The chances of a stock market correction increased last week so don’t be surprised if the smarties think it’s time to take profit. The failure of the Fed Chair, Jerome Powell, to excite the market with his press conference and Donald Trump’s escalation of the trade war, has to make it hard for stocks to keep sneaking higher.

Then we have earnings season upon us locally and, as the AFR headlined today, it looks like it could be “brutal!” Miners should report impressively but industrials have had to deal with a sub-2% growth, restricted lending from banks, the pre-election anxiety-affected lower confidence of both business and consumers and all the negativity that has come out of the trade war escalation.

With the US President slamming a 10% tariff on the remaining $US 300 billion worth of Chinese goods now not tariffed (as of September 1), with threats this could be increased to 25% (like the other $US 250 billion worth of goods from China), it’s hard to see the next leg higher for stocks any time soon.

In fact, it’s the scenario I’ve been telling my financial planning clients was a possibility. And while I still think Trump will try for a trade deal, leaving yourself scope to benefit from such an agreement makes sense. But it’s also wise that you start thinking about the defensive assets in your portfolio.

After all, many of you could have made great money out of BHP, Rio or Fortescue, so it might be time to take some money off the table to boost your potential income.

Of course, with term deposits paying such hopelessly low interest rates, many of us have to go up the risk curve, so hybrids with the big banks are worth considering. But remember, they’re not as safe as term deposits.

Also as interest rates have been falling, they’re not as attractive as they were a couple of years ago. As Paul Rickard has pointed out, they have become relatively “expensive defensives”.

If you’d like to keep a toe or two in the market but at the same time boost your income, dividend funds such as the Vanguard Australian Share High Yield ETF (VHY) or the Switzer Dividend Growth Fund (SWTZ) could be relevant at this stage of the cycle.

While VHY has had better capital gains with a bigger exposure to the miners, SWTZ has fared better on a yield basis.

In the year to June 30, SWTZ paid 7.27% before franking, while VHY coughed up 6.82%. A combo of both could be a cautiously adventurous way to play these pretty income-defensive products.

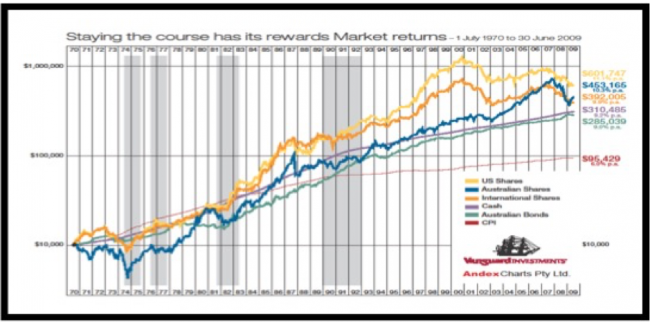

In all my years of talking to you, I don’t think I’ve ever said it was time to get defensive or time to raise your cash levels. But I’ve never had to deal with the huge human curve ball called Donald Trump, with a trade war and with our stock market at record highs. In the chart below, the blue line shows how a stock market reaches a peak, crashes and then passes the old all-time high before having another serious crash.

The blue line also shows that a real breakout from the overall slope of the line happens ahead of a crash.

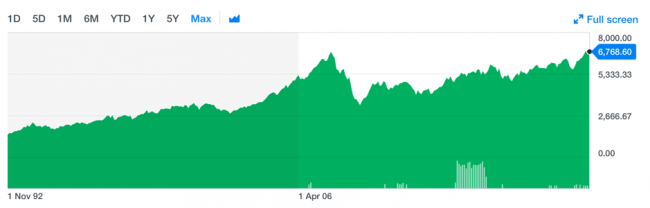

You can see we’ve had a small breakout where you can see the index level of 6768.60 in the chart above but it’s more likely to be a prelude to a correction rather than a crash.

Trump isn’t in a hurry for a trade war truce and he could even up the ante, raising the 10% tariff on the remaining $US300 billion worth of Chinese goods not tariffed to 25%.

That would spook Wall Street, with an increasing number of analysts wondering if the Chinese could decide to wait him out all the way to next year’s election, hoping they get a new Democrat President to deal with.

This is becoming increasingly messy. I can’t see Donald or the Fed likely to rescue the situation with another cut, while the US stock market is not having a hissy fit over all this trade war posturing.

I’m not putting my cue in the rack just yet when it comes to stocks, because I think we have to see a bigger breakout before a crash is on the cards. That means I’m looking for another buy-the-dip opportunity so I’m collecting cash, taking profit and waiting for another leg up, which I suspect won’t be any time soon.

As the chart below shows, August to October is not historically the greatest months for stocks. The returns May to October average only 0.95%. And remember, most of the big crashes have shown up in September or October.

On the other hand, the period November to April has an average return of 10.69%. That seems the more likely time that a trade deal will be struck, if one is to be had at all. Donald Trump is prepared to shock the stock market but he wouldn’t want to face the US electorate with a Wall Street crash and pending recession.

Source: CNBC

That said, if you don’t want to go to cash, playing an income product could reduce your downside if a surprise crash came along. However, if there is only a correction, your capital might slide but your dividends could be very much unaffected. You’d also get capital upside, if and when the market recovers.

Anyway, that’s the way I’m playing it but I do have a timing problem. I want to pocket my big miners’ dividends first (which have surprised me) before selling.

Rio coughs up dividends (trades ex-dividend) later this week but BHP is late August. However, in that time, the market could sell off! This is just another take on “climbing the wall of worry” that people like me often talk about. But that’s life in the fast lane of investing.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.