I am a big believer in running a portfolio of individual shares to manage wealth, particularly when it comes to Australian shares. The tax drivers (franking credits, off-market share buybacks etc), plus the opportunity to participate in capital raisings, plus the fact that the Aussie market is relatively concentrated and finally, a sense of “I know what I am investing in” lead me to the conclusion that I can do better than a boring, passively managed index-tracking exchange traded fund (ETF).

But I recognize that ETFs work for some investors, particularly those that don’t enjoy the hassle of managing individual shares, and when it comes to the global universe of shares, you can invest in ETFs that offer the potential for outperformance. Further, the whole ETF category has expanded with “active ETFs” where the manager picks stocks and actively manages the portfolio.

A popular method of portfolio construction is the ‘core and satellite’ approach. Designed to minimize costs and volatility, it provides the opportunity for market outperformance.

Typically, the core consists of positions that will provide market performance at low cost and below or at market levels of risk. Index tracking ETFs are ideally suited for this, but they can comprise a portfolio of “blue-chip” and other relatively low beta stocks. The core is always more than 50% of the portfolio and can be as high as 85% to 90%.

Additional positions, known as satellites, are added to the portfolio. The aim is to generate above-market performance (with obviously an above market level of risk). Actively managed ETFs, thematic ETFs, sector ETFs or country ETFs are well suited to this. If the portfolio comprises individual stocks rather than ETFs, this is where you add the higher growth/more speculative/ higher risk/ higher beta stocks.

A ‘step by step’ guide to creating a portfolio for market outperformance

Firstly, I am going to create a portfolio for total share market exposure – Australia and overseas. I could potentially do a ‘core and satellite’ on just Australian shares or just overseas shares, but many of the thematic opportunities are global, so I think it makes sense to combine.

I am a growth investor so my allocation to Australia will be about 50% to 55% and my allocation offshore will be 45% to 50%.

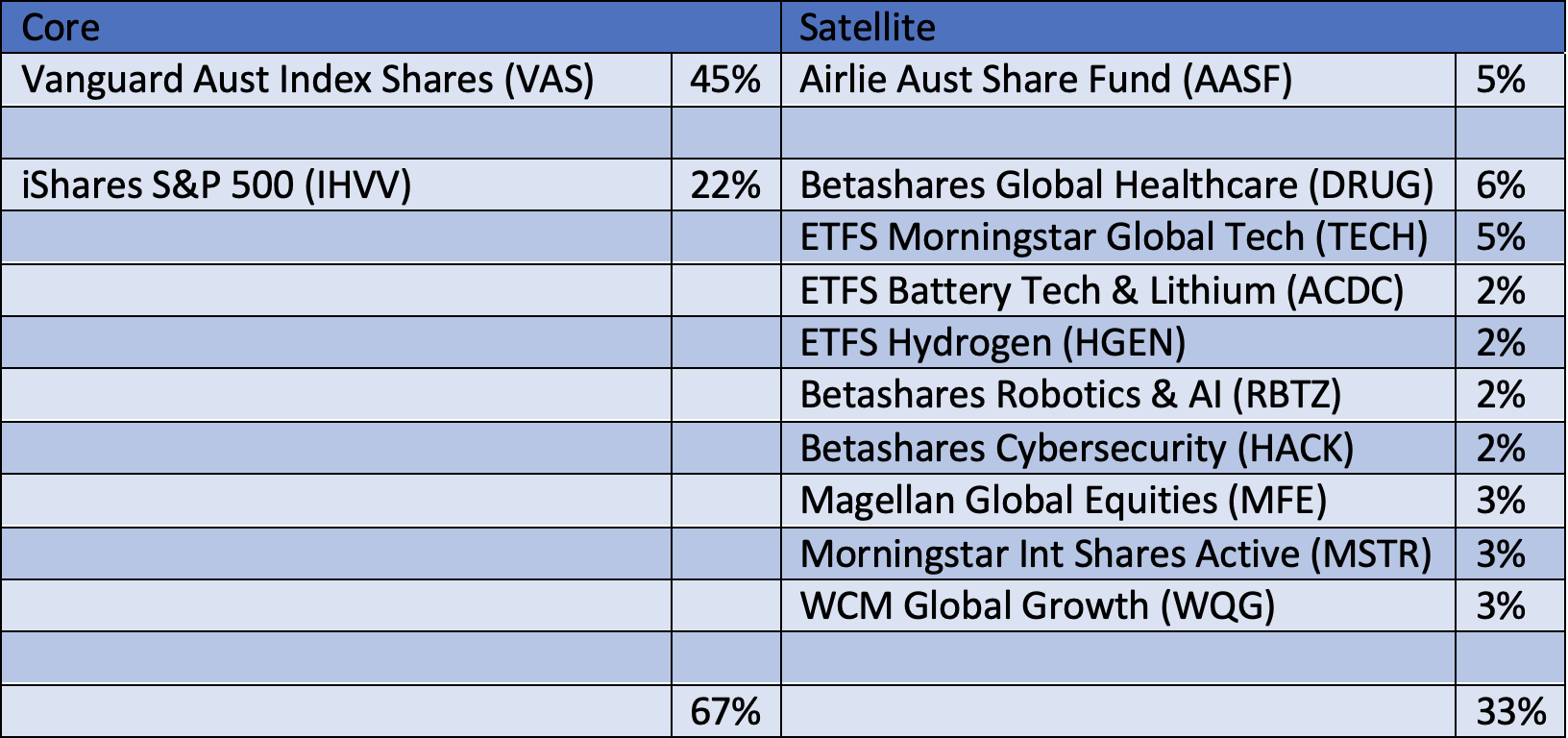

For the ‘core’ Aussie, I will invest in Vanguard’s Australian Shares Index ETF (VAS) with a weighting of 45%. VAS tracks the S&P/ASX 300 and with management fees of just 0.10% pa, is very low cost.

For the ‘core’ overseas component, I have selected the currency hedged IHVV from iShares. It tracks the US S&P 500. Management fee is a respectable 0.10% pa. Weighting 22%.

I could have selected a fund tracking the global share market, such as Vanguard’s MSCI International Shares Hedged ETF (VGAD), but my instincts tell me to stay with the “lead” market. In the satellite, there will be more opportunity for “country” risk, with active managers and thematic ETFs investing globally.

That means the core has a weighting of 67%. The satellite will be weighted at one-third or 33%.

Now to the satellite. If I think about growth and megatrends, three that continue to stand out are digitisation, the “green economy” and health care. The latter is driven by an ageing population in the west, technology and growing demand for treatments/therapies and investment by Governments at a rate above the normal GDP growth rate.

With digital disruption, this translates into seeking an over-weight investment in technology, including areas such as artificial intelligence, robotics and cyber security. Potentially “industries of the future”. The “green economy” includes renewables and EVs/batteries.

The ETFs that invest in these “megatrends” are global in orientation because the companies are competing in a global marketplace.

I am going to consider the following:

- For the healthcare overweight exposure, BetaShares Global Healthcare ETF – currency hedged or DRUG at 6%. This tracks an index of the world’s leading healthcare companies, excluding Australia;

- For my broad tech overexposure, the ETFS Morningstar Global Technology ETF or TECH at 5%. This is a quasi “active” ETF, with Morningstar screening companies according to their “moat methodology” and “fair value”;

- For exposure to “industries of the future”/technology/renewables etc:

- ETFS Battery Tech & Lithium ETF or ACDC at 2%;

- ETFS Hydrogen ETF or HGEN at 2%;

- Betashares Global Robotics and Artificial Intelligence ETF or RBTZ at 2%;

- Betashares Global Cybersecurity ETF or HACK at 2%;

- For active investment management overseas, I am going to take exposure through three managers:

- Magellan Global Equity Fund (Currency Hedged) or MFG at 3%;

- Morningstar International Shares Active ETF or MSTR at 3%;

- WCM Global Growth or WQG at 3%

- For active investment management in Australia, the Airlie Australian Share Fund or AASF at 5%. This fund is led by John Sevior, Matt Williams and Emma Fisher.

To recap, here is my ‘core and satellite’ portfolio, with the ‘core’ at 67% and satellite at 33%. The Australian exposure is a touch over 50% as some of the thematic ETFs include Australian companies:

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.