With Austria going back into full lockdown, taking your eye off the Coronavirus ball in Europe is not a wise play for investors right now. A short-term sell off is likely but this should prove a buying opportunity. This follows Germany targeting the unvaccinated with new restrictions on Thursday, with case numbers rising disturbingly.

It’s Austria today but market influencers can’t help asking: will this be a wider global brake on economic growth in 2022? That’s a fair question.

Lockdown threats from inadequate vaccinations and poor government administration of the virus mean slower economic recoveries and that delays interest rate rises, which actually is good for tech stocks!

CNBC explained Europe’s stock market slide from record territories for the various national indexes this way: “Europe is once again front and centre, with multiple countries experiencing record daily caseloads, imposing partial lockdowns and tightening rules on the unvaccinated”.

The Austrian stock market plunged 3.1%, which shows the punishment for mishandling the reopening and puts pressure on the unvaccinated, as the majority won’t be happy if the minority of anti-vaxxers KO jobs and businesses again. It will be a big issue here as politicians actually wonder how they navigate an election win next year, with a big block of voters unvaccinated and annoyed, while not saying anything to cheese off the majority who are jabbed.

Predictably, the news wasn’t good for airlines, and Boeing gave up more than 5%, while United Airlines was off over 3%. Our market could see this coming and that explains why Qantas lost 3.18% last week, and there could be more downside on Monday.

What implications the unvaccinated issue has must be seen in this good news from the US last week: “Shares in retailer Macy’s rose 21.2% after it raised annual earnings guidance on Thursday,” CommSec reported. “The nation’s largest retailer lifted annual sales and profit forecasts but supply chain issues hit third quarter margins.”

Now that was a great revelation, showing what is possible provided we don’t have more lockdowns and pandemic threats. On the other hand, these positive outlook statements and the share price positivity that goes with them could prove to be wrong if the impact of the unvaccinated isn’t well-handled.

Need proof? Try this from CNBC again: “The pullback in airline and travel stocks came about a week after the Biden administration lifted pandemic travel restrictions that have barred many international visitors for nearly 20 months. That move was cheered by airlines and other travel companies. But the increase in Covid cases and new restrictions in Europe was damping hopes for an immediate rebound in trans-Atlantic travel, a usually lucrative segment that is key to large carriers’ return to profitability.”

And it’s why I now think we could see a pullback in stocks but I will argue it will be a buying opportunity for the patient long-term investor.

Tom Lee, who founded Fundstrat Global Advisers, this week tipped a pullback before a rebound into a higher finish for the year. He pointed to uncertainty around leadership within the Federal Reserve with Jerome Powell possibly dumped this week from his Fed Governor’s gig this weekend “and some technical factors”.

Throw in some lockdown threats, which he did refer to because of rising Covid cases and Tom’s argument is even more believable. “In this kind of market, especially so close to year-end, people just treat 2% drawdowns like it’s an annihilation. There is a chance for people to overreact and that’s why you need to buy that,” Lee said.

Interestingly, these virus/lockdown concerns lower rising interest rate worries and explain why tech stocks and the Nasdaq had a good day at the office on Friday in the Big Apple.

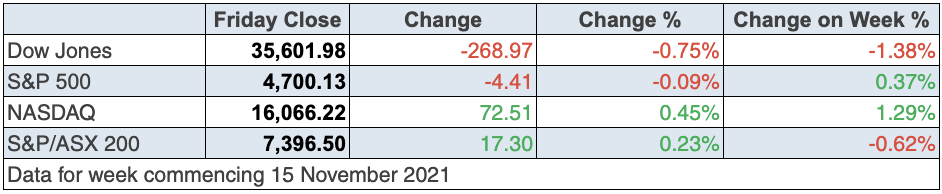

To the local story and the S&P/ASX 200 finished the week on a small 0.2% rise but lost 0.6% for the week, with the Index at 7396.5.

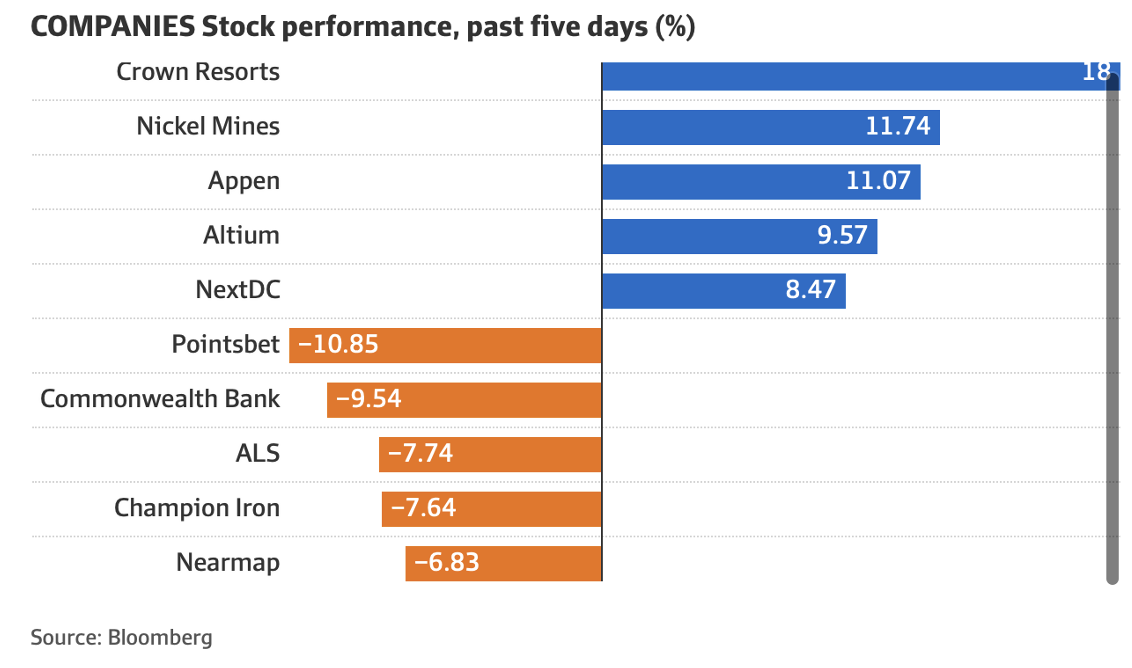

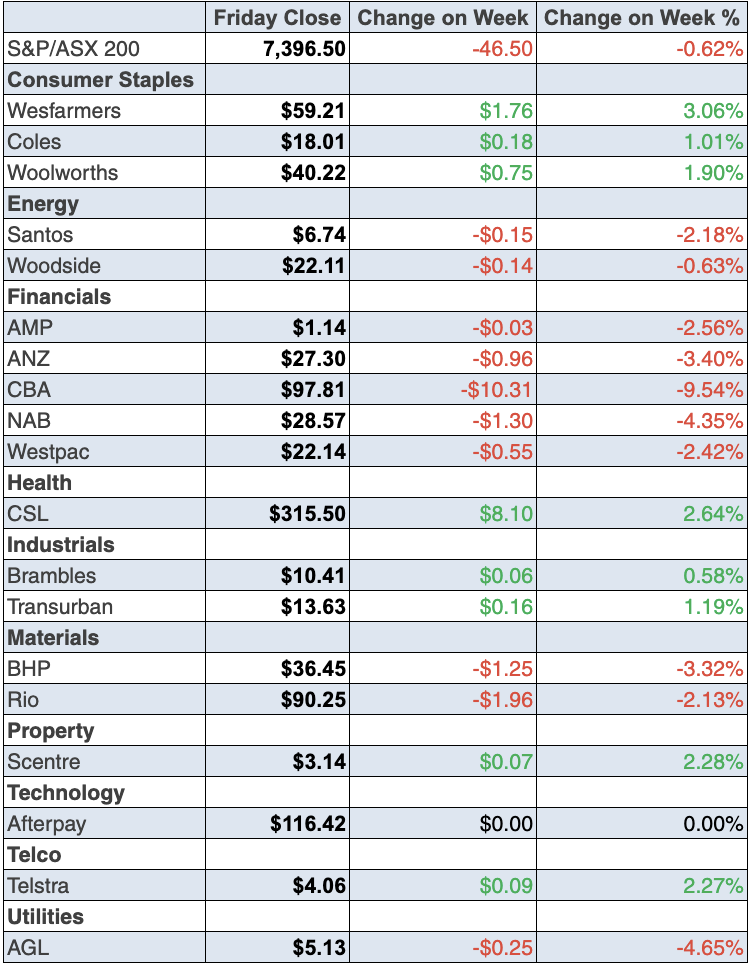

Here are the big winners and losers for the week. Who would’ve ever thought they’d see the CBA in the losers section? In fact, the analysts did, which I often pointed out in our Boom! Doom! Zoom! show and they still think so, with an average target price of $87.25! If that happens, I’d be a buyer but that’s a story for another day. The other banks copped it too, with Westpac down 2.55% to $22.14, NAB off 2.22% to $28.57 and ANZ 3.33% lower at $27.30.

Bluescope had a red week, down 0.91% (but I liked its Friday rise of 2.37%) and BHP lost for the week too, down 3% but rose 1.4% on Friday. RIO gained 0.83% and Fortescue 0.85% on Friday, despite headlines such as “Iron ore price falls to lowest in 18 months on dismal demand outlook” from the website mining.com. Weakening China demand is behind the current slide in iron ore prices. But the rise on Friday might suggest the future for iron ore is not as murky as the headlines infer.

The big winner was a pay-off for gamblers, with Crown Resorts up 16.57% on Friday after US-based Blackstone raised its takeover offer to $12.50 cash per share.

It was good to see Next DC rising 7.91% for the week with its CEO Craig Scroggie giving this financial year so far a thumbs up. And ELO was up 4.79% for the week indicating bargain hunters haven’t given up on tech stocks.

What I liked

- This from AMP’s Shane Oliver: “There were some more signs of easing bottleneck pressures over the last week but it’s a bit mixed: a surge in auto production in the US is consistent with an easing in the shortage of semiconductors; the number of containers on LA docks is down by 29%, and now the oil price has fallen 7% from its highs.”

- The main measure of wages – the Wage Price Index (WPI) – rose by 0.6% in the September quarter to be up 2.2% on a year ago – the strongest annual growth rate in 18 months. That’s what the RBA wants.

- National skilled job vacancies rose by 7.8% in October to stand at a 13-year high of 250,882 positions.

- The Conference Board leading index in the US rose by 0.9% in October (survey: 0.8%). The Philadelphia Federal Reserve manufacturing index lifted from 23.8 to 39 in November (survey: 24).

- US retail sales rose by 1.7% in October (survey: 1.4%). Industrial production rose by 1.6% in October (survey: 0.7%).

- The New York Empire State manufacturing index rose from 19.8 to 30.9 in November (survey: 21.2).

- Chinese retail sales and industrial production in October were both up on the previous month and ahead of market expectations. Retail sales rose 4.9% on the year, with production up 3.5%.

What I didn’t like

- The weekly ANZ-Roy Morgan consumer confidence rating fell by 2.8% – the most in 14 weeks – to 106. Confidence had hit 17-week highs in the previous week on optimism about the economic reopening, with double-dose Covid-19 vaccination rates over 80% in Australia’s south-east. The jump in unemployment from 4.6% to 5.2% was the main worry but I think this will be a temporary issue.

- Travel and casino groups fell in response to rising Covid-19 case numbers in Europe.

Good China news

I liked this from CommSec’s Craig James: “The second largest global economy had been losing momentum since April and the latest data arrests that decline – at least for the latest month, but base effects for the data still complicate analysis.”

If we want 2022 to be a good year for stocks, China needs to make an economic comeback and the virus had to be beaten. These are huge watches for stock-players for next year.

Shane Oliver also liked the Xi/Biden get together: “The Xi/Biden summit reached no major resolutions but at least it was a step in the right direction and the final part of both sides’ post-summit statements left the door open to future progress, which could include removing tariffs. There’s a long way to go though (and US public opinion is sceptical) but at least we are a long way from the tit-for-tat lose/lose escalation of the Trump years.”

I’d love to see economics trump politics, purely for stock price reasons!

The week in review:

- This week in the Switzer Report, I outline 3 stocks [1] that look to be in prime position for growth in 2022.

- Paul Rickard takes a deep dive into the hotly requested topic of the Westpac (WBC) share buyback [2] and whether you should accept it. This buyback comprises a higher than usual ‘capital component’ and proportionately lower ‘franked dividend’, with Paul crunching the numbers to ascertain which investors this would be suitable for.

- James Dunn explores the sector that always seems to be the flavour of the month, none other than buy now pay later (BNPL) stocks. He looks at four companies that are ripe for future growth, [3] including market favourites Afterpay (APT) and Zip Co (Z1P).

- It is quite apparent to everyone now that Covid-19 and the impending lockdowns have thrown a spanner in the works for many industries while allowing others to thrive, creating new normals for how we go about certain aspects of our lives in the process. One such industry to excel post-pandemic is edtech, or online learning. As such, Tony Featherstone gives his four edtech stocks at the top of the class. [4]

- In this week’s edition of “Hot” stocks, Managing Director at Fairmont Equities, Michael Gable shares his technical analysis on rare-earths mining company Lynas Corporation Limited (LYC) [5] and why it is currently sitting in a positive position.

- This week in Buy, Hold, Sell – What the Brokers Say, there were 11 upgrades and 10 downgrades [6] in the first edition, and 2 upgrades and 1 downgrade [7] in the second edition.

- In Questions of the Week, [8] Paul answers your questions on the Macquarie Group Share Purchase offer, Harvey Norman’s (HVN) dividend yield, falling share prices of Australian Finance Group (AFG) and Liberty Finance Group (LFG), and if Polynovo (PNV) is currently a high-risk investment.

- And in Paul’s third and final article [9] for the week, he considers whether Australia & New Zealand tech darling Xero can finally break through its infamous $155 barrier.

Our videos of the week:

- Fund Manager David Allingham reveals his hot small cap stocks + why house prices won’t fall 25% [10]

- Dr Ross gives a deep dive into the condition called frailty | The Check Up [11]

- 7 quality stocks with heaps of upside: XRO, DMP, A2M & more + how fund managers pick hot stocks! [12]

- When will Dr Phil start raising interest rates + will CBA profit keep the stock price rising | Mad about Money [13]

- Buyable stocks: Cleanaway, Qube, Healius & more; Will rates spike + Is Commercial Property a buy? [14]

Top Stocks – how they fared:

The Week Ahead:

Australia

Tuesday November 23 – Weekly consumer confidence index (November 21)

Tuesday November 23 – Markit purchasing managers’ indexes (November)

Tuesday November 23 – Speech by Reserve Bank official

Tuesday November 23 – Reserve Bank official on panel

Wednesday November 24 – Reserve Bank official on panel

Wednesday November 24 – Construction work done (September quarter)

Thursday November 25 – Business investment (September quarter)

Thursday November 25 – Weekly payroll jobs & wages (October 30)

Friday November 26 – Retail trade (October)

Overseas

Monday November 22 – China 1-year and 5-year loan prime rates

Monday November 22 – US Chicago Fed national activity index (October)

Monday November 22 – US Existing home sales (October)

Tuesday November 23 – Markit purchasing managers’ indexes (November)

Tuesday November 23 – US Richmond Fed manufacturing index (November)

Wednesday November 24 – US Federal Reserve meeting minutes (November 3)

Wednesday November 24 – US Economic (GDP) growth (September quarter)

Wednesday November 24 – US durable goods orders (October)

Wednesday November 24 – US goods trade balance (October)

Wednesday November 24 – US Wholesale inventories (October)

Wednesday November 24 – US Personal income & spending (October)

Wednesday November 24 – US new home sales (October)

Food for thought: “An investment in knowledge pays the best interest.” — Benjamin Franklin

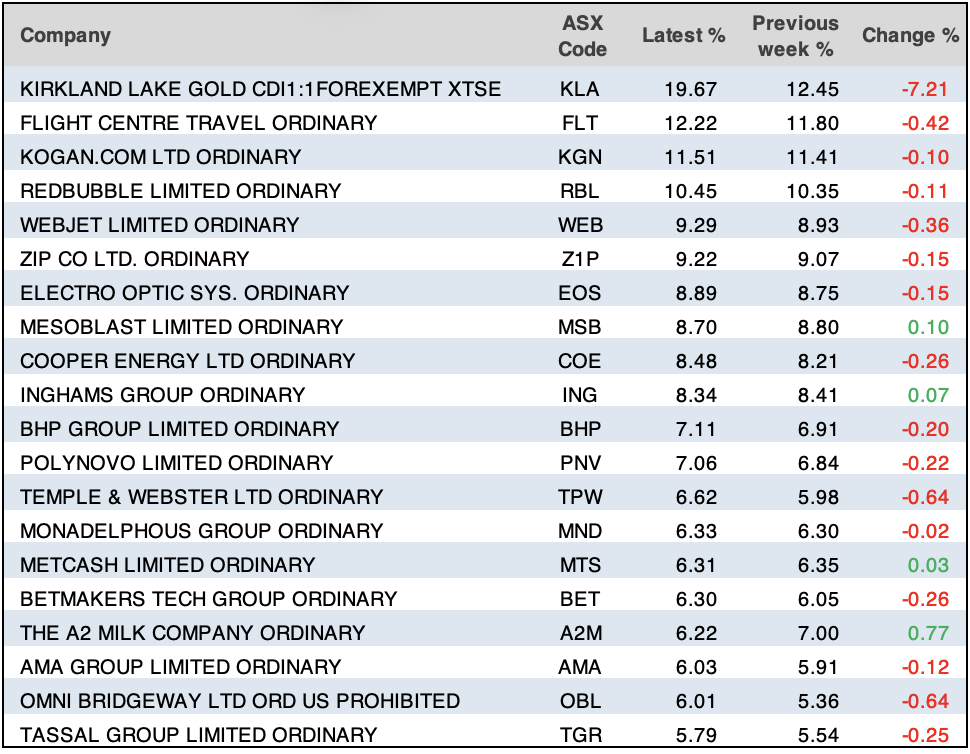

Stocks shorted:

ASIC releases data daily on the major short positions in the market. These are the stocks with the highest proportion of their ordinary shares that have been sold short, which could suggest investors are expecting the price to come down. The table shows how this has changed compared to the week before.

Chart of the week:

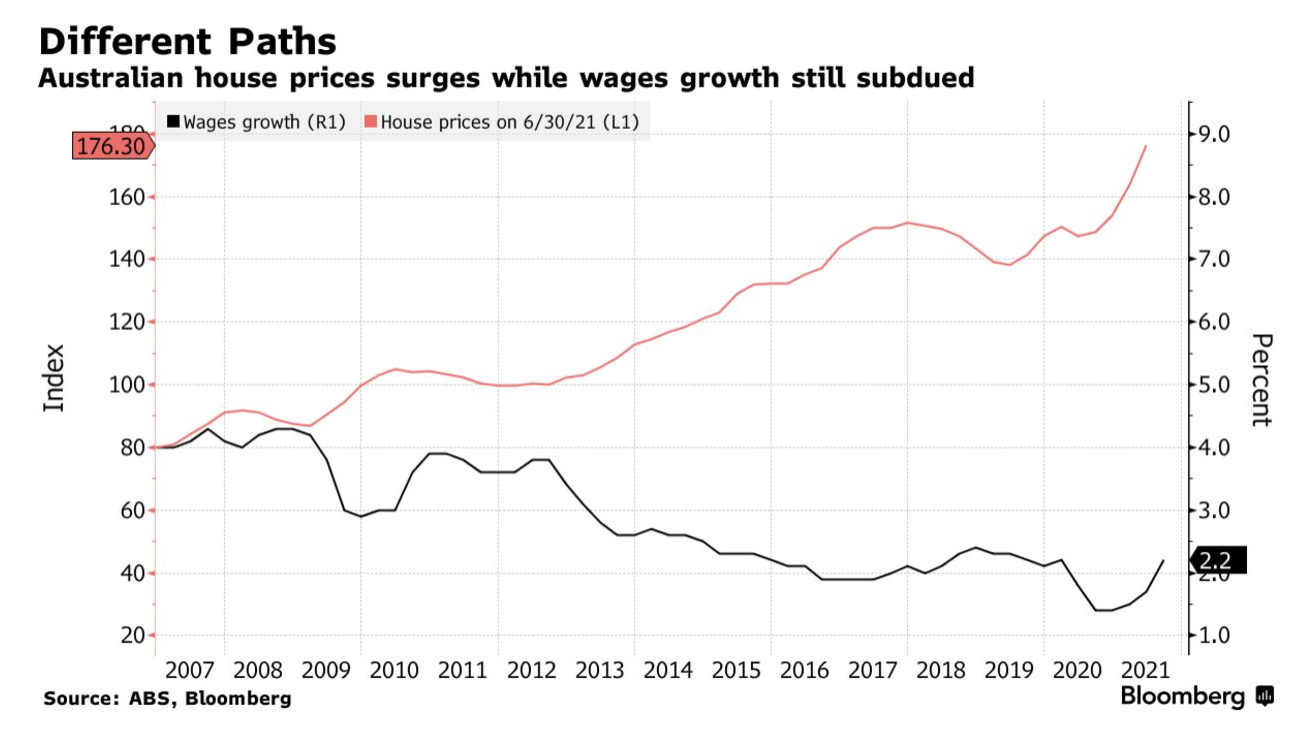

Our chart of the week is quite fitting given the laser focus on Australia’s booming housing market and the growing concerns over an imminent crash. A recent study from CoreLogic found that Australia’s booming property market has significantly outrun our real wages over the past two decades, driving up household debt. The property consultant’s head of research Eliza Owen says it “is because movements in wages and inflation will influence the cash rate, a key determinant of mortgage rates”. Reserve Bank Governor Philip Lowe said this week he would use wages growth as one of the “guideposts” to assess whether inflation is “sustainably” within the central bank’s 2-3% target range. Bloomberg reports that: “The RBA sees pay gains accelerating to 3% in about two years, from 2.2% at the most recent reading, opening the door to a potential rate increase in late 2023.

“CoreLogic’s research underlines the importance of wages for monetary policy given Australian households are highly leveraged, with the nation’s debt to income ratio among the highest in the developed world. That leaves home owners vulnerable to rapid and sharp rate hikes.”

Top 5 most clicked:

- 3 good stocks that look poised for growth [1] – Peter Switzer

- Should you accept the Westpac share buyback? [2] – Paul Rickard

- Buy now pay later stocks with growth ahead [3] – James Dunn

- Buy, Hold, Sell – What the Brokers Say [6] – Rudi Filapek-Vandyck

- 4 top of class edtech stocks [4] – Tony Featherstone

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.