I’ve never seen one of my favourite singers, Bob Dylan, as an inspiration for smart stock-playing but his song Blowin’ in the Wind actually has a lot of relevance.

The current messages blowing from the US and local stock markets seem to be suggesting that my call that the current rally will look more entrenched and sustainable by the December quarter (October to December) is believable. In fact, the recent bounce for stocks, which could easily be tested over the next three weeks (before we see the next US inflation number) has been bigger and earlier than I expected. Note, history has shown that you can never guess the timing and the magnitude of the movements of share market indexes reliably weeks or months in advance.

I started suggesting to you that from mid-June we were possibly seeing what could have been the bottoming process. It now looks like that was a pretty good call. That said, a left-field curve ball such as something silly from Putin or Xi Jinping could test that June low.

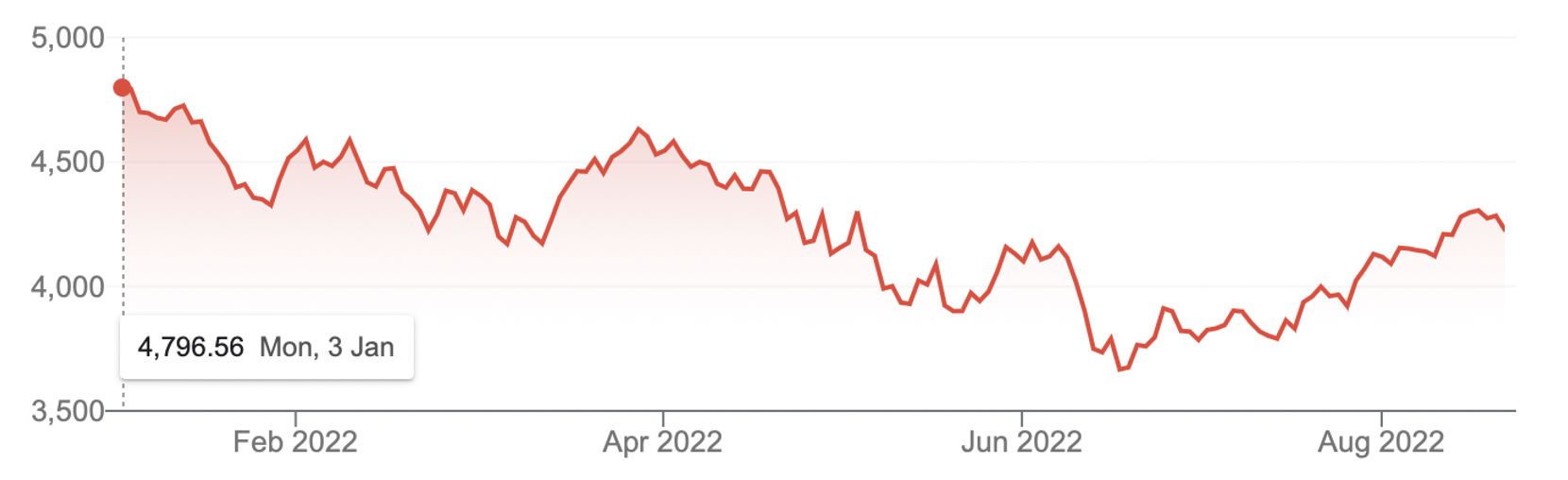

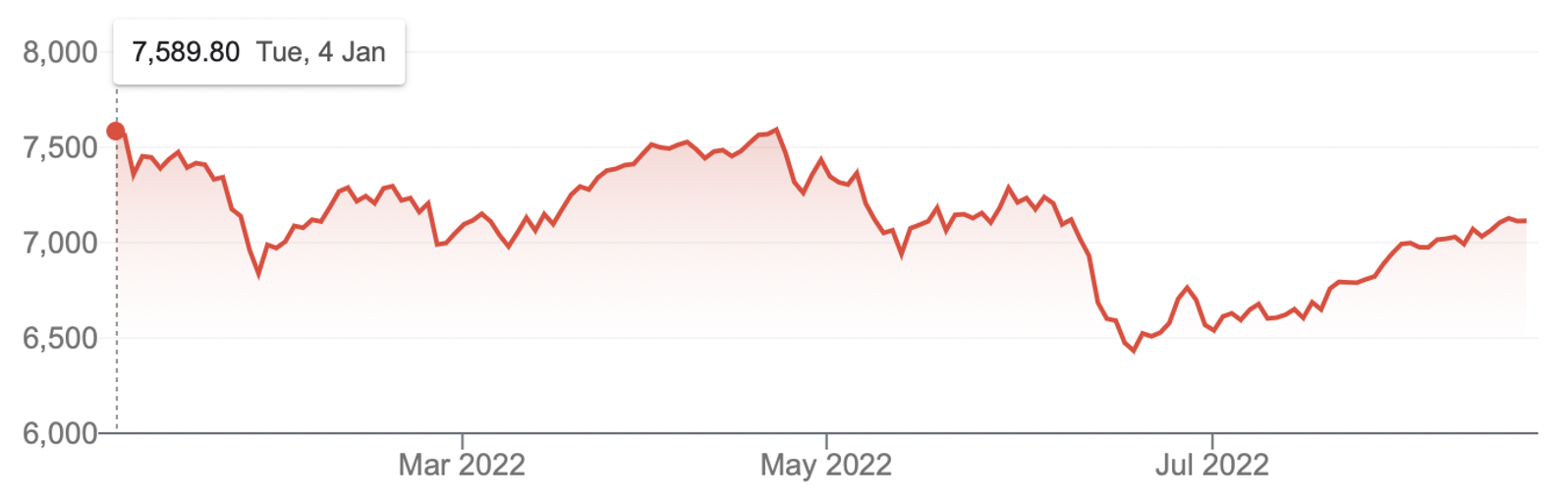

These charts show how strong the comeback of these stocks has been.

S&P 500

S&P/ASX 200

The S&P 500 was down 24% year-to-date at one stage in June, while our ASX 200 was off about 15%. Right now, the former is down only about 12% and we’re down 6.2%. These are convincing comebacks and make me ask: What should I be investing in?

A column in The Times newspaper I was reading over the weekend while in London for a few days, suggested backing losers can be a winning play! However, one thing was missing in this recommendation: it’s only a good play if the potential stocks or funds are quality losers.

When the CBA went to $60 after the Coronavirus crash, that was a quality business with a temporary “loser” tag on it. At close to $100 now, buying the bank has netted those investors a 66% return, and now they’d be getting a dividend yield of 6.4% before franking!

An easy quality loser is the ETF for the ASX 200 Index. If there is another sell-off (for temporary reasons, such as a smaller drop in US inflation when September 13 comes along, meaning the Fed will have to remain aggressive with its interest rate rise program), then I could easily be a buyer of the A200, STW or IOZ.

Why? Because we’ve seen since June 17 that when it becomes clear that the rate rise cycle is about to ease or stop, tech and other growth stocks are bought.

It’s blowing in the wind from Wall Street that the “losers now will later win…” so it’s only a matter of time — but let me remind you that this is best believed for quality assets/performers.

As I read the story in The Times, I thought about a listed fund I’ve invested in called WQG, which is run by Contango Asset Management (CGA). I’m a shareholder in CGA and it runs my Switzer Dividend Growth Fund (CGA actually bought my fund, as it collected a number of funds to build up its total funds under management).

To be precise, one of those funds under CGA’s umbrella is the US-based WCM, which was persuaded by CGA to list two funds here based on their investments worldwide. One is WCMQ (which is more like an ETF) and whatever WCM is achieving in the US is pretty well mirrored here. On the other hand, the listed company WQG is driven by the same investments but its unit price can be more influenced by market sentiment.

With listed investment companies (LIC), we often see good assets assessed incorrectly by the market where the net asset value of the fund could say that the stock should be worth $2 but the market is only willing to pay $1.50. Such a LIC would be trading at a 25% discount to its true value.

Some good and generally small funds often suffer this problem and it encourages opportunistic traders (or raiders) to buy into the fund at a low price. These raiders can launch a takeover offer that can raise the price, and not only do they pocket the profit, but they can also win the company itself.

Other LICs close their discount because the reasons for their falling in share price reverses, and that’s why I was thinking about WQG. This had been a great performer until the rising interest rate scenario in the US and worldwide hurt growth and tech stocks it invests in.

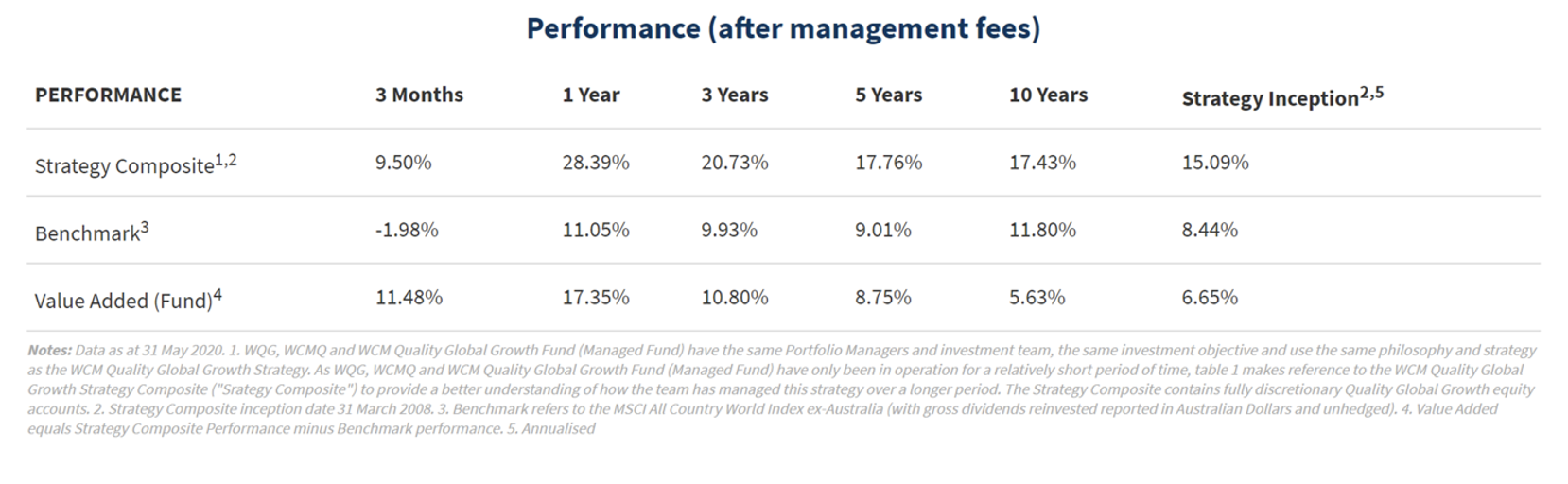

The guys who manage this fund look for globally great growth businesses that have uniquely quality cultures. Their investment strategy has worked since its inception before the GFC, and these two tables below show an interesting story.

These numbers were as of 31 May 2020, not long after the Coronavirus crash of March 2020. Look at the numbers on the top line compared to the benchmark numbers on the middle row. These guys have been quality performers, showing they’ve averaged 15.09% a year. They outperformed the benchmark by 6.65%.

However, look at the impact of one year or so of interest rate rises smashing growth and tech companies.

Taking the five-year and the Inception readings, you can see that this bad year of rising interest rates has taken the five-year performance from 17.76% a year to 12.91%, and the Inception numbers from 15.09% to 11.14% a year. These are still good results but it shows how the past year has impacted these types of funds.

Magellan (MFG) has suffered the same kind of growth/tech caning. It has been unsettled by some internal issues, which now might be settled. Its recent share price moves suggest some investors think it’s regaining its quality tag, with a rise of 25% since July 15.

You can’t be sure, but my financial planning business is giving MFG’s funds a little time to see if they can live up to and restore their quality performance rating.

In the case of WQG, the market had smacked the stock down 30% since December 31, but since June 10 it has rebounded 11.6%, which I’m guessing is a sneak preview of what will happen to a lot of tech-and growth-oriented stocks and funds from the December quarter and rolling into 2023. How would that happen? That’s simple — inflation has to come down, which would bring down fears of too many interest rate rises that could create a full-blown recession.

If the US September inflation reading is a ripper, then I’ll be buying stocks and funds, quietly singing: “For the loser now, will be later to win, for the times they are a-changin’!” If it’s a disappointing number, I’ll have to wait, but eventually, quality losers will come through and if you buy a few of them, that diversification will soften the blow of some short-term losers that might take more time to rebound.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.