Last week’s market rally gave me the chance to catch my breath. I’d been sitting on the sidelines throughout September’s intense volatility and market dive, holding my breath and waiting for the recovery. Some of my stocks fell sharply – the so-called high beta stocks. These stocks tend to go up and down faster than the overall index. I knew that. So while I didn’t like it when they fell, I also wasn’t tempted to overreact and dump them.

Readers might recall my column two months ago where I wrote that I had just sold some stock in my super fund ‘just in case’ I needed cash to pay my pension (read, Special Feature: How I handled last week’s dive [1]). Well, that moment arrived at the end of September. I needed some cash, but I didn’t need to sell any stock to pay my pension at the market low because I had planned for an event of some sort.

Thankfully, my dividend cheques had also started to arrive, further helping my cash position. I normally like to hold 1-3% in cash in my SMSF and I’m now in the middle of my comfort range.

The research question I’m now focused on is whether the market has overreacted to the European debt crisis in September. Stocks became very cheap last month – many were about the same multiple (price-to-earnings ratio) as at the bottom of the market in 2009. Yet, companies are generally more cashed up now compared to 2009 and earnings growth outlooks are strong, if not stellar.

Against this backdrop, I’ve been paying a lot of attention to the relativity between the US and Australian stock markets.

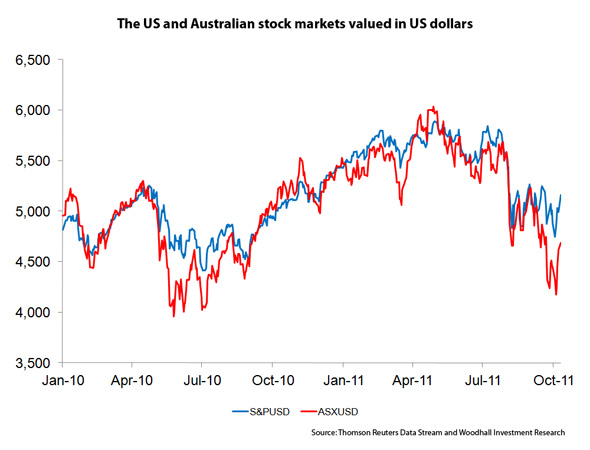

For 22 months or so from the start of 2010, our market lagged the S&P 500. But, when I convert our market index into US dollars (to compare apples with apples) the two indexes moved very closely together (when scaled properly) as you can see in this chart.

[2]As you can see from the chart, the Australian market was relatively cheap compared with the US market at two periods over the past year. The first disturbance in this otherwise stable relationship was for a month or two near the middle of 2010 when the mining tax was first put on the table.

[2]As you can see from the chart, the Australian market was relatively cheap compared with the US market at two periods over the past year. The first disturbance in this otherwise stable relationship was for a month or two near the middle of 2010 when the mining tax was first put on the table.

The second was in the middle of September, when something happened that I can’t (yet) explain. Our market became so cheap relative to the US that I believe we will have a stronger bounce back over coming weeks.

Of course, I have to consider the possibility that my theory – that foreigners are buying the Australian market as a hedged outcome (that is, valuing our market in US dollars) – might have broken down.

As I have no spare cash at present, I’m not in a position to buy, but I would otherwise have been tempted. I was happy buying BHP Billiton (BHP) at $38.40, Rio Tinto (RIO) at $70.01 and Boart Longyear (BLY ) at $3.02 between the August and September dips and would do so again if I had the cash on hand at these slightly lower prices today.

Of course, I would have preferred to buy these stocks (and others) at these lows. But, in a few weeks, I suspect I will still be sitting on some modest profits from these stocks.

Last week’s jobs data in the US was much stronger than analysts expected, and European leaders are at last getting their act together by addressing the region’s sovereign debt problems. These events are good news and I’m eagerly awaiting the ride up in stock prices.

I’m also working on setting target prices for all of my stocks to note at which point I will start taking profits. I wrote about this strategy previously when I sold Lynas (LYC) on the way up.

Without a plan, I might sit and hold onto a company for too long. A correction of some magnitude is bound to happen time and time again; such is life in the equity markets. By taking some profits from time to time, I might again be able to get through future dips without trading at the bottom – it’s called managing risks.

Woodhall Investment Research Pty Ltd

ABN 17 141 486 160

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.

Also in the Switzer Super Report

- Peter Switzer: Will Europe ruin this year’s Santa Claus rally? [3]

- Tony Negline: How to develop vacant land using your SMSF [4]

- Charlie Aitken: Why Australians have lost control of share prices [5]

- Alistair Bailey: Contemporary art prices lead auction recovery [6]