I’ve experienced some big changes at universities over the past few decades, having completed several postgraduate programs during that time.

Changes include the outsourcing of teaching to part-time lecturers; growth in online learning; higher fees (sigh!); and fewer students on campus.

No change is more significant – or important for ASX-listed education stocks – than the boom in international students.

In 2006, I recall taking a master’s degree with a handful of international students, some of whom have become lifelong friends. Today, it’s common for foreign students to dominate course numbers, at least at some universities.

At the orientation event for one master’s degree, I was the only domestic student in a class of 40. I chose another program, mostly because it was offered online, but also because I sought a more balanced student cohort between domestic and international students.

Do not read this column as yet another complaint about Australia’s surging population, high migration and international student numbers. I’ve taught many international students at university over the years and admired their effort.

Readers might have their own view on migration and its effect on infrastructure and rental markets. My focus is the share market and how growth in international students in Australia remains a long-term investment opportunity.

Namely, 725,582 international students took Australian courses in the January-August 2023 period, Federal Government data shows. That’s up 31% on the same period a year ago as student numbers rebound after COVID-19.

India (at 120,277 students) is just behind China (at 154,467) and likely to catch up ground as Australia’s trade relationship with India expands. India’s growth trajectory suggests many more Indian students studying in Australia.

Regulatory risks are rising. A backlash to migration levels amid a housing crisis, visa changes and levies on international student fees are some risks. International education can be a volatile industry, as the COVID-19 experience showed.

Longer term, I can’t see growth in international education in Australia slowing too much. Right or wrong, some universities can’t survive without international students. Moreover, growth in developing nations for university education – and migration to advanced economies – are tailwinds.

Growth in international students will, in turn, underpin demand for English-language testing and student-placement services for decades. Universities and vocational colleges will need to source more students and students will need to pass English-language requirements to gain entry. It’s a great business model

Here are two ways to gain exposure to growth in international students studying in Australia and demand for English-language testing services:

- IDP Education (ASX: IEL)

Long-term readers of this column know IDP has been a preferred stock of mine for many years. At a Switzer event some years ago, I recall being asked on stage to name which stock I would buy if I could only buy one. The answer: IDP.

IDP’s performance justified that view. The stock has a five-year annualised return (including dividends) of almost 21%. However, after soaring gains until late 2021, IDP has had a flat few years as the market digests its growth.

Chart 1: IDP Education

To recap, IDP is a global leader in education services. The $6.5-billion company provides English-language testing and teaching, and student placement services.

English-language testing contributed almost two-thirds of IDP’s FY22 revenue. IDP part-owns IELTS (the International English Language Testing System), which is one of the most widely used and accepted tests for English proficiency.

Student-placement services provide about a quarter of IDP’s revenue (the company also offers digital marketing services and events). Student placements, particularly from India, have boosted IDP’s growth profile. Universities in Australia, the US and Canada are enrolling more Indian students.

Despite this growth, IDP is down from a 52-week high of $32.02 to $23.38, as Chart 1 above shows. The stock traded at almost $40 in late 2021.

Why the fall? It’s partly due to rising competition in English-language testing services and a slowdown in student-placement services. Predictably, student placements took a hit during COVID-19 and took a while to recover.

Management changes at IDP and concerns about visa processing in Canada (and its effect on demand for Indian students to study in Canada) also added to market hesitation in IDP’s valuation. After soaring gains in 2021, IDP was priced for perfection, meaning it didn’t take much bad news to knock the share price.

IDP’s recent growth in placement services and IELTS tests is encouraging. At its AGM in October, IDP said it helped enrol students into 84,600 courses in FY23, a 53% increase on FY22. Australia remained IDP’s largest market and its Canadian, UK and US businesses had record student enrolments.

On IELTS, IDP administered a record 1.93 million tests in over 80 countries in FY23, up 1% on a year earlier. That’s slow growth but heading in the right direction again after COVID-19 disruption. The rollout of IELTS tests online to more than 50 countries in FY23 bodes well for growth and efficiency gains.

I suspect the market is underestimating IDP’s potential in data. Administering almost 2 million IELTS tests in a year and placing tens of thousands of students creates a lot of valuable data on international education. This data, and the algorithms that analyse it, are lifting conversion rates for students who seek IDP’s services.

IDP’s current price of $23.38 compares to a consensus price target of $27.25, based on 12 analysts. IDP is no screaming buy, but the business is high quality, well run and has a formidable position in a long-term growth market.

If you expect the international student boom in Australia to roll on, albeit with occasional volatility, IDP is the best way to play the trend.

- NextEd Group (ASX: NXD)

Formerly known as iCollege, NextEd reinforces the volatility in education providers that rely heavily on government policy.

NextEd is one of Australia’s largest private education providers with over 25,000 students annually via nine campuses and 16 recruitment offices worldwide.

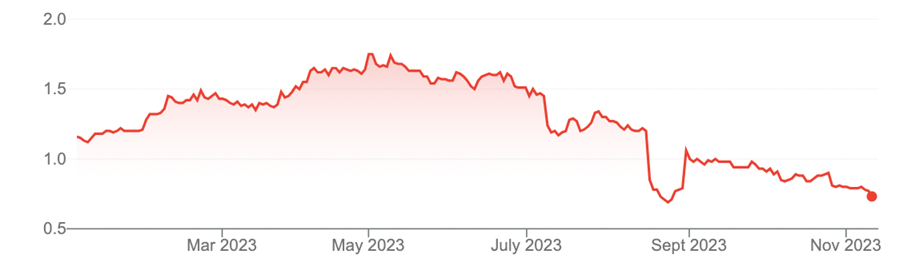

NextEd has had a tough year with a year-to-date return of -36%. The stock is down from a 52-week high of $1.86 to 70 cents.

A Federal Government crackdown this year on the visa system for international students and the closing of some loopholes crunched NextEd’s share price.

The government’s ‘temporary COVID-19 408 Visa’ provides onshore non-residents – including previous student visa holders – unlimited working rights for 12 months without needing to study. Holders of this visa soared fourfold on a year ago.

NextEd estimated that the visa change would cost its industry over $700 million. NextEd expected the 408 Visa to remain in place for all of FY24 and said the change on its earnings was hard to quantify.

In October, NextEd said the effect of the 408 Visa extension was subsiding and that student retention is trending in the right direction. After an almighty regulatory hit, NextEd appears to be stabilising its operation.

As a $155-million micro-cap, NextEd suits speculators. Many risks for NextEd remain as it recovers from the shock to its business this year.

Also true is the market’s propensity for vast overreaction when bad news hits small stocks, particularly sudden regulatory change that is hard to quantity. It’s the old story: sell first and worry about the facts later.

I note some fund managers who are good judges of small-cap stocks have recently increased their holding in NextEd, capitalising on its price fall.

Buying into bad news – when nobody wants to know a stock – can be rewarding, but it takes conviction, patience and high-risk tolerance. NextEd is one for small-cap speculators to watch at these levels. Micro-caps can fall further and stay down for much longer than investors might expect, in this market.

Chart 2: NextEd Group

Source: Google Finance

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal investment advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 15 November 2023.