The biggest disconnect in the Australian equity market continues to be the performance of iron ore producers versus the spot price of iron ore. While many commentators continue to forecast an imminent iron ore price collapse, as they have for three years, the supply and demand facts simply don’t support that theory, and neither does the resilience of the spot iron ore price.

September was the month of total global market and economic dislocation; rumours swept the brittle equity markets that China had turned away iron ore shipments, a couple of global brokers put out ‘scare-broking reports’, and most iron ore equities fell 30%-50%. Short sellers (who make money on an asset’s value falling) had an absolute field day, most likely dragging other less willing sellers in as share prices tanked.

However, we have now had four pieces of factual information about iron ore demand and supply in September and that information tells a very different story:

- The Port Hedland Port Authority reported record shipments in September (BHP, FMG and AGO ship from Pt Hedland).

- Rio Tinto reported a quarterly iron ore production record of 60mt, saying they “can sell everything they produce”.

- BHP paid record leasing rates for large capesized vessels on the Port Hedland-China route.

- Chinese customs data showed that iron ore imports for September were up 2.5% from the previous month and 15.5% from a year earlier – not exactly a “collapse”. Further, the September number of 60.57mt was the highest raw China import number since January.

There is simply no factual evidence of any slowdown in demand for iron ore in China. It’s that simple.

It’s exactly the same situation as the sell-off in Macau casino stocks last month; they were pounded on fears of a revenue slowdown only to experience a V-shape recovery on factual data showing a 13% increase in tourists to Macau in September. Ditto for luxury goods vendors with perceived China leverage (like Burberry).

To me, it seems all the China bears – most of whom have never been to China – all just top-down short Australian iron ore stocks, Macau casino and luxury goods retailer stocks whenever they are jumping at Chinese slowdown shadows. They are the classic example of ‘short the rumour, short cover the fact’.

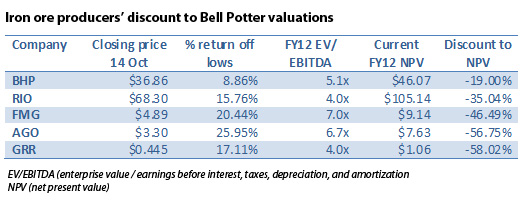

While Australian iron ore equities have recovered somewhat from the grossly oversold and over-shorted levels of early October, the table below shows you the discount to our medium-term conservative valuations for each current iron ore producer.

[1]These iron ore producers remain ridiculously cheap, heavily shorted and in the mid-cap space, and highly vulnerable to China Inc based takeover offers. Even big, safe, strong, cash rich BHP Billiton is trading on a 20% discount to our financial year 2012 net present value (NPV). There’s nothing surer in my mind that over the next few months as the world gets over ‘Euromess’ and works out where growth really is (East), that all these stocks above will start aggressively closing the gaps between share prices and NPVs.

[1]These iron ore producers remain ridiculously cheap, heavily shorted and in the mid-cap space, and highly vulnerable to China Inc based takeover offers. Even big, safe, strong, cash rich BHP Billiton is trading on a 20% discount to our financial year 2012 net present value (NPV). There’s nothing surer in my mind that over the next few months as the world gets over ‘Euromess’ and works out where growth really is (East), that all these stocks above will start aggressively closing the gaps between share prices and NPVs.

Fortescue Metals Group (FMG) – Buy

Fortescue is undertaking a rapid expansion to 155Mtpa that we do not believe is being priced in by the market. Progressively meeting the milestones for increasing production should see the stock rerate. Fortescue is relying on cash flow from operations to fund its expansion, which increases the financing risk. If prices stay at current levels, the financing plan remains robust. Under a worst-case scenario, the Solomon (60Mtpa) component of the expansion can be delayed and funded when cash allows. If we assume that the 5th berth is not approved, and the ultimate production level does not exceed 140Mtpa, our valuation for that level is $7.56 a share, which still well above the current share price. We have maintained our ‘buy’ rating, albeit with a slightly lower target price of $9.11 a share, assuming that the 155Mtpa level can be achieved.

Super Retail Group (SUL) – Accumulate

We’ve downgraded Super Retail Group (SUL) to ‘accumulate’ after it announced this week that it is acquiring Rebel Group from Archer Capital for total consideration of $610 million (pre acquisition costs). The growth dynamics of the recreational market remain robust and the strategic fit with Super Retail’s existing leisure business makes sense. However we believe the price paid is not a bargain at this point in the retail cycle. Structural changes in the retail sector (online retailing) will also impact Rebel Sports product offering. This increases the risk profile of the group. We back management who have a solid track record, however we’ve revised our target price to $6.46 from $7.07, pending further clarification from management.

Telstra Corporation (TLS) – Buy

Shareholders have voted in favour of the National Broadband Network deal. We view this as a critical step towards a major rerating event given the regulatory certainty it provides. The four key benefits from the deal are: a more stable regulatory ; $11 billion compensation; sustainable free cash flow in the medium term environment (which will help it maintain its 28 cents per share fully-franked dividend); and greater strategic flexibility for opportunities in a NBN world. We expect Telstra to rerate if it passes the final hurdle – the ACCC approval of the structural separation undertaking. We also estimate that TLS can buy-back 4% of issued shares per annum over the next eight to 10 years. We reinforce our ‘buy’ rating with a share price target of $3.55.

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.

Also in the Switzer Super Report

- Peter Switzer: It’s just like punting on horses [2]

- Paul Rickard: Do Woolworths’ hybrid notes offer good returns? [3]

- JP Goldman: Which Aussie index ETF is best? [4]

- Tony Negline: Should you have income protection insurance? [5]