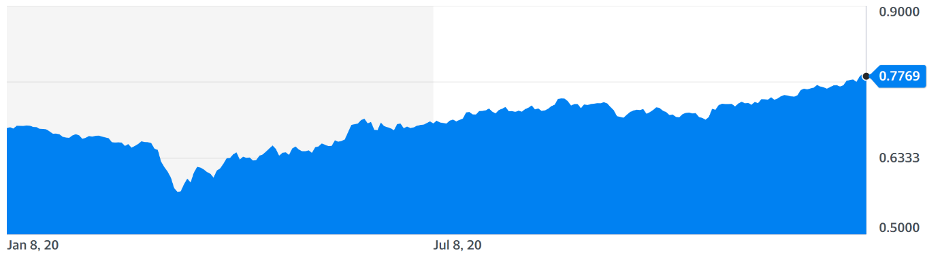

One of the major investment themes of 2020, which has continued into 2021, has been the rise of the Aussie dollar.

Since hitting a low of just under 58 US cents in late March, the Aussie dollar has risen by almost 35%, last week briefly touching 78 US cents.

Australian $ vs US $ – last 12 months

Driving the rise of the Aussie dollar have been two powerful forces. Firstly and most importantly, the ongoing weakness in the US dollar as investors fear a debasing of the currency with the US Federal Reserve and US Government providing massive monetary and fiscal support to the US economy. Secondly, with prospects for global economic growth improving, commodity prices have been rising. Arguably, Australia is seen to have handled the Covid-19 crisis better than many other countries, and this has also lent support.

We have been warning about the rise in the Aussie dollar for more than six months. Last July, we reviewed which sectors and stocks would be impacted by a stronger currency (see https://switzersuperreport.com.au/if-the-aussie-dollar-keeps-rising-which-stocks-could-be-trashed/ [1]). At the time, the dollar was around 72 US cents and our expectation was the Aussie dollar could hit 80 US cents over the next 12 months.

While the recent run-up has been quicker than expected and a period of consolidation is possible, the “trend is your friend” and I continue to expect the currency to move higher.

Here are 5 strategies to reduce the impact on your investment portfolio of an appreciating currency.

1. Hedge currency risk on offshore investments by switching into hedged products

Unless you have millions of dollars to invest and arrangements in place with your bank, practically speaking, you cannot hedge currency exposures. However, you can invest in currency hedged products (funds) and depending on the product, switch from an unhedged version to a currency hedged version.

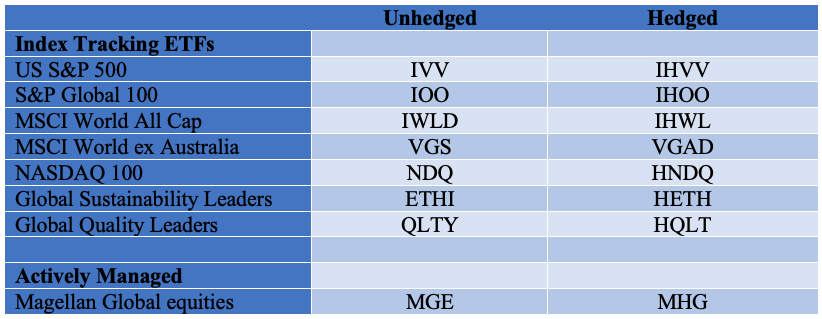

Many of the index tracking exchange traded funds (ETFs) offer currency hedged versions. For example, the biggest international shares ETF listed on the ASX, iShares IVV which tracks the US S&P 500 index, offers a currency hedged version, IHVV. If you hold IVV and want the currency hedged version, you will need to sell IVV and buy IHVV. Apart from marginally higher management fees in IHVV, the products are otherwise identical.

Of the active managers, Magellan offers a currency hedged version of its core Magellan Global Equities Fund, MGE. This trades under the ASX code of MHG.

The table below shows unhedged and currency-hedged versions for the major ETFs and ASX quoted active managed funds.

In fixed interest, several providers offer as standard hedged products (which give access to credit and volatility risk, but not foreign exchange risk). VIF (Vanguard International Fixed Interest Index Fund) and VCF (Vanguard International Credit Securities Index Fund) are automatically hedged back into Australian dollars. iShares also has two hedged ETFs: IHCB (iShares Core Global Corporate Bond) and IHHY (iShares Global High Yield Bond).

2. Reduce exposure to offshore index ETFs – consider actively managed funds

A rising Aussie dollar will impact on the performance of unhedged index hugging exchange traded funds. While this is also true for actively managed funds, some managers will seek to mitigate in part the foreign exchange risk.

Further, managers who bias stock selections to companies that earn revenue from global operations rather than the US domestic economy won’t be as badly impacted because they are less exposed to a weakening US dollar.

3. Consider investing in emerging markets

I have never been a huge fan of investing in emerging markets, but if the US dollar continues to weaken, emerging markets should be beneficiaries.

4. In Australia, pullback on exposures in some sectors

I outlined the impact on Australian stock sectors of a rising currency in https://switzersuperreport.com.au/if-the-aussie-dollar-keeps-rising-which-stocks-could-be-trashed/ [1] . Unfortunately, some of the biggest losers are some of Australia’s best companies, most particularly in the healthcare and non-ferrous materials areas. These include companies such as CSL, Cochlear, Resmed, Sonic, Ramsay, Amcor, James Hardie, BlueScope, Aristocrat and Macquarie.

From experience, I am very mindful of selling “great” companies in a bull market, so outright sales should be approached with caution. It could be a case of selective trimming, and further, resisting the temptation to invest more in these companies if the price stalls.

There will also be some winners from a rising currency, but they will be well and truly outnumbered by the losers. Winners will include discretionary retailers of electronic goods, furniture, homewares and appliances (JB Hi-fi, Harvey Norman, Nick Scali, Wesfarmers, kogan.com) and importers of luxury goods and motor vehicles (e.g. Eagers Automotive).

5. Be patient – there could be some great buying opportunities offshore

If the Aussie dollar continues to rise, there could be some great opportunities to invest offshore. One of my big investment “regrets” was not buying New York or London property when the Aussie dollar busted through parity during the commodities boom of 2010/2011. It subsequently peaked at over 110 US cents.

I work on the basis that the long run “true” value of the Aussie dollar is in the 70 US cent to 75 US cent range. To be materially overweight offshore and take on this risk, I want to see the Aussie dollar well outside the range. This might take years or not even happen this time around – so patience will be required.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.