Is ASX a buy? That was a question that a number of our subscribers put to me at our Boom Doom Zoom webinar on Thursday, and one I had been pondering for a couple of weeks. This follows a trading update at an ASX Limited Investor Day, where new CEO Helen Lofthouse delivered the bad news about the costs of the CHESS replacement project and technology modernisation, and the shares got thumped.

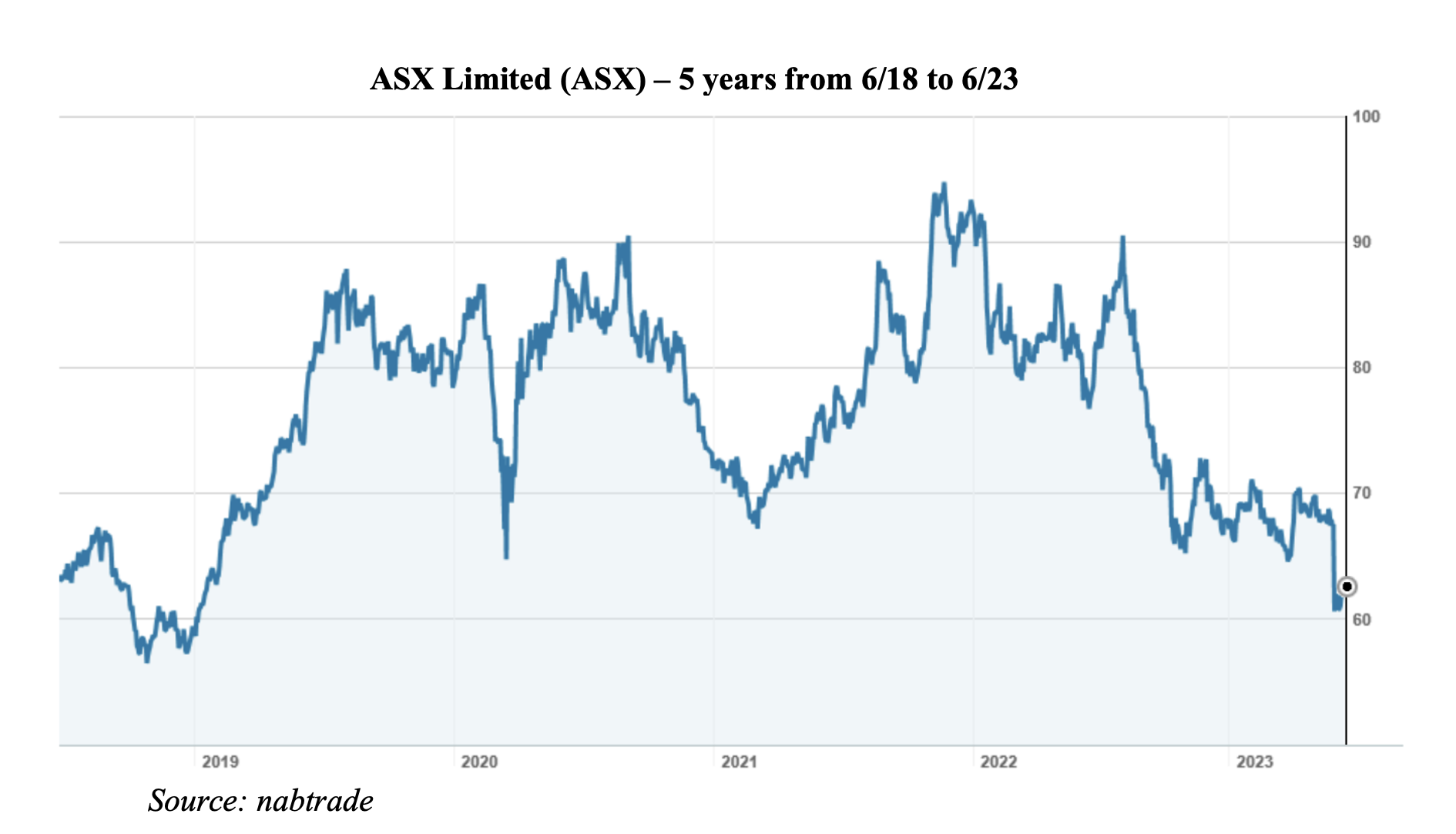

I was an original shareholder in ASX arising from its corporatisation in the mid-nineties and have watched the shares (initially valued around $2.50) rise as high as $90.00 a few years back. On Friday, they closed at $61.63.

So, the question “is ASX a buy?” is well worth considering. Here goes.

What I like about ASX

- ASX is an effective monopoly:

– 89% share of cash market share trades

– 100% share of exchange traded futures and options in Australia

– 100% share of clearing and settlement (via CHESS)

– Near 100% share of new listings

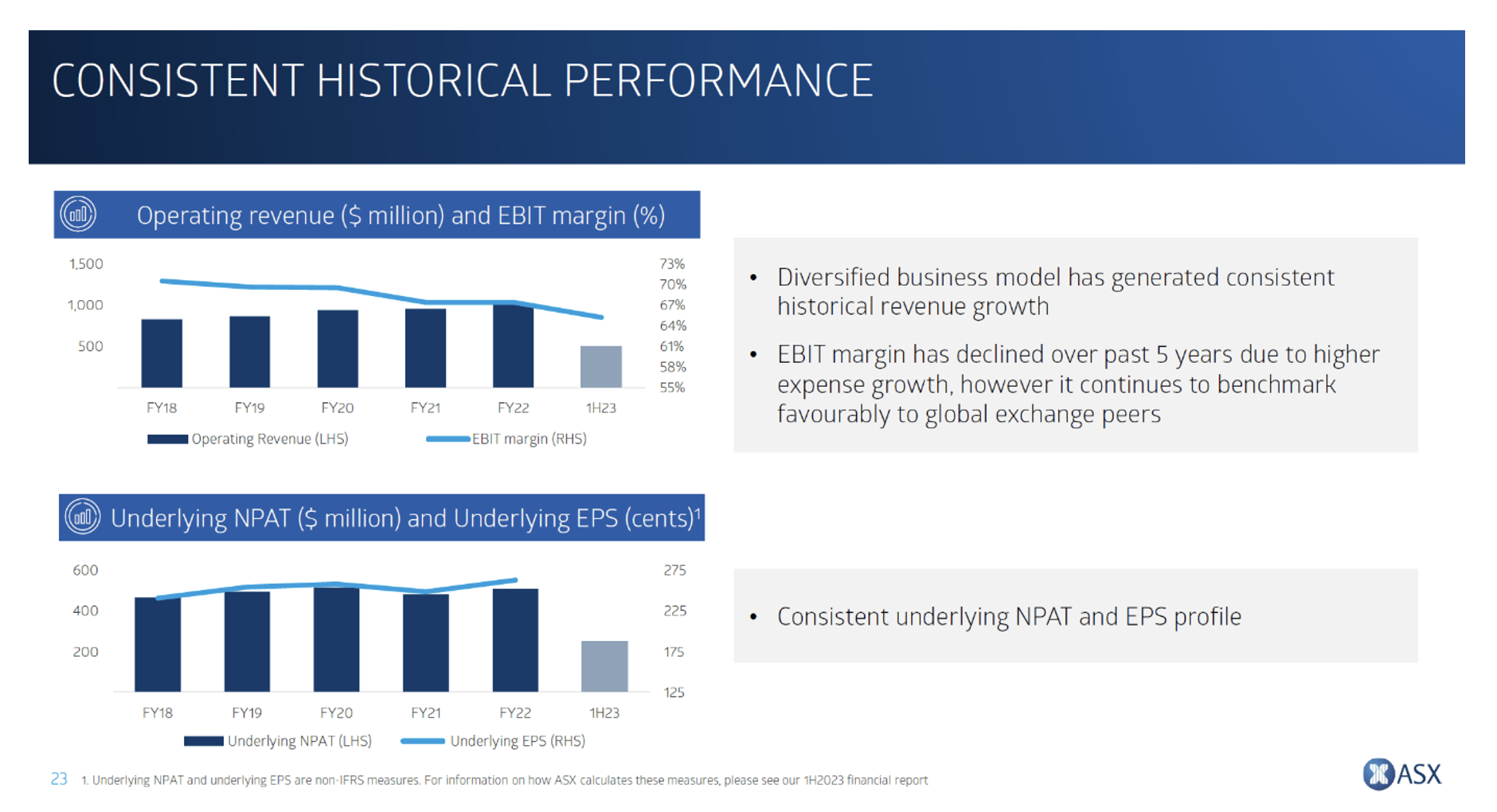

– Very strong position with regard to market data - Despite its exposure to market volatility (which drives trading activity, clearing activity and potentially new listings), ASX’s revenue (and earnings) have proved to be remarkably consistent. Revenues for market data and listing fees paid by companies are almost independent from market activity. The slide below from the ASX highlights ‘consistent financial performance’ as a strength

-

- Potentially, it is supported by macro trends that are tailwinds for the ASX. It describes these as the growing Australian capital base (partly due to the size of the investible capital from Australian super funds), increasing demand for technology and data, and the Government’s decarbonisation agenda.

- ASX’s high dividend payout ratio, which until recently was 90%. This meant that ASX paid reasonable fully franked dividends.

What I don’t like about ASX

- It has a terrible record in the delivery of new product/new technology. The CHESS replacement project, which it has paused and is now re-assessing after writing off $250m, is just the latest disaster. Before this we had the debacle of mfunds, investment in retail trading of fixed interest securities and the failed tie up with the Singapore Stock Exchange.

- It has a new management team that is unproven. This may turn out to be a real positive – only time will tell – but it is unproven at the moment. CEO Helen Lofthouse has been in the job 10 months and most of the Executive has also turned over. Tim Whitely is the new CIO, Clive Triance will be joining in August to replace Tim Hogben as Group Executive Securities and Payments, Lisa Green, Group Executive People & Culture is leaving, and a new Chief Customer and Operating Officer is being recruited to replace Val Mathews who resigned in May.

- On paper, ASX is not particularly cheap. It is trading on a multiple of 25.1 times forecast FY23 earnings and 23.6 times forecast FY24 earnings. As for being a “yield stock”, the total dividend for FY23 (expected to be around 221c) puts ASX on a yield of 3.6% (based on a share price of $61.63) and for FY24, a prospective yield of 3.7%.

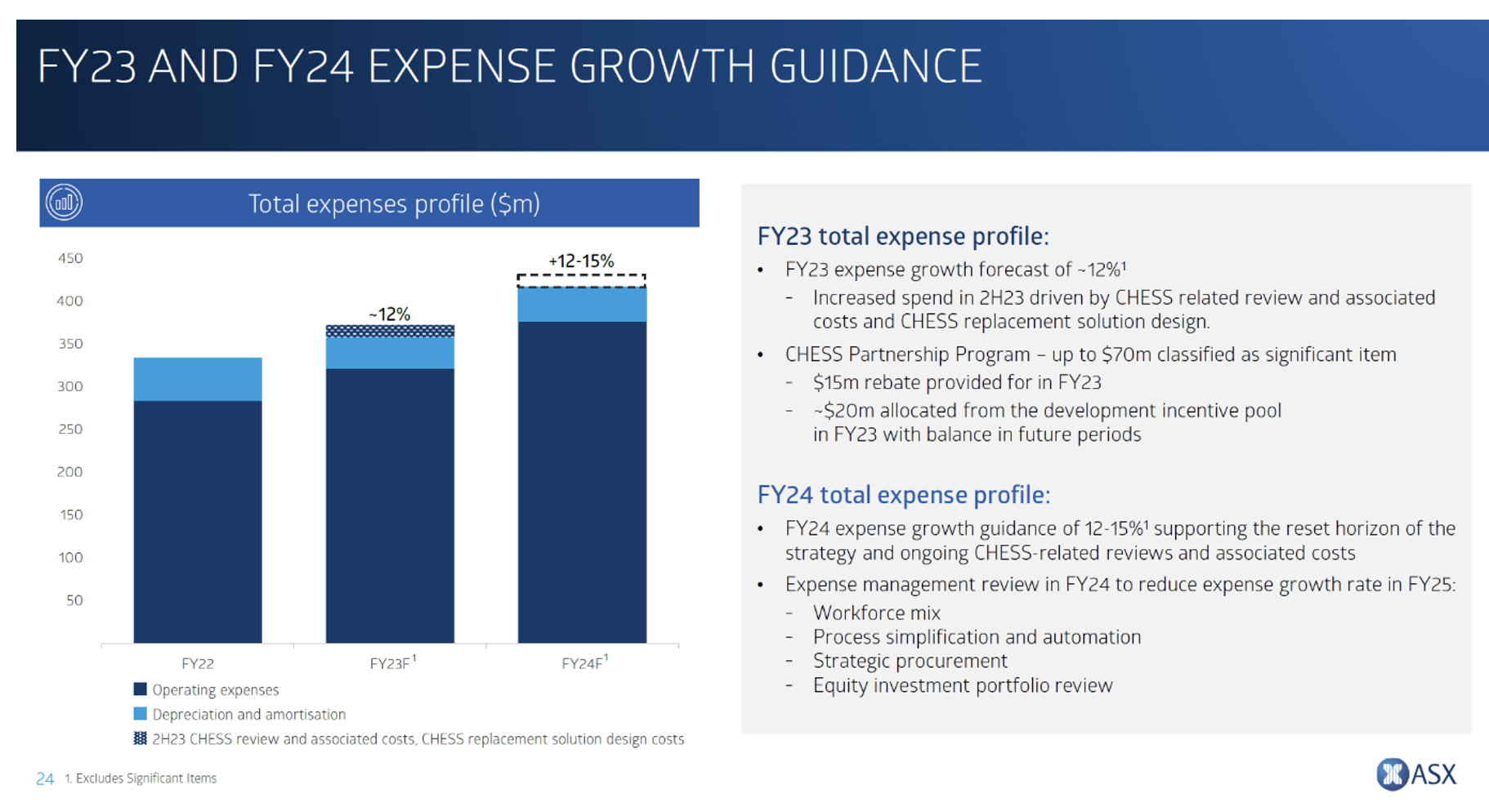

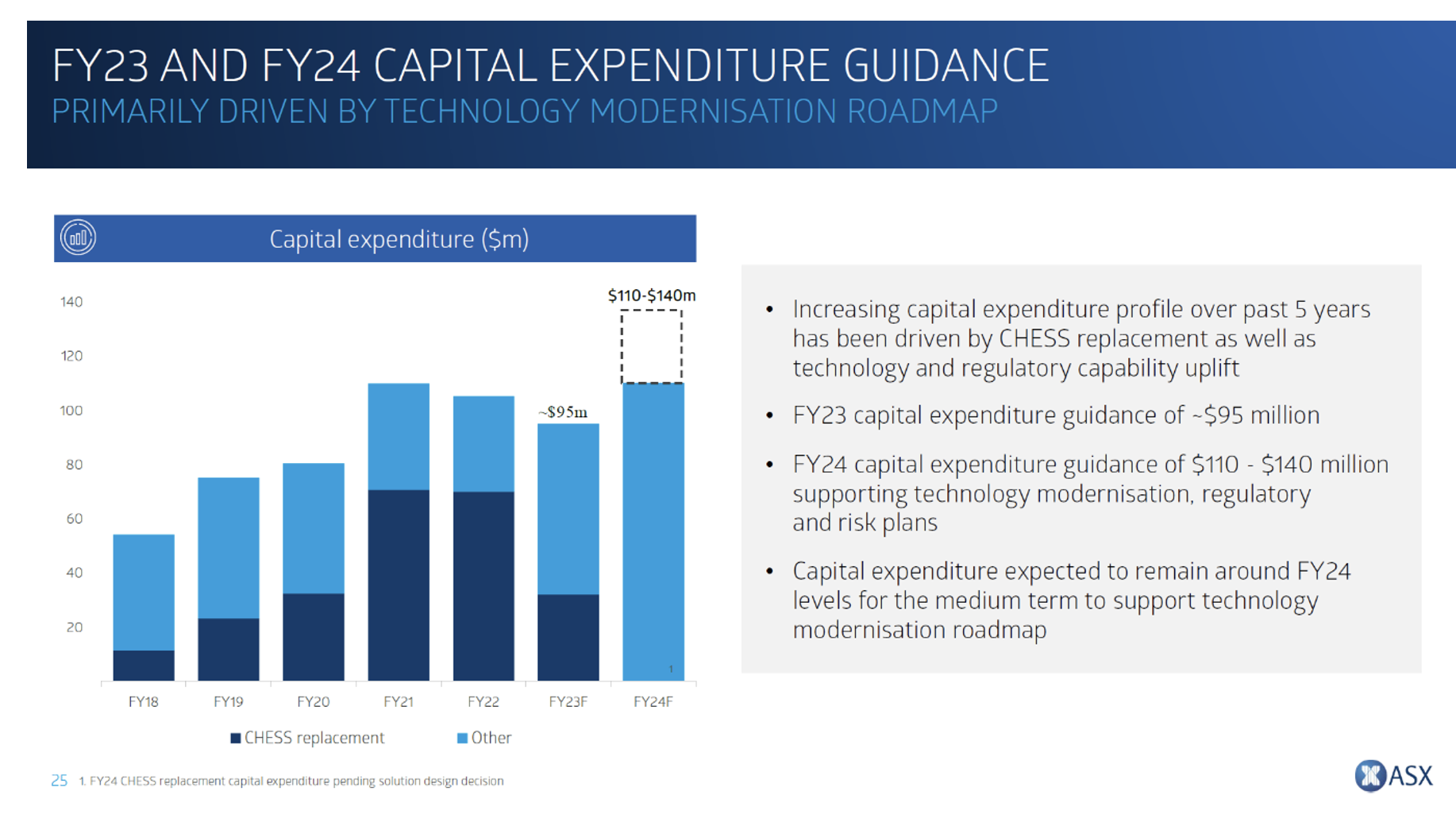

- Because of the CHESS replacement project and the need to upgrade technology across the organisation, ASX has issued the following guidance:

- FY23 expense growth of circa 12%

- FY24 expense growth of 12% to 15%

- An increase in capital expenditure to $110m to $140m in FY24, from $95m in FY23.

The following slides paint an unattractive picture.

ASX will reduce its dividend payout ratio to a target of 80% to 90% and introduce a medium-term ROE (return on equity) target of 13.0% to 14.5%.

What do the brokers’ say?

In summary, the brokers are marginally positive on the stock. According to FN Arena, of the six major brokers who cover the stock, there are two ‘buy’ recommendations, three ‘neutral’ recommendations, and 1 ‘sell’ recommendation. The consensus target price is $65.47, 6.2% higher than Friday’s closing ASX price of $61.63.

The table below shows individual recommendations and target prices.

Ord Minnett views ASX as “materially undervalued”, while most of the other Brokers are fairly “non plussed’ about ASX, seeing it as a defensive stock with a high margin business but low single digit revenue growth.

All said that the ASX’s cost guidance was higher than expected. Most can’t see the immediate catalyst for an upgrade. To quote the precis of Morgan Stanley’s commentary:

“Morgan Stanley believes it will take some time for investors to regain confidence in management at the ASX after higher costs and a weaker capital position than expected were revealed at yesterday’s investor day.

The company revised down the dividend payout ratio to 85% from 90% and made a new debt issue of $200-300m.

The broker suggests new management is taking a conservative stance on costs and capital to address the CHESS and other technology upgrades.

Cost growth guidance was 7-8% higher than the consensus forecast and capex guidance rose to -$110-140m versus the -$126m forecast by Morgan Stanley.

The analyst forecasts low single-digit revenue growth from FY22-25 while costs are expected to grow at a more than 10% compound annual growth rate (CAGR).”

Is it a buy?

I can’t get excited about a stock yielding a prospective 3.7%, with low single digit revenue growth and expenses growing in double digits.

If I wanted a “defensive stock”, I think I would be better off with something like Telstra (different industry but arguably with some of the same defensive/monopolistic characteristics). It is also trading on a multiple around 25 times earnings, but it is yielding almost 4.0%. It is growing revenue and holding expense growth to low single digit.

And comparted to riskless Term Deposits, which are now paying up to 5%, a yield of 3.7% fully franked (5.25% when grossed up) is small compensation given the risk involved in backing that the new ASX Management Team can do what their predecessors couldn’t.

ASX is not a buy.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.