A subscriber to my TV show (Switzer Investing) complained about Rudi Filapek-Vandyke’s long commitment to the great Australian company CSL. Another long-term ‘CSL-ophile’ is my colleague Paul Rickard. After missing the stock when the market temporarily fell out of love with it, I’ve become a fan in recent times.

The closing date for CSL’s share purchase plan is looming and the market has given the company a bit of a dumping, though on Friday, bargain hunters wisely swooped, with the stock up 3.24% to $257.51. Last Thursday you could’ve got in for $247.

Some smarties made 4% the easy way in a couple of days but have they been sold a pup, as my subscriber suggests after listening to Rudi with me on my latest episode [1] of Switzer Investing.

To be precise, this is what the subscriber, let’s call him Antony, said in his email: “Hi Peter, always interesting (and frustrating) listening to your interviews with Rudi. And, as usual, CSL can do no wrong when it comes to Rudi. But this is what I see. Since its high in Feb 2020, CSL has fallen by 28.4%. From its March 2020 market crash low, it has barely gone up 1%. Dividend yield is very weak at just over 1%, and not fully franked. So, after nearly two years, most of which has been a raging bull market (peaking in August 2021), CSL has performed negatively and poorly. How is a new investor supposed to have confidence investing in CSL now? I do not accept “believing” it’s for the longer-term view, as an answer. Sorry, but that is a con and BS. The market story with CSL going back 3 to 5 years was that this great stock was then a great BUY and it would easily outperform the market up to now. It has not happened. You cannot be objective if you hold and ‘fall in love’ with a stock, regardless of its share price performance.”

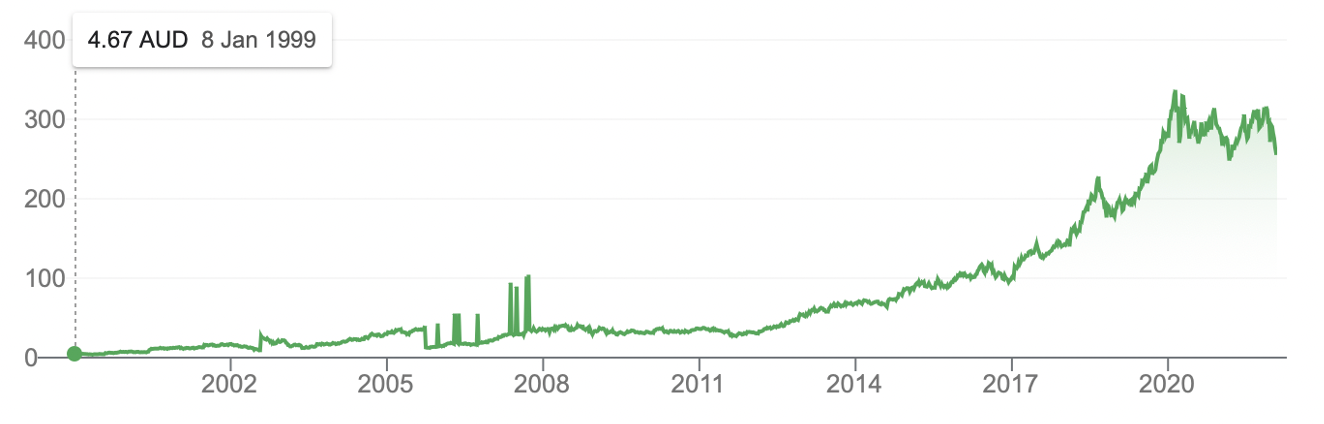

Antony is clearly a man with a strong view, but is he right or wrong on CSL and Rudi’s ‘co-mance’ with this company? His gripe on the dividend isn’t a valid criticism, as CSL is a growth company earning most of its income overseas. But we have to assess how good a growth company it is. This chart is insightful.

CSL Limited (CSL)

This proves that CSL is a growth company with a capital G, but it does show it can go for sustained periods of sideways price action. For example, from November 2007 (when the GFC crash was starting), it was $32. By November 2011, it was $30. But these were strange times. The US was in what was called the Great Recession and CSL earns a lot of its income in the United States.

Those who kept the faith were rewarded. From December 2012 to February 2020 CSL’s stock price went from $32 to a cool $336. Over that time my expert buddies like Rudi and Paul were getting it right for themselves and anyone who wanted to listen to them.

Antony’s gripe with the company spans from “its high in Feb 2020, [where] CSL has fallen by 28.4%. From its March 2020 market crash low, it has barely gone up 1%”.

That’s true if you want to compare its share price over the past two years — February 2020 to nearly February 2022. That $336 high was a zenith-like high after a rise of 950%! Also, it’s Coronavirus crash was 19%, while the overall market fell 35%. And by April 2020, it was back to $329, as the chart below shows.

CSL Limited (CSL)

What this chart also shows is that if you’d bought CSL on the dips, you could’ve made good money until this most recent sell-off, which has hit a lot of good stocks. If you’d bought in the previous dip when it was $253 in March last year, you’d still be in the money with the current share price at $257.

And the current lower price is linked to something special, namely its takeover of Vifor Pharma, a company into kidney problems, which positions CSL into a growth sector for medical issues and helps to diversify the business.

Also, CSL hasn’t been helped by the Coronavirus and what it has meant for its plasma business, which experts believe will bounce back as we see the world get back to normal. It’s seen as a reopening trade stock based on the idea that the pandemic world has disturbed this very successful business. And I believe it, Antony.

And so do the experts that Rudi surveys in his FNArena business. The consensus average of the people who analyse companies professionally sees a 24.4% upside.

All six investment companies and broker businesses like the company, with Citi expecting a 32% gain and Macquarie 31.26%.

The target price is $320 but that’s based on a near-term call. For the patient, long-term player who holds no CSL, listening to Rudi could be rewarding. For those who bought at the top (whether that applies to CSL, CBA or a great property) it can take time before you realise a big gain.

We’re in buying territory for CSL. Even those who bought to hold could easily bring down their average holding price by buying more at this attractive price.

It’s not wise to ever bank on one company to continue to be world-class, which is why I encourage diversification. But Antony, if CSL doesn’t put on a significant spurt in price between now and 2023, I’ll be surprised. Your criticism of the company is valid if you’re a trader. And if you are, you should have bought in March 2021 at $248 and sold in late November for $315.

That would’ve been a gain of 27% in nine months, which is nice money if you can make it, based on what expert fund managers think is one of the best companies in the world.

Antony, you have to work out who you are. If you’re a short-term player, you have to buy cheap and sell before markets go volatile. And since November last year, I’ve been warning about volatility in 2022 — and that’s what we’re getting.

If you’re a long-term investor, then I’d advise two years (and two wildly weird years) is not long enough for such an investor. (This episode covers Paul’s take [2] on the CSL share purchase plan.)

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.