One of Sydney’s most famous conditioners, Les Motto, used to say to us as he flogged us in his gym: “When the going gets tough, the tough get going.” Over the years I’ve twisted this inspirational motivator so I say, “when markets sell-off, the smart get ready to buy.”

Now I’m not saying buy now because I suspect the failure of Silicon Valley Bank is bound to spook markets for a while. Eventually, the real threat to other banks in the US system will become clearer and the value-hunters will go on a buying spree.

Am important sideshow for stocks this week will be Tuesday’s US Consumer Price Index number. If the core rate of inflation increases by more than 0.4%, the share market will have a double reason to sell off. However, if the better-than-expected hourly wage rise data, which showed in last Friday’s Jobs Report for the US in February, helps lower inflation, then the thinking will be that the Fed might be closer to the top of its rising interest rate program, and that will be good for market optimism.

You might be wondering how vulnerable the US banking system is and whether this could be the making of a new GFC-style crash. To be honest, I have the belief that US banks are in pretty good shape but I was more upbeat when I read this about the banking system from hotshot economist, Mark Zandy — the respected economist from Moody’s. “The system is as well-capitalised and liquid as it has ever been. The banks that are now in trouble are much too small to be a meaningful threat to the broader system.”

Sure, this outfit didn’t cover themselves in glory before the GFC but I doubt whether their brand could suffer a double debt assessment disaster.

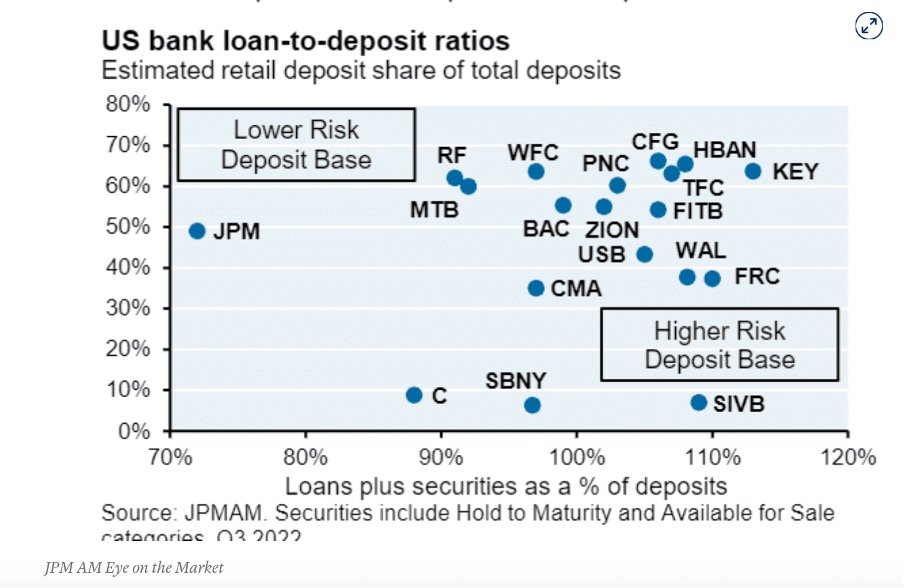

Fortunately, not many US banks courted a potential disaster as SVB did, as this chart shows.

Like the high-risk customers, it has courted over the years, its banking business model left it open to this untimely end. SVB’s heavy reliance on corporate deposits (rather than retail) and high percentage of assets held in loans and securities, made it unusually risky compared with other banks.

“SVB was in a league of its own: a high level of loans plus securities as a percentage of deposits, and very low reliance on stickier retail deposits as a share of total deposits. Bottom line: SVB carved out a distinct and riskier niche than other banks, setting itself up for large potential capital shortfalls in case of rising interest rates, deposit outflows and forced asset sales,” said Michael Cembalest, who is J.P. Morgan Asset Management’s chairman of market and investment strategy.

Already the Fed is getting advice to stop raising rates. Given the uncertainty from this event, it makes perfect sense. A bank failure shocks consumers and businesses, even more than eight interest rate rises in 12 months!

What I found intriguing was that as the non-banking world worried about SVB’s demise and the banking system, Wells Fargo bank (one of the USA’s biggest banks) is recommending investors look at Signature Bank, which is a cryptocurrency specialist bank!

I also like the fact that the US Treasury Secretary Janet Yellen said he wasn’t interested in rescuing SVB and that “The American banking system is really safe and well capitalised — it’s resilient”.

This helps me have confidence in my strategy to wait for a time to buy.

Right now, the CBA is down about 0.5% today and just under 4% for the week, but it’s off 13% for the month. It’s getting close to buying territory, considering it was $111 in early February this year. I wouldn’t dive in yet but if the US CPI is bad, another market sell-off would be likely and that could make the bank look more buyable.

Are there any other reasons why I see this as a potential buying opportunity?

Inflationary expectations in the US have been falling and that is bound to be a great circuit-breaker for the pessimism linked to rising interest rates. AMP’s Shane Oliver explained why falling inflationary expectations are important for stocks going forward. “The 1970s experience tells us the longer inflation stays high, the more businesses, workers and consumers expect it to stay high, and then they behave (in terms of wage demands, price setting and tolerance for price rises) in ways that perpetuate it,” he explained. “The good news is that short term (1-3 years ahead) inflation expectations have fallen lately in the US and longer-term inflation expectations remain low. “The latter is consistent with 2% or so inflation and suggests the job of central banks should be far easier today than say in 1980, when the same measure was around 10% and deep recession was required to get inflation back down. The key is that it stays low.”

Remember, when inflation is beaten and rate rises are over, stock prices will surge but the market could anticipate all this before it happens.

So, watch this space and work out how you want to position your portfolio for the future, some time later in 2023. The easy one is a hedged product for the S&P 500, such as IHVV, but there are more exotic ones for the real thrill seekers, but make sure it’s hedged if you plan to hold for a reasonable period of time.Here’s Shane on why being hedged for a falling US dollar and rising Oz dollar makes sense: “The US dollar is a counter cyclical currency, so big moves in it are of global significance and bear close watching as a key bellwether of the economic and investment cycle. Due to the relatively low exposure of the US economy to cyclical sectors, the $US tends to be a “risk-off” currency, that is, it goes up when there are worries about global growth and down when the outlook brightens.

When inflation is dropping nicely and rate rises are over, the economic outlook will brighten. I’m cautious about other banks falling over in the US, because it often happens when recessions threaten but as long as the big ones are OK, I’ll be on the prowl for a buying opportunity over the next few weeks.