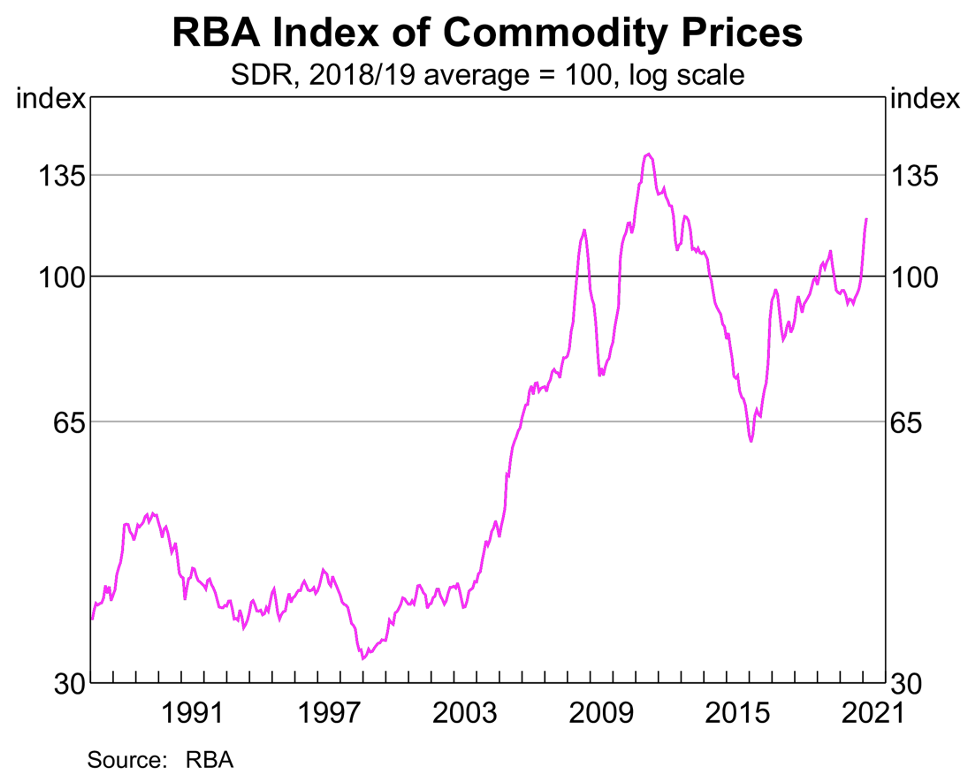

Holdings in other miners should also be considered. We are no doubt witnessing a bull market for commodities, as has been evidenced by the strong rise in the price of base metals such as copper, lead, nickel and zinc. However, the following graph from the RBA puts context around the current boom. On this index, we are not that far off the high of the 2011/2012 “commodity super-cycle”.

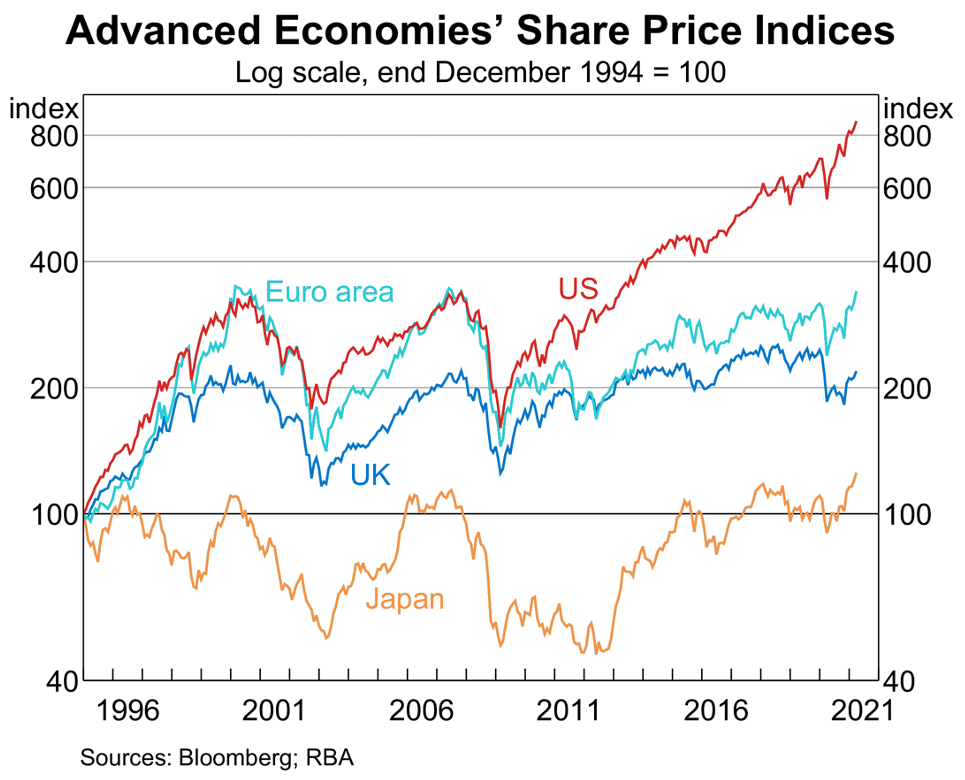

Secondly, I would consider holdings in international equities, particularly unhedged positions in the USA. For good reasons, the US share market has comprehensively outperformed Europe, the UK, Japan and for that matter, Australia, over the last decade (see chart below).

That is not to say that the current US bull market is coming to an end. However, if other markets offer better value and there is to be a pullback, the US could be hit harder. The “unhedged” view is that I expect ongoing weakness in the US dollar.

Finally, this bull market has been driven by “growth” stocks more than by “value” stocks, so on a correction or major pullback, it is likely that “growth” stocks or companies on high PE (price/earnings) or EV/Sales (enterprise value to sales) multiples will be hit. The whole ‘buy now, pay later’ sector is an example of this. Consider the technology majors and companies such as Seek, James Hardie and Aristocrat.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.