When reviewing stock ideas, there’s always a bias to focus on winners and overlook or underplay losers. Too many commentators, myself included at times, revisit stocks that have rallied, and take too long to put a line through bad stocks.

The truth is, you learn far more from losing stocks than from winners. I thought about this recently while writing an article on dealing with stock losses. Occasional losses are inevitable; the goal is to minimise and learn from them.

The hardest part is knowing when to sell poor performers. You research a stock and have high conviction in its prospects. When the stock falls, you tell yourself it’s even better value. You buy more stock or do nothing and hope for recovery. We’ve all been there.

Hope is not an investment strategy. Nor is buying a stock because it ‘looks’ cheap. You need to form a view on a stock – an investment thesis, as the pros call it – and figure out if something has changed and your view is wrong.

Have an open mind. When a stock you like slumps, it’s tempting to seek facts that confirm your opinion on the company. It’s easy to reject facts that contradict your view and argue that it’s the market that has it wrong.

Sometimes the market is wrong. Your investment thesis is firmly intact even though the share price has tumbled during a bout of sentiment-driven market turbulence. You buy more stock because volatility creates asset mispricing.

At other times, your view on the stock is incorrect. Often, investors underestimate the challenges facing companies with cyclical and structural risks. They don’t realise how far – and for how long – some companies can fall.

The key is to identify when your view is wrong and act early to stem losses. Never forget the two great rules of investing: 1) capital preservation is everything, 2) always remember rule one. Cutting losses early preserves capital.

Of course, every investor and every stock is different. Sometimes the best action is no action. But it pays to revisit the losers in your portfolio from time to time – and understand what caused the loss.

Here are two disappointing stocks I have favoured in the past few years, and an explanation of what’s gone wrong and if value still exists.

- Judo Capital Holdings (ASX: JDO)

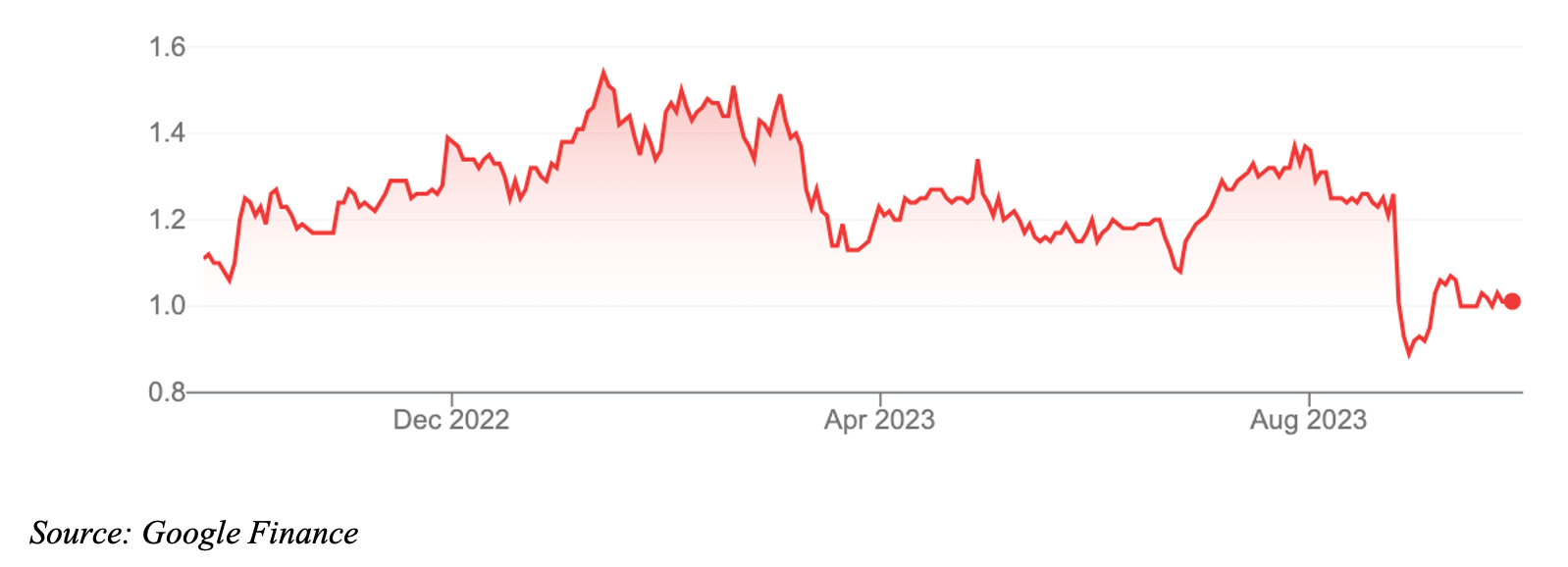

I featured Judo in this Report in February 2023 at $1.99 a share, Judo now trades at $1 after a tough 12 months. I took too long to realise my view on Judo was incorrect and thought it represented better value after it fell.

To recap, Judo is a bank that targets small and medium-size enterprises. Having written on small business in Australia for many years, I’d always thought this market was badly underserved by the big four banks.

Judo has the hallmarks of a successful small-cap company. It grew steadily before listing and had a reasonable valuation upon listing. Many funds liked the Judo float in late 2021; it was reportedly three times oversubscribed.

I’d interviewed Judo management and was impressed with how the company was (and is) run. I liked Judo’s long-term prospects to take market share from the big-four banks in SME lending. Even a tiny gain in market share was valuable for Judo.

More broadly, I favoured banking stocks when interest rates were near zero, believing the sector would benefit as rates inevitably rose. Higher rates help bank Net Interest Margins (the difference between interest paid and received) but can be a problem if rates rise too far, credit growth slows and bad debts balloon.

In August, Judo reported its underlying Net Interest Margin rose that its gross loan book exceeded $9 billion.

Judo also flagged a tougher outlook in FY24 and doubled its expenses for impaired loans. Judo said it had seen an increase in loans that were 90-plus days and in impaired customers, although added its asset quality was robust.

I underestimated the extent of Judo’s increase in provisioning for impaired loans to reflect a more subdued economic outlook. In fairness, the loan arrears Judo reported are off a low base and below sector averages. But the risk of an increase in SME bad debts is clearly rising as the economy slows.

As such, I’ll take my bruises on Judo and move on. The company’s supporters – some fund managers I know think the stock has fallen too far – might accuse me of getting too bearish at the bottom. Perhaps, but with rates likelier to fall than rise from here, and the full brunt of higher rates on SME loan repayments yet to be felt, I can’t find a catalyst to re-rate Judo in the next 12 months.

Also, I’ve also seen too many IPOs wallow in the small-cap graveyard for years when their float disappoints. Judo, a high-quality business, might be an exception, but poor sentiment towards a small cap is a hard ship to turn.

Chart 1: Judo Capital Holdings

- Challenger (ASX: CGF)

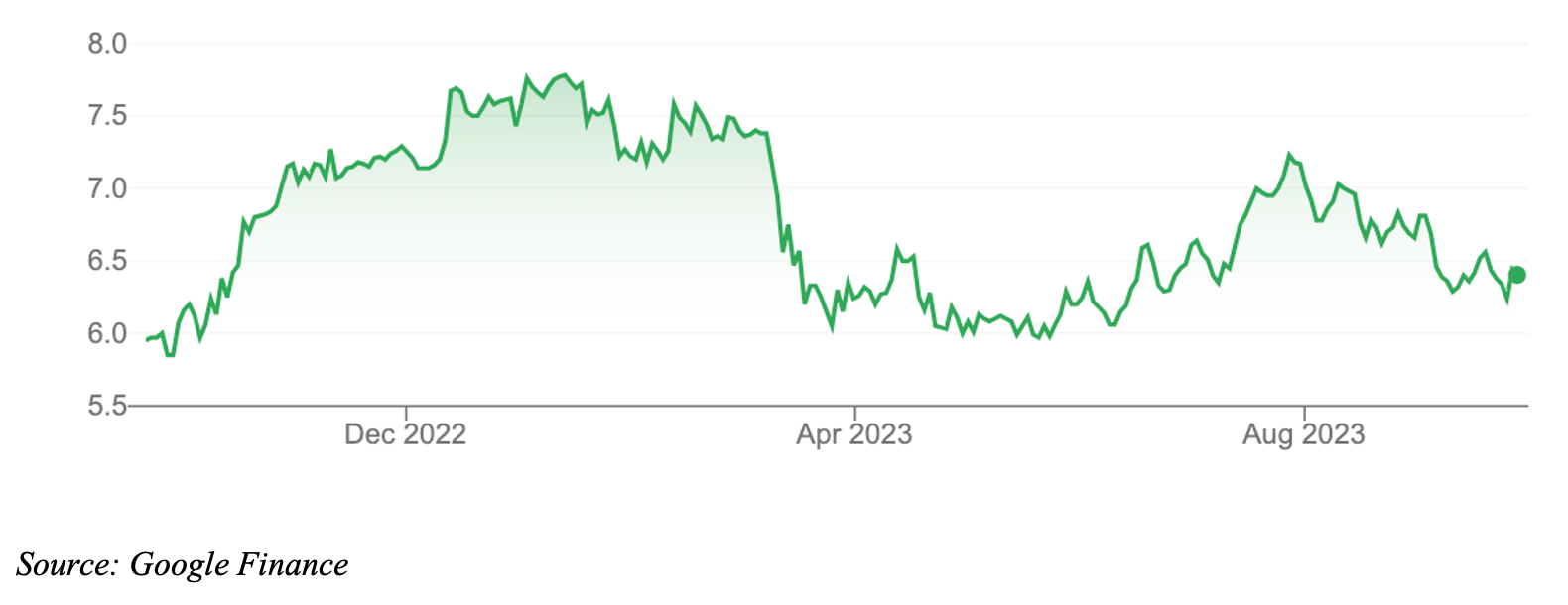

In December 2021, I outlined a positive view on Challenger in this Report at around $6 a share. In July this year, I again wrote favourably on Challenger at $6.67.

The annuities giant now trades at $6.40. It’s up a little on my first column, but I expected Challenger to do much better by now. Sometimes you can be right and wrong on a stock at the same time. For example, its price rises or falls for reasons you didn’t expect, or it does much better or worse than you expected.

Revisiting underperforming stocks is not just about the losers. It’s also about knowing when capital should be reallocated to ideas with better prospects.

As Australia’s dominant annuity provider, Challenger should be in a sweet spot. For the first time in years, its annuities offer attractive returns thanks to rising interest rates. Challenger’s annuity sales and enquiries have soared this year.

Longer term, Challenger is superbly positioned for an ageing population, growth in retirement savings and rising demand for income solutions for retirees.

Challenger’s improving outlook is not reflected in its price. The stock is up only 7.5% over one year. Operationally, Challenger is doing well, but not as well as the market expected, judging by its performance against consensus estimates.

That said, my investment thesis for Challenger remains intact. I expected its annuity sales to take off this year as rates rose. I thought Challenger’s balance sheet would continue to improve; that new management would drive higher performance; and that Challenger would increase its rate of product innovation.

I still think Challenger will eventually be taken over by Apollo Global Management (it owns 19.1%). If a takeover doesn’t occur, Challenger has much to gain from its relationship with Apollo through product innovation.

With my view unchanged, I’ll stick with Challenger for now. An impatient market wants faster gains, but corporate turnarounds take time. Still, if Challenger can’t capitalise on conditions this year and next, it will lose market confidence.

Chart 2: Challenger

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 27 September 2023.