On many occasions I have explained how I invest but possibly a new reader of one P.Switzer inquired what I mean when I say: “Buy quality companies, when the market is down and hold them for the long term.”

Using the Twitter platform Stu pondered what I actually mean when I say “for the long term.”

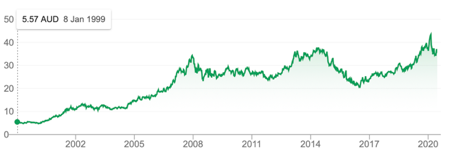

Stu tweeted his question with the following chart but I’m not sure why:

I can’t see the relevance of a volume chart but I can see why someone might look at the stock price showing a quality company such as CBA and wonder how long is this “long term” of which you speak and how long do I have to wait to make money?

Before looking at such a chart, let’s look at the Investopedia definition of the long term.

“Long term refers to the extended period of time that an asset [1] is held. Depending on the type of security, a long-term asset can be held for as little as one year or for as long as 30 years or more,” it explains. “Generally speaking, long-term investing for individuals is often thought to be in the range of at least seven to 10 years of holding time, although there is no absolute rule.”

I see the mid-term as 2 to 5 years. Anything less goes into the short term or very short term, which puts you in the “you’re trading and punting” class.

Let’s look at the CBA over these time periods

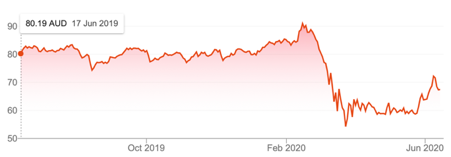

CBA short-term

The short-term player would have had a rotten experience of the CBA seeing its share price drop from $91 before the Coronavirus crash to a low $54.26 on March 23. That’s a 40% loss. However, since then, the stock in the very short term has rebounded to $67 so the gain has been 23%.

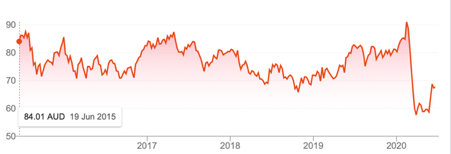

CBA medium term

And the story doesn’t improve that much over the medium term, which makes me happy I never say: “Buy quality companies for the medium term!”

But let’s get this in perspective. In 2015, the Government implemented restrictive measures on the banking system to make our banks’ balance sheets stronger, which cut into profitability. At the same time, APRA cracked down on lending to Asian property buyers and then, in late 2017, the Hayne Royal Commission was set up and we can see that this company and its rivals have faced a perfect storm of headwinds bordering on cyclones!

Certainly, if you only got into CBA over the past five years and had taken my advice and bought it on each serious dip, you would have a dollar cost average share price of about $70.

But over that time, you would have received about an 8% return via dividends and franking credits, which isn’t bad for a poor mid-term performer.

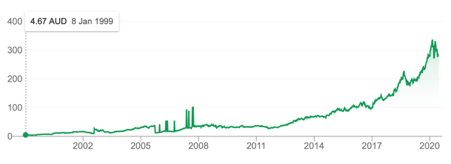

What about the long term?

Here the story well and truly endorses my view that you buy quality companies when the market is down, and you wait for the long term.

This chart says the CBA went as low as $28 in January 2009 but even if you had waited to mid-2009 and bought in at $40, your capital gain would be 67.5% and your most recent dividend yield was 10.7% plus franking!

With all of its externally–imposed problems, it still has been a good long-term investment.

And what if we selected a company that hasn’t had a constant run in with Government, such as CSL or Woolworths? Would they reinforce my argument that buying quality companies when they’re being smashed is a good investing idea?

CSL

Woolworths (WOW)

You don’t get rich in a day but daily. You grow your wealth by being invested in quality companies for the long term. I rest my case.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.