Last Thursday night’s broad based sell-off in commodities has called into question our sector view, where we have been maintaining an overweight position in the ‘Materials’ and ‘Energy’ sectors. Copper prices are now off more than 20% from their highs, while the spot price for iron ore is down 10% from its February high.

We think it largely comes down to a view about the Asian industrialisation phenomena – particularly China and India. Sustainable growth without rampant inflation is the key, and while industrial production may have turned down a little, the authorities in China seem pretty determined to “nurture” the growth process. This is a long-term, once-in-a-generation bull market in commodities and while our confidence has been shaken by the events of the last couple of months, it is too early to call the bull market over. We suggest that you maintain an overweight position in materials and energy stocks, and look for opportunities in the current equity market weakness to increase your exposure.

We are a little more confident about the ‘consumer discretionary’ sector, where we maintain an underweight position. Consumer confidence, already shaken, will not recover quickly and there is a cyclical shift away from ‘bricks & mortar’ retailing. Clearly oversold – however, if the market rallies, this sector will lag and any bounce will be limited.

Finally, a note of caution about the financial sector. Australian banks are not immune from the regulatory pressures for increased capital and are now quite expensive compared to their global peers. Buy for tax-advantaged income – not for capital growth.

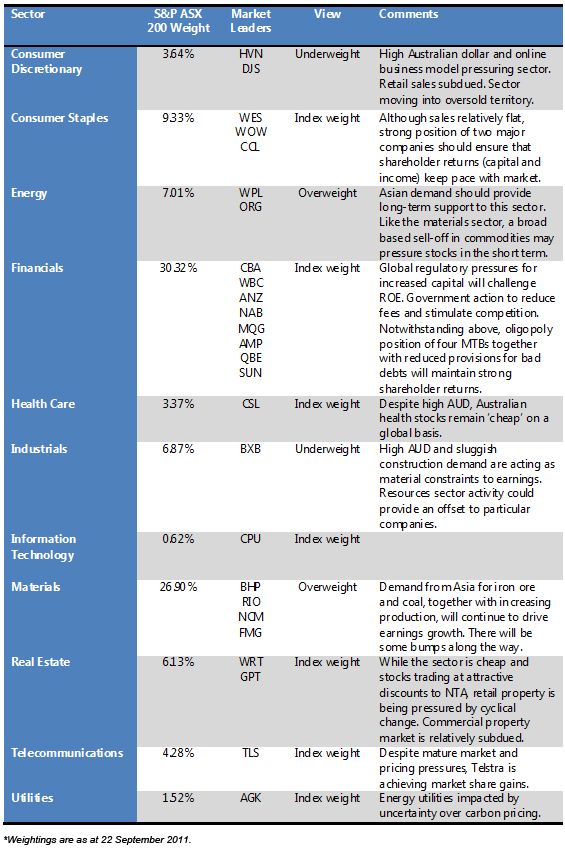

Our views on the major industry sectors that comprise the ASX 200, and some brief reasons, are as follows:

[1]Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.

[1]Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.

Also in today’s Switzer Super Report

- Peter Switzer: The rally is close at hand [2]

- Tony Negline: Speak up now if you don’t like these super changes [3]

- Roger Montgomery: Four value stock picks [4]