The right question now has to be — how should I play these Trump tariffs? And my current answer is that it might be risky to believe the worst of the latest sell-off is behind us.

Why? That’s simple, Donald Trump is unpredictable and right now I’m waiting until April 2 when retaliatory tariffs are expected to begin, before I decide if it’s buy time for stocks that have been beaten up since the US President unleashed uncertainty on Wall Street and global stock markets.

My longer-term 2025 view is that stocks will resume their upward move once the tariff imposts are made clear. If Trump continues to play an erratic game with tariffs, the bounce back of stocks will be delayed, and while Friday’s nice rise on the New York Stock Exchange and the Nasdaq were previews of what should happen when the tariff threats and terror are over, I do think we’ll see some more down days before the rebound of share prices becomes stronger.

The buyers on Friday on Wall Street and today locally were investors who, for example, thought Macquarie at $196.52 (which we saw last week) was irresistible, given it was over $240 only at the start of February. These players hope the share price doesn’t sink below $196. If it did, they might be buyers again on the belief that stocks will rise later in the year.

The following factors make the case for believing stocks will resume their rise:

- Trump will eventually settle on his tariffs.

- Interest rates are on the way down.

- Slowdowns are more likely than recessions.

- Trump tax cuts will be bandied around.

- Trump deregulation will be a plus for stocks.

- Artificial Intelligence will be a huge plus for corporate bottom lines and then stock prices.

- China will eventually grow faster.

Provided they don’t get out of hand and create a real global trade war, these Trump tariffs are actually creating a buying opportunity. So, the next question is — what should I buy?

Paul Rickard and I were asked this question in our Boom, Doom, Zoom program. We agreed the likes of Macquarie (MQG), Goodman Group (GMG) and Promedicus (PME) are the kinds of companies to look at in a sell-off.

The analysts agree, especially on MQG and GMG. However, there’s a divided view on PME.

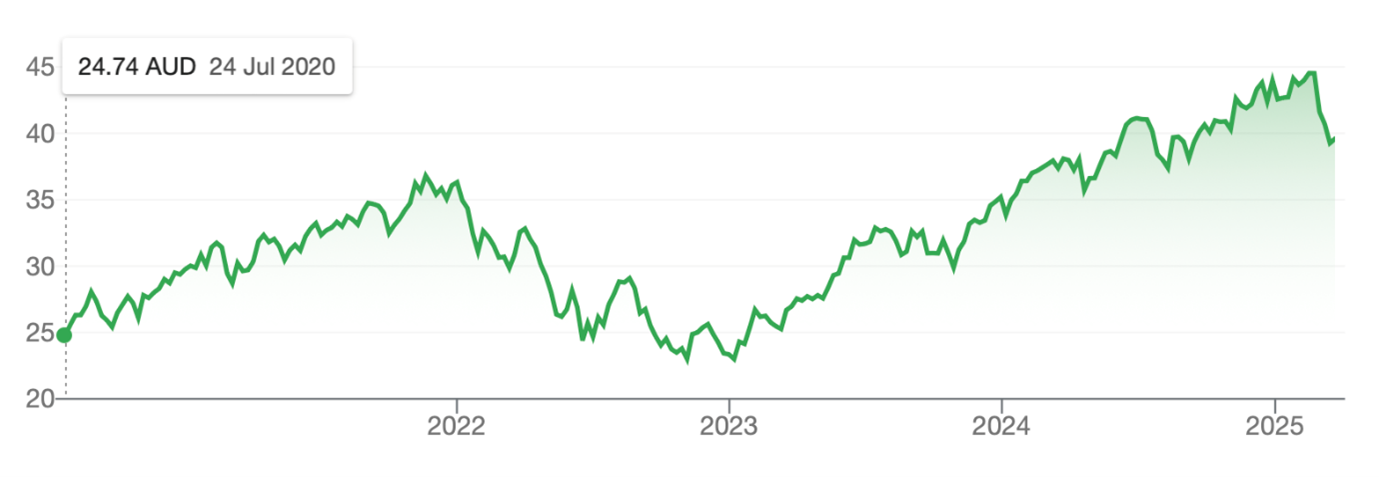

Away from individual stocks, there are ETFs worth thinking about. The one that made us a lot of money a year or so ago was HNDQ, which captures the top 100 stocks in the Nasdaq. The chart below tells an interesting story and suggests it could be time to give it another go.

HNDQ

In 2023, I tipped it could be a nice play after the 2022 interest rate rise smashed tech/growth stocks. The unit price was around $23. It topped out in mid-February at $44.53. I got my advice clients out around $38.

It’s now $39.60 so I’m not ready to give it a go again.

If, however, there is another leg down and I see $36, I could be a buyer.

One reason I got out of HNDQ was because I expected lower interest rates to lead to a rotation out of the big tech companies — such as the Magnificent 7 — and into smaller tech/growth stocks.

This rotation effect plus the Trump tariff effects have hurt the Magnificent 7 — Nvidia, Meta Platforms, Apple, Amazon, Microsoft, Alphabet and Tesla.

This is what Morningstar.com is now suggesting: “After leading the bull market higher for the better part of two years, the mega-cap tech stocks known as the Magnificent Seven have been among those hit hardest in the ongoing selloff roiling the US stock market. As a result, these formerly ultra-expensive stocks seem less pricey. Some even look cheap enough for Morningstar analysts to call them buys.”

Any comeback of the share prices of these great companies will help HNDQ. So will the rotation into those top 100 Nasdaq companies that will like lower interest rates, and which will be undoubtedly tapping into AI opportunities.

Another and probably more risky play is GEAR, which pretty well captures the rise of the ASX 200 Index but with a magnification effect. Of course, it does the same when stock prices are falling.

I talked to subscribers about GEAR when it was $23. We got some of our financial planning clients in at lower prices, but they are thrill seeker types. GEAR topped out at $34.03, and we got our clients out at $30 just for safety but it’s now $28.08.

I’d be happy to try GEAR again at $26 or maybe $27, provided I thought the Trump curve ball bag was empty. Like HNDQ, I’ll be watching for a buying opportunity based on my view that stocks could easily go higher later this year.

Be clear on this: both HNDQ and GEAR are higher risk plays, with the latter especially so. But with Donald Trump in power, any false move on trade or geopolitics could be tricky for tech stocks or leveraged investments such as GEAR.

Provided I’m right on the longer-term future for stocks, if HNDQ goes back to its old high there could an 11% gain. If GEAR makes its old high, then there could be a 21% gain in the offing.

But note this well: both are riskier plays.