I’d like you to write this date down: Friday 24 June 2022. And if you’re an investor in stocks, I want you to remember it.

It might not be memorable if you’re a trader or speculator who plays a short-term money-making game, but for anyone who has seen their portfolio fall in value this year or who’s wanting to get into stocks more seriously, 24 June 2022 could be a day you should never forget. On this day, our stock market (as measured by the S&P/ASX 200 Index) rose 0.8% on Friday and 1.6% for the week, making it the best trading week for over three months.

Over that time, our market has lost close to 10%, so that 1.6% gain in a week is appreciated. But the question is: Can we take this gain as a sign that the worst of this correction for us and the bear market crash for Wall Street is behind us, and therefore is it time to buy beaten-up stocks?

That question makes a lot more sense when you register what US markets did last week. In case you missed it, the Dow closed up 5.3% for the week, the S&P 500 some 6.7% higher and the Nasdaq did an 8.5%+ jump. By the way, the S&P 500 moved out of bear market territory to be down only 18.5%.

While these all look like good signs, history has told me that I can’t get too positive about the short term, when stocks are in bear markets or big corrections like our S&P/ASX 200 Index, which is down over 13% since we topped out in August last year. We actually nearly reached that top again in April this year, but then succumbed to the interest rate anxiety/recession fears that have gripped Wall Street and seen tech stocks smashed. And no ‘stock’ captures this best than Cathie Wood’s ARK Innovation ETF (ARKK), which has fallen 64.81% in a year and 52.75% year-to-date.

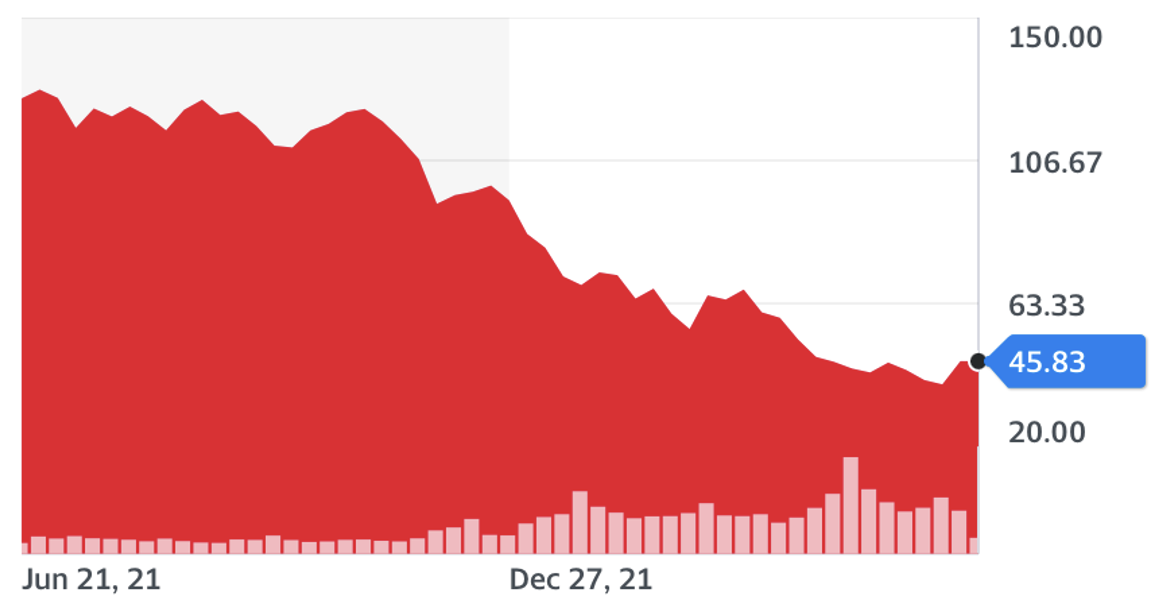

ARK Innovation ETF (ARKK)

In February last year, this was a US$157 stock and is now $US45.83 but last week it rebounded, wait for it, 22.7%! Over the month, it was up 7.5%, while the S&P 500 Index was down 3.6%.

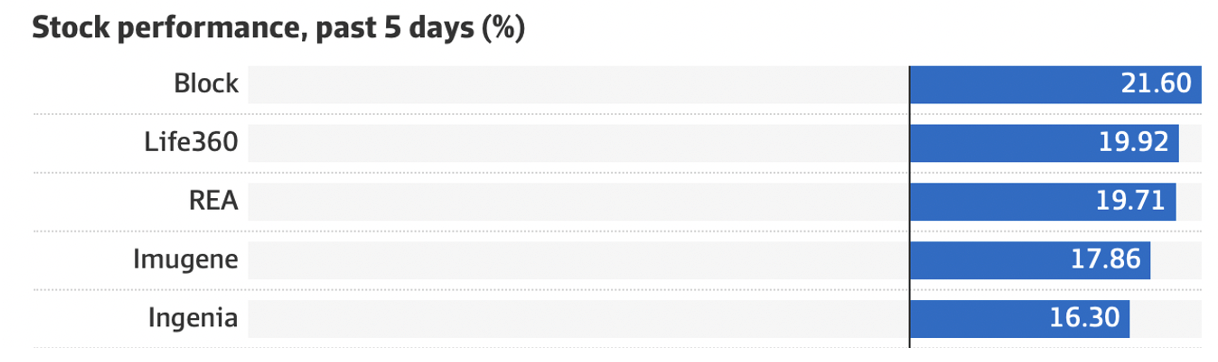

This is a promising sign that buyers are thinking it’s time to start picking up oversold tech stocks. We saw that here on Friday. Look at Bloomberg/AFR’s table of best performers — these are tech, buy now pay later and biotech companies that have been dumped!

Other tech names like Zip rose 21.59%, Megaport 15.9% and Nuix 11.27%. What we’re probably looking at is a more positive move in what’s called the bottoming process for the stock market. This is where short-sellers take profit by buying stocks they’ve been crashing. They do this because they suspect the downside gain isn’t worth the risk of losing the money they’ve made short selling stocks they thought were way overpriced.

I think June 24 was an important date in the bottoming process, but it doesn’t mean we’re out of the woods as this expert relates: “We believe that bounce in U.S. equity markets over the past three trading days has been a bear market rally off deeply oversold conditions,” Wolfe Research’s Chris Senyek wrote in a note last Friday. “While there may be some additional near-term follow through, we believe that our intermediate-term bearish base case remains intact and that the next leg down is going to be driven by rising recession risks and downward earnings revisions.”

Buying now leaves you exposed to the data flow of the next month, where market experts will be watching for signs that inflation is peaking in the US and that recession fears are overdone. If the data drop over the next month tells this kind of story, then investing now will be rewarding. But it’s more likely that this will be a story for August, more than July.

By August, the US economy should be showing more signs that the interest rate rises from the Fed are working to bring inflation down and China will be more out of lockdown and its related supply chain problems that add to global inflation should be dissipating.

Of course, if this doesn’t happen and inflation persists, then June 24 was a false dawn — making it a memorable lesson for investors. And the fears will be that more Fed interest rate rises are coming and the concerns about the likelihood of a real recession eventuating will escalate and stocks will take another leg down.

By the way, if the Fed has to get tougher on rates to beat inflation, our Dr Phil Lowe and the RBA will also play a tougher game, as it seems our central bank boss is heavily influenced by what the Fed’s Jerome Powell is doing to clobber inflation.

Right now, I’m banking on central bankers getting it right, but they will need help from areas they can’t control — China and Russia. This is what Trading Economics reported Powell saying last week about his dual goal to bring down inflation and avoid recession: “Fed Chair Powell acknowledged that steep interest rate hikes may cause a recession in the US, and avoiding it mostly depends on the factors beyond Fed control. ‘The other risk, though, is that we would not manage to restore price stability and that we would allow this high inflation to get entrenched in the economy,’ Powell added. ‘We can’t fail on that task. We have to get back to 2% inflation’.”

That’s why the data and geopolitical matters will be crucial to June 24 being a day that heralded that stocks can rebound nicely later this year. And please don’t think I’m alone in being positive. I recently revealed what JPMorgan’s Marko Kolanovic, the investment bank’s company’s chief global markets strategist, is seeing in his market crystal ball and it bears repeating for this story. Here’s his analysis:

- His team expects the S&P 500 to end the year at 4800. That’s 27.7% above where the broad market index closed on Wednesday.

- This would be the S&P 500’s all-time high set on January 3.

- He thinks a geo-political solution to the Ukraine war will happen later this year.

- Inflation will fall.

- Moderating inflation will help the US avoid a recession.

- That would be good for US company profits.

- And that means stock prices have been over-smashed this year.

- If right, his scenario will also mean interest rates won’t have to rise as much as the most negative forecasters have been predicting.

This guy is no market-guessing slouch, as JPM’s website proudly reveals: “For the first time in the Institutional Investor Research survey’s history, J.P. Morgan has been awarded the top spot across all Global team awards. The firm has once again been named the Top Global Research Firm [1] and, for the first time, the #1 Equity Research Team [2]. These two accomplishments are in addition to the previously announced title of 2021.”

Another believer that stocks will rebound this year and into next is Jeremy Siegel (the Russell E. Palmer Professor of Finance at the Wharton School of the University of Pennsylvania), who I’ve followed for decades. Two weeks ago he advised CNBC: “We’ve had bigger shocks in the past … There may be another 5%, who knows, there may be another 10%, but that means for me, moving forward, that just raises the return on the market looking forward. Hold in there. If you’ve got cash, begin to employ it. You won’t be sorry a year from now.”

I know I’ve told basically a one-sided story about why you want to get exposure to stocks but that’s because most other things you read will be scaring the pants off you. And that’s OK for short-term plays — until the economic data and geopolitical events help, stock markets will be volatile. But June 24 showed that if inflation data improves and a serious recession is unlikely, stocks (especially tech stocks) will be bought.

The risky play might be to buy into any near-term sell-offs waiting for the rebound later this year. The safer strategy would be to wait until we see more evidence of big stock buyer action before you put your money where Marko Kolanovic says stocks are heading.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.