My colleague James Dunn did a cathartic evaluation at what he has learnt and not learnt quickly enough about investing. Peppering his walk down stock-buying lane were stats on how so many companies come and go, taking investors’ money with them.

The big takeout message was summed up by James in this paragraph: “In other words, all that we have come to think of as “the return from the share market” – that is, about 10% a year for nearly the last century in the US, as measured by the S&P 500 index, and about 11.7% a year for the S&P/ASX 200 index and its predecessors – actually comes from an extremely narrow group of stocks. The ‘survivor bias’ is huge.”

Anyone who has been a regular reader of my market education pieces and the work of my colleague Paul Rickard, knows we have a healthy respect of blue chip “survivor” companies. In fact, I’ve advised young investors who’ve asked me for a stock tip, to wait for a market crash and buy the best companies then.

If you can’t wait for a crash, then buying quality names when they are temporarily out of favour is a great watch -and-pounce strategy, which worked in 2023. Let me recap some great companies that rewarded those who kept the faith and went long last year.

1. CSL: dropped from $313 to $230 but is now $289.

2. XERO: started 2023 at $73.85 and is now $114.

3. Resmed: low of $21.44 in September and is $26.39.

4. Macquarie: low of $158.53 in November and is $183.28.

Sure, if you got in early or late you might not have the greatest of stories with the above stocks but if you went for MQG at $170, you could have bought at $158 to dollar cost down your overall average cost.

If you lack confidence in picking stocks, you could have used the same watch-and-pounce play for the overall S&P/ASX 200 or the 300 index via the Vanguard Australian Shares Index or VAS.

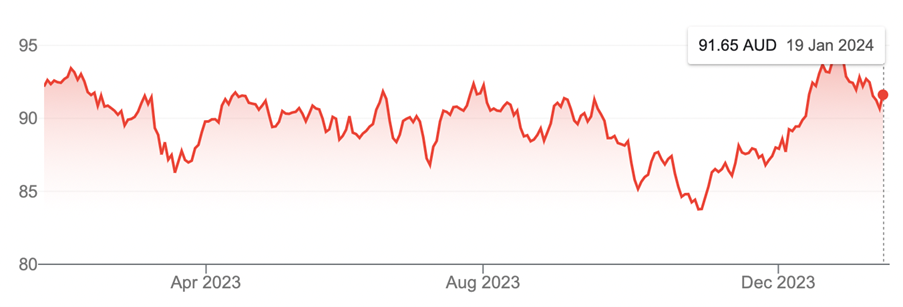

Vanguard Australian Shares Index (VAS.)

You could’ve bought this around $86 five times over 2023 before it fell to $83.77 but given it’s now $91.65, playing it safe with a quality ETF could have netted you around 7% before a 4% dividend, so let’s throw in franking credits and call it 12%!

James Dunn is right to warn about investing in companies that go nowhere over time, but some can be useful for making money from speculative plays.

A risk averse investor could put 90% in dividend-paying funds (such as VAS, the Vanguard High Yield Fund or even the Switzer Dividend Growth Fund) but allocate 10% of a portfolio to speculative plays.

For example, while ZIP has been a bad long-term hold, those who bought it at 26 cents last year in October, have now made 146% in a little over three months.

And those who bit the bullet on Tyro at 95 cents in June or 86 cents in October last year have made 9% or 21%, depending on when they bought. Also, if they took profit at $1.44 in September, they could have made 51% or 67%!

These sorts of speculative plays can add oomph to a nice 12% made up of a reliable, blue-chip portfolio or a quality ETF for the overall index.

To avoid being the kind of investing casualty that James worries about, you need to set your core portfolio for quality dividend players. Then you need to be on the lookout for quality companies that are temporarily out of favour with market influencers, just like CSL was, and that’s when you should be a buyer.

And if have a quality core portfolio and add other quality companies when they’re cheap, and then speculate on lesser quality companies that have potential but have really been smashed, you can really add some alpha to your overall returns.

Clearly, I see it as our job to remind you when quality companies are cheap. Historically I think we’ve been pretty good at doing exactly that.

What’s the quality company that now looks cheap? I reckon it’s Telstra. The consensus view of analysts see a 10% rise but Morgan Stanley thinks 19.65% is possible. And don’t forget TLS is a good dividend payer.

And what about a speculative stock?

I go for Chalice Mining, where the consensus view is 247% higher, while Bell Potter sees a 404.67% gain out there! This is a real gamble play, which means you have to go into this one knowing you could lose, or you might have to wait for a pay-off. The current price is $1.07, and the consensus target price is $3.73.

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.